Residential and Commercial Roofing Materials Market Share, Size, Trends, Industry Analysis Report

By Construction Type (New Construction, Re-roofing); By Product; By Application; By Region; Segment Forecast, 2024 - 2032

- Published Date:Feb-2024

- Pages: 117

- Format: PDF

- Report ID: PM4574

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

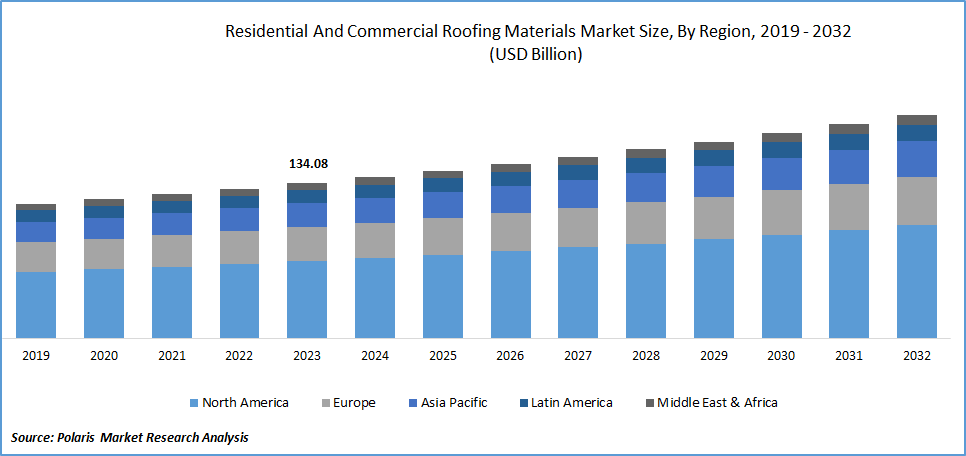

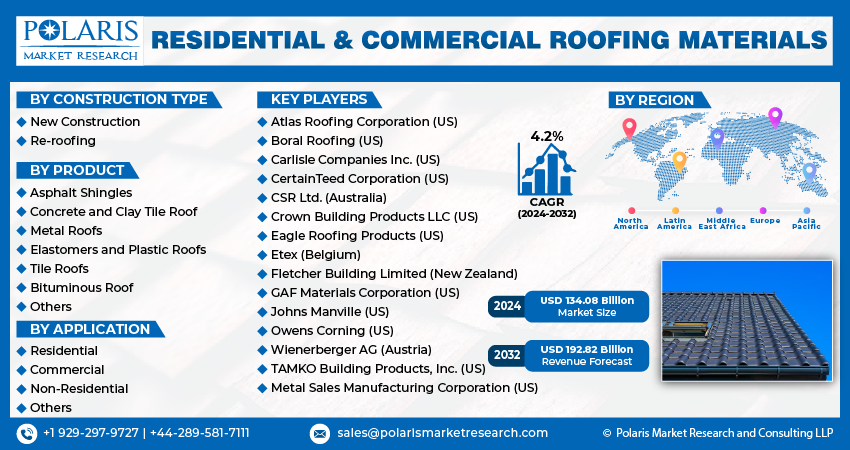

Residential and commercial roofing materials market size and share was valued at USD 129.21 billion in 2023. The market is anticipated to grow from USD 134.08 billion in 2024 to USD 192.82 billion by 2032, exhibiting a CAGR of 4.2% during the forecast period.

Market Overview

The rapid surge in construction activities in the world market is demonstrating a positive outlook for residential and commercial roofing material demand during the forecast timeframe. According to industrial data, by 2030, the United States is expected to receive $60 billion in construction contracts from plant construction companies annually. These trends are likely to stimulate the need for roofing materials in the long run.

The research report offers a quantitative and qualitative analysis of the residential and commercial roofing materials market to enable effective decision-making. It covers the key trends and growth opportunities anticipated to have a favorable impact on the market. Besides, the study covers segment and regional revenue forecasts for market assessment.

To Understand More About this Research: Request a Free Sample Report

The ongoing government regulations promoting the integration of sustainable roofing technology and initiatives by non-government organizations to promote environmental safety are anticipated to exhibit prominent growth potential in the next few years.

- For instance, in October 2023, the Green Roofs for Healthy Cities unveiled the development of the Green Roof Infrastructure Network to enhance the use of green roofs and other rainwater infrastructure in British Columbia.

Moreover, the COVID-19 pandemic created a surge in the demand for attractive roofing materials driven by the existence of stringent lockdown measures, making most people on their homes in a way facilitated the necessity to arrange their dwellings appealingly, contributing to the demand for residential and commercial roofing materials in the world.

Growth Drivers

The rising establishment of new schemes to face climate change

The extreme climatic conditions on a global scale due to the highest emissions of greenhouse gases are encouraging governments to step forward with new policy initiatives to assist their citizens in overcoming the consequences. For instance, in April 2023, Telangana, a state in India, introduced the cool roof policy for independent residential and commercial buildings other than apartments with a view to promoting thermally compatible and heat-resilient buildings, apart from energy efficiency.

Increasing demand for roofing for renovation activities

The growing demand for house remodeling activities can be attributable to their cost-effectiveness in constructing a new building. The presence of advanced roofing materials in the marketplace is encouraging households to adopt the latest materials for their dwellings, positively associating with the circular economy trend, as construction generates 40% of solid waste annually.

The growing global population is likely to bolster the need for housing and, in turn, residential and commercial roofing materials during the assessment period. According to United Estimates, the global population will rise by approximately 2 billion people by 2050.

Restraining Factors

Prevalence of supply chain disruptions

The presence of a raw material shortage in the world is expected to obstruct the growth of the global roofing materials market, driven by the potential to utilize alternatives such as plastic, cedar, and other materials in construction activities.

The devastating weather conditions, including tornadoes, hurricanes, and catastrophic hail storms, caused damage to the dwellings, necessitating the need for strong and durable roofing materials. The strong demand in the world, specifically in Texas and Oklahoma, is creating a shortage of shingles, motivating house owners to adopt other alternatives.

Report Segmentation

The market is primarily segmented based on construction type, product, application, and region.

|

By Construction Type |

By Product |

By Application |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Construction Type Analysis

Re-roofing segment is anticipated to grow at a faster pace during the forecast period

The re-roofing segment is expected to grow at a healthy CAGR during the residential and commercial roofing materials market forecast period, owing to its economic value and environmental friendliness. As the establishment of new construction necessitates a higher cost of investment, house owners are opting for re-roofing activities as a part of house remodeling and renovation tasks.

The new construction segment is likely to witness substantial growth in the next few years, driven by the growing construction activities in urban areas and the rising demand for dwellings. The higher rate of return on new construction activities is gaining traction among a larger number of the population to invest their savings in the construction of buildings, apartments, and other commercial dwellings, contributing to segmental growth during the forecast timeframe.

By Product Analysis

Asphalt shingles segment exhibited the largest market share over other products

The asphalt shingles segment received the largest global share in 2023 and is anticipated to boost its market position during the assessment period. This is highly influenced by the durability and lower investment in maintenance of the roofing material compared to the other roofing types. The potential resistance power of asphalt shingles to ice, fire, wind, and other extreme weather conditions is fueling their adoption by house owners. Furthermore, the affordability and cost-effectiveness of asphalt shingles are likely to bolster their demand in the next few years.

According to the global residential and commercial roofing materials market forecast, the metal roofing segment is projected to register nominal growth in the marketplace. This is attributable to the ease of installation and energy efficiency. The enhanced safety of metal roofing at the time of a lightning strike or wildfire and the higher recycling content (25–95%) of roofing in line with asphalt shingles are likely to drive significant demand potential in the coming years.

By Application Analysis

Commercial segment witnessed the largest market revenue share in 2023

The commercial segment accounted for the most prominent revenue share in the global market in 2023. This is driven by the growing demand for solar installation in roofing and the effort to cut down on energy costs. For instance, in February 2023, Solarsense unveiled that it received a 400% rise in commercial inquiries about solar adoption in the manufacturing sector in 2022. This is likely to inspire companies to adopt compatible roofing systems to effectively fit solar panels, contributing to the global market demand for roofing materials.

The residential segment is projected to witness significant growth in the coming years, driven by the rising disposable income of the global population, empowering investment in residential construction and renovation tasks for long-term benefits.

Regional Insights

North America region accounted for the largest share of the global market in 2023

The North America region experienced the largest share in the global market. The region’s growth is attributable to the rising housing shortage and continuous need for roofing material displacement due to extreme weather conditions, primarily hurricanes. Based on available data, in the United States, approximately two-thirds of the population has housing ownership; however, the nation is witnessing a housing shortage of between 1.5 million and 6 million dwellings.

The Asia Pacific region is projected to grow at a faster rate with a higher CAGR during the forecast period due to the growing population in the region, which facilitates the higher demand for construction activities and drives the need for prominent residential and commercial roofing materials in the marketplace. The presence of larger-population countries in the region, such as India and China, is likely to propel the growth of the market during the forecast period.

The significant rise in the global population is showing enormous opportunities for the residential and commercial roofing materials market. According to the UN-Habitat estimation, approximately three billion people will require adequate housing by 2030.

Key Market Players & Competitive Insights

Strategic partnerships to boost the competition

The residential and commercial roofing materials market development is fragmented with the presence of several players and is likely to witness competition driven by rising expansion activities in the global market. For instance, in January 2024, Centre Partners announced the completion of its acquisition of Quick Roofing.

Some of the major players operating in the global market include:

- Atlas Roofing Corporation (US)

- Boral Roofing (US)

- Carlisle Companies Inc. (US)

- CertainTeed Corporation (US)

- CSR Ltd. (Australia)

- Crown Building Products LLC (US)

- Eagle Roofing Products (US)

- Etex (Belgium)

- Fletcher Building Limited (New Zealand)

- GAF Materials Corporation (US)

- Johns Manville (US)

- Metal Sales Manufacturing Corporation (US)

- Owens Corning (US)

- TAMKO Building Products, Inc. (US)

- Wienerberger AG (Austria)

Recent Developments in the Industry

- In January 2024, Manufacturers Reserve Supply entered into a partnership agreement with Brava Roof Tile, a sustainable roofing provider, to expand its product offering in the world market.

- In January 2024, Omnia Exterior Solutions entered a new partnership with a commercial and residential roofing company, Ace Roofing, to promote its roofing materials product portfolio.

Report Coverage

The residential and commercial roofing materials market report emphasizes key regions across the globe to provide a better understanding of the product to the users. Also, the report provides market insights into recent developments, and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers an in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, construction type, product, application, and their futuristic growth opportunities.

Residential and Commercial Roofing Materials Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 134.08 billion |

|

Revenue Forecast in 2032 |

USD 192.82 billion |

|

CAGR |

4.2% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2032 |

|

Segments Covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions and segmentation. |

Navigate through the intricacies of the 2024 residential and commercial roofing materials market with precision, thanks to the comprehensive statistics on market share, size, and revenue growth rate assembled by Polaris Market Research Industry Reports. This thorough analysis not only provides a glimpse into the historical context but also extends its reach with a market forecast outlook until 2032. Immerse yourself in the richness of this industry analysis by securing a complimentary PDF download of the sample report.

FAQ's

The global residential and commercial roofing materials market size is expected to reach USD 192.82 billion by 2032

Atlas Roofing Corporation, Boral Roofing, Carlisle Companies Inc., CertainTeed Corporation, & CSR Ltd. are the top market players in the market.

North America region contribute notably towards the global Residential and Commercial Roofing Materials Market.

Residential and commercial roofing materials market exhibiting the CAGR of 4.2% during the forecast period.

The Residential and Commercial Roofing Materials Market report covering key segments are construction type, product, application and region.