Ophthalmic Drug Market Size, Share, Trends, & Industry Analysis Report

By Drug Class (Anti-VEGF Agents, Anti-glaucoma), By Disease, By Route of Administration, By Product Type, By Dosage Form, By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 116

- Format: PDF

- Report ID: PM4073

- Base Year: 2024

- Historical Data: 2020-2023

What is the Ophthalmic Drug Market Size?

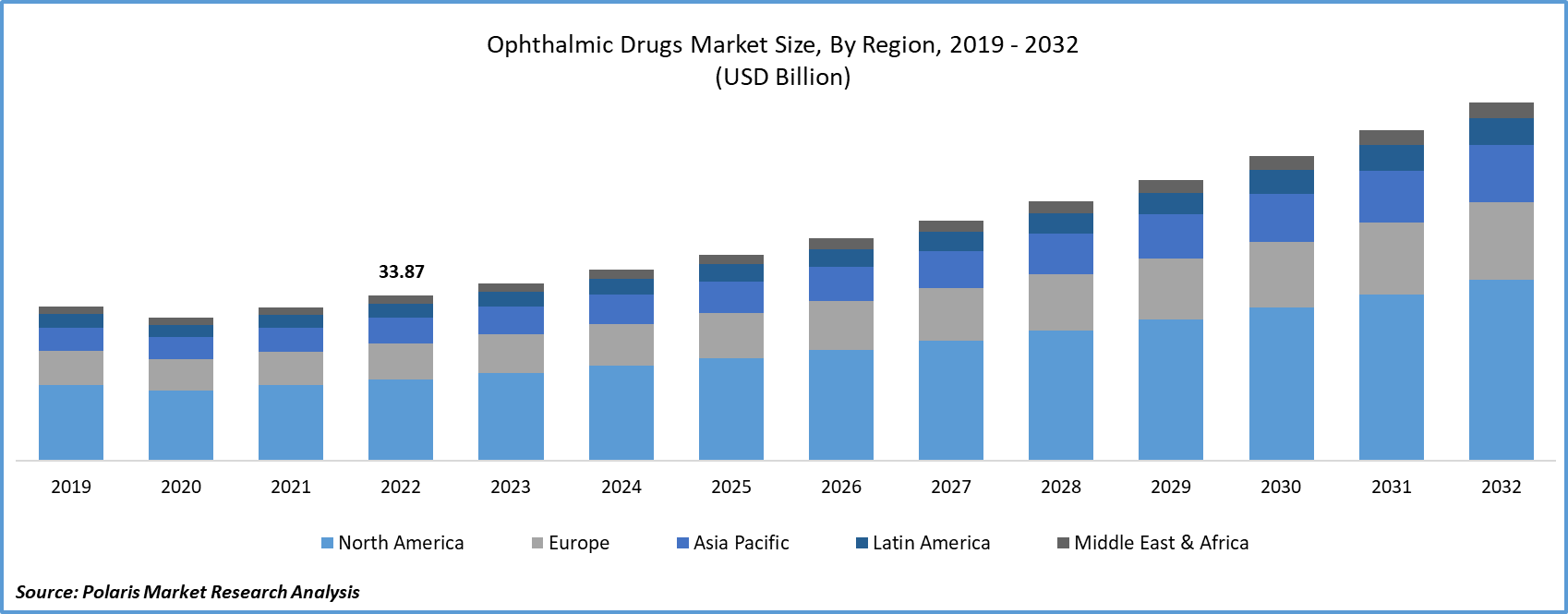

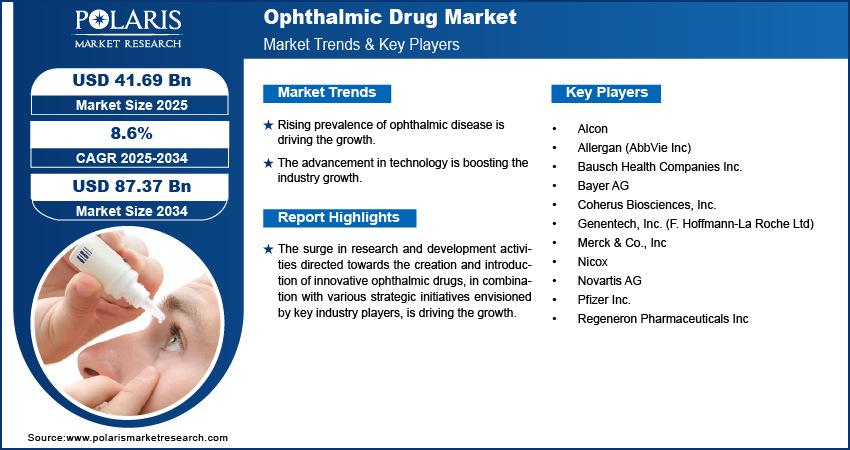

The global ophthalmic drug market was valued at USD 38.47 billion in 2024 and is expected to grow at a CAGR of 8.6% during the forecast period. The growth is driven by rising prevalence of eye disorder, rising elderly population and focus on fast track product approvals.

Key Insights

- The Anti-VEGF segment is expected to witness significant growth during the forecast period due to rising prevalence of retinal disorders.

- The semisolid dominated with largest share in 2024 due to due to the increasing approvals and product launches.

- North America dominated with largest share in 2024 due to the higher prevalence of eye diseases and an increasing awareness of these conditions.

- Asia Pacific is projected to accounted for a significant share in the global market driven by presence of substantial patient population, a high prevalence of eye diseases.

Industry Dynamics

- The increased in research and development activities is fueling the industry growth.

- Rising prevalence of ophthalmic disease is driving the growth.

- The advancement in technology is boosting the industry growth.

- Stringent regulatory requirements and lengthy approval processes for new ophthalmic drugs limits the growth.

Market Statistics

- 2024 Market Size: USD 38.47 Billion

- 2034 Projected Market Size: USD 87.37 Billion

- CAGR (2025-2034): 8.6%

- Largest Market: North America

Impact of AI on Industry

- Speeds up the identification of potential ophthalmic drug candidates by analyzing large biomedical datasets.

- Improves patient selection, monitoring, and outcome prediction, improving the efficiency and success rate of clinical trials for eye-related drugs.

- Reduce R&D cost by streamlining preclinical and clinical phases.

To Understand More About this Research: Request a Free Sample Report

The surge in research and development activities directed towards the creation and introduction of innovative ophthalmic drugs, in combination with various strategic initiatives envisioned by key industry players, is driving the growth. Furthermore, the unaddressed requirements within the realm of ophthalmology are likely to fuel the expansion of the ophthalmic drug market. As per a report by the World Health Organization in October 2021, an estimated 2.2 billion individuals grapple with vision impairments, encompassing both nearsightedness and farsightedness. Notably, around half of these cases, accounting for at least 1 billion instances, can be prevented through suitable treatment. Age-related factors predominantly underpin the leading causes of blindness and vision impairments. This heightened prevalence places a considerable financial burden on governments, with myopia alone estimated to cost as much as USD 244 billion in terms of vision impairment. Consequently, due to the rising incidence of eye-related disorders, the ophthalmic drug market is poised to encounter promising growth opportunities.

Ophthalmic drugs are pertained to the eye or adjoining tissue. Drugs for ocular management surface in several configurations involving solutions, ointments, suspensions, and gels and can be utilized to distribute an active pharmaceutical ingredient (API) to the exterior of the eye, within the eye, near to eye, or they can be utilized with an ophthalmic device. There is an aggregate of ophthalmic preparations obtainable over the counter for extensive sales, with the majority offering a cure for dry eye or redness.

Industry Dynamics

Growth Drivers

What are the Factors Driving the Industry Growth?

The industry is driven by combination of various factor. Major factor driving the growth is rising prevalence of eye disorder. Eye disorder such as glaucoma, age-related macular degeneration (AMD), diabetic retinopathy, and dry eye syndrome is rising globally. This rise in the prevalence is driving the demand for the ophthalmic drugs. Moreover, the number of elderly populations is rising worldwide. This rise in the elderly population is further fueling the prevalence of eye disease, consequently driving the demand for the ophthalmic drugs. Moreover, the government focus on fast-track approvals for novel drugs are rising, due to which players with drugs are entering the industry. This in turn is driving the expansion of the industry.

Report Segmentation

The market is primarily segmented based on disease, drug class, route of administration, dosage form, product type, and region.

|

By Drug Class |

By Disease |

By Route of Administration |

By Product Type |

By Dosage Form |

By Region |

|

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Which Segment By Drug Class is Expected to Witness Significant Growth?

The Anti-VEGF segment is poised to exhibit a substantial CAGR throughout the forecast period. The increasing prevalence of retinal disorders such as diabetic retinopathy, age-related macular degeneration, and others, coupled with a rising rate of diagnosis for these conditions in the population, is driving the growing demand for anti-VEGF therapy in various regions. For instance, according to the CDC, approximately 20.0 million Americans were affected by age-related macular degeneration, and the global figure is projected to reach 288 million by 2040, consequently driving the segment demand in the forecast period. Furthermore, the increasing number of product approvals and launches is contributing to the segment's global growth. For instance, In January 2022, Genentech, Inc., a subsidiary of F. Hoffmann-La Roche Ltd., obtained approval from the U.S. FDA for Vabysmo, a treatment for wet, or neovascular, age-related macular degeneration and diabetic macular edema, targeting vascular endothelial growth factor.

Why Semisolid Segment Dominated in 2024?

The Semisolid segment dominated with the largest share in 2024 primarily due to the increasing approvals and product launches, encompassing ointments, suspensions, gels, and others. The expanded utilization of ointments, especially in addressing inflammatory conditions, infections, and dry eye, is contributing to their growing popularity, given their enhanced efficacy. Additionally, the segment's growth is further driven by the heightened focus of key industry players on obtaining approvals and introducing a wider range of products. For instance, In November 2021, I-MED Pharma Inc. introduced I-DEFENCE, a nighttime ointment for dry eye, to the U.S. market

Regional Insights

How North America Captured Largest Market Share in 2024?

North America dominated with largest share in 2024 due to a higher prevalence of eye diseases and an increasing awareness of these conditions. Additionally, the ongoing research and development efforts of key industry players are expected to drive regional growth further. Furthermore, North America benefits from the presence of major players such as Pfizer Inc., Alcon, and Bausch and Lomb, which drives the product accessibility, thereby driving the growth.

What are the Reasons for Asia Pacific's Significant Growth?

Asia Pacific is expected to witness significant growth during the forecast period due to several factors, including a substantial patient population, a high prevalence of eye diseases, and the emergence of local companies. Although the Asia Pacific region boasts the largest patient base, the treatment rate is comparatively lower in this area, which creates an opportunity for global players as well as local businesses. Furthermore, the implementation of various strategic initiatives by market players is anticipated to contribute to regional growth.

Key Market Players & Competitive Insights

The market is characterized by intense competition, with established players relying on advanced technology, high-quality products, and a strong brand image to drive revenue growth. These companies employ various strategies such as research and development, mergers and acquisitions, and technological innovations to expand their product portfolios and maintain a competitive edge in the market.

Some of the major players operating in the global market include:

- Alcon

- Allergan (AbbVie Inc)

- Bausch Health Companies Inc.

- Bayer AG

- Coherus Biosciences, Inc.

- Genentech, Inc. (F. Hoffmann-La Roche Ltd)

- Merck & Co., Inc

- Nicox

- Novartis AG

- Pfizer Inc.

- Regeneron Pharmaceuticals Inc

Recent Developments

- July 2025, Alcon launched TRYPTYR (acoltremon ophthalmic solution) 0.003% in the U.S. as a first-in-class treatment for Dry Eye Disease, offering rapid natural tear production and expanding options for over 30 million Americans suffering from dry eye symptoms.

- July 2025, Lupin launched its generic Loteprednol Etabonate Ophthalmic Suspension, 0.5% in the U.S., a bioequivalent to Bausch & Lomb’s Lotemax, expanding treatment options for steroid-responsive eye inflammation and targeting a USD 55 million annual market.

- In September 2022, Santen Pharmaceutical and UBE have received U.S. FDA approval for Omlonti, an eye drop solution for lowering intraocular pressure in individuals with glaucoma or ocular hypertension.

- In June 2022, F. Hoffmann-La Roche Ltd. has been granted approval by Health Canada for Vabysmo, an authorization for the treatment of neovascular (wet) Age-related Macular Degeneration (AMD) and Diabetic Macular Edema (DME).

- In April 2022, Sandoz, a subsidiary of Novartis, introduced its generic combination eye drops, consisting of brimonidine tartrate and timolol maleate, in an ophthalmic solution with a concentration of 0.2% and 0.5%, respectively. This generic medication is considered equivalent to AbbVie's COMBIGAN and is intended to reduce eye pressure in patients with ocular hypertension (high eye pressure) within the United States.

Ophthalmic Drug Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 38.47 billion |

| Market size value in 2025 | USD 41.69 billion |

|

Revenue forecast in 2034 |

USD 87.37 billion |

|

CAGR |

8.6% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments Covered |

By Disease, By Drug Class, By Route of Administration, By Dosage Form, By Product Type, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

• The market size was valued at USD 38.47 Billion in 2024 and is projected to grow to USD 87.37 Billion by 2034.

• The market is projected to register a CAGR of 8.6% during the forecast period.

• A few of the key players in the market are Alcon, Allergan (AbbVie Inc), Bausch Health Companies Inc., Bayer AG, Coherus Biosciences, Inc., Genentech, Inc. (F. Hoffmann-La Roche Ltd), Merck & Co., Inc., Nicox, Novartis AG, Pfizer Inc., and Regeneron Pharmaceuticals Inc.

• The semi solid segment accounted for the largest market share in 2024.

• The Anti-VEGF is expected to record significant growth.

• The market size was valued at USD 38.47 Billion in 2024 and is projected to grow to USD 87.37 Billion by 2034.

• The market is projected to register a CAGR of 8.6% during the forecast period.

• A few of the key players in the market are Alcon, Allergan (AbbVie Inc), Bausch Health Companies Inc., Bayer AG, Coherus Biosciences, Inc., Genentech, Inc. (F. Hoffmann-La Roche Ltd), Merck & Co., Inc., Nicox, Novartis AG, Pfizer Inc., and Regeneron Pharmaceuticals Inc.

• The semi solid segment accounted for the largest market share in 2024.

• The Anti-VEGF is expected to record significant growth.