Scleral Lens Market Size, Share, Trends, Industry Analysis Report

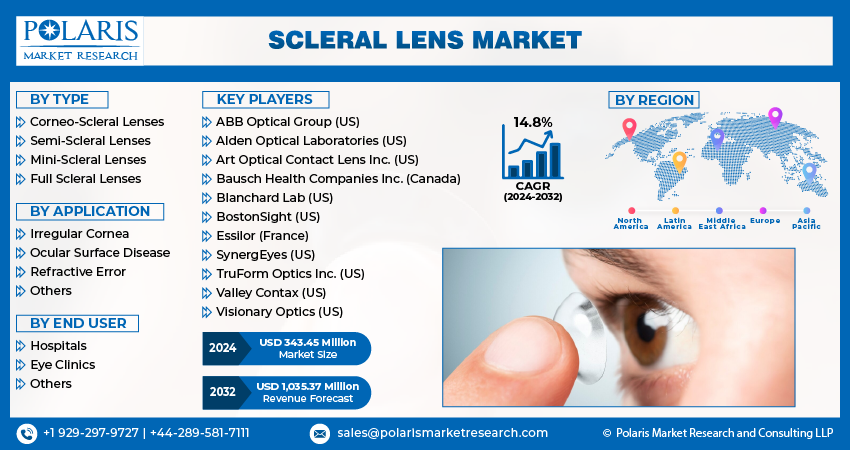

: By Type (Corneo-Scleral Lenses, Semi-Scleral Lenses, Mini-Scleral Lenses, and Full Scleral Lenses), By Application, By End Use, and By Region – Market Forecast, 2025–2034

- Published Date:May-2025

- Pages: 126

- Format: PDF

- Report ID: PM4576

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

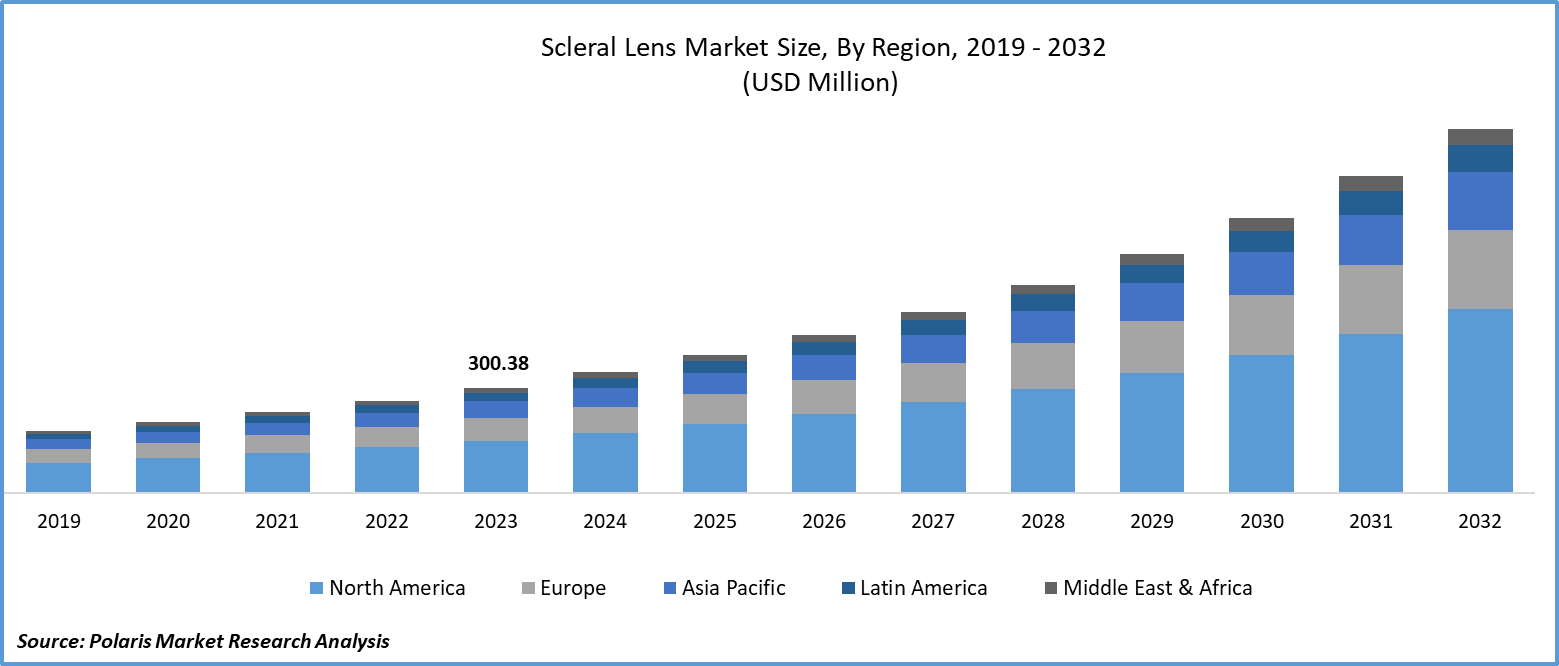

The scleral lens market size was valued at USD 318.39 million in 2024. It is projected to grow from USD 353.54 million in 2025 to USD 918.40 million by 2034, exhibiting a CAGR of 11.2% during 2025–2034.

The scleral lens market refers to the segment of the ophthalmic device industry focused on the development, manufacturing, and distribution of large-diameter gas permeable contact lenses that vault over the cornea and rest on the sclera. These lenses are primarily used to manage complex corneal conditions such as keratoconus, severe dry eyes disease, and post-surgical corneal irregularities. Unlike traditional contact lenses, scleral lenses provide a tear-filled reservoir between the lens and the cornea, enhancing comfort and improving visual acuity in patients with irregular or compromised corneal surfaces.

Rising prevalence of corneal disorders, particularly keratoconus and ocular surface disease, is driving increased clinical demand for specialized vision correction solutions. According to the Centers for Disease Control and Prevention, approximately 90 million Americans aged 40 and above suffer from vision and ocular disorders, representing over 60% of this demographic. Projections indicate that by 2050, in the absence of effective therapeutic interventions, the incidence of diabetic retinopathy is expected to escalate by 72%.

To Understand More About this Research: Request a Free Sample Report

Growing awareness among eye care professionals about the therapeutic benefits of scleral lenses is enhancing adoption rates across both developed and emerging markets. Furthermore, the integration of advanced materials offering greater oxygen permeability and longer wear time continues to attract attention from both clinicians and patients, supporting industry expansion.

Market Dynamics

Technological Advancements in Lens Customization

Technological advancements in lens customization, including the integration of 3D ocular surface mapping and digital imaging, are significantly contributing to the rising demand for scleral lenses. These innovations allow for a highly personalized approach to lens design, ensuring a more accurate fit for patients with irregular corneas, severe dry eye, or post-surgical complications. Enhanced precision in measurement reduces trial-and-error fittings, shortens chair time, and improves long-term wearability and visual acuity. In addition, the development of advanced software platforms that simulate lens performance on individual eyes is optimizing practitioner workflows. This technological progression is not only improving patient outcomes but also increasing clinical confidence in prescribing scleral lenses, which is directly supporting market growth.

Increasing Aging Population

An aging global population is playing a pivotal role in market growth, driven by the rising prevalence of age-related ocular disorders such as keratoconus, corneal ectasia, and severe dry eye disease. According to the Population Reference Bureau, the US population aged 65 and above is projected to rise from 58 million in 2022 to 82 million by 2050, a 47% increase. This age group’s share of the total population is expected to grow from 17% to 23%. Older adults often experience changes in ocular physiology that make conventional contact lenses unsuitable, increasing demand for therapeutic alternatives such as scleral lenses. This demographic shift is contributing to demand for scleral lenses as healthcare systems and eye care providers prioritize advanced vision correction options to address complex corneal conditions in the elderly. Additionally, the growing availability of specialty eye care services for aging populations is enhancing accessibility to scleral lens fittings, further reinforcing market dynamics.

Segment Insights

Market Breakdown by Type

Based on type, the market is segmented into corneo-scleral lenses, semi-scleral lenses, mini-scleral lenses, and full scleral lenses. The mini-scleral lenses segment accounted for a major market share in 2024 due to their optimal balance between ease of handling and enhanced ocular surface coverage. These lenses provide superior stability and comfort for patients with moderate to severe corneal irregularities, making them highly preferred in clinical practice. Their mid-range diameter offers a less invasive fit compared to full scleral lenses while still forming a protective tear reservoir, which is critical for managing dry eye and post-surgical complications. This segment's dominance is further reinforced by growing practitioner familiarity, streamlined fitting protocols, and increasing patient compliance, all of which are contributing to overall growth.

The corneo-scleral lenses segment is expected to grow at a robust pace in the coming years, owing to increasing demand for hybrid contact lens alternatives among patients with early-stage corneal irregularities. These lenses combine the advantages of traditional gas permeable lenses with the added stability of scleral landing zones, making them suitable for individuals needing enhanced comfort and visual acuity without the full coverage of mini- or full scleral designs. Growing adoption among optometrists for managing mild ectatic disorders and early keratoconus is contributing to industry expansion for this segment. Additionally, improvements in edge design and oxygen permeability are supporting their wider clinical adoption.

Market Breakdown by End User

In terms of end user, the market is segmented into hospitals, eye clinics, and others. The eye clinics segment held the largest market share in 2024 due to their specialization in customized contact lens fittings and access to advanced diagnostic tools such as corneal topography and 3D ocular surface mapping. These settings are particularly well-equipped to handle complex cases such as keratoconus and severe ocular surface disease, which often require scleral lens intervention. A growing number of optometrists and ophthalmologists are being trained in specialty lens fitting techniques, which is increasing patient throughput and driving targeted prescription rates. This specialized expertise and infrastructure are contributing to sustained scleral lens market expansion for the eye clinic segment.

The hospitals segment is projected to grow at a rapid pace during the forecast period, owing to the increasing number of surgical interventions that result in corneal irregularities, necessitating post-operative vision rehabilitation through scleral lenses. Tertiary care hospitals are expanding their contact lens departments to include advanced scleral lens services, especially for patients recovering from keratoplasty, trauma, or severe ocular burns. Integration of ocular surface disease management into multidisciplinary care models is enhancing referrals for scleral lens evaluations. These trends are contributing to the scleral lens market demand in hospital settings, where complex patient profiles demand highly tailored vision correction solutions.

Regional Insights

By region, the study provides the scleral lens market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America held the largest market share in 2024 due to a well-established specialty contact lens infrastructure, high awareness among eye care professionals, and widespread access to advanced diagnostic technologies. A robust reimbursement framework for complex corneal disease management further supports patient access to scleral lenses across both private and institutional care settings. The growing prevalence of keratoconus, post-surgical corneal irregularities, and ocular surface disorders has also driven demand for specialty lenses. In addition, extensive practitioner training programs and continuous innovation in lens design from regional manufacturers are propelling the demand for scleral lenses in North America. Strong distribution networks and proactive adoption of novel fitting technologies are reinforcing the region’s dominance.

The Asia Pacific market is expected to register a significant CAGR during the forecast period due to the rising burden of untreated corneal diseases, increasing myopia prevalence, and expanding access to specialty eye care in emerging economies. The International Myopia Conference (IMC) 2024, held in Sanya, China from September 25 to 28, brought together researchers and eyecare practitioners to address the growing prevalence of myopia. In India, Satish Kumar Gupta’s study found that 22% of rural and 42% of urban school children were affected by myopia of at least -0.75D, with urban areas showing higher rates of astigmatism and high myopia, highlighting the impact of urbanization. Rapid improvements in healthcare infrastructure, coupled with growing awareness of advanced vision correction options, are contributing to the scleral lens market opportunities across the region. Investments in optometry education and training is also accelerating the availability of skilled practitioners capable of fitting complex lenses. Local manufacturing capabilities are evolving, enabling cost-effective product offerings tailored to the regional population.

Key Players and Competitive Insights

The competitive landscape of the scleral lens industry is characterized by a dynamic interplay of technology advancements, innovation-driven product pipelines, and aggressive market expansion strategies. Companies are heavily investing in customizable lens design technologies, including wavefront-guided optics and 3D corneo-scleral mapping, to improve patient-specific outcomes and gain a competitive edge. The industry is witnessing increased activity in mergers and acquisitions, often focused on vertically integrating lens design, manufacturing, and distribution capabilities to streamline operations and expand global reach. Post-merger integration efforts are being strategically aligned to enhance product development cycles and scale specialty lens portfolios. Additionally, joint ventures and strategic alliances between ophthalmic equipment manufacturers and clinical institutions are fostering advancements in scleral lens fitting methodologies and material sciences.

Frequent product launches targeting niche indications such as advanced keratoconus and ocular surface disease reflect the ongoing push for portfolio diversification. Competitive differentiation is increasingly shaped by oxygen-permeable materials, moisture retention technology, and hybrid lens innovations. According to industry analysis, the rising demand for vision rehabilitation in post-surgical and irregular cornea cases is creating fertile ground for industry growth. These factors, combined with shifting consumer preferences toward specialty lenses, highlight the evolving scleral contact lens industry dynamics and the high potential for sustained market penetration across both established and emerging geographies.

The industry is fragmented, with the presence of numerous global and regional players. A few major players in the market are ABB Optical Group, Alden Optical Laboratories, Art Optical Contact Lens Inc., Bausch + Lomb, Blanchard Lab, BostonSight, Essilor, SynergEyes, TruForm Optics Inc., Valley Contax, and Visionary Optics.

ABB Optical Group, engaged in the distribution and manufacturing of optical products, operates through three main business supports—ABB Contact Lens, ABB Labs, and ABB Business Solutions. The company specializes in a comprehensive portfolio that includes soft contact lenses, custom specialty lenses such as scleral lenses, and gas permeable designs. ABB Optical Group’s product offerings also extend to the manufacturing and distribution of specialty lenses like Ortho-K lenses, which are used for myopia management. The company provides a variety of services to eye care professionals, including shipping, inventory management, and technology solutions to support practice operations. ABB Optical Group’s presence is nationwide in the US, supplying nearly two-thirds of eye care professionals across the country.

Alden Optical Laboratories, engaged in the manufacture of custom soft and gas permeable contact lenses, has established expertise in producing lenses for a range of vision correction needs, including spherical, toric, multifocal, and scleral designs. The company’s product portfolio features HP Sphere, Classic Sphere, HP Toric, HP Multifocal, and GP Toric lenses, as well as prosthetic and enhancing tints available on all base designs. Alden Optical Laboratories also develops lens designs for medically indicated ocular conditions, such as keratoconus, addressing both therapeutic and corrective requirements. Services provided by the company include custom lens manufacturing tailored to individual prescriptions and ocular conditions, with a focus on high-quality, made-to-order solutions. Alden Optical Laboratories is headquartered in Lancaster, New York, and operates primarily within the US.

List of Key Companies in Scleral Lens Market

- ABB Optical Group

- Alden Optical Laboratories

- Art Optical Contact Lens Inc.

- Bausch + Lomb

- Blanchard Lab

- BostonSight

- Essilor

- SynergEyes

- TruForm Optics Inc.

- Valley Contax

- Visionary Optics

Scleral Lens Industry Developments

May 2024: Bausch + Lomb introduced Zenlens ECHO in the US. It is a custom scleral contact lens designed for irregular corneas, including severe ocular conditions and post-surgical cases.

October 2023: Alcon launched its TOTAL30 Multifocal, the first monthly water gradient multifocal contact lens. This innovation strengthened its presence in fast-growing markets.

February 2023: Visionary Optics released a new custom-designed scleral lens with an improved fit for better patient comfort.

Scleral Lens Market Segmentation

By Type Outlook (Revenue, USD Million, 2020–2034)

- Corneo-Scleral Lenses

- Semi-Scleral Lenses

- Mini-Scleral Lenses

- Full Scleral Lenses

By Application Outlook (Revenue, USD Million, 2020–2034)

- Irregular Cornea

- Ocular Surface Disease

- Refractive Error

- Others

By End User Outlook (Revenue, USD Million, 2020–2034)

- Hospitals

- Eye Clinics

- Others

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Scleral Lens Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 318.39 million |

|

Market Size Value in 2025 |

USD 353.54 million |

|

Revenue Forecast by 2034 |

USD 918.40 million |

|

CAGR |

11.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 318.39 million in 2024 and is projected to grow to USD 918.40 million by 2034.

The global market is projected to register a CAGR of 11.2% during the forecast period.

North America held the largest market share in 2024 due to a well-established specialty contact lens infrastructure, high awareness among eye care professionals, and widespread access to advanced diagnostic technologies

A few key players in the market are ABB Optical Group, Alden Optical Laboratories, Art Optical Contact Lens Inc., Bausch + Lomb, Blanchard Lab, BostonSight, Essilor, SynergEyes, TruForm Optics Inc., Valley Contax, and Visionary Optics. Market Overview

The mini-scleral lenses segment accounted for the largest market share in 2024 due to their optimal balance between ease of handling and enhanced ocular surface coverage.

The eye clinics segment held the largest market share in 2024 due to their specialization in customized contact lens fittings and access to advanced diagnostic tools such as corneal topography and 3D ocular surface mapping.