Dairy Foods Market Size, Share, Trends, & Industry Analysis Report

By Source (Cattle, Sheep, Goat, Camel), By Product, By Distribution Channel, and By Region -Market Forecast, 2025 - 2034

- Published Date:Sep-2025

- Pages: 119

- Format: PDF

- Report ID: PM2458

- Base Year: 2024

- Historical Data: 2020 - 2023

Overview

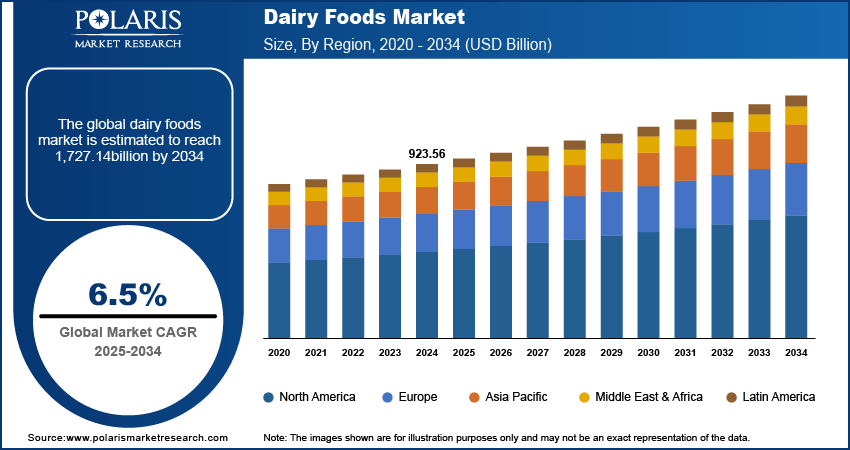

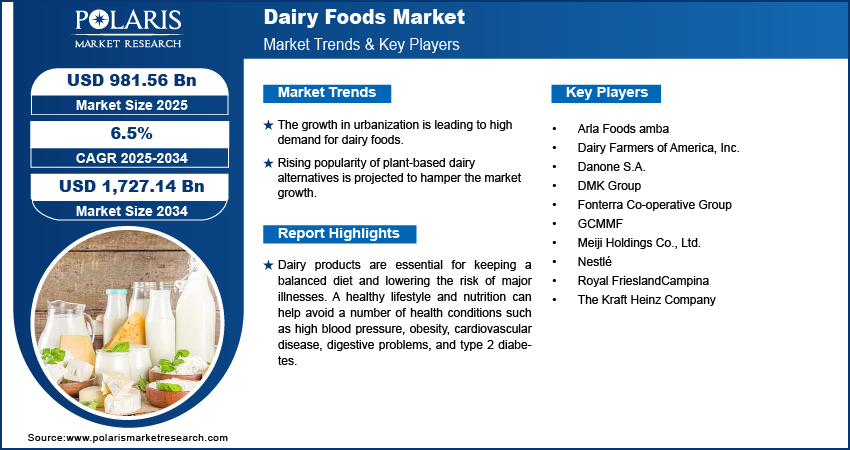

The global dairy foods market size was valued at USD 923.56 billion in 2024. The market is projected to grow at a CAGR of 6.5% during 2025 to 2034. Key factors driving demand for dairy foods include growing global populations, rising disposable incomes, and urbanization.

Key Insights

- Based on the product segment, the milk segment held the largest revenue share in 2024, due to a growing population and rising incomes.

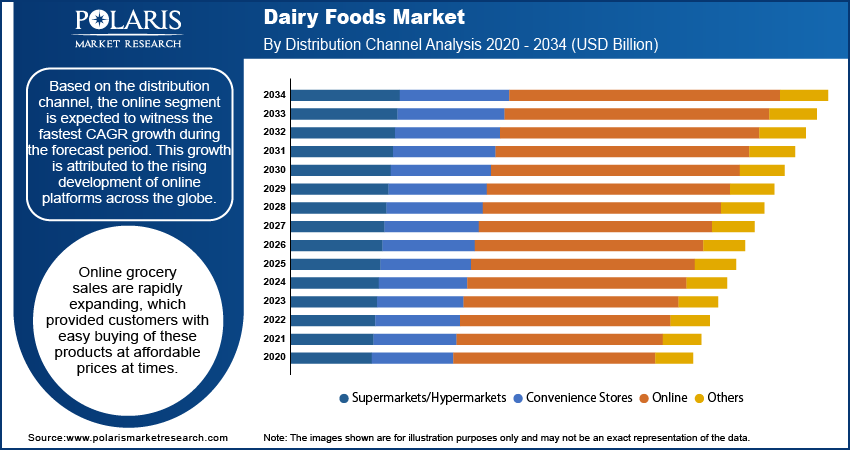

- The online segment is expected to witness the fastest CAGR growth during the forecast period, owing to the rising development of online platforms across the globe.

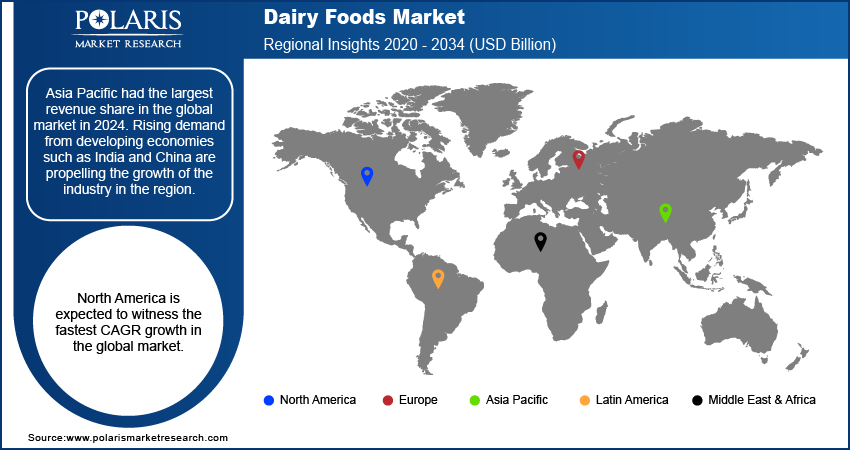

- Asia Pacific had the largest revenue share in the global market in 2024, due to rising demand from developing economies such as India and China.

- North America is expected to witness the fastest CAGR growth in the global market in the coming years, owing to rising health awareness.

Industry Dynamics

- The demand for the dairy foods market is fueled by the health benefits associated with their consumption.

- The growth in urbanization is leading to high demand for dairy foods.

- Growing disposable incomes in emerging countries are creating a lucrative market opportunity.

- Rising popularity of plant-based dairy alternatives is projected to hamper the market growth.

Market Statistics

- 2024 Market Size: USD 923.56 Billion

- 2034 Projected Market Size: USD 1,727.14 Billion

- CAGR (2025-2034): 6.5%

- Asia Pacific: Largest Market Share

To Understand More About this Research: Request a Free Sample Report

AI Impact on Dairy Foods Market

- AI helps in feed management, herd health, and milk yield.

- AI sensors and vision systems detect contamination and ensure product consistency.

- AI predicts demand, manages inventory, and reduces food waste in distribution.

- AI helps reduce energy use, water consumption, and greenhouse gas emissions in dairy production.

Dairy products are essential for keeping a balanced diet and lowering the risk of major illnesses. A healthy lifestyle and nutrition can help avoid a number of health conditions such as high blood pressure, obesity, cardiovascular disease, digestive problems, and type 2 diabetes. Furthermore, the easy availability of such products as a result of the development of emerging retail facilities and cold chain logistics is also contributing to the demand for the industry. The growing demand for these products is being driven by a large growth in sales of milk food products through online distribution.

The dairy foods market report details key market dynamics to help industry players align their business strategies with current and future trends. It examines technological advances and breakthroughs in the industry and their impact on the market presence. Furthermore, a detailed regional analysis of the industry at the local, national, and global levels has been provided.

The outbreak of the Covid-19 pandemic had a significant impact on the demand for the dairy foods market. Worldwide lockdown and stringent regulations caused an increasing number of people to be confined in their houses, allowing consumers to spend more time in their kitchens, resulting in an increase in household consumption of these products. Owing to its wide range, demand for categories such as cheese, yogurt, milk, and paneer increased significantly. Furthermore, the pandemic has encouraged consumers to adopt a healthier eating regime. Consumer preferences have evolved toward the consumption of milk-based products, which created lucrative opportunities for manufacturers to enhance their product offerings. Manufacturers converted the surplus milk into highly demanded value-added dairy foods such as butter, paneer, ghee, cheese, and sweets, further enhancing the dairy foods market.

However, the COVID-19 epidemic has significantly impacted the dairy foods market supply chain. In terms of both production and consumption of these products, several countries witnessed a decrease in demand owing to manpower shortages and disruptions in raw materials supply that halted dairy foods manufacturing.

Industry Dynamics

Growth Drivers

The demand for dairy foods market is fueled by the health benefits associated with their consumption. They are high in carbohydrates, protein, calcium, phosphorus, potassium, vitamin A, vitamin D, riboflavin, niacin, and other nutrients, which provide a variety of health benefits. One of the important reasons driving the industry growth is consumers' increasing awareness of health and the consumption of healthy foods to maintain good health. These products are commonly consumed to improve overall health and well-being. In addition, there has been a considerable increase in the number of people who follow a vegetarian diet, which is driving up the demand for milk products to meet the diet's protein requirements.

Know more about this report: Request for sample pages

Report Segmentation

The market is primarily segmented based on source, product, distribution channel, and region.

|

By Source |

By Product |

By Distribution Channel |

By Region |

· |

· |

· |

|

Know more about this report: Request for sample pages

Insight by Product

Based on the product segment, the milk segment held the largest revenue share in 2024. This dominance is attributed to the population expansion, rising incomes, rapid urbanization, and dietary changes in emerging countries. This trend is highly evident in East and Southeast Asia, especially in densely populated nations such as India, China, Indonesia, and Vietnam. Growing demand for milk and milk products provided an excellent opportunity for producers in high-potential, peri-urban areas to improve their livelihoods through increased production.

Insight by Distribution Channel

Based on the distribution channel, the online segment is expected to witness the fastest CAGR growth during the forecast period. This growth is attributed to the rising development of online platforms across the globe. Online grocery sales are rapidly expanding, which provided customers with easy buying of these products at affordable prices at times. The growing smartphone adoption also propelled the segment growth. Furthermore, the increaseing Gen-Z popualtion and growing disposable inome contributed to the segment dominance.

Geographic Overview

Asia Pacific had the largest revenue share in the global market in 2024. Rising demand from developing economies such as India and China are propelling the growth of the industry in the region. The market is growing due to rising awareness about healthy lifestyles and wellbeing, rising disposable income, and the availability of high-quality dairy foods in a wide range. Furthermore, the rising government initiatives of various nations present across the region to further expand the dairy foods sector is another factor contributing to the market demand. In June 2020, the Government of India, in collaboration with the Department of Animal Husbandry and Dairying, announced a $ 2.1 billion infrastructure development fund with an interest subsidy scheme to encourage private sector and MSMEs investment in dairy foods.

North America is expected to witness the fastest CAGR growth in the global market. Some industry categories have benefited from changes in consumer behavior brought on by COVID-19, such as the increasing usage of digital channels. The increased sale of dairy foods in the region is accelerated by the rising health awareness among consumers about the importance of adopting nutritious eating habits. Many firms in the region are focusing on developing new products for consumers as people's willingness to try out new and innovative products increases. The launch of numerous innovative yogurt products, such as fat-free, flavored, and drinkable yogurt, is expected to offer up new growth avenues for the market's makers.

Competitive Insight

Companies operating in the market are hevily investing in the development iof new products to capture the wide market presence. Small players are focusing on the development of flavor dairy products to attract younger population. The growing focus on expanding company's presence is also leading to high competition in the market. Some of the major players operating in the global market include Arla Foods amba, Dairy Farmers of America, Inc, Danone S.A, DMK Group, Fonterra Co-operative Group, GCMMF, Meiji Holdings Co., Ltd., Nestle, Royal FrieslandCampina, and The Kraft Heinz Company.

In 2021, Nestlé launched Wunda, a new pea-based beverage that is an excellent source of protein and fiber. Its great neutral taste, its various applications, and the fact that it is carbon neutral make it an ideal plant-based alternative to milk.

Dairy Foods Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 923.56 Billion |

| Market size value in 2025 | USD 981.56 Billion |

|

Revenue forecast in 2034 |

USD 1,727.14 Billion |

|

CAGR |

6.5% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Segments covered |

|

|

Regional scope |

|

|

Key companies |

Arla Foods amba, Dairy Farmers of America, Inc, Danone S.A, DMK Group, Fonterra Co-operative Group, GCMMF, Meiji Holdings Co., Ltd., Nestle, Royal FrieslandCampina, and The Kraft Heinz Company |

Navigate through the intricacies of the 2024 Intelligent Dairy Foods Market with precision, thanks to the comprehensive statistics on market share, size, and revenue growth rate assembled by Polaris Market Research Industry Reports. This thorough analysis not only provides a glimpse into the historical context but also extends its reach with a market forecast outlook until 2032. Immerse yourself in the richness of this industry analysis by securing a complimentary PDF download of the sample report.

Browse Our Top Selling Reports

Paprika Oleoresin Market Size, Share 2024 Research Report

Orthopedic Contract Manufacturing Market Size, Share 2024 Research Report

Residential and Commercial Roofing Materials Market Size, Share 2024 Research Report

FAQ's

• The global market size was valued at USD 923.56 billion in 2024 and is projected to grow to USD 1,727.14 billion by 2034.

• The global market is projected to register a CAGR of 6.5% during the forecast period.

• Asia Pacific dominated the market in 2024

• A few of the key players in the market are Arla Foods amba, Dairy Farmers of America, Inc, Danone S.A, DMK Group, Fonterra Co-operative Group, GCMMF, Meiji Holdings Co., Ltd., Nestle, Royal FrieslandCampina, and The Kraft Heinz Company

• The milk segment dominated the market revenue share in 2024.