U.S. Patient Temperature Management Market Size, Share, Trends, Industry Analysis Report

By Product (Patient Warning Systems and Patient Cooling Systems), By Application, By End-Use, By Country – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 128

- Format: PDF

- Report ID: PM6270

- Base Year: 2024

- Historical Data: 2020-2023

Overview

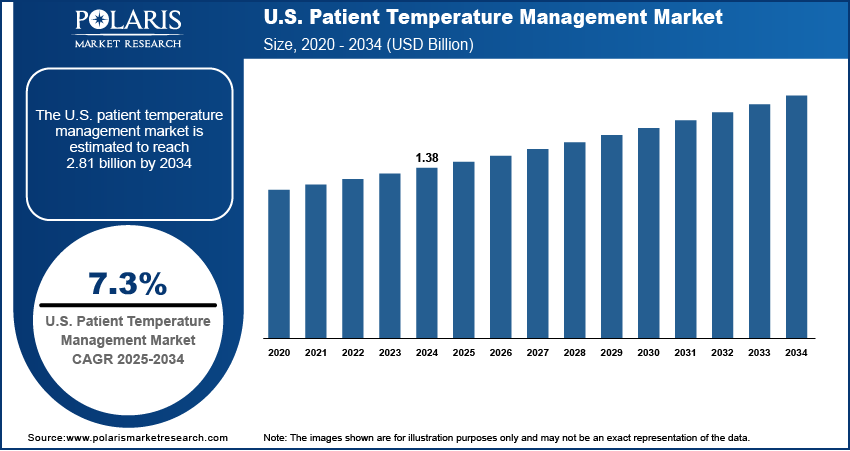

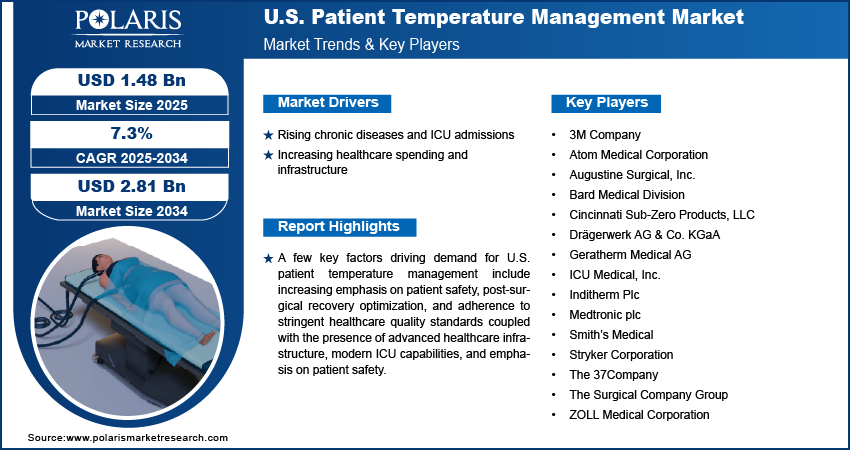

The U.S. patient temperature management market size was valued at USD 1.38 billion in 2024, growing at a CAGR of 7.3% from 2025 to 2034. Key factors driving demand for U.S. patient temperature management include rising prevalence of chronic diseases and critical illnesses coupled with increasing healthcare spending and well-established healthcare infrastructure.

Key Insights

- The patient warming systems held the largest share in 2024, driven by extensive use in surgical and critical care settings.

- The cardiology segment accounted for the fastest CAGR by 2034, due to the growing application of generative AI to speed up hit identification, lead optimization, and preclinical candidate selection.

Industry Dynamics

- The rising prevalence of chronic diseases and critical illnesses is increasing ICU admissions, driving the demand for advanced patient temperature control systems across U.S. hospitals and surgical centers.

- Growth in healthcare spending, combined with a well-established medical infrastructure, is fostering the adoption of high-performance temperature management devices to improve clinical outcomes.

- The integration of quantum computing with generative AI offers a transformative opportunity to enhance precision, automation, and predictive capabilities in temperature regulation technologies.

- High implementation costs related to advanced equipment, intelligent monitoring systems, and skilled workforce requirements continue to limit adoption among smaller healthcare facilities.

Market Statistics

- 2024 Market Size: USD 1.38 Billion

- 2034 Projected Market Size: USD 2.81 Billion

- CAGR (2025–2034): 7.3%

AI Impact on U.S. Patient Temperature Management Market

- AI enhances performance optimization in temperature management systems by analyzing patient data, treatment context, and historical trends to deliver precise thermal control tailored to individual needs.

- Integration of AI enables adaptive temperature regulation, automatically adjusting heating or cooling in real time based on patient vitals, surgery type, and clinical protocols.

- AI-powered diagnostics assist in early detection of system faults, sensor malfunctions, or temperature deviations, supporting predictive maintenance and reducing equipment downtime in critical care settings.

- AI improves clinician interaction by enabling intuitive interfaces, real-time alerts, and data-driven insights, enhancing patient safety, clinical decision-making, and workflow efficiency across U.S. healthcare facilities.

The U.S. Patient Temperature Management market comprises advanced warming and cooling devices, thermal blankets, and fluid management systems designed to maintain normothermia in surgical, perioperative, and critical care settings. Innovations in precision temperature regulation, non-invasive monitoring, and automated feedback technologies enhanced device performance, safety, and user-friendliness. Effective prevention of perioperative hypothermia, hyperthermia, and related complications supports improved recovery times, reduced hospital stays, and better utilization of healthcare resources.

The demand for U.S. Patient Temperature Management solutions in the U.S. is expanding due to heightened emphasis on patient safety, post-surgical recovery optimization, and adherence to stringent healthcare quality standards. The integration of real-time monitoring, automated adjustments, and advanced control mechanisms is enabling manufacturers to offer highly efficient and compliant solutions. Healthcare facilities are increasingly adopting these systems to improve clinical outcomes, streamline workflow, and meet evolving regulatory requirements.

The presence of advanced healthcare infrastructure, modern ICU capabilities, and emphasis on patient safety is propelling the growth of the market. Growing volumes of perioperative procedures coupled with high prevalence of cardiovascular disease are boosting demand for precise temperature management systems. According to the American Heart Association, cardiovascular disease (CVD) is projected to impact at least 60% of U.S. adults by 2050. Healthcare facilities, including hospitals and ambulatory surgical centers, are expanding the use of warming and cooling devices to minimize post-surgical complications and enhance patient recovery.

Drivers & Opportunities

Rising Prevalence of Chronic Diseases and Critical Illnesses Increasing ICU Admissions and Demand for Temperature Control Systems: The growing burden of chronic diseases and critical illnesses in the U.S. is fueling the adoption of advanced U.S. Patient Temperature Management systems across hospitals, surgical centers, and intensive care units. According to the U.S. Centers for Disease Control and Prevention, 6 in 10 Americans live with at least one chronic disease, while 4 in 10 are affected by two or more chronic conditions. Cardiovascular diseases, stroke, sepsis, and trauma cases require precise temperature regulation to prevent complications and improve recovery outcomes. The increasing rate of ICU admissions underscores the need for reliable warming and cooling devices, thermal blankets, and fluid management solutions capable of delivering accurate, consistent, and automated temperature control.

Increasing Healthcare Spending Coupled with Well-Established Healthcare Infrastructure: The U.S. benefits from robust healthcare infrastructure and high per capita healthcare spending, creating a conducive environment for the adoption of advanced temperature management technologies. According to the Centers for Medicare & Medicaid Services (CMS), national health expenditures in the U.S. are projected to reach USD 7.2 trillion by 2031, driven by investments in innovative medical devices, clinical workflow optimization, and patient safety initiatives. Hospitals and surgical facilities are increasingly deploying systems with real-time monitoring, automated feedback, and integrated electronic health record (EHR) compatibility to enhance operational efficiency and regulatory compliance. This strong infrastructure, coupled with a focus on quality care and technological innovation, is fueling the market growth for U.S. Patient Temperature Management solutions.

Segmental Insights

By Product

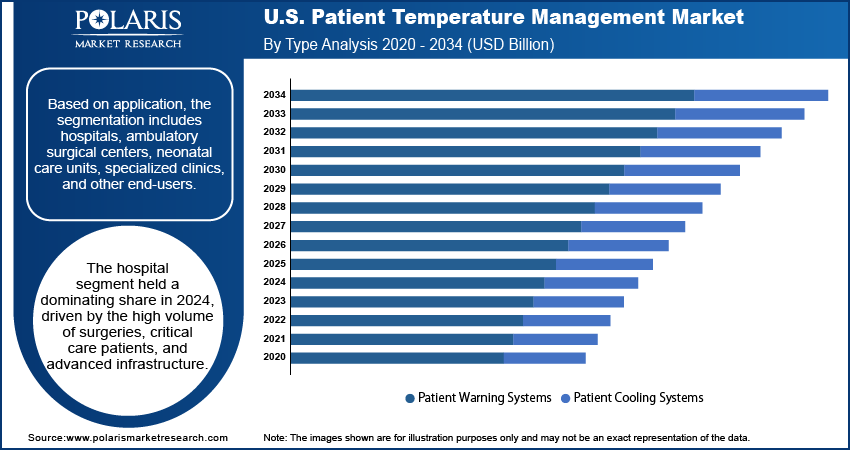

Based on product, the U.S. Patient Temperature Management market is segmented into patient warming systems and patient cooling systems. The patient warming systems segment accounted for the largest share in 2024, driven by their extensive use in perioperative care, critical care units, and emergency settings. These systems help maintain normothermia during surgical procedures, reducing the risk of hypothermia-related complications, improving patient outcomes, and shortening recovery times. Hospitals and surgical centers are increasingly adopting advanced warming blankets, fluid warmers, and forced-air warming devices to ensure precise and reliable temperature control.

The patient cooling systems segment is expected to register the fastest growth during the forecast period. Rising prevalence of hyperthermia, fever management requirements in critical care, and neuroprotective therapeutic applications are driving demand for automated cooling devices, cooling blankets, and ice-cold fluid systems. Technological advancements enabling precise, controlled, and non-invasive cooling are encouraging adoption in surgery, cardiology, neurology, and intensive care units.

By Application

Based on application, the market is categorized into general surgery, cardiology, pediatrics, neurology, orthopedic surgery, thoracic surgery, and others. The general surgery segment held the largest share in 2024, fueled by the high volume of surgical procedures requiring perioperative temperature management to minimize post-surgical complications and optimize patient safety. Advanced warming and cooling solutions are increasingly integrated into operating rooms to maintain optimal patient temperature throughout procedures.

The cardiology segment is projected to grow at the highest CAGR during the forecast period. Increasing incidence of cardiac procedures, including catheters, bypass surgeries, and interventional treatments, is driving the adoption of precise temperature management systems. These solutions help prevent hypothermia or hyperthermia during procedures, improving patient outcomes and enabling more efficient cardiac care.

By End-Use

Based on end-use, the market is segmented into hospitals, ambulatory surgical centers, neonatal care units, specialized clinics, and other end-users. Hospitals accounted for the largest share in 2024, driven by the high volume of surgeries, critical care patients, and advanced infrastructure supporting the deployment of U.S. Patient Temperature Management systems. Integration of automated warming and cooling devices across surgical and intensive care units enhances clinical efficiency and patient safety.

Neonatal care units are expected to register the fastest growth over the forecast period. Premature and critically ill newborns are highly susceptible to temperature fluctuations, necessitating specialized warming and cooling solutions. Advanced incubators, radiant warmers, and integrated monitoring systems are increasingly adopted to maintain optimal thermal environments, improve survival rates, and support neonatal care protocols.

Key Players & Competitive Analysis

The U.S. patient temperature management market is characterized by strong competition among leading manufacturers, with companies such as 3M Company, Atom Medical Corporation, Augustine Surgical, Inc., Bard Medical Division, Cincinnati Sub-Zero Products, LLC, and Drägerwerk AG & Co. KGaA driving innovation through advanced product development, clinical performance improvements, and targeted market strategies. 3M Company delivers a broad range of warming and cooling solutions designed for perioperative, critical care, and emergency settings, supported by extensive research and clinical validation. Augustine Surgical, Inc. specializes in patient warming technologies that integrate ease of use, portability, and efficiency to address diverse hospital requirements. Cincinnati Sub-Zero Products, LLC focuses on high-precision thermal regulation systems that optimize patient safety and recovery outcomes. Drägerwerk AG & Co. KGaA incorporates advanced monitoring and automated control technologies into its platforms, enhancing usability and reliability for healthcare providers.

The U.S. market is witnessing growing adoption of patient warming and cooling systems across hospitals, ambulatory surgical centers, and intensive care units to improve perioperative outcomes, reduce post-operative complications, and maintain temperature stability in vulnerable patients. Manufacturers are focusing on next-generation thermal blankets, fluid warmers, cooling devices, and integrated monitoring platforms that offer precise temperature regulation with minimal invasiveness. Strategic collaborations with hospitals, group purchasing organizations (GPOs), and healthcare networks are expanding product accessibility and market penetration. Competitive strategies increasingly emphasize automated, energy-efficient, and user-friendly systems designed to comply with stringent U.S. healthcare standards and enhance overall patient care.

Prominent companies in the U.S. patient temperature management market include 3M Company, Atom Medical Corporation, Augustine Surgical, Inc., Bard Medical Division, Cincinnati Sub-Zero Products, LLC, Drägerwerk AG & Co. KGaA, Geratherm Medical AG, ICU Medical, Inc., Inditherm Plc, Medtronic plc, Smiths Medical, Stryker Corporation, The 37Company, The Surgical Company Group, and ZOLL Medical Corporation.

Key Players

- 3M Company

- Atom Medical Corporation

- Augustine Surgical, Inc.

- Bard Medical Division

- Cincinnati Sub-Zero Products, LLC

- Drägerwerk AG & Co. KGaA

- Geratherm Medical AG

- ICU Medical, Inc.

- Inditherm Plc

- Medtronic plc

- Smiths Medical

- Stryker Corporation

- The 37Company

- The Surgical Company Group

- ZOLL Medical Corporation

U.S. Patient Temperature Management Industry Developments

In July 2025: Medline introduced the ComfortTemp Patient Warming System, a complete solution aimed at improving patient comfort and maintaining normothermia during surgical procedures. The system features disposable blankets and gowns equipped with an innovative lock-in hose mechanism and a rotating elbow connector, ensuring secure placement and flexible setup.

In January 2024: ZOLL, a subsidiary of Asahi Kasei, received U.S. FDA clearance and the CE mark for a significant upgrade to the Thermogard Temperature Management System. This enhancement enables the device to deliver core and surface temperature management, making it the first solution to offer precise, personalized patient care supported by intelligent analytics and comprehensive temperature control.

U.S. Patient Temperature Management Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Patient Warning Systems

- Conventional Warning Systems

- Surface Warning Systems

- Intravascular Warning Systems

- Patient Cooling Systems

- Conventional cooling Systems

- Surface Cooling Systems

- Intravascular Cooling Systems

By Application Outlook (Revenue, USD Billion, 2020–2034)

- General Surgery

- Cardiology

- Pediatrics

- Neurology

- Orthopedic Surgery

- Thoracic Surgery

- Others

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Hospitals

- Ambulatory surgical centers

- Neonatal care units

- Specialized clinics

- Other end-users

U.S. Patient Temperature Management Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.38 Billion |

|

Market Size in 2025 |

USD 1.48 Billion |

|

Revenue Forecast by 2034 |

USD 2.81 Billion |

|

CAGR |

7.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, and segmentation. |

FAQ's

The market size was valued at USD 1.38 billion in 2024 and is projected to grow to USD 2.81 billion by 2034.

The market is projected to register a CAGR of 7.3% during the forecast period.

A few of the key players in the market are 3M Company, Atom Medical Corporation, Bard Medical Division (Becton, Dickinson and Company), Cincinnati Sub-Zero Products, LLC (Gentherm), Drägerwerk AG & Co. KGaA, Geratherm Medical AG, Inditherm Plc, ICU Medical, Inc., Medtronic plc, Stryker Corporation, Smiths Medical (ICU Medical), The 37Company, The Surgical Company Group (TSC Life), and ZOLL Medical Corporation (Asahi Kasei Group).

The patient warming systems segment dominated the market revenue share in 2024.

The cardiology segment is projected to witness the fastest growth during the forecast period.