Ceramic Membrane Market Size, Share, Trends, Industry Analysis Report

: By Material (Alumina, Zirconium Oxide, Titania, Silica, and Others), Technology, Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Dec-2024

- Pages: 118

- Format: PDF

- Report ID: PM1365

- Base Year: 2024

- Historical Data: 2020-2023

Ceramic Membrane Market Overview

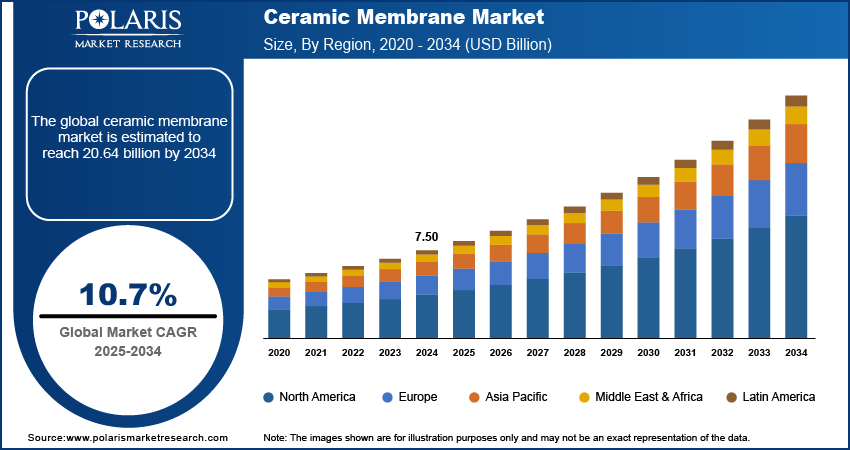

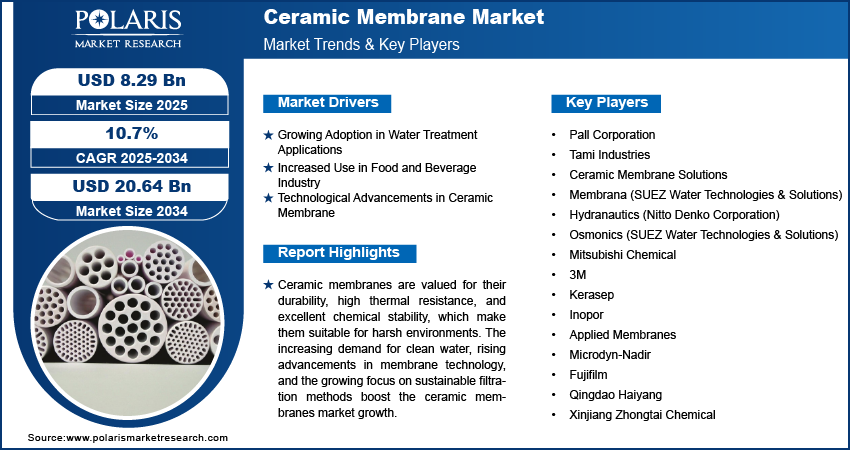

The global ceramic membrane market size was valued at USD 7.50 billion in 2024. The market is projected to grow from USD 8.29 billion in 2025 to USD 20.64 billion by 2034, exhibiting a compound annual growth rate (CAGR) of 10.7% during 2025–2034.

The global ceramic membrane market refers to the use of ceramic-based filtration technology in various industries such as water treatment, food and beverage processing, and pharmaceuticals. Ceramic membranes are valued for their durability, high thermal resistance, and excellent chemical stability, which make them suitable for harsh environments. Key drivers of market growth include the increasing demand for clean water, advancements in membrane technology, and the growing focus on sustainable filtration methods. Additionally, the rise in focus on industrial wastewater treatment and the adoption of ceramic membranes in biotechnological and pharmaceutical applications are notable ceramic membrane market trends.

To Understand More About this Research: Request a Free Sample Report

Ceramic Membrane Market Drivers and Trends

Growing Adoption in Water Treatment Applications

Ceramic membranes are increasingly being used for water filtration in municipal and industrial sectors due to their ability to efficiently filter organic and inorganic contaminants. With the growing global population and the subsequently rising water demand, the need for clean water sources has intensified. Ceramic membranes offer advantages such as high fouling resistance, long operational lifetimes, and the ability to withstand higher temperatures compared to polymer-based membranes. Ceramic membranes provide a sustainable solution for managing water resources effectively, helping municipalities and industries meet stringent water quality standards. Thus, the increasing adoption of ceramic membranes in water treatment applications will be one of the primary ceramic membrane market trends during the forecast period.

Increased Use in Food and Beverages Industry

Ceramic membranes offer significant advantages in food and beverage processing applications, including the clarification of juices, wine, and dairy products, as well as in the concentration of various ingredients such as proteins. The increasing consumer demand for high-quality, natural, and minimally processed products has propelled the adoption of ceramic membrane technology. In particular, ceramic membranes are being used to replace traditional filtration methods, offering better control over pore size, improving yield, and enhancing product quality. The food and beverage sector is seeing a shift toward more sustainable production processes, and ceramic membranes are favored for their efficiency, chemical stability, and longevity. Therefore, the rising use of ceramic membranes in the food and beverage industry is driving the ceramic membranes market expansion.

Technological Advancements in Ceramic Membrane

Researchers are developing new materials and improving membrane manufacturing techniques to enhance the performance and cost-effectiveness of ceramic membranes. These innovations include the introduction of advanced coating technologies that improve membrane fouling resistance and lifespan. In addition, there are increasing efforts to scale up the production of ceramic membranes to meet the growing demand in industrial applications. The development of hybrid membranes combines ceramic and polymer materials to enhance performance while reducing production costs. As a result, ceramic membranes are becoming more affordable and accessible for a wider range of applications, from wastewater treatment to food processing. Hence, technological advancements in ceramic membrane design and manufacturing are expected to fuel the ceramic membrane market development in the coming years.

Ceramic Membrane Market Segment Insights

Ceramic Membrane Market Outlook – Material-Based Insights

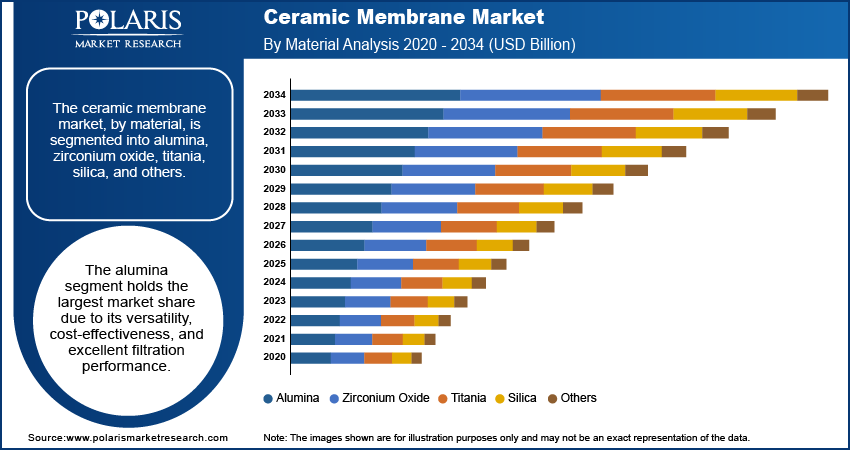

The ceramic membrane market, by material, is segmented into alumina, zirconium oxide, titania, silica, and others. The alumina segment holds the largest market share due to its versatility, cost-effectiveness, and excellent filtration performance. Alumina membranes are widely used across various applications, including water treatment, food processing, and industrial filtration, owing to their high mechanical strength and resistance to chemical and thermal stress. The demand for alumina-based membranes is particularly strong in the water treatment industry, where their affordability and durability make them the preferred choice. However, the zirconium oxide segment is registering the highest growth, driven by their enhanced chemical stability and superior performance in harsh environments, such as in the chemical and pharmaceutical sectors. These membranes are gaining traction due to their ability to withstand high temperatures and aggressive chemicals, making them ideal for advanced filtration processes that require high selectivity and efficiency.

The silica and titania segments are also witnessing growth, particularly in specialized applications where higher filtration precision is required, such as in the food and beverage industry. The adoption of silica membranes is primarily driven by their stability and resistance to corrosion in certain organic and inorganic solutions. Titania membranes are appreciated for their photocatalytic properties, which make them suitable for environmental and water treatment processes. Despite these advancements, alumina-based membranes continue to dominate the market due to their broader application scope and established presence in various industries. However, as technological advancements continue, material-specific membranes such as zirconium oxide are expected to experience faster growth, particularly in industrial filtration and high-end applications.

Ceramic Membrane Market Outlook – Technology-Based Insights

The ceramic membrane market, by technology, is segmented into ultrafiltration, microfiltration, nano-filtration, and others. The ultrafiltration (UF) segment holds the largest market share due to its effectiveness in a wide range of filtration applications. Ultrafiltration membranes are widely used for separating particles, macromolecules, and colloids from liquids, making them particularly valuable in water treatment, food and beverage processing, and wastewater treatment. The versatility of ultrafiltration in both industrial and municipal settings, combined with its ability to operate at low pressures, has made it the preferred choice in many sectors. The increasing demand for clean and potable water, along with the growing focus on sustainable filtration methods, is expected to maintain ultrafiltration's dominant position in the market.

The nano-filtration segment, while the smallest in market share, is registering the highest growth, driven by its ability to remove smaller particles and organic molecules with higher precision compared to ultrafiltration. Nano-filtration membranes are gaining traction in advanced water treatment applications and in industries where high selectivity is required, such as in the pharmaceutical and biotechnology sectors. The growth of nano-filtration is also being propelled by the increasing regulatory pressure for higher standards of water quality and the growing trend of using less chemical-intensive methods for separation. As the technology becomes more refined and cost-effective, it is anticipated to experience faster adoption, particularly in applications demanding a high level of filtration performance and efficiency.

Ceramic Membrane Market Outlook – Application-Based Insights

The ceramic membrane market, by application, is segmented into water & wastewater treatment, food & beverage, biotechnology, pharmaceuticals, and others. The water and wastewater treatment segment holds the largest market share. The growing global demand for clean water and the increasing concerns over wastewater management have positioned this segment as the leading application for ceramic membranes. Ceramic membranes are highly valued in water treatment due to their durability, efficiency, and ability to withstand harsh conditions, making them ideal for both municipal and industrial applications. As governments and industries face increasing pressure to meet environmental standards and reduce water wastage, the growing water and wastewater treatment sector is expected to boost the growth of the ceramic membranes market in the coming years.

The biotechnology and pharmaceutical segments are registering the highest growth, fueled by the increasing demand for high-purity filtration solutions in these industries. Ceramic membranes are used for critical applications such as the filtration of proteins, enzymes, and other biomolecules in biotechnological processes. The pharmaceutical industry benefits from ceramic membranes for applications such as drug formulation and production processes that require precise filtration and high sterility. As these industries expand and regulatory requirements become more stringent, the demand for ceramic membranes with advanced filtration capabilities is expected to rise significantly, driving continued growth in this segment.

Ceramic Membrane Market Regional Insights

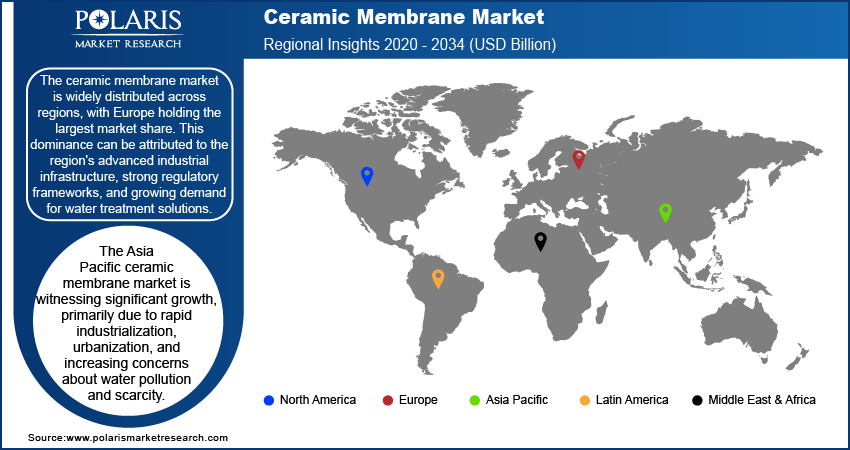

By region, the study provides ceramic membrane market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. The market is widely distributed across regions, with Europe holding the largest market share. This dominance can be attributed to the region's advanced industrial infrastructure, strong regulatory frameworks, and growing demand for water treatment solutions. Europe has been at the forefront of adopting sustainable technologies, driven by stringent environmental regulations and a strong emphasis on eco-friendly practices. The demand for ceramic membranes is particularly high in industries such as water and wastewater treatment, food and beverage, and pharmaceuticals, where high filtration standards are critical. The presence of key manufacturers and technological innovations in the region further contributes to Europe's leading position in the global market.

The Asia Pacific ceramic membrane market is witnessing significant growth, primarily due to rapid industrialization, urbanization, and increasing concerns about water pollution and scarcity. Countries such as China, India, Japan, and South Korea are driving the demand, with water treatment being one of the primary applications for ceramic membranes. The region's growing food and beverage industry, coupled with the rising biotechnology and pharmaceutical sectors, further supports market expansion. Additionally, as governments of Asia Pacific countries focus on improving wastewater management and industrial effluent treatment, ceramic membranes are becoming increasingly favored for their durability and efficiency. The region is also expected to benefit from technological innovations and cost reduction in membrane manufacturing, which will drive wider adoption across various industries.

Ceramic Membrane Market – Key Players and Competitive Insights

The ceramic membrane market features several companies that are active in the development and manufacturing of filtration technologies. Key players include Pall Corporation, which is known for its broad range of filtration products, including ceramic membranes, for water treatment and industrial applications. Tami Industries offers ceramic membranes for various sectors, particularly in water purification and food processing. Ceramic Membrane Solutions focuses on membrane technology for wastewater treatment and industrial filtration. Membrana manufactures polymeric and ceramic membranes for applications such as water filtration and food and beverage processing. Hydranautics, a subsidiary of Nitto Denko Corporation, provides advanced membrane products for desalination and water treatment. Osmonics, a division of SUEZ Water Technologies & Solutions, specializes in water treatment technologies, including ceramic membrane filtration. Other notable players include Mitsubishi Chemical (which produces high-performance ceramic membranes for industrial applications), 3M (which provides filtration products for the life sciences and industrial markets), and Kerasep (which is known for its advanced ceramic membrane technology for the oil and gas sector). Companies such as Inopor, Applied Membranes, and Microdyn-Nadir also manufacture ceramic membranes used for water and wastewater treatment. Fujifilm produces ceramic membranes for industrial applications such as food and beverage filtration. Qingdao Haiyang and Xinjiang Zhongtai Chemical are key players in the Chinese market, which offer cost-effective ceramic membrane solutions, especially in water treatment and desalination.

In terms of competition, companies in the ceramic membrane market are increasingly focusing on technological advancements and efficiency improvements. They are investing in research and development to enhance membrane lifespan, fouling resistance, and cost-effectiveness. Some companies are also expanding their portfolios by developing hybrid membrane solutions that combine ceramic and polymer materials to optimize performance and reduce costs. The competition is marked by a shift toward offering more customized filtration solutions tailored to specific industrial needs. Players such as Pall Corporation and SUEZ Water Technologies & Solutions leverage their global presence and established relationships with industrial customers to maintain a strong market position. Smaller and newer companies, such as Ceramic Membrane Solutions and Inopor, are focusing on niche applications and gaining traction through specialized products that meet the specific needs of high-end industries such as biotechnology and pharmaceuticals.

The ceramic membrane market is witnessing a trend toward consolidation as some companies acquire smaller players to expand their product offerings and technological capabilities. However, there remains significant competition in the market, especially in terms of innovation and the ability to offer cost-effective solutions. Companies that can provide high-quality ceramic membranes with longer operational lifespans and better performance under extreme conditions are likely to gain a significant ceramic membrane market share during the forecast period. Additionally, the increasing regulatory focus on environmental sustainability, coupled with the need for efficient water and wastewater treatment solutions, is driving companies to invest in more advanced, eco-friendly technologies. As these trends continue, the competitive landscape is expected to evolve, with more emphasis on performance, customization, and sustainability.

Pall Corporation is a key player in the ceramic membrane market, known for its filtration products used across various industries, including water treatment, food processing, and pharmaceuticals. The company provides ceramic membranes that are valued for their ability to handle harsh environments and their long operational lifespans. Pall Corporation is particularly active in the water treatment segment, offering solutions that cater to municipal and industrial needs.

3M is another significant player in the ceramic membrane market, offering filtration solutions primarily for water treatment, food and beverage, and life sciences applications. 3M’s ceramic membranes are designed for high-performance filtration, providing long-term durability and effective particle removal in various applications.

Key Companies in Ceramic Membrane Market

- Pall Corporation

- Tami Industries

- Ceramic Membrane Solutions

- Membrana (SUEZ Water Technologies & Solutions)

- Hydranautics (Nitto Denko Corporation)

- Osmonics (SUEZ Water Technologies & Solutions)

- Mitsubishi Chemical

- 3M

- Kerasep

- Inopor

- Applied Membranes

- Microdyn-Nadir

- Fujifilm

- Qingdao Haiyang

- Xinjiang Zhongtai Chemical

Ceramic Membrane Industry Developments

- In August 2024, 3M announced a collaboration with a global energy company to deploy its ceramic membrane filtration technology in a large-scale desalination plant. This initiative aims to address water scarcity issues by improving the efficiency and sustainability of the desalination process.

- In June 2024, Pall Corporation partnered with Cemex to implement water treatment solutions at Cemex’s plants, using Pall’s ceramic membrane technology to improve water recycling and reduce water consumption in cement production.

Ceramic Membrane Market Segmentation

By Material Outlook

- Alumina

- Zirconium Oxide

- Titania

- Silica

- Others

By Technology Outlook

- Ultrafiltration

- Microfiltration

- Nano-Filtration

- Others

By Application Outlook

- Water & Wastewater Treatment

- Food & Beverage

- Biotechnology

- Pharmaceuticals

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Ceramic Membrane Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 7.50 billion |

|

Market Size Value in 2025 |

USD 8.29 billion |

|

Revenue Forecast by 2034 |

USD 20.64 billion |

|

CAGR |

10.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global ceramic membrane market value reached USD 7.50 billion in 2024 and is projected to grow to USD 20.64 billion by 2034.

The global market is projected to register a CAGR of 10.7% during 2025–2034.

Europe held the largest share of the global market in 2024.

Pall Corporation, Tami Industries, Ceramic Membrane Solutions, Membrana (SUEZ Water Technologies & Solutions), Hydranautics (Nitto Denko Corporation), Osmonics (SUEZ Water Technologies & Solutions), Mitsubishi Chemical, 3M, Kerasep, and Inopor are a few key players in the market.

The alumina segment accounted for the largest share of the global market in 2024.

The ultrafiltration segment accounted for the largest market share in 2024.

A ceramic membrane is a type of filtration technology made from inorganic materials, typically ceramics such as alumina, zirconium oxide, or titania. These membranes are designed to separate particles, molecules, and contaminants from liquids or gases in various industrial applications. Ceramic membranes are known for their durability, resistance to high temperatures, harsh chemicals, and mechanical stress. They are commonly used in water and wastewater treatment, food and beverage processing, pharmaceutical production, and other industries that require high-performance filtration. Their ability to operate efficiently over long periods with minimal fouling and maintenance makes them a reliable choice for demanding filtration processes.

A few key trends in the ceramic membrane market are described below: Rising Focus on Sustainability: Increasing demand for eco-friendly and energy-efficient filtration solutions to meet environmental regulations and reduce carbon footprints. Technological Advancements: Ongoing research and development efforts aimed at enhancing membrane performance, lifespan, and fouling resistance. Rising Water Treatment Demand: Growth in the global need for clean water, particularly in developing regions, driving the adoption of ceramic membranes in water and wastewater treatment. Expansion in Emerging Markets: Increased industrialization and urbanization in regions such as Asia Pacific and Latin America boost the demand for filtration technologies.

A new company entering the ceramic membrane market must focus on developing cost-effective, high-performance solutions that address key industry pain points, such as fouling resistance and extended membrane lifespan. Innovating hybrid technologies that combine ceramic and polymer membranes could open new application areas while improving efficiency and reducing costs. Additionally, targeting emerging markets, particularly in Asia Pacific and Latin America, where industrialization and water treatment needs are growing, would offer significant growth opportunities during the forecast period.

Companies producing ceramic membranes and related products and other consulting firms must buy the report.