Contact Lenses Market Size, Share, & Industry Analysis Report

: By Material (Silicone Hydrogel, Gas Permeable, and Hybrid), By Design, By Application, By Distribution Channel, By Usage, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 114

- Format: PDF

- Report ID: PM1085

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

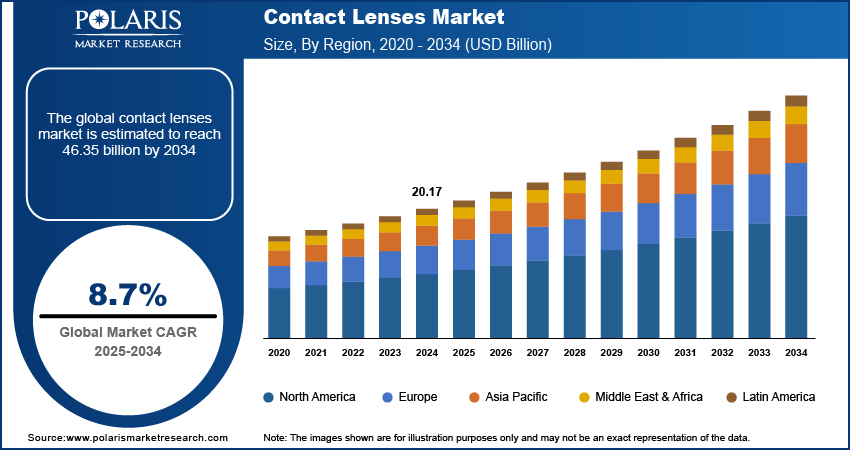

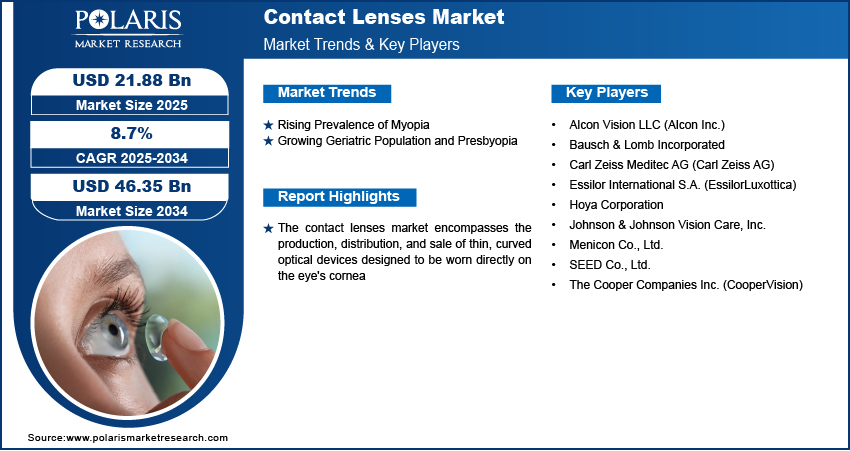

The contact lenses market size was valued at USD 20.17 billion in 2024. It is projected to grow from USD 21.88 billion in 2025 to USD 46.35 billion by 2034, exhibiting a CAGR of 8.7% during 2025–2034.

Contact lenses are primarily used to correct vision for individuals affected by refractive errors such as myopia, hyperopia, astigmatism, and presbyopia. Beyond vision correction, contact lenses are also utilized for cosmetic purposes, offering a way to alter eye color or enhance appearance.

One significant driver for increasing demand for ophthalmic spectacle lenses and equipment, along with contact lenses, is the rising prevalence of vision impairments worldwide. Conditions such as myopia are becoming increasingly common, particularly due to lifestyle factors such as increased screen time. The aging global population also contributes to growth, as age-related vision issues such as presbyopia become more prevalent. Furthermore, a growing interest in personal appearance, ophthalmic eye dropper, and fashion trends is boosting the demand for cosmetic contact lenses. Technological advancements, such as the development of more comfortable and breathable lens materials, including silicone hydrogel, and the increasing availability of daily disposable lenses, are also fueling expansion.

To Understand More About this Research:Request a Free Sample Report

Industry Dynamics

Rising Prevalence of Myopia

The increasing prevalence of myopia, or nearsightedness, is a significant driver. Globally, the incidence of myopia has been on the rise, particularly among younger generations. A study published in the British Journal of Ophthalmology in 2023 noted a significant increase in myopia prevalence among children and adolescents worldwide. A meta-analysis published in the Journal Ophthalmology projected that by 2050, 49.8% of the global population (4.758 billion people) will be myopic. This growing population with myopia represents a substantial and expanding consumer base requiring vision correction. Moreover, The American Academy of Ophthalmology highlights the growing concern about high myopia, which increases the risk of glaucoma, retinal detachment, and myopic maculopathy. Contact lenses offer a convenient and often preferred alternative to spectacles for many individuals having myopia, especially for active lifestyles or aesthetic reasons. This escalating need for vision correction due to the rising rates of myopia is a key factor propelling the growth.

Technological Advancements in Lens Materials and Designs

Innovations have led to the development of more comfortable, breathable, and specialized lenses. For instance, silicone hydrogel materials, which allow for greater oxygen permeability, have significantly improved wearability and reduced the risk of eye dryness and discomfort. Research published in Eye & Contact Lens in 2022 highlighted the ongoing development of novel lens designs, including multifocal lenses for presbyopia and orthokeratology lenses for myopia management. These advancements enhance the user experience, expand the range of vision problems that can be addressed with contact lenses, and attract new users seeking advanced vision correction solutions. Thus, continuous technological advancements in contact lens materials and designs act as a major driver.

Growing Geriatric Population and Presbyopia

The expanding global geriatric population and the associated increase in presbyopia are significant contributors dynamics. Presbyopia, the age-related loss of the eye's ability to focus on nearby objects, typically affects individuals over the age of 40. As life expectancy increases and the population ages, the number of individuals experiencing presbyopia is also rising. A report by the National Eye Institute (NEI) in 2021 projected a substantial increase in the number of presbyopia cases in the coming decades. Contact lenses, particularly multifocal designs, offer an effective vision correction solution for individuals suffering from presbyopia, providing an alternative to reading glasses or bifocals. This growing demographic with age-related vision changes is a crucial factor driving the demand and fostering the expansion.

Segmental Insights

Market Assessment By Material

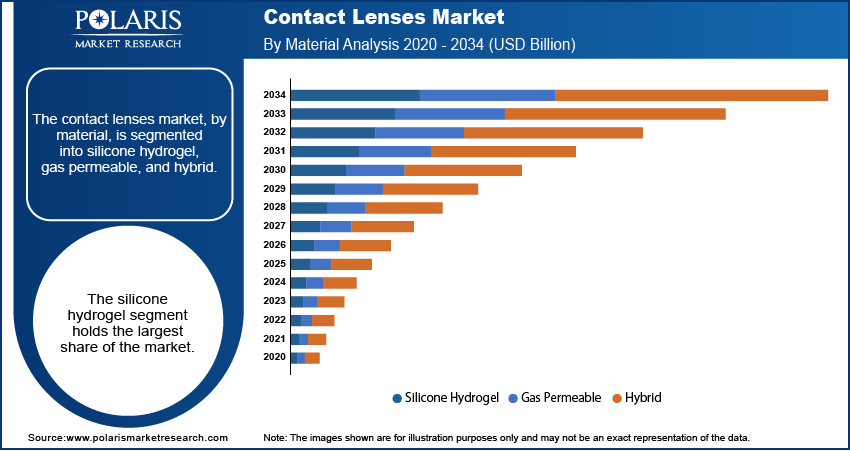

The contact lenses market, by material, is segmented into silicone hydrogel, gas permeable, and hybrid. The silicone hydrogel segment holds the largest share. This dominance can be attributed to the enhanced oxygen permeability offered by silicone hydrogel lenses, which translates to improved comfort and ocular health for wearers. The increased breathability reduces the risk of hypoxia-related complications, making them a preferred choice for daily and extended wear. Furthermore, continuous innovations in silicone hydrogel technology have led to the development of lenses with improved wettability and reduced lens deposits, further solidifying their popularity among both practitioners and consumers. The comfort and health benefits associated with silicone hydrogel materials have made them the leading choice.

While currently holding a smaller share, the gas permeable segment is anticipated to exhibit the highest growth rate in the coming years. These rigid lenses offer exceptional oxygen permeability and can provide superior vision correction for certain conditions, such as high astigmatism and keratoconus. Increasing awareness among eye care professionals and patients about the benefits of gas permeable lenses for specific vision needs is contributing to their growing adoption. Moreover, advancements in lens designs and materials are enhancing the comfort and wearability of gas permeable lenses, addressing previous limitations. This renewed focus on the unique advantages offered by gas permeable lenses positions this segment for significant growth.

Market Evaluation By Design

The segmentation, by design, includes toric, spherical, multifocal, and others. The spherical segment accounts for the largest share. Spherical lenses are the most commonly prescribed type, designed to correct standard vision problems such as myopia (nearsightedness) and hyperopia (farsightedness). The widespread prevalence of these refractive errors ensures a consistent and substantial demand for spherical contact lenses. Their established presence, coupled with continuous improvements in comfort and material technology, contributes to their continued dominance in terms of share.

The multifocal segment is expected to demonstrate the highest growth rate in the coming years, primarily driven by the increasing global geriatric population and the subsequent rise in presbyopia, an age-related condition affecting near vision. Multifocal contact lenses offer a convenient solution for individuals affected by presbyopia, allowing them to see clearly at multiple distances without reading glasses. As the population ages and awareness of multifocal lens technology grows, the demand for these lenses is anticipated to increase significantly, positioning the multifocal segment for the highest growth in the future.

Market Assessment By Application

The segmentation, by application, includes corrective, cosmetic, therapeutic, prosthetic, and lifestyle-oriented. The corrective segment holds the largest share. This is primarily due to the fundamental role of contact lenses in addressing a wide range of vision impairments, including myopia, hyperopia, astigmatism, and presbyopia. The sheer volume of individuals requiring vision correction globally ensures a consistent and substantial demand for corrective contact lenses. These lenses are considered a mainstream solution for vision care, contributing to their significant presence.

The lifestyle-oriented segment is anticipated to experience the highest growth rate during the forecast period. This growth is fueled by an increasing consumer focus on convenience and specific lifestyle needs. This category includes lenses designed for sports activities, extended wear for busy schedules, and those offering UV protection. As consumer preferences evolve toward more adaptable and specialized vision solutions that integrate seamlessly with their lifestyles, the demand for lifestyle-oriented contact lenses is expected to rise significantly in the coming years.

Market Assessment By Distribution Channel

The segmentation, by distribution channel, includes eye care practitioners, e-commerce, and retail. The eye care practitioners segment commands the largest share. This dominance is rooted in the crucial role of optometrists and ophthalmologists in prescribing and dispensing contact lenses. These professionals conduct eye examinations, determine the appropriate lens type and fit, and provide essential guidance on lens care and usage. The requirement for professional consultation and prescription for many types of contact lenses contributes significantly to the substantial share held by eye care practitioners.

The e-commerce segment is projected to exhibit the highest growth rate. The increasing penetration of internet usage and the growing preference for online shopping are driving this expansion. E-commerce platforms offer convenience, a wider selection of products, and often competitive pricing, attracting a growing number of consumers to purchase their contact lenses online. The ease of reordering and direct-to-consumer delivery further contributes to the rising popularity of this distribution channel, positioning the e-commerce segment for the highest growth.

Market Assessment By Usage

The segmentation, by usage, includes disposable, daily disposable, frequently replacement, and traditional. The disposable segment holds the largest share. This significant share is primarily driven by the convenience and hygiene offered by disposable lenses, which are typically replaced on a two-weekly or monthly basis. The ease of use and reduced need for extensive cleaning and storage solutions make them a popular choice among contact lens wearers, contributing to their dominant position.

The daily disposable segment is anticipated to experience the highest growth rate during the forecast period. This rapid growth is fueled by an increasing emphasis on eye health and convenience. Daily disposable lenses eliminate the need for cleaning and storage, reducing the risk of lens-related infections and offering maximum convenience for users. The growing awareness of these benefits and the increasing adoption of daily disposable lenses by new and existing wearers are expected to drive the highest growth in the coming years.

Regional Analysis

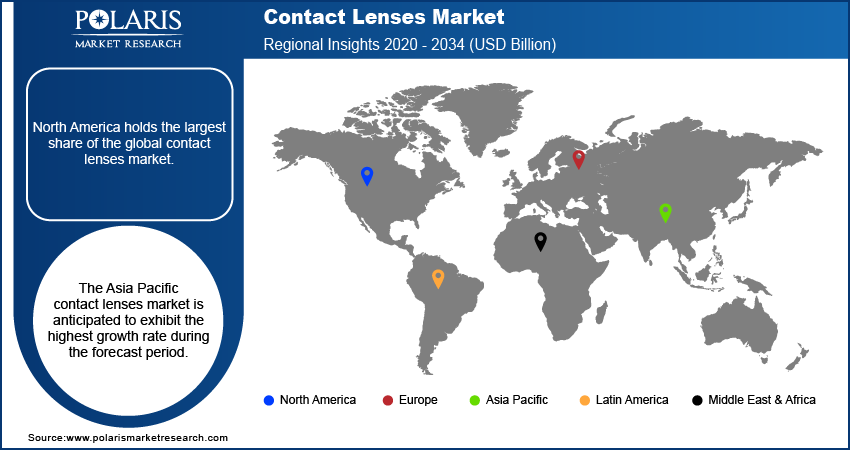

The contact lenses market demonstrates varied regional dynamics across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America and Europe have historically represented significant markets due to well-established healthcare infrastructure, high awareness regarding vision correction, and the presence of leading players. Asia Pacific is emerging as a high-growth area, fueled by increasing disposable income, a rising prevalence of myopia, and growing healthcare access. Latin America and the Middle East & Africa are also witnessing increasing adoption of contact lenses, albeit from a smaller base, driven by improving living standards and greater awareness of vision care options.

North America holds the largest share, owing to a well-established consumer base with high awareness and adoption rates of contact lenses for vision correction and cosmetic purposes. The presence of advanced healthcare systems and a strong distribution network further contribute to the region's leading position. Furthermore, a relatively higher disposable income in North America allows for greater spending on vision care products, including premium and specialty contact lenses, propelling the North America contact lenses market expansion.

The Asia Pacific contact lenses market is anticipated to exhibit the highest growth rate during the forecast period. This rapid expansion is driven by several converging factors, including a large and youthful population base experiencing increasing rates of myopia, particularly in East Asian countries. Rising disposable incomes and improving access to eye care services across the region are also contributing to greater adoption of contact lenses. Moreover, increasing awareness regarding the benefits of contact lenses over traditional spectacles, coupled with evolving lifestyle preferences, is fueling a significant surge in demand, positioning Asia Pacific as the region with the most promising growth prospects.

Key Players and Competitive Insights

A few major active players in the contact lenses market include Johnson & Johnson Vision Care, Inc. (Johnson & Johnson); Alcon Vision LLC; Bausch & Lomb Incorporated (Bausch Health Companies Inc.); The Cooper Companies Inc. (CooperVision); Hoya Corporation; Essilor International S.A. (EssilorLuxottica); Carl Zeiss Meditec AG; Menicon Co., Ltd.; and SEED Co., Ltd. These companies are actively involved in the development, manufacturing, and distribution of a wide range of contact lenses for vision correction and other applications.

The competitive landscape is characterized by the presence of several well-established global players and some regional manufacturers. Competition is driven by continuous innovation in lens materials, designs, and functionalities, such as enhanced comfort, breathability, UV protection, and solutions for specific vision conditions such as astigmatism and presbyopia. Companies are also focusing on expanding their product portfolios, particularly in the high-growth segments such as daily disposables and multifocal lenses. Strategic collaborations, partnerships, and acquisitions are also observed as companies strive to strengthen their penetration and expand their geographical reach.

Alcon Vision LLC (Alcon Inc.) is a global leader in eye care, with its operational headquarters located in Fort Worth, Texas, US, although it has a paper headquarters in Geneva, Switzerland. The company offers a comprehensive range of vision care products, including daily disposable, reusable, and color-enhancing contact lenses, as well as a wide array of ocular health products such as solutions for dry eye and contact lens care. Their dedication to innovation and a broad product portfolio makes them a significant player in addressing diverse consumer needs.

Johnson & Johnson Vision Care, Inc. (Johnson & Johnson) has its headquarters in Jacksonville, Florida, US. The company is renowned for introducing the world's first disposable soft contact lens under the ACUVUE brand. It offers a wide spectrum of contact lenses catering to various vision needs, including lenses for nearsightedness, farsightedness, astigmatism, and presbyopia. They provide lenses with different replacement frequencies, from daily disposables to monthly options, and also offer contact lens solutions. Their strong brand recognition and continuous focus on research and development maintain their strong presence.

List of Key Companies in Contact Lenses Market

- Alcon Vision LLC (Alcon Inc.)

- Bausch & Lomb Incorporated (Bausch Health Companies Inc.)

- Carl Zeiss Meditec AG (Carl Zeiss AG)

- Essilor International S.A. (EssilorLuxottica)

- Hoya Corporation

- Johnson & Johnson Vision Care, Inc. (Johnson & Johnson)

- Menicon Co., Ltd.

- SEED Co., Ltd.

- The Cooper Companies Inc. (CooperVision)

Contact Lenses Industry Developments

- October 2023: Alcon announced the introduction of its TOTAL30 MF (multifocal) contact lenses in the US and some international markets. These lenses are specifically designed for individuals affected by presbyopia, offering a daily disposable option that aims to provide comfort and clear vision at various distances.

- March 2023: CooperVision launched its MyDay Energys contact lenses in the US. These daily disposable silicone hydrogel lenses are designed with a unique aspheric optic and Aquaform Technology.

Contact Lenses Market Segmentation

By Material Outlook (Revenue – USD Billion, 2020–2034)

- Silicone Hydrogel

- Gas Permeable

- Hybrid

By Design Outlook (Revenue – USD Billion, 2020–2034)

- Toric

- Spherical

- Multifocal

- Others

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Corrective

- Cosmetic

- Therapeutic

- Prosthetic

- Lifestyle-oriented

By Distribution Channel Outlook (Revenue – USD Billion, 2020–2034)

- Eye Care Practitioners

- E-commerce

- Retail

By Usage Outlook (Revenue – USD Billion, 2020–2034)

- Disposable

- Daily Disposable

- Frequently Replacement

- Traditional

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Contact Lenses Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 20.17 billion |

|

Market Size Value in 2025 |

USD 21.88 billion |

|

Revenue Forecast by 2034 |

USD 46.35 billion |

|

CAGR |

8.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The contact lenses market has been segmented into detailed segments of material, design, application, distribution channel, and usage. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Market Entry Strategies

A key growth strategy in the field of contact lenses revolves around continuous product innovation, focusing on enhanced comfort, breathability, and specialized features such as blue light filtering and ophthalmic drug delivery capabilities. Market penetration can be improved by expanding awareness about the benefits of contact lenses over traditional eyewear, particularly in emerging economies. Strategic collaborations with eye care practitioners remain crucial for driving prescriptions and ensuring proper fitting and usage. Furthermore, leveraging digital marketing and e-commerce platforms can enhance accessibility and reach a wider consumer base. Personalization and customization of lens offerings to cater to specific lifestyle needs and vision requirements also present significant development opportunities.

FAQ's

The global market size was valued at USD 20.17 billion in 2024 and is projected to grow to USD 46.35 billion by 2034.

The market is projected to register a CAGR of 8.7% during the forecast period.

North America held the largest share of the market in 2024.

A few major players include Johnson & Johnson Vision Care, Inc. (Johnson & Johnson); Alcon Vision LLC; Bausch & Lomb Incorporated (Bausch Health Companies Inc.); The Cooper Companies Inc. (CooperVision); Hoya Corporation; Essilor International S.A. (EssilorLuxottica); Carl Zeiss Meditec AG; Menicon Co., Ltd.; and SEED Co., Ltd.

The silicone hydrogel segment accounted for the largest share of the market in 2024.

Following are a few of the trends: ? Increasing Prevalence of Myopia: The rising incidence of nearsightedness globally, especially among younger populations due to increased screen time, is a significant driver for the demand for corrective contact lenses. ? Technological Advancements in Lens Materials: Ongoing innovations in materials such as silicone hydrogel are leading to more breathable, comfortable, and safer lenses for extended wear, enhancing user experience. ? Growing Preference for Daily Disposables: Daily disposable lenses are gaining popularity due to their convenience, hygiene benefits, and reduced risk of infections compared to reusable options.

Contact lenses are thin, curved lenses that are placed directly on the surface of the eye to correct vision or for cosmetic or therapeutic purposes. They serve as a medical ophthalmic equipment and device that can correct refractive errors such as myopia (nearsightedness), hyperopia (farsightedness), astigmatism (blurred vision due to irregular cornea shape), and presbyopia (age-related loss of near vision). Beyond vision correction, some contact lenses are designed to alter eye color or to deliver medication to the eye. They offer an alternative to eyeglasses and can provide a wider field of vision and greater comfort for some individuals.