Glaucoma Market Size, Share, Trends, Industry Analysis Report

: By Disease Type (Open Angle Glaucoma, Angle Closure Glaucoma, and Others), Drug Class, Distribution Channel, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 114

- Format: PDF

- Report ID: PM1366

- Base Year: 2024

- Historical Data: 2020-2023

Glaucoma Market Overview

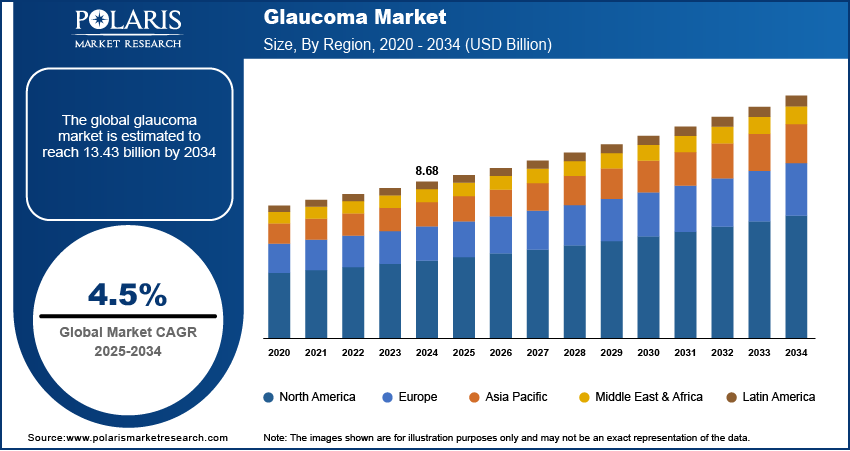

The glaucoma market size was valued at USD 8.68 billion in 2024. The market is projected to grow from USD 9.05 billion in 2025 to USD 13.43 billion by 2034, exhibiting a CAGR of 4.5% during 2025–2034.

The glaucoma market encompasses pharmaceutical treatments, surgical procedures, and medical devices aimed at managing glaucoma, a group of eye conditions that cause optic nerve damage and vision loss. Key market drivers include the rising prevalence of glaucoma due to an aging population, increased awareness and screening programs, and advancements in treatment options such as minimally invasive glaucoma surgeries (MIGS) and sustained-release drug delivery systems. Glaucoma market trends include the development of novel therapeutics targeting intraocular pressure and neuroprotection, the integration of artificial intelligence in glaucoma diagnostics, and the expansion of teleophthalmology for remote patient monitoring. Regulatory approvals and reimbursement policies also influence market growth.

To Understand More About this Research: Request a Free Sample Report

Glaucoma Market Dynamics

Aging Population Leading to Increased Glaucoma Cases

The growing elderly population worldwide is a major factor driving the expansion of the glaucoma market. Aging significantly increases the risk of developing glaucoma, a progressive eye disease that can lead to vision loss if left untreated. As a result, the demand for effective diagnostic tools, advanced treatment options, and long-term disease management solutions is rising. Innovations in early detection methods, such as optical coherence tomography (OCT) and advanced imaging technologies, are improving early diagnosis and intervention rates. Additionally, the increasing availability of minimally invasive glaucoma surgeries (MIGS) and novel drug therapies is further fueling market growth. With healthcare infrastructure improving and awareness about glaucoma rising, the market is expected to continue expanding to meet the needs of the aging population. dvancements in Diagnostic Technologies Enhancing Early Detection

Innovations in diagnostic tools have improved the early detection and management of glaucoma. The development of advanced imaging techniques and devices has enabled more accurate assessments of intraocular pressure and optic nerve health. These technological advancements facilitate timely interventions, thereby driving the demand for diagnostic equipment. Thus, the rising advancements in diagnostic technologies that are enhancing early detection boost the glaucoma market demand.

Emergence of Novel Therapeutics and Treatment Approaches

The introduction of new pharmacological treatments and surgical procedures has significantly impacted the glaucoma market development. Innovative therapies, including sustained-release drug delivery systems and minimally invasive glaucoma surgeries (MIGS), offer improved patient outcomes and reduced side effects. These advancements have led to increased adoption of novel therapeutics and treatment approaches, further propelling market expansion.

Glaucoma Market Segment Insights

Glaucoma Market Assessment by Disease Type

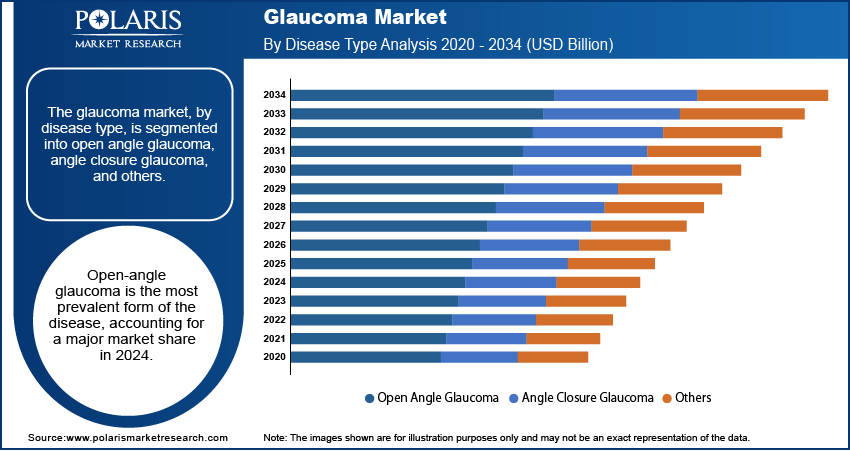

The glaucoma market, by disease type, is segmented into open angle glaucoma, angle closure glaucoma, and others. The open-angle glaucoma dominated the glaucoma market share in 2024 due to the highly increasing incidence of age-related eye disorders, including blurred vision and vascular conditions. The widespread adoption of hypotensive medications to reduce intraocular pressure further contributes to the dominance of the segment.

The angle-closure glaucoma segment, while less common, is experiencing notable growth due to high awareness and improved diagnostic capabilities. Advancements in imaging technologies and increased screening efforts have led to earlier detection and treatment, thereby driving the expansion of the segment. The growing recognition of angle-closure glaucoma's potential severity has prompted healthcare providers to focus more on its management, contributing to its rising market share.

Glaucoma Market Evaluation by Drug Class

The glaucoma market, by drug class, is segmented into prostaglandins analogs, beta-blockers, adrenergic agonists, carbonic anhydrase inhibitors, and others. The prostaglandin analogs segment represented the major market share in 2024, primarily due to their efficacy in reducing intraocular pressure (IOP) and the convenience of once-daily dosing. These medications have become the preferred first-line therapy for many patients, contributing to their substantial market share.

Glaucoma Market Outlook by Distribution Channel

The glaucoma market, by distribution channel, is segmented into hospital pharmacy, retail pharmacy, and online pharmacy. The hospital pharmacy segment holds the largest share in 2024. This dominance is attributed to patients' preference, especially among the elderly, for receiving treatment in outpatient settings. Hospital pharmacies, often situated within specialized glaucoma clinics staffed by qualified optometrists and ophthalmologists, provide comprehensive eye examinations and accurate prescriptions, ensuring patients receive specialized care in a comfortable environment. Additionally, hospital pharmacies dispense prescription medications, including eye drops and oral drugs, essential for managing glaucoma. Pharmacists play a crucial role in ensuring proper drug selection, dosage, and patient counseling, further solidifying the prominence of hospital pharmacies in the distribution of glaucoma treatments.

The online pharmacy segment is experiencing the fastest growth in the glaucoma treatment market. For patients who prefer not to visit physical stores, online pharmacies offer a convenient alternative for purchasing prescription drugs. Factors such as ease of access, competitive pricing, and a wide selection of medications contribute to the increasing recognition of digital pharmacies. Patients with chronic conditions, including glaucoma, find it beneficial to obtain their medications online, particularly for prescription renewals and maintenance treatments. The provision of home delivery services by online pharmacies further enhances their appeal, giving the segment a competitive edge in the market.

Glaucoma Market Regional Outlook

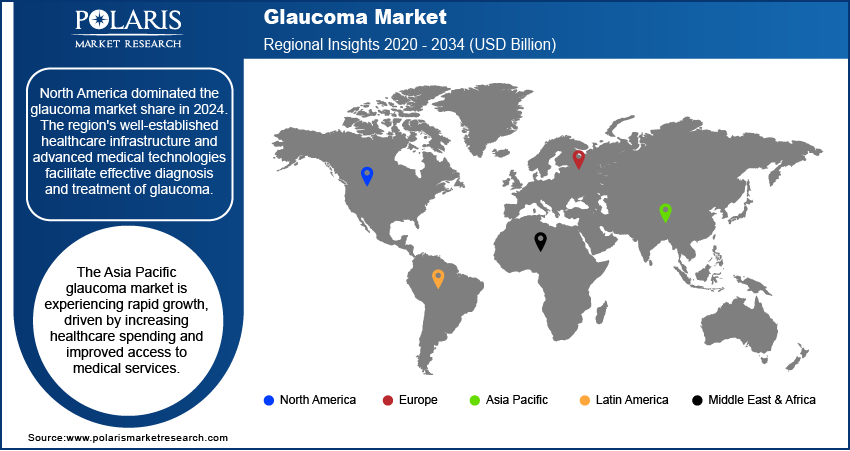

By region, the report provides glaucoma market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the glaucoma market revenue share in 2024. The region's well-established healthcare infrastructure and advanced medical technologies facilitate effective diagnosis and treatment of glaucoma. A high prevalence of the disease, coupled with increasing incidences of ocular disorders and diabetes, contributes to the demand for glaucoma therapeutics. Additionally, the presence of key market players and strong research and development activities further boost North America's dominance in the market.

The Europe glaucoma market benefits from accessible healthcare services and technological advancements. The region's focus on research and development, along with a high prevalence of glaucoma, supports market growth. Germany holds the largest market share within Europe, while the UK is experiencing the fastest growth in this sector.

The Asia Pacific glaucoma market is experiencing rapid growth, driven by increasing healthcare spending and improved access to medical services. A rising geriatric population and changing lifestyle patterns contribute to the higher prevalence of glaucoma in the region. Government initiatives aimed at preventing and treating eye diseases, along with advancements in healthcare infrastructure, further propel glaucoma market expansion in the region.

Glaucoma Market – Key Players and Competitive Analysis Report

The glaucoma market comprises several key players actively involved in developing and providing treatments for this eye condition. Notable companies include Novartis AG; Pfizer Inc.; Merck & Co., Inc.; Bausch & Lomb Incorporated; Allergan plc; and Teva Pharmaceutical Industries Ltd. These organizations contribute significantly to the availability of various therapeutic options for glaucoma patients.

Additional contributors to the glaucoma market are Santen Pharmaceutical Co., Ltd.; Aerie Pharmaceuticals, Inc.; Ocular Therapeutix, Inc.; and Nicox S.A. These companies focus on innovative treatments and drug delivery systems to enhance patient outcomes. Their efforts in research and development play a crucial role in advancing glaucoma therapy.

The competitive landscape is characterized by ongoing research initiatives, strategic partnerships, and product launches aimed at improving treatment efficacy and patient adherence. Companies are investing in novel therapeutics and exploring minimally invasive surgical options to address unmet medical needs in glaucoma care. This dynamic environment fosters the development of advanced solutions, ultimately benefiting patients and healthcare providers alike.

Novartis AG, headquartered in Basel, Switzerland, is a major multinational pharmaceutical company specializing in innovative healthcare solutions. The company focuses on research, development, and manufacturing of medicines across various therapeutic areas, including oncology, neuroscience, ophthalmology, and immunology. Novartis has a strong presence in the glaucoma therapeutics market, providing advanced treatments for this progressive eye condition that can lead to blindness if untreated. Glaucoma is characterized by increased intraocular pressure (IOP), which damages the optic nerve. Novartis offers a range of glaucoma medications, particularly eye drops such as prostaglandin analogs and beta-blockers, aimed at reducing IOP by decreasing fluid production or enhancing its drainage from the eye.

Pfizer Inc., one of the world's largest pharmaceutical companies, has a significant presence in the glaucoma treatment market. Pfizer's most notable contribution to glaucoma care is Xalatan, a prostaglandin analog that has been a leading medication for reducing intraocular pressure (IOP) in patients having open-angle glaucoma or ocular hypertension since its approval in the late 1990s. Xalatan has been widely prescribed due to its efficacy and patient tolerance, making it a cornerstone in glaucoma management. Over the years, Pfizer has continued to innovate around Xalatan, introducing tools such as Xal-Ease to enhance patient compliance and ease of use.

List of Key Companies in Glaucoma Market

- Aerie Pharmaceuticals, Inc.

- Alcon Inc.

- Allergan plc

- Bausch & Lomb Incorporated

- EyePoint Pharmaceuticals, Inc.

- Glaukos Corporation

- Hoya Corporation

- Merck & Co., Inc.

- Nicox S.A.

- Novartis AG

- Ocular Therapeutix, Inc.

- Pfizer Inc.

- Santen Pharmaceutical Co., Ltd.

- Sun Pharmaceutical Industries Ltd.

- Teva Pharmaceutical Industries Ltd.

Glaucoma Industry Developments

-

In February 2025, Alcon announced the US Launch of Voyager DSLT, a first-of-its-kind treatment for glaucoma and ocular hypertension.

-

In March 2023, Novartis partnered with the Philippine Glaucoma Society to promote awareness about glaucoma and the importance of regular eye examinations. This collaboration aims to enhance early detection and treatment of glaucoma in the Philippines.

Glaucoma Market Segmentation

By Disease Type Outlook (Revenue – USD Billion, 2020–2034)

- Open Angle Glaucoma

- Angle Closure Glaucoma

- Others

By Drug Class Outlook (Revenue – USD Billion, 2020–2034)

- Prostaglandins Analogs

- Beta-blockers

- Adrenergic Agonists

- Carbonic Anhydrase Inhibitors

- Others

By Distribution Channel Outlook (Revenue – USD Billion, 2020–2034)

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

By Regional Outlook (Revenue –USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Glaucoma Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 8.68 billion |

|

Market Value in 2025 |

USD 9.05 billion |

|

Revenue Forecast by 2034 |

USD 13.43 billion |

|

CAGR |

4.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy: The glaucoma market has been broadly segmented on the basis of disease type, drug class, and distribution channels. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Growth/Marketing Strategy: The glaucoma market growth strategy focuses on expanding product portfolios through the development of novel therapeutics, advanced drug delivery systems, and minimally invasive surgical options. Companies are investing in research and development to introduce more effective treatments that improve patient compliance and outcomes. Strategic partnerships, collaborations, and acquisitions are key drivers for market expansion, enabling access to new technologies and broader market reach. Additionally, increased awareness campaigns and expanding distribution networks, particularly through online pharmacies, are helping to improve accessibility to treatments globally. Enhanced regulatory support and favorable reimbursement policies also contribute to market growth.

FAQ's

The market size was valued at USD 8.68 billion in 2024 and is projected to grow to USD 13.43 billion by 2034.

The market is projected to register a CAGR of 4.5% during the forecast period

North America held the largest share of the market in 2024.

The market comprises several key players actively involved in developing and providing treatments for this eye condition. A few notable companies include Aerie Pharmaceuticals, Inc.; Alcon Inc.; Allergan plc; Bausch & Lomb Incorporated; EyePoint Pharmaceuticals, Inc.; Glaukos Corporation; Hoya Corporation; Merck & Co., Inc.; Nicox S.A.; Novartis AG; Ocular Therapeutix, Inc.; Pfizer Inc.; Santen Pharmaceutical Co., Ltd.; Sun Pharmaceutical Industries Ltd.; and Teva Pharmaceutical Industries Ltd.

The open angle glaucoma segment accounted for the largest share of the market in 2024.

The hospital pharmacy segment accounted for the largest share of the market in 2024.

Glaucoma is a group of eye conditions that cause damage to the optic nerve, which is essential for vision. This damage is often associated with elevated intraocular pressure (IOP), though it can occur with normal pressure as well. The condition usually develops slowly and without symptoms, making early detection challenging. If left untreated, glaucoma can lead to permanent vision loss or blindness. It is one of the leading causes of blindness worldwide. The most common form is open-angle glaucoma, but other types, such as angle-closure glaucoma, exist and may present different symptoms and risks. Regular eye exams are critical for early diagnosis and effective management.

A few key trends in the market are described below: Advancements in Drug Delivery Systems: Development of sustained-release drug formulations and novel delivery systems to improve patient adherence and treatment efficacy. Minimally Invasive Surgical Techniques: Increasing use of minimally invasive glaucoma surgeries (MIGS) to reduce recovery time and improve patient outcomes. Telemedicine and Remote Monitoring: Growing adoption of teleophthalmology and remote monitoring tools for better patient management, especially in remote areas. Artificial Intelligence in Diagnostics: Integration of AI and machine learning in diagnostic tools to enhance early detection and personalized treatment plans.

A new company entering the market must focus on developing innovative drug delivery systems, such as sustained-release formulations or digital health solutions such as mobile apps for remote monitoring. By investing in minimally invasive surgical techniques (MIGS) or novel combination therapies, the company can differentiate itself in terms of treatment effectiveness and patient compliance. Additionally, partnerships with healthcare providers and AI-based diagnostic tools could provide a competitive edge in early detection and personalized treatment. Staying ahead in regulatory approvals and ensuring strong reimbursement support will also be critical for gaining market traction and customer trust.

Companies manufacturing, distributing, or purchasing glaucoma treatment and diagnosis-related products and other consulting firms must buy the report.