Orthodontic Headgear Market Size, Share, Trends, Industry Analysis Report

By Product (Cervical Pull, High Pull, Reverse Pull (Facemask), Others), By Age Group, By End User, and By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 125

- Format: PDF

- Report ID: PM6505

- Base Year: 2024

- Historical Data: 2020-2023

Overview

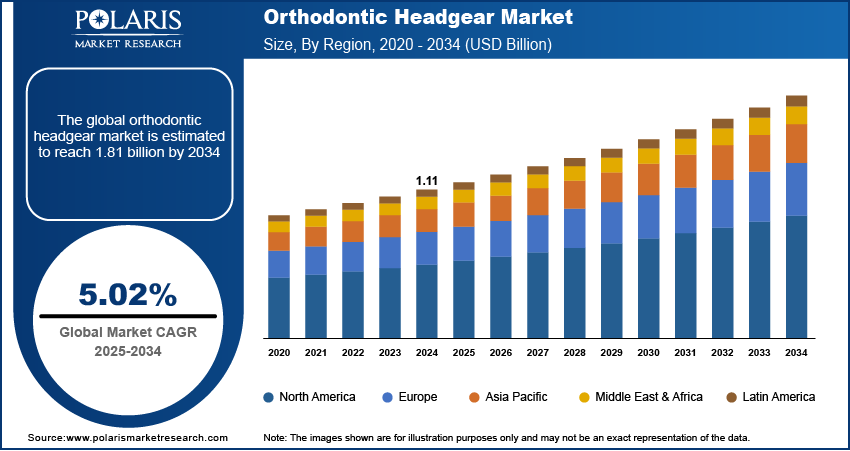

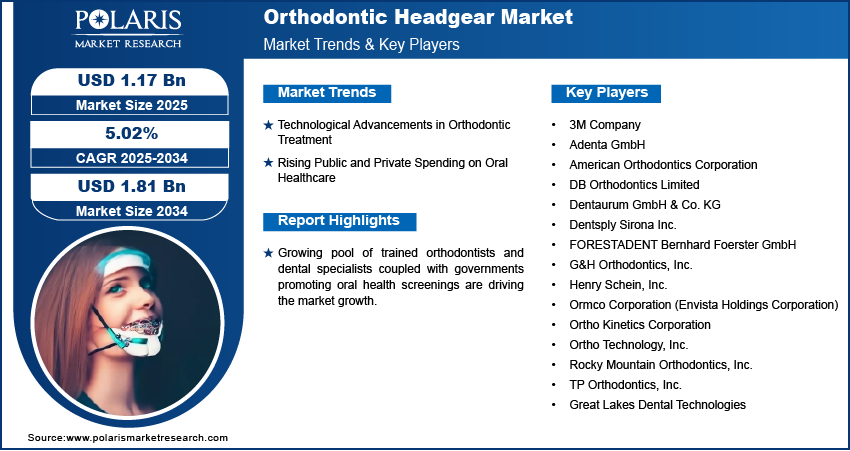

The global orthodontic headgear market size was valued at USD 1.11 billion in 2024, growing at a CAGR of 5.02% from 2025 to 2034. Technological advancements in orthodontic treatment along with rising public and private spending on oral healthcare is propelling the market growth.

Key Insights

- The cervical pull headgear segment led market in 2024 due to its effectiveness in overbites correction and usage among orthodontists on a large scale.

- The dental clinics dominated end user segment, fueled by orthodontic specialty services and tailored treatment plans.

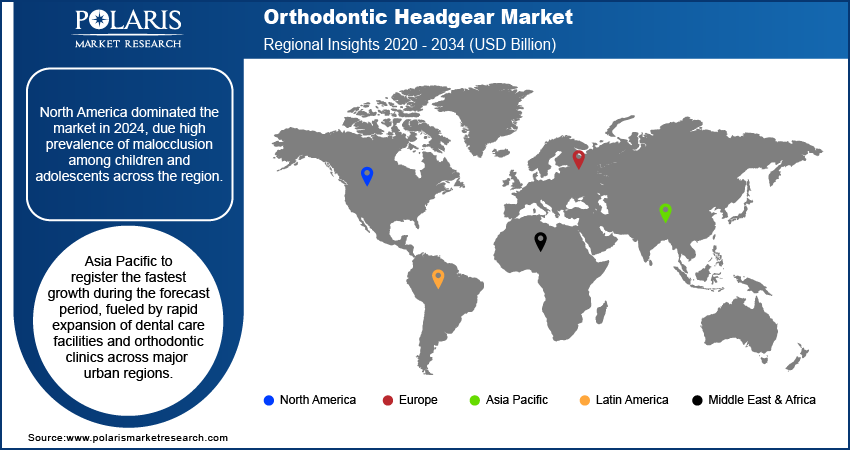

- North America dominated in orthodontic headgear industry in 2024.

- The U.S. held the largest share in North America, propelled by advanced, tailored orthodontic appliances and specialty appliances system.

- Asia Pacific is anticipated to grow syeadily over the forecast period, driven by the swift growth of dental care centers and orthodontic clinics in the large urban areas.

- India dominated Asia Pacific, led by preventive orthodontics and poor patient hygiene compliance.

Industry Dynamics

- Tech advancements in orthodontics boost headgear adoption market worldwide.

- Rising oral healthcare spending increases demand for orthodontic solutions.

- Low compliance and discomfort limit headgear adoption globally.

- Integration of smart compliance monitoring features presents new opportunities for the industry.

Market Statistics

- 2024 Market Size: USD 1.11 Billion

- 2034 Projected Market Size: USD 1.81 Billion

- CAGR (2025–2034): 5.02%

- North America: Largest Market Share

The orthodontic headgear industry comprises external specialized dental appliances employed to correct jaw alignment and regulate tooth movement in orthodontic therapy. They are often prescribed for adolescents and children to correct overbites, underbites, and skeletal discrepancies that cannot be resolved using braces. Advances in light materials, personalized fitting, and greater comfort design are improving patient compliance and treatment efficacy.

The market for orthodontic headgear is supported by an increasingly large number of trained orthodontists and dental experts, propelled by global dental education programs and professional training programs.

Governments across regions are encouraging oral health check-ups and early intervention programs in schools and communities, focusing on preventive treatments and awareness. In March 2025, India's Ministry of Ayush held a nationwide campaign emphasizing the role of oral hygiene and its relationship with general well-being, which is driving greater early adoption of orthodontic treatments and headgear wear.

Drivers & Opportunities

Technological Advancements in Orthodontic Treatment: Advancement in technologies such as AI-driven orthodontic planning, 3D scanning, and personalized headgear are enhancing precision, efficacy, and comfort of treatment by leaps and bounds. In October 2025, researchers at Korea University Anam Hospital, KAIST, and the University of Ulsan developed ARNet-v2, an AI system for optimizing orthodontic treatment planning and enabling clinicians to achieve more accurate and predictable outcomes.

Rising Public and Private Spending on Oral Healthcare: Increasing government and private sector investments in dental health are enabling broader applications of orthodontic treatments. According to the World Health Organization's Oral Health Report 2025, oral diseases remain a major global health problem, as they impact up to 3.7 billion people. The far-reaching impact is driving the demand for restorative and preventive dental care services, including advanced orthodontic headgear systems.

Segmental Insights

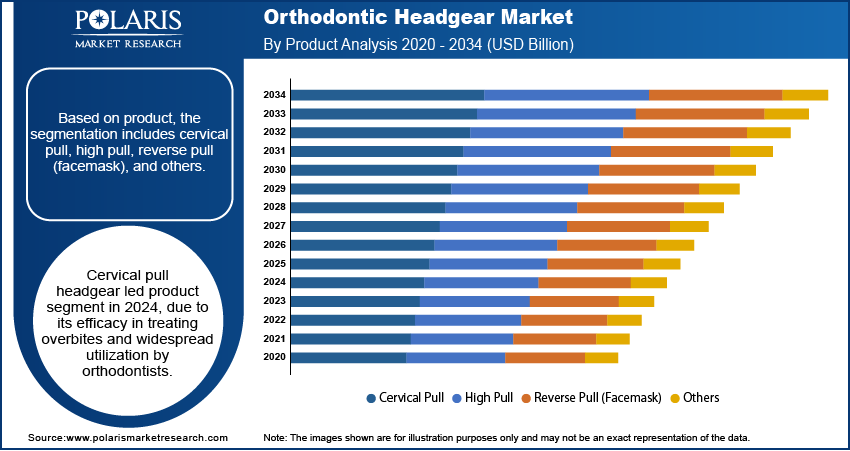

By Product

Based on product type, the orthodontic headgear market is segmented into cervical pull, high pull, reverse pull (facemask), and others. Cervical pull headgear led product segment in 2024, duet to its efficacy in treating overbites and widespread utilization by orthodontists.

High pull headgear is anticipated to experience rapid growth through the forecast period, attributed to its efficacy in managing vertical facial growth and applicability for the treatment of intricate malocclusions.

By Age Group

The market is segmented by age group into children/young teens, older teens, and adults. Children/young teens held the biggest share in 2024, driven by the growing recommendation for early orthodontic treatment in order to achieve the best jaw and dental alignment.

Older teens are projected to experience steady growth, driven by aesthetic issues and postponed treatment adoption.

By End User

By end user, the market is classified into hospitals, dental clinics, and others. Dental clinics obtained the largest market share in 2024, fueled by dedicated orthodontic services and customized treatment plans.

Hospitals are predicted to see continued growth, as orthodontic departments expand and increasing numbers adopt integrated treatment methods.

Regional Analysis

North America dominated the orthodontic headgear market due high prevalence of malocclusion among children and adolescents across the region. Growing awareness of preventive and early-stage orthodontic treatment among parents is further strengthening the adoption of headgear systems across dental clinics, pediatric dental centers, and orthodontic care facilities.

The U.S. Orthodontic Headgear Market Overview

The U.S. dominated the North America market due to intense adoption of technologically advanced and personalized orthodontic appliances. In April 2025, Specialty Appliances introduced the OnBRACE system, a new line of prefabricated, laser-sintered metal fixed orthodontic appliances developed for the U.S. market, highlighting the rising clinical focus on precision-based treatment and patient comfort.

Asia Pacific Orthodontic Headgear Market Insights

Asia Pacific is experiencing fast growth in the orthodontic headgear industry, fueled by rapid expansion of dental care facilities and orthodontic clinics across major urban regions. Increasing disposable income, growing healthcare spending, and rising preference for pediatric dental care are contributing to higher acceptance of early orthodontic treatment among families in emerging economies.

India Orthodontic Headgear Market Analysis

India is leading the market in Asia Pacific, due to the rising shift toward preventive and controlled orthodontic intervention, driven by the need to minimize hygiene-related complications such as gingivitis and decalcification observed in non-compliant patients. For example, a study in India found that 78% of orthodontic patients failed to follow oral hygiene instructions even after they were advised, reflecting a consistent deficiency in patient awareness, education, and cooperation.

Europe Orthodontic Headgear Market Assessment

Europe held significant market share in the orthodontic headgear market due to established dental care facilities and easy access to specialist orthodontic practitioners. High consciousness among parents and healthcare providers for early orthodontic treatment makes the diagnosis and correction timely during childhood and adolescence, and thus continuous demand in the market.

Key Players & Competitive Analysis

The global market for orthodontic headgear is competitive, with companies focusing on enhancing patient comfort, treatment duration, and headgear system customizability. Developments span lightweight designs, adjustable fittings, to enhanced materials to ensure optimal compliance and enhanced orthodontic outcomes. Strategic alliance with dental clinics, orthodontists, and distributors is driving the global presence of players, while ongoing product development aims to cater to evolving clinical needs and patient preferences.

Prominent players in orthodontic headgear market comprises of 3M Company, Adenta GmbH, American Orthodontics Corporation, DB Orthodontics Limited, Dentaurum GmbH & Co. KG, Dentsply Sirona Inc., FORESTADENT Bernhard Foerster GmbH, G&H Orthodontics, Inc., Henry Schein, Inc., Ormco Corporation (Envista Holdings Corporation), Ortho Kinetics Corporation, Ortho Technology, Inc., Rocky Mountain Orthodontics, Inc., TP Orthodontics, Inc., and Great Lakes Dental Technologies.

Key Players

- 3M Company

- Adenta GmbH

- American Orthodontics Corporation

- DB Orthodontics Limited

- Dentaurum GmbH & Co. KG

- Dentsply Sirona Inc.

- FORESTADENT Bernhard Foerster GmbH

- G&H Orthodontics, Inc.

- Henry Schein, Inc.

- Ormco Corporation (Envista Holdings Corporation)

- Ortho Kinetics Corporation

- Ortho Technology, Inc.

- Rocky Mountain Orthodontics, Inc.

- TP Orthodontics, Inc.

- Great Lakes Dental Technologies

Orthodontic Headgear Industry Developments

In September 2025: The Association of Dental Industry and Trade of India (ADITI) hosted Expodent Bengaluru, South India’s largest dental trade show highlighting next-gen orthodontic innovations.

In April 2023: Ormco rebranded with a new logo, tagline, and colors to emphasize innovation and global positioning.

Orthodontic Headgear Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Cervical Pull

- High Pull

- Reverse Pull (Facemask)

- Others

By Age Group Outlook (Revenue, USD Billion, 2020–2034)

- Children/Young Teens

- Older Teens

- Adults

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Hospitals

- Dental Clinics

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Orthodontic Headgear Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.11 Billion |

|

Market Size in 2025 |

USD 1.17 Billion |

|

Revenue Forecast by 2034 |

USD 1.81 Billion |

|

CAGR |

5.02% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion, Volume in Kilotons and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 1.11 billion in 2024 and is projected to grow to USD 1.81 billion by 2034.

The global market is projected to register a CAGR of 5.02% during the forecast period.

North America dominated the market in 2024.

A few of the key players in the market are 3M Company, Adenta GmbH, American Orthodontics Corporation, DB Orthodontics Limited, Dentaurum GmbH & Co. KG, Dentsply Sirona Inc., FORESTADENT Bernhard Foerster GmbH, G&H Orthodontics, Inc., Henry Schein, Inc., Ormco Corporation (Envista Holdings Corporation), Ortho Kinetics Corporation, Ortho Technology, Inc., Rocky Mountain Orthodontics, Inc., TP Orthodontics, Inc., and Great Lakes Dental Technologies.

The cervical pull headgear segment dominated the market revenue share in 2024.

The older teens segment is projected to witness the fastest growth during the forecast period.