Membranes Market Size, Share, Trends, & Industry Analysis Report

By Material (Polymeric, Ceramic, Other), By Technology, By Application, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5739

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

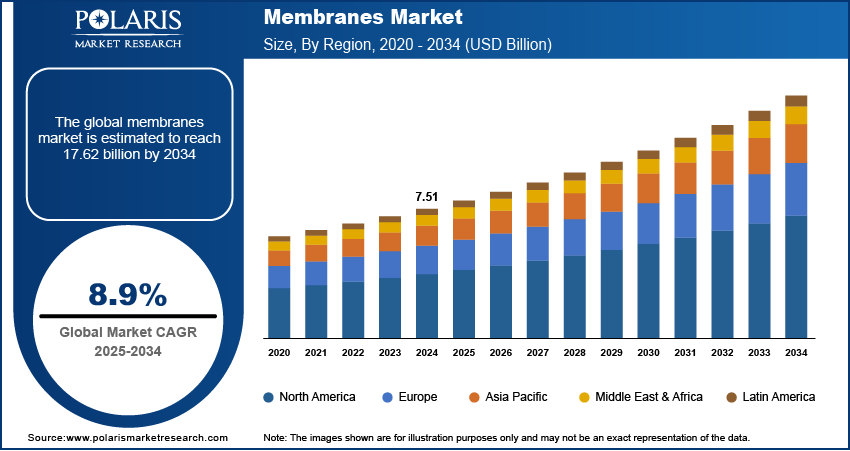

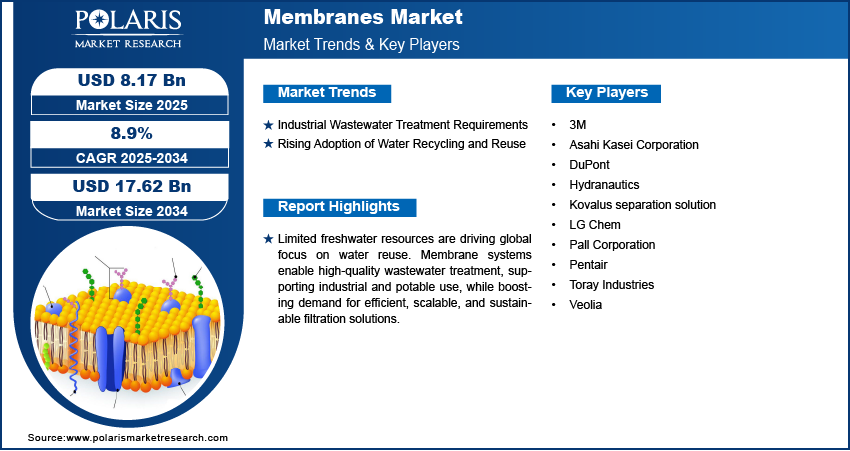

The global membranes market size was valued at USD 7.51 billion in 2024, growing at a CAGR of 8.9% during 2025–2034. The growth is driven by the rising adoption of water recycling and growing wastewater from major industries such as chemical and pharmaceutical.

Membranes are thin barriers or films that allow certain substances, such as water or gases, to pass through while blocking others unwanted particles based on size, charge, or chemical properties. They are widely used in water treatment, healthcare, and industrial separation processes.

The increasing global need for clean and safe drinking water is driving the demand for membranes. There is rising pressure on water resources as populations are growing and urbanizing, especially in developing countries. Membrane technologies such as reverse osmosis and ultrafiltration help remove contaminants, salts, and bacteria, making water safe to use. These systems are widely used in municipal water and wastewater treatment equipment plant and even in households. Governments and organizations are investing in advanced membrane solutions to ensure reliable access to potable water for both domestic and industrial use, with water scarcity and pollution becoming global issues, thereby driving the growth.

To Understand More About this Research: Request a Free Sample Report

Innovations in membrane materials and system designs are making membranes more efficient, durable, and cost-effective. Modern membranes offer improved chemical resistance, longer lifespans, and higher filtration performance, which reduces operational costs and maintenance. New types such as nanofiltration membranes and forward osmosis membranes are opening up applications in difficult-to-treat water and high-recovery systems. Automation and smart monitoring systems are also being integrated into membrane operations, making them easier to manage. These advancements are helping membrane technology reach a wider range of industries and regions, making it a more attractive solution for both new installations and upgrades to existing systems.

Industry Dynamics

Industrial Wastewater Treatment Requirements

Industries such as chemicals, textiles, pharmaceuticals, and food processing produce large amounts of wastewater that must be treated before it can be discharged or reused. According to the United States Environmental Protection Agency, in 2022, 196 million pounds of water was released with chemicals by industries in the US alone. Stricter environmental regulations are pushing industries to adopt cleaner and more efficient wastewater treatment technologies. Membranes are especially effective in separating pollutants, recovering valuable materials, and meeting discharge standards. They offer a compact, energy-efficient solution that is tailored to specific industrial needs. Industries are increasingly turning to membranes to reduce their environmental footprint while improving their water management practices and complying with local and international regulations, as sustainability is becoming a higher priority, thereby driving growth.

Rising Adoption of Water Recycling and Reuse

Freshwater resources are becoming increasingly limited, prompting many regions to prioritize water reuse and recycling. According to the Eurostat, the European Union has passed laws & regulations regarding water reuse. Membrane systems play a crucial role in treating wastewater to a quality suitable for industrial processes, irrigation, or even indirect potable use. This method conserves valuable water supplies and eases the burden on both freshwater sources and wastewater treatment infrastructure. Membranes are particularly well-suited for these applications due to their ability to deliver high-quality treated water. Growing global awareness around water conservation is driving up the demand for dependable and scalable membrane technologies across various sectors.

Segmental Insights

By Material Analysis

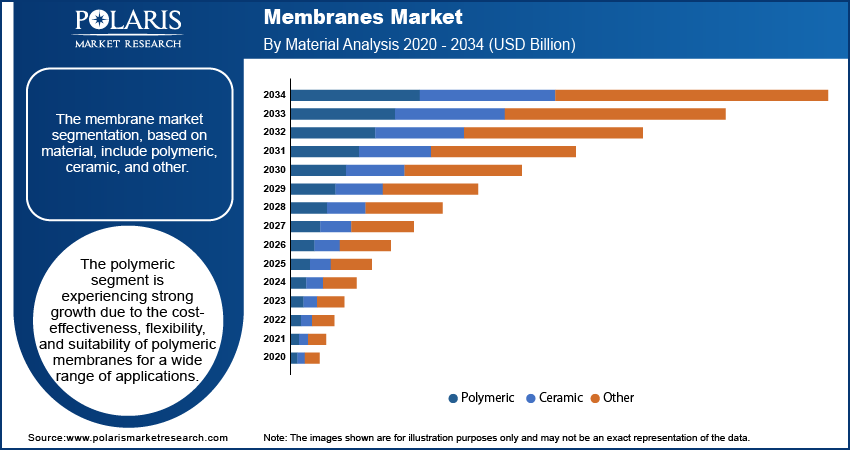

The segmentation, based material, includes polymeric, ceramic, and other. Polymeric membranes are experiencing strong growth due to their cost-effectiveness, flexibility, and suitability for a wide range of applications. Made from materials such as polysulfone, polyethersulfone, and PVDF, these membranes are widely used in water treatment, food processing, pharmaceuticals, and industrial filtration. Their ability to offer high performance at relatively low production costs makes them popular in both developing and developed regions. Ongoing innovations in polymer formulations are improving durability, chemical resistance, and efficiency. Polymeric membranes are increasingly favored as industries are seeking scalable and economical solutions, thereby driving their demand.

The ceramic segment is expected to witness the fastest growth during the forecast period due to its high durability, heat resistance, and strong chemical tolerance. Ceramic membranes handle aggressive chemicals and extreme temperatures, making them ideal for harsh industrial environments such as oil and gas, chemicals, and mining. Though initially more expensive, their long lifespan and minimal maintenance needs make them cost-effective in the long run. The increasing focus on industrial wastewater treatment and stricter environmental regulations are further boosting their adoption. The demand for ceramic membranes is rising as demand for robust and long-lasting filtration solutions is growing.

By Technology Analysis

The segmentation, based on technology, includes ultrafiltration, microfiltration, nanofiltration, and others. The ultrafiltration segment dominated with the largest share in 2024 due to its wide application range and high efficiency in removing bacteria, viruses, and suspended solids. It is commonly used in municipal water treatment, food and beverage processing, and pharmaceuticals. Ultrafiltration membranes strike a balance between cost, performance, and ease of operation, which makes them a preferred choice for many industries. Their ability to provide consistently high-water quality with relatively low energy consumption is driving their demand. The increasing demand for clean water, especially in urban areas, is further driving segment dominance.

The microfiltration segment is expected to witness significant growth during the forecast period, as microfiltration systems are employed in industries that need to remove larger particles such as sediments, fats, and bacteria without affecting the overall composition of the liquid. It is widely used in dairy processing, beverage production, and pharmaceutical pre-filtration processes. Microfiltration membranes operate under lower pressure and consume less energy, making them efficient and cost-effective for specific applications. Technological advancements are improving membrane life and performance. The adoption of microfiltration systems is expanding rapidly as more industries are seeking sustainable and gentle filtration methods for delicate processes, thereby driving segment growth.

Regional Analysis

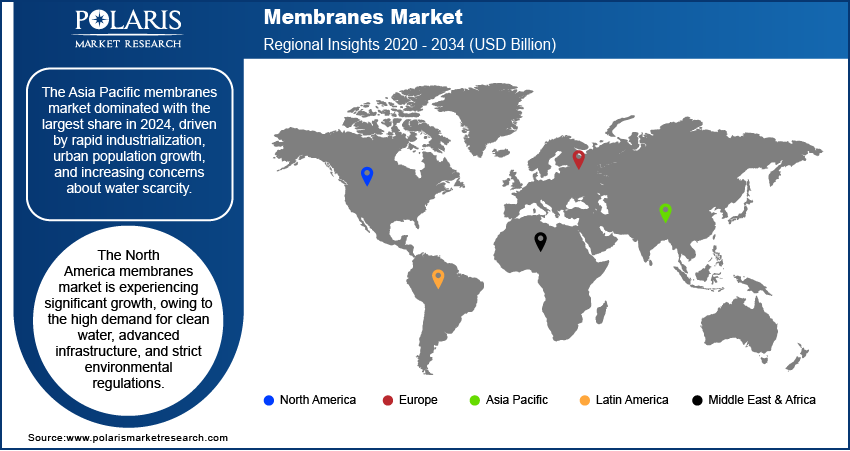

The Asia Pacific membranes market dominated with the largest share in 2024, driven by rapid industrialization, urban population growth, and increasing concerns about water scarcity. Countries such as China, Japan, and South Korea have invested heavily in advanced water treatment infrastructure, promoting the use of membrane technologies. Rising environmental regulations and demand for clean water in both industrial and municipal sectors have boosted adoption. Additionally, strong manufacturing capabilities and lower production costs give the region a competitive edge, thereby driving the industry growth in the region.

The India membranes market is expected to witness significant growth during the forecast period, due to rising water pollution, urbanization, and industrial development. Government initiatives such as “Jal Jeevan Mission” and “Make in India” are encouraging the adoption of advanced water treatment solutions, including membrane systems. The need for effective wastewater management in sectors such as textiles, pharmaceuticals, and chemicals is further driving demand. Additionally, the launch of domestic membrane manufacturing facilities is improving accessibility and reducing costs, thereby driving the industry growth in the country.

The North America membranes market is projected to witness substantial growth driven by high demand for clean water, advanced infrastructure, and strict environmental regulations. The US leads the region with widespread adoption of membrane technologies in municipal water treatment, pharmaceuticals, and food industries. Investments in research and development has further led to the introduction of more durable and efficient membranes. Furthermore, water reuse initiatives and concerns about aging water systems are pushing for upgrades using membrane-based solutions, thereby driving the region growth.

The Canada membranes market is expected to experience significant growth due to increasing investments in water infrastructure and environmental protection. Rising industrial activity and climate change pressures are driving the need for efficient water treatment and reuse technologies. Canadian industries and municipalities are adopting membrane systems to meet high water quality standards, particularly in regions with water stress or indigenous communities with limited access. The government’s focus on clean technologies and funding support for sustainable water solutions is expected to accelerate industry growth in the country during the forecast period.

Key Players and Competitive Analysis

The global membranes market is highly competitive, with several key players driving innovation and market expansion. 3M is known for its strong R&D and broad product portfolio, serving industries such as healthcare and water treatment. Asahi Kasei Corporation leverages its advanced chemical expertise to produce high-performance membranes, especially for water purification. DuPont, after merging with Dow’s water business, offers a wide range of membrane technologies, including reverse osmosis and ultrafiltration, with a strong global footprint. Hydranautics, a part of Nitto Group, focuses on energy-efficient membrane solutions, particularly in desalination and industrial applications. Kovalus Separation Solutions specializes in tailored membrane systems for complex separation needs, emphasizing innovation and customer-specific solutions. LG Chem is a new player, investing heavily in membrane technology for water treatment, particularly in Asia. Pall Corporation, under Danaher, is strong in filtration and separation technologies, with applications in biopharma and food & beverage sectors. Pentair focuses on residential and commercial water solutions, with membranes playing a major role in its product offerings. Toray Industries is a global leader, especially in reverse osmosis membranes, known for durability and efficiency. Veolia integrates membrane technology into its broader water management services, offering comprehensive and sustainable solutions worldwide.

Key Players

- 3M

- Asahi Kasei Corporation

- DuPont

- Hydranautics

- Kovalus separation solution

- LG Chem

- Pall Corporation

- Pentair

- Toray Industries

- Veolia

Industry Developments

In February 2025, Memsift Innovations and the Murugappa Group launched the GOSEP ultrafiltration membrane and inaugurated a high-tech manufacturing facility, significantly expanding global membrane production and advancing sustainable water treatment solutions.

In April 2024, Asahi Kasei launched a membrane system to produce water for injection (WFI), using Microza technology to reduce CO₂ emissions, lower energy costs, and improve water quality over traditional distillation methods in pharmaceutical manufacturing.

Membranes Market Segmentation

By Material Outlook (Revenue, USD Billion, 2020–2034)

- Polymeric

- Ceramic

- Other

By Technology Outlook (Revenue, USD Billion, 2020–2034)

- Ultrafiltration

- Microfiltration

- Nanofiltration

- Others

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Water & Wastewater treatment

- Industrial Processing

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Membranes Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 7.51 Billion |

|

Market Size Value in 2025 |

USD 8.17 Billion |

|

Revenue Forecast by 2034 |

USD 17.62 Billion |

|

CAGR |

8.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 7.51 billion in 2024 and is projected to grow to USD 17.62 billion by 2034.

The global market is projected to register a CAGR of 8.9% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are 3M; Asahi Kasei Corporation; DuPont; Hydranautics; Kovalus Separation Solutions; LG Chem; Pall Corporation; Pentair; Toray Industries; and Veolia.

The ultrafiltration segment dominated the market share in 2024.

The polymeric segment is expected to witness the significant growth during the forecast period.