Europe Beverage Packaging Equipment Market Size, Share, Trends, Industry Analysis Report

By Automation (Manual, Semi-Automatic, Fully Automatic), By Application, By Type – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 125

- Format: PDF

- Report ID: PM6357

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

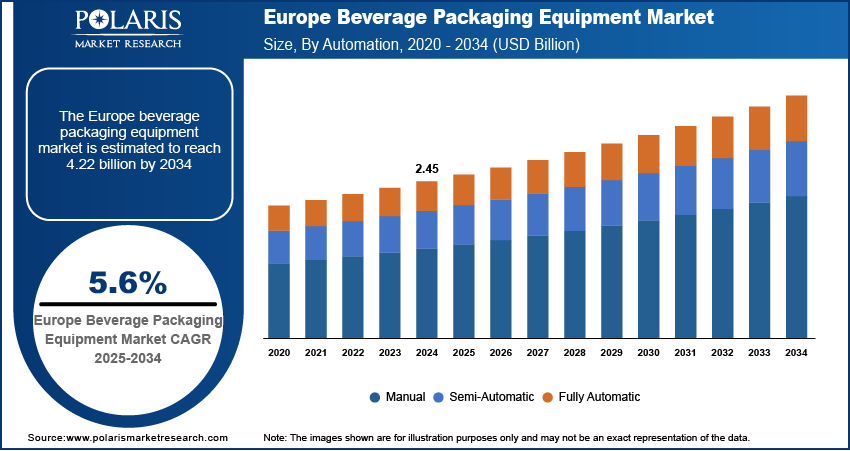

The Europe beverage packaging equipment market size was valued at USD 2.45 billion in 2024 and is anticipated to register a CAGR of 5.6% from 2025 to 2034. A few main drivers for the market expansion are the rising demand for packaged beverages and a strong focus on sustainability. The push for automation and smart technologies in production is also a major factor, helping companies improve efficiency and keep up with changing consumer demands.

Key Insights

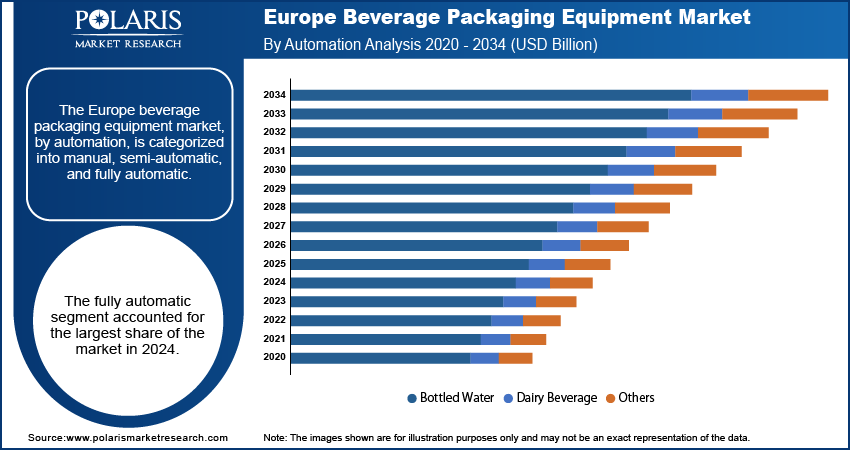

- By automation, the fully automatic segment held the largest share in Europe in 2024.

- Based on application, the bottled water segment is accounted for the largest share in 2024.

- In terms of type, the filling and capping machines segment dominated the revenue share in 2024.

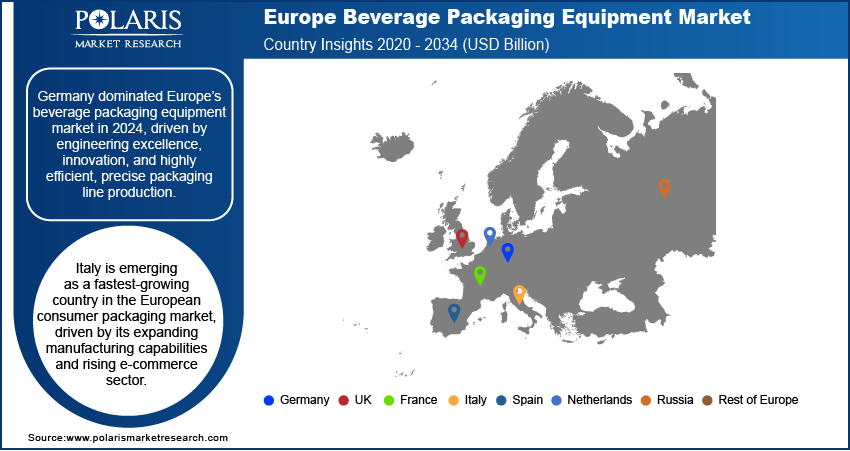

- By country, Germany held the largest share in 2024 due to its world-class engineering expertise and strong focus on technological innovation,

Industry Dynamics

- The increasing consumer preference for convenience and single-serve packaging is a major driver, leading to higher production demands. This trend requires advanced machinery that can handle various container types and sizes efficiently, prompting companies to invest in new equipment to meet the changing preferences of consumers.

- A significant push toward eco-friendly and sustainable packaging solutions is also a key factor. Regulations and growing environmental awareness are compelling manufacturers to adopt machinery that can work with recyclable, compostable, and lightweight materials. This shift is driving demand for innovative equipment that supports a circular economy and reduces waste.

- The need for greater production efficiency and reduced labor costs is boosting the adoption of automated and smart manufacturing systems. These advanced technologies, including robotics and real-time monitoring, help companies streamline operations, improve product quality, and increase output, which is essential for remaining competitive in the fast-paced industry.

Market Statistics

- 2024 Market Size: USD 2.45 billion

- 2034 Projected Market Size: USD 4.22 billion

- CAGR (2025–2034): 5.6%

- Germany: Largest Country Share

AI Impact on Europe Beverage Packaging Equipment Market

- Market players in Europe are integrating AI in their businesses due to strong R&D investments and a culture of innovation.

- The imposition of stringent food safety and sustainability regulations across the region accelerates AI integration for compliance and traceability.

- AI helps enhance predictive maintenance, extend equipment life, and reduce downtime.

- Machine learning (ML) algorithms optimize packaging design, production scheduling, and equipment synchronization.

- Real-time monitoring systems are used to improve quality control, detect defects early, and ensure consistency.

The beverage packaging equipment includes the machinery used to fill, seal, label, and handle various containers for beverages. This equipment is essential for packaging drinks such as water, juices, and soft drinks. The industry's growth is tied to the demand for automation to increase efficiency and the need for new machines to handle different packaging materials and designs.

Changing demographics and consumer focus on health are a few drivers. As the population ages and consumers become more health-conscious, there is a growing demand for beverages that align with their health needs, such as fortified water, functional drinks, and ready-to-drink (RTD) products. This shift pushes companies to invest in equipment that can handle new product formulations and specialized packaging formats. Also, the rise of e-commerce has a notable impact. Companies need equipment that can produce smaller, more durable packages that are suitable for shipping directly to consumers, which is a departure from traditional bulk packaging for retail stores.

The growing consumer focus on health and wellness is a key factor, as it directly influences the types of beverages being produced and packaged. As people become more aware of the link between diet and health, there is a clear move away from sugary drinks. For instance, the World Health Organization has long recommended that people reduce their daily intake of free sugars. This guidance has led to a noticeable decline in the consumption of traditional soft drinks and an increase in the popularity of low-sugar or no-sugar alternatives, such as sparkling water, infused waters, and natural juices. Beverage companies are responding by re-engineering their products, which, in turn, requires new packaging equipment to handle these different liquids and their unique bottling requirements.

Drivers and Trends

Sustainability and Circular Economy Initiatives: The push for sustainability and the circular economy in Europe is a primary force shaping the beverage packaging equipment market. With growing consumer demand for eco-friendly products and stricter environmental policies, beverage companies are under pressure to adopt more sustainable packaging solutions. This trend has created a need for advanced machinery that can handle new types of materials such as recycled plastics, bioplastics, and lighter glass, as well as support innovative designs that reduce material waste. The focus is shifting from simply recycling to creating a closed-loop system, which means packaging equipment must be more versatile and capable of processing materials that can be reused and recycled more effectively.

This drive is strongly supported by recent government action and data. For example, the European Commission's "State of the Digital Decade" report from 2024 highlights the importance of transitioning to a circular economy. Also, Eurostat data published in 2024 shows that many EU countries are already exceeding the 2025 recycling targets set out in the Packaging and Packaging Waste Directive. This regulatory push and proven progress on recycling rates create a clear demand for equipment that helps companies meet and exceed these new standards. The need to adapt to these new policies and material requirements is driving investments in new and specialized equipment.

Increasing Automation and Digitalization: The push for greater automation and digitalization is another key driver of the beverage packaging equipment market in Europe. Companies are seeking to improve production efficiency, reduce labor costs, and increase the flexibility of their operations to respond to changing market demands. The integration of smart technologies, such as sensors, robotics, and artificial intelligence, allows for more precise control over the packaging process, from filling and sealing to quality control and logistics. This speeds up production but also helps reduce waste and ensures consistent product quality, which is crucial in a highly competitive market.

Recent government reports highlight the growing adoption of these technologies across European industries. According to the "Use of artificial intelligence in enterprises" statistics published by Eurostat in 2024, the use of AI technologies in EU enterprises increased by over 5% points compared to the previous year. This indicates a broader trend of digital transformation that is also taking hold in the manufacturing sector, including beverage production. This strong focus on technological advancement is a major factor, as companies invest in automated and intelligent systems to enhance their competitive edge.

Segmental Insights

Automation Analysis

Based on automation, the segmentation includes manual, semi-automatic, and fully automatic. The fully automatic segment held the largest share in 2024. This is because large-scale beverage companies in Europe require high-speed, continuous production lines to meet the massive demand for their products. Fully automatic systems are designed to operate with minimal human intervention, handling everything from bottle filling and capping to labeling and palletizing at a much faster pace than other options. This level of automation is essential for reducing human error and ensuring product consistency and safety, which are critical in the food and beverage sector. Furthermore, these machines are well-suited for the complex and high-volume operations of major manufacturers. By integrating a full range of functions into a single, automated line, companies can significantly boost their output, optimize their workflow, and keep operational costs down over the long term. This focus on maximizing efficiency and scale is the primary reason this segment commands the largest revenue share.

The fully automatic segment is anticipated to register the highest growth rate during the forecast period. This rapid expansion is fueled by the ongoing technological advancements transforming the manufacturing sector. As companies embrace Industry 4.0 and the concept of smart factories, fully automatic equipment becomes a key part of their strategy. These modern machines are often equipped with sensors and software that enable real-time data monitoring and predictive maintenance, which helps prevent costly downtime and improve overall efficiency. The rising cost of labor and the need for more specialized skills in the workforce also make investing in full automation an attractive solution for many businesses. This equipment offers the flexibility to handle a wide variety of packaging materials and product sizes, which is crucial for companies trying to keep up with diverse consumer trends.

Application Analysis

Based on application, the segmentation includes bottled water, dairy beverages, alcoholic beverages, and others. The bottled water segment held the largest share in 2024. The high market share of this segment is driven by the huge volume of production and consistent consumer demand for convenient and safe hydration. As health awareness grows across the continent, more people are choosing bottled water over sugary drinks, which has created a need for high-speed, efficient packaging lines. Companies in this space require robust equipment that can handle a vast number of bottles, ensuring each is filled, capped, and labeled with precision to meet strict hygiene and quality standards. The standardized nature of bottled water production also favors specialized machinery that can operate continuously at a high throughput, further cementing this segment's dominance in the market. The sheer scale and stable demand from this application segment make it a foundational pillar for the packaging equipment.

The alcoholic beverages segment is anticipated to register the highest growth rate during the forecast period. This growth is largely fueled by changing consumer tastes and a move toward premium, craft, and specialty drinks. As consumers seek out unique and high-quality low alcoholic products such as craft beers, artisan spirits, and local wines, manufacturers need flexible and versatile packaging equipment. These producers often operate at a smaller scale but require machinery that can handle diverse packaging formats, from small bottles and unique can designs to different labeling and secondary packaging requirements. The rise of e-commerce has also contributed to this growth, as it has opened up new distribution channels that favor visually appealing and protected packaging for direct shipping. This shift toward niche and high-end products is pushing the demand for equipment that is efficient and highly adaptable, as well as capable of supporting brand differentiation.

Type Analysis

Based on type, the segmentation includes filling & capping machines, labelling & coding machines, palletizing & depalletizing machines, conveying & handling machines, cleaning & sterilizing machines, wrapping & bundling machines, cartoning machines, and others. The filling & capping machines segment held the largest share in 2024. This is because these machines are the most fundamental and crucial part of any beverage production line. They are directly responsible for the two most vital steps in packaging: accurately filling containers with the product and securely sealing them to prevent contamination and leakage. Given the high production volumes required by the beverage sector, manufacturers rely heavily on these machines for their speed, precision, and reliability. Their ability to handle various types of containers and liquids, while maintaining strict sanitary conditions, makes them an indispensable investment for any company. As a result, the filling and capping machine segment forms the backbone of the market, with continuous demand from both new and established beverage producers who need to ensure product integrity and consumer safety on a massive scale.

The segment for labelling and coding machines is anticipated to register the highest growth rate during the forecast period. This growth is being driven by several key trends, including a greater focus on product traceability, evolving consumer demands, and the need for enhanced brand marketing. New regulations often require detailed product information and batch codes to be clearly printed on every item, which has increased the need for advanced coding technologies. At the same time, brands are using more sophisticated and unique labels to attract consumers on crowded store shelves, driving demand for flexible and high-speed labeling machines that can handle complex designs and materials. The integration of digital printing and smart packaging features, such as QR codes, further boosts the need for modern equipment that can apply these technologies effectively. This increasing focus on both regulatory compliance and consumer engagement is fueling the rapid expansion of the labelling and coding machines segment.

Country Analysis

The Germany beverage packaging equipment market held the largest share in 2024. It stands as a powerhouse in the European market due to its long-standing reputation for engineering excellence and technological innovation. The country's strong manufacturing base and focus on high-quality, precision machinery make it a leader in producing advanced, fully automated packaging lines. German manufacturers are well-known for their commitment to Industry 4.0 principles, integrating digital solutions, robotics, and smart systems into their equipment. This allows for greater efficiency, flexibility, and a high degree of customization, which meets the complex demands of both domestic and international beverage producers. Furthermore, a strong emphasis on sustainability and energy efficiency within German manufacturing has positioned its equipment as a top choice for companies aiming to meet strict environmental regulations.

Italy Beverage Packaging Equipment Market Overview

Italy is another major player, recognized for its specialized expertise and innovation in packaging machinery. The Italian market thrives on a network of highly skilled, often family-owned companies that focus on developing niche and bespoke solutions. This specialization has made Italian manufacturers particularly strong in areas such as bottling, labeling, and wine-related equipment. The industry is also known for its rapid adoption of new technologies and its ability to offer flexible and scalable solutions. Italian companies often export their sophisticated machinery worldwide, leveraging their reputation for design, quality, and adaptability to meet a diverse range of client needs.

France Beverage Packaging Equipment Market Overview

France is a significant market for beverage packaging equipment, driven by a large and diverse domestic beverage industry. The country has a strong demand for machinery across various sectors, including bottled water, wine, and dairy products. French manufacturers are focused on producing efficient and reliable equipment that can support the high production volumes of these industries. The country’s market is also influenced by a growing focus on sustainable packaging solutions and the premiumization of products, which pushes for advanced and aesthetically pleasing labeling and bottling technologies. This combination of a robust domestic industry and a forward-looking approach to innovation makes France a key player in the European market.

Key Players and Competitive Insights

The European beverage packaging equipment market is a dynamic and highly competitive space, with major players such as Krones AG, KHS GmbH, Sidel Group, Tetra Pak, and Syntegon Technology GmbH at the forefront. These companies compete on several fronts, including technological innovation, product quality, global reach, and service offerings. The competitive landscape is characterized by a mix of large, multinational corporations that offer a complete range of turnkey solutions and a number of smaller, regional players that specialize in specific types of machinery or niche applications. The trend toward automation and sustainability has intensified the competition, as companies strive to develop more energy-efficient and flexible equipment that can handle new, eco-friendly packaging materials. The market is also seeing strategic acquisitions and partnerships as companies look to expand their product portfolios and geographical footprint.

A few prominent companies in the industry include Krones AG, KHS GmbH, Sidel Group, Tetra Pak, Syntegon Technology GmbH, GEA Group AG, Serac Group, Sacmi Group, Duravant LLC, ProMach Inc., and Barry-Wehmiller Companies, Inc.

Key Players

- Barry-Wehmiller Companies, Inc.

- Duravant LLC

- GEA Group AG

- KHS GmbH

- Krones AG

- ProMach Inc.

- Sacmi Group

- Serac Group

- Sidel Group

- Syntegon Technology GmbH

- Tetra Pak

Europe Beverage Packaging Equipment Industry Developments

March 2024: Krones AG announced the completion of its acquisition of Netstal Maschinen AG, a company specializing in injection molding technology. This move strengthens Krones' portfolio in the rigid plastic packaging sector, particularly in preform production, and aims to provide more integrated solutions to its customers.

Europe Beverage Packaging Equipment Market Segmentation

By Automation Outlook (Revenue – USD Billion, 2020–2034)

- Manual

- Semi-Automatic

- Fully Automatic

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Bottled Water

- Dairy Beverage

- Alcoholic Beverages

- Others

By Type Outlook (Revenue – USD Billion, 2020–2034)

- Filling & Capping Machines

- Labelling & Coding Machines

- Palletizing & Depalletizing Machines

- Conveying & Handling Machines

- Cleaning & Sterilizing Machines

- Wrapping & Bundling Machines

- Cartoning Machines

- Others

By Country Outlook (Revenue – USD Billion, 2020–2034)

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

Europe Beverage Packaging Equipment Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 2.45 billion |

|

Market Size in 2025 |

USD 2.58 billion |

|

Revenue Forecast by 2034 |

USD 4.22 billion |

|

CAGR |

5.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 2.45 billion in 2024 and is projected to grow to USD 4.22 billion by 2034.

The market is projected to register a CAGR of 5.6% during the forecast period.

Germany held the largest share.

A few key players in the market include Krones AG, KHS GmbH, Sidel Group, Tetra Pak, Syntegon Technology GmbH, GEA Group AG, Serac Group, Sacmi Group, Duravant LLC, ProMach Inc., and Barry-Wehmiller Companies, Inc.

The fully automatic segment accounted for the largest share of the market in 2024.

The alcoholic beverages segment is expected to witness the fastest growth during the forecast period.