U.S. Sludge Dewatering Equipment Market Size, Share, Trends, Industry Analysis Report

By Technology Type (Belt Filter Press, Centrifuges, Screw Press, Others), By Application – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 130

- Format: PDF

- Report ID: PM6105

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

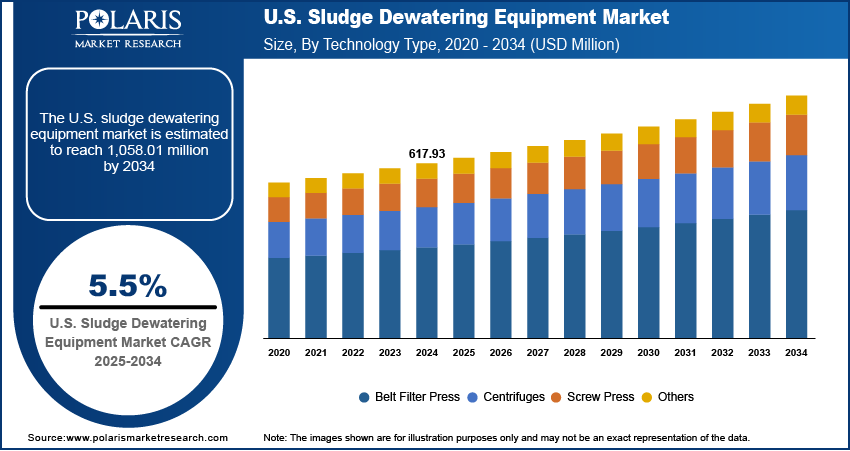

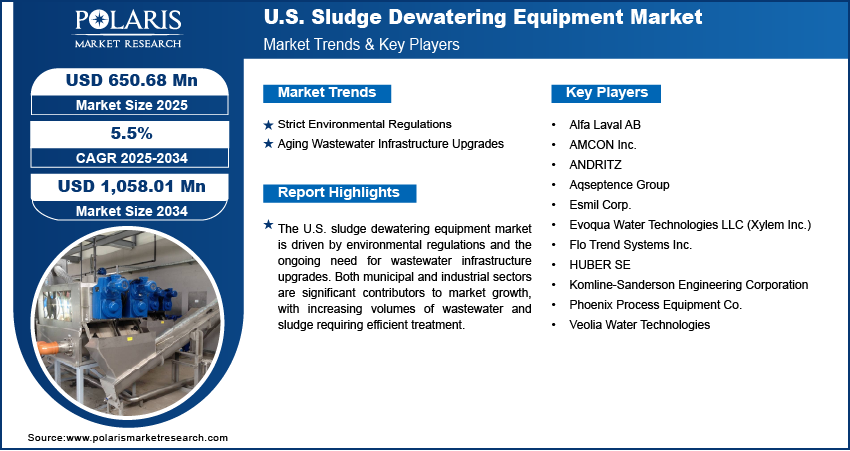

The U.S. sludge dewatering equipment market size was valued at USD 617.93 million in 2024 and is anticipated to register a CAGR of 5.5% from 2025 to 2034. Strict environmental regulations, booming wastewater generation from urban and industrial expansion, and rising demand for cost-effective, energy-efficient sludge treatment solutions are driving U.S. investment in advanced sludge dewatering equipment across municipal and industrial sectors.

Key Insights

- By technology type, the belt filter presses segment held the largest share in 2024 due to their proven cost-effectiveness and ability to handle large volumes of sludge continuously.

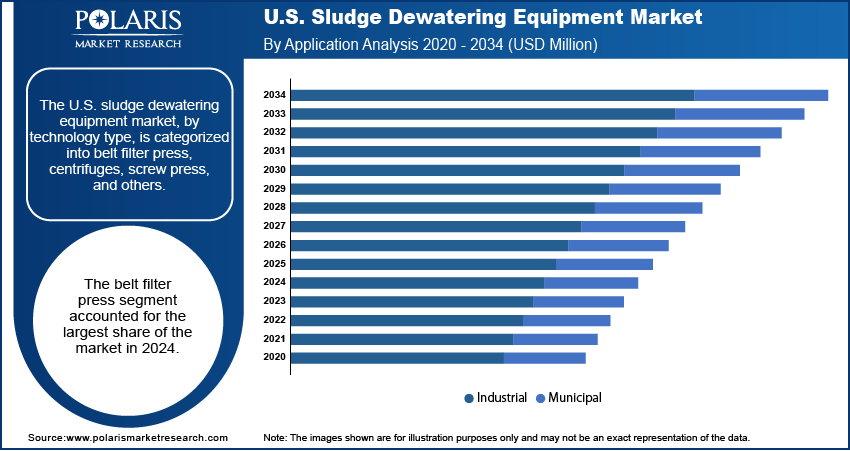

- By application, the municipal application segment held the largest share in 2024. This is primarily driven by the extensive and continuous generation of wastewater from residential and commercial areas across the nation, necessitating robust dewatering solutions for public health and environmental protection.

Industry Dynamics

- Stringent environmental regulations are pushing for better sludge management and disposal.

- Increased investments in upgrading and building new wastewater treatment infrastructure are boosting demand.

- The rising volume of industrial waste generated requires efficient dewatering solutions.

- Technological advancements in dewatering equipment are improving efficiency and lowering operational costs.

Market Statistics

- 2024 Market Size: USD 617.93 million

- 2034 Projected Market Size: USD 1,058.01 million

- CAGR (2025–2034): 5.5%

To Understand More About this Research: Request a Free Sample Report

The U.S. sludge dewatering equipment market involves machines and systems designed to remove water from sludge, a byproduct of wastewater treatment or packaged wastewater treatment. This process significantly reduces the volume and weight of sludge, making it easier and more cost-effective to handle, transport, and dispose of waste, while also preparing it for further processing or reuse.

The increasing focus on resource recovery from sludge and the growing trend of adopting mobile dewatering systems drive the U.S. sludge dewatering equipment market growth. The push for resource recovery is leading to the adoption of more advanced dewatering technologies that can extract valuable materials such as biogas or nutrients from sludge, moving toward a circular economy model.

The growing focus on resource recovery from sludge is driving innovation in dewatering processes. Traditionally viewed as waste for disposal, sludge is now being recognized as a source of valuable materials. Technological advancements and increased emphasis on sustainability have led to the development of dewatering methods that produce biosolids suitable for use as agricultural fertilizers. This shift reduces reliance on landfills and supports circular economy practices. This helps reduce waste and creates a valuable product, as seen in initiatives supported by the Environmental Protection Agency (EPA) that promote beneficial reuse of biosolids. Another example is the recovery of phosphorus, a vital nutrient, from wastewater sludge, which helps address concerns about phosphorus scarcity and pollution.

Drivers and Opportunities

Strict Environmental Regulations: Environmental regulations are a primary force driving the U.S. sludge dewatering equipment market expansion. The U.S. Environmental Protection Agency (EPA) sets and enforces rules to ensure proper handling and disposal of sludge from wastewater treatment plants. These regulations aim to protect public health and the environment by limiting the pollutants that can be released into water bodies and land. As these regulations become more stringent, there is an increased need for advanced dewatering technologies to meet compliance standards.

The Clean Water Act (CWA) and its amendments, particularly the Water Quality Act, mandated the EPA to create a comprehensive program to reduce environmental risks from sewage sludge and encourage beneficial reuse. The "Standards for the Use or Disposal of Sewage Sludge (40 CFR Part 503)," as outlined by the U.S. EPA in their "Sewage Sludge Laws and Regulations" updated in January, 2025, specifies limits for pollutants, pathogen reduction, and management practices for sludge used on land, incinerated, or placed in surface disposal sites. Such detailed and regularly reviewed regulations mean that wastewater treatment facilities must invest in efficient sludge dewatering equipment to meet these evolving standards.

Aging Wastewater Infrastructure Upgrades: The need to upgrade and modernize aging wastewater treatment infrastructure across the U.S. is a significant driver for the sludge dewatering equipment market. Many existing treatment plants are old and require significant repairs or replacement to handle current and future wastewater volumes and meet modern treatment standards. As these facilities undergo rehabilitation or new construction, there is a natural demand for new and efficient dewatering solutions as part of the overall system upgrade.

According to a report on "Wastewater Infrastructure Funding: Background and Affordability Issues" by Congress.gov updated in June, 2025, the U.S. EPA estimated national wastewater infrastructure needs to be $630 billion over 20 years. This substantial figure highlights the immense investment required for infrastructure improvements. Furthermore, the report notes that between 2016 and 2024, total needs estimates increased by about 70%, with significant increases in categories such as decentralized wastewater treatment (170% increase). This continuous and substantial investment in updating and expanding wastewater treatment capabilities across the nation directly fuels the demand for new and improved sludge dewatering equipment, including dewatering pumps.

Segmental Insights

Technology Type Analysis

Based on technology type, the U.S. sludge dewatering equipment market segmentation includes belt filter press, centrifuges, screw press, and others. The belt filter press segment held the largest share in 2024, due to their widespread adoption across municipal wastewater treatment plants and industrial facilities. These systems are well-regarded for their cost-effectiveness and their ability to handle large volumes of sludge continuously. The design, which typically involves gravity drainage and then increasing pressure through a series of rollers, allows for efficient dewatering while keeping operational costs relatively low. Their reliability and suitability for diverse sludge types contribute significantly to their continued preference in many applications where consistent, high-volume processing is essential for effective sludge management.

The centrifuge segment is anticipated to register the highest growth rate during the forecast period. This surge in demand is attributed to their superior efficiency in separating solids from liquids, their compact footprint, and their adaptability to various sludge characteristics. Centrifuges offer high-speed processing and can achieve a higher solids content in the dewatered sludge, which is beneficial for reducing disposal costs. Their increasingly automated operations also appeal to facilities seeking to minimize manual intervention and optimize throughput. The ongoing technological advancements in centrifuge design, focusing on energy efficiency and improved performance, are making them an increasingly attractive option for modern wastewater treatment and industrial processes seeking advanced dewatering solutions.

Application Analysis

Based on application, the U.S. sludge dewatering equipment market segmentation includes industrial and municipal. The municipal segment held the largest share in 2024, primarily due to the vast and continuous generation of wastewater from residential, commercial, and public facilities across urban and suburban areas. As populations grow and urbanization continues, the volume of municipal wastewater increases, placing immense pressure on existing treatment infrastructure. Municipal wastewater treatment plants, also known as Publicly Owned Treatment Works (POTWs), are essential for processing this large volume of sewage sludge to protect public health and the environment. The need for efficient dewatering in these facilities is crucial for reducing the volume of sludge before disposal, which significantly lowers transportation and landfill costs. Additionally, the imposition of strict environmental regulations on municipal wastewater discharge contributes to the rising demand for advanced dewatering solutions in this segment.

The industrial application segment is anticipated to record the highest growth rate during the forecast period. This growth is driven by the increasing volume of complex and diverse waste generated across various industrial sectors such as food and beverage, pharmaceuticals, chemicals, mining, and pulp and paper. These industries face increasingly stringent environmental regulations regarding their wastewater discharge and sludge disposal, compelling them to invest in more effective and compliant dewatering technologies. Furthermore, many industrial facilities are exploring opportunities for resource recovery from their waste streams, such as extracting valuable materials or producing biogas, which requires specialized dewatering equipment or water and wastewater treatment equipment. The adoption of energy-efficient and automated sludge dewatering equipment is also a key trend within the industrial sector as companies seek to reduce operational costs and enhance their sustainability efforts.

Key Players and Competitive Insights

The U.S. sludge dewatering equipment market features a competitive landscape with several established players and a few emerging ones. These companies compete on various factors, including the efficiency and technological sophistication of their equipment, after-sales service, customization capabilities, and pricing. The market is moderately consolidated, with major global and domestic players holding significant shares, but there is also room for regional manufacturers offering specialized or cost-effective solutions. Strategic initiatives such as research and development into automation and energy efficiency are common, as market players are focusing on expanding product portfolios to meet evolving regulatory demands and client needs.

A few prominent companies in the industry include Alfa Laval AB, ANDRITZ AG, Veolia Water Technologies, HUBER SE, Komline-Sanderson Engineering Corporation, Evoqua Water Technologies LLC (Xylem Inc.), Aqseptence Group, Phoenix Process Equipment Co., Flo Trend Systems Inc., Esmil Corp., and AMCON Inc.

Key Players

- Alfa Laval AB

- AMCON Inc.

- ANDRITZ

- Aqseptence Group

- Esmil Corp.

- Evoqua Water Technologies LLC (Xylem Inc.)

- Flo Trend Systems Inc.

- HUBER SE

- Komline-Sanderson Engineering Corporation

- Phoenix Process Equipment Co.

- Veolia Water Technologies

U.S. Sludge Dewatering Equipment Industry Developments

May 2025: Pelagia acquired Fjord Solutions, a supplier of aquaculture equipment. With its Blue Ocean Technology brand, Pelagia provides sludge and water treatment systems, specializing in dewatering, storage, and value generation, thereby strengthening its presence in sustainable aquaculture operations.

U.S. Sludge Dewatering Equipment Market Segmentation

By Technology Type Outlook (Revenue – USD Million, 2020–2034)

- Belt Filter Press

- Centrifuges

- Screw Press

- Others

By Application Outlook (Revenue – USD Million, 2020–2034)

- Industrial

- Pulp & Paper

- Textile

- Food & Beverage

- Chemical

- Others

- Municipal

U.S. Sludge Dewatering Equipment Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 617.93 million |

|

Market Size in 2025 |

USD 650.68 million |

|

Revenue Forecast by 2034 |

USD 1,058.01 million |

|

CAGR |

5.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 617.93 million in 2024 and is projected to grow to USD 1,058.01 million by 2034.

The market is projected to register a CAGR of 5.5% during the forecast period.

A few key players in the market include Alfa Laval AB, ANDRITZ AG, Veolia Water Technologies, HUBER SE, Komline-Sanderson Engineering Corporation, Evoqua Water Technologies LLC (Xylem Inc.), Aqseptence Group, Phoenix Process Equipment Co., Flo Trend Systems Inc., Esmil Corp., and AMCON Inc.

The belt filter press segment accounted for the largest share of the market in 2024.

The industrial segment is expected to witness the fastest growth during the forecast period.