PROFINET Managed Switch Market Size, Share, Trends, Industry Analysis Report

By Product Type, By End Use (Manufacturing, Communication, Energy & Power, Others), and By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 122

- Format: PDF

- Report ID: PM6499

- Base Year: 2024

- Historical Data: 2020-2023

Overview

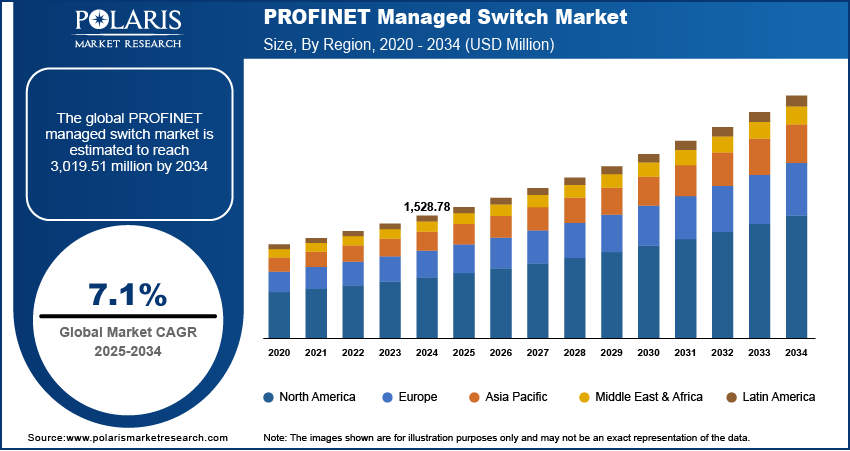

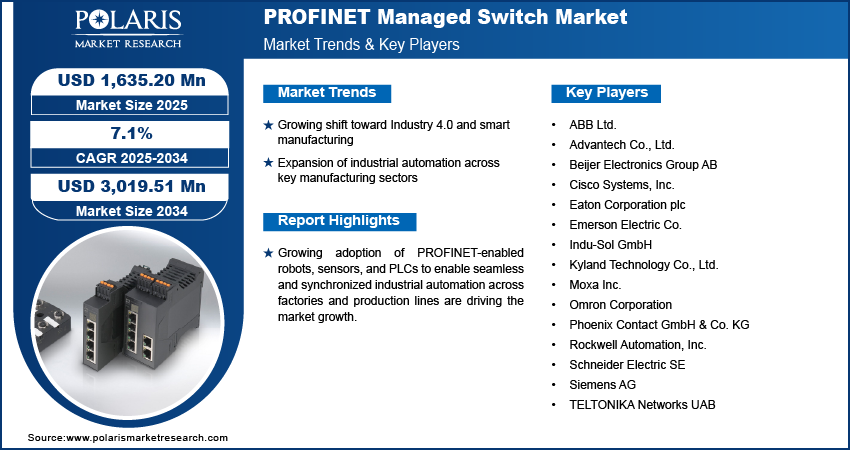

The global PROFINET managed switch market size was valued at USD 1,528.78 million in 2024, growing at a CAGR of 7.1% from 2025 to 2034. Growing shift toward industry 4.0 and smart manufacturing coupled with expansion of industrial automation across key manufacturing sectors is boosting the market growth.

Key Insights

- Standalone managed switches dominated in 2024 owing to ease of integration, affordability, and compatibility with small to medium-sized industrial installations.

- Communication end use dominated in 2024, based on high-speed industrial networks and increasing IoT adoption.

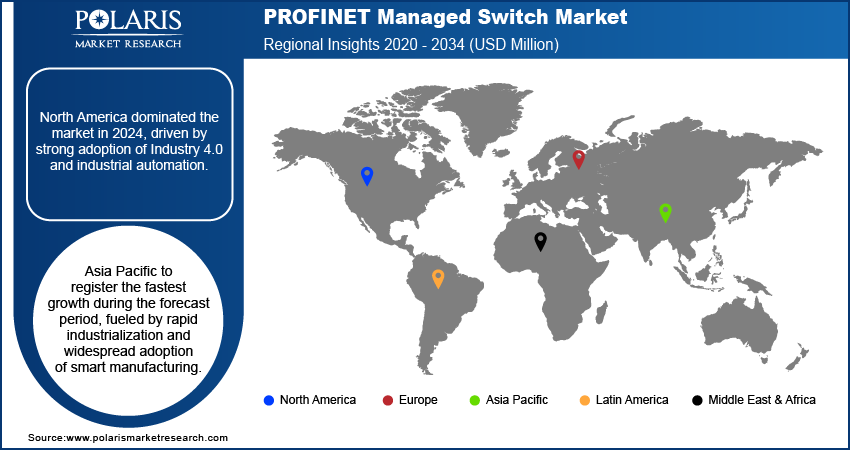

- North America dominated in 2024, fueled by Industry 4.0 and cutting-edge industrial automation adoption.

- The U.S. accounted for the largest regional share, driven by investment in smart factories and digital twin technologies.

- Asia Pacific projected to grow rapidly, driven by accelerated industrialization and smart manufacturing uptake.

- China is expanding due to IIoT solutions, industrial robots, and vast automated warehouses.

Industry Dynamics

- Industry 4.0 and smart manufacturing boost PROFINET switch adoption.

- Industrial automation growth increases demand for high-speed, reliable networks.

- High deployment and integration costs limit SME adoption.

- AI-driven monitoring and self-healing networks create new opportunities.

Market Statistics

- 2024 Market Size: USD 1,528.78 Million

- 2034 Projected Market Size: USD 3.019.51 Million

- CAGR (2025–2034): 7.1%

- North America: Largest Market Share

The PROFINET managed switch market includes industrial network switches that are tasked with managing, monitoring, and optimizing real-time data communication in automated manufacturing environments. The switches are extensively used in factory automation, process control, robotics, and industrial IoT solutions to provide trustworthy connectivity, minimal latency, and determinate data transfer. Network diagnostics, security features, and smooth integration with PLCs and SCADA systems are enhancing operational visibility, uptime, and scalability.

The market is expanding at a fast pace with growing adoption of PROFINET-powered robots, sensors, and PLCs to facilitate seamless and concurrent industrial automation across factories and production lines. In June 2025, ProSoft Technology launched ILX56-PNC and ILX56-PND modules for ControlLogix systems, which offer increasing speed and reliability of connectivity with PROFINET devices, superior diagnostics, and more streamlined commissioning. All these developments are making manufacturers realize increasing productivity and integrating complexities.

Industrial end users are increasingly opting for PROFINET managed switches with remote monitoring, energy-saving, and predictive maintenance features. Such solutions minimize unplanned downtime, enhance operational efficiency, and facilitate smarter, connected factory environments. This trend leads to the extensive adoption of advanced switches among manufacturing facilities.

Drivers & Opportunities

Growing shift toward Industry 4.0 and smart manufacturing: Exponential adoption of Industry 4.0 technologies and increasing need for real-time, deterministic industrial communications are driving the installation of PROFINET-managed switches in high-speed production networks. Teltonika Networks introduced the TSW202 and TSW212 managed switches with support for PROFINET in February 2024 to provide improved industrial connectivity and smooth automation. This breakthrough is making it possible to have more accurate control and monitoring in intelligent manufacturing systems.

Expansion of industrial automation across key manufacturing sectors: Growing automation levels in manufacturing industries like automotive, energy, and process manufacturing are developing considerable demand for dependable and scalable industrial Ethernet infrastructure. Global industrial robot density, as reported by the International Federation of Robotics, hit 162 units per 10,000 staff in 2023 more than two times the level seven years prior indicating increasing automation globally. The development underscores the key role of PROFINET-managed switches in enabling advanced industrial applications.

Segmental Insights

By Product Type

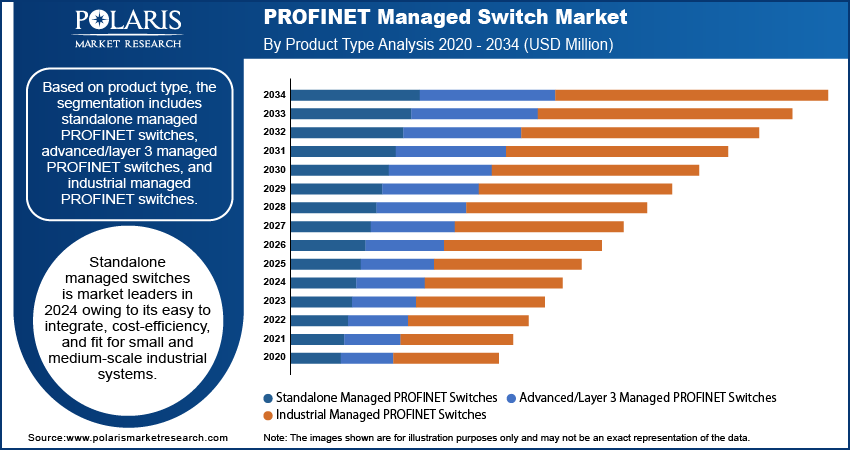

The PROFINET managed switch market is segmented into standalone managed PROFINET switches, advanced/layer 3 managed PROFINET switches, and industrial managed PROFINET switches. Standalone managed switches are market leaders in 2024 owing to it’s easy to integrate, cost-efficiency, and fit for small and medium-scale industrial systems.

Advanced/layer 3 managed switches projected to experience strong growth in the forecast period as they provide improved network management, routing capabilities, and support for advanced industrial automation systems.

By End Use

By end use, the market is categorized into manufacturing, communication, energy & power, and others. The manufacturing accounted for the largest share of the market in 2024, due to the growing use of industrial automation and smart factory technologies.

The communication market is projected to expand steadily, fueled by the growth of high-speed industrial networks and the incorporation of IoT.

Regional Analysis

North America led the PROFINET managed switch market due to high adoption of Industry 4.0 and industrial automation, mostly in automotive, aerospace, and advanced manufacturing industries. There is a strong ecosystem of automation and robotics vendors that focuses on PROFINET compatibility, resulting in increasing demand for managed switches to provide secure and high-speed industrial communication.

The U.S. PROFINET Managed Switch Market Overview

The U.S. was the market leader in North America, driven by major industrial OEM investments in digital twin technologies and smart factory solutions, which drove the adoption of advanced PROFINET-based networks. In January 2025, the U.S. Department of Energy announced nearly USD 13 million in funding under the third round of the USD 50 million State Manufacturing Leadership Program. Previous rounds supported 17 projects across 15 states, enabling thousands of small and medium manufacturers to implement smart manufacturing technologies and leverage high-performance computing resources.

Asia Pacific PROFINET Managed Switch Market Insights

Asia Pacific is experiencing a fast growth in the PROFINET Managed Switch industry, fueled by rapid industrialization and widespread adoption of smart manufacturing, particularly in China, South Korea, Japan, and India. Digital transformation, smart factories, and high-speed industrial infrastructure initiatives by governments further enhance the growth of the market.

China PROFINET Managed Switch Market Analysis

China is dominating the Asia Pacific market, propelled by high IIoT solution adoption, industrial robots, and warehouse automation systems. As per International Federation of Robotics, China reached a robot density level of 470 robots per 10,000 workers, from a level of 402 robots per 10,000 workers in the previous year, highlighting rapid adaptation of automation technologies.

Europe PROFINET Managed Switch Market Assessment

Europe held substantial share driven by the dominant presence of international automation leaders like Siemens, Bosch, and ABB, which are keenly promoting PROFINET as the industrial networking standard. Adoption of Industry 4.0 policies at EU and national levels is spurring the adoption of high-end managed switch solutions at manufacturing plants, increasing industrial connectivity and efficiency.

Key Players & Competitive Analysis

The global PROFINET managed switch market is moderately competitive with emphasis on network stability, high speed, and industrial automation compatibility. Prominent trends are high-performance switches, improved cybersecurity, scalable designs, and partnerships with integrators for assisting smart manufacturing integration.

Major companies in the global PROFINET managed switch market are ABB Ltd., Advantech Co., Ltd., Beijer Electronics Group AB, Cisco Systems, Inc., Eaton Corporation plc, Emerson Electric Co., Indu-Sol GmbH, Kyland Technology Co., Ltd., Moxa Inc., Omron Corporation, Phoenix Contact GmbH & Co. KG, Rockwell Automation, Inc., Schneider Electric SE, Siemens AG, and TELTONIKA Networks UAB.

Key Players

- ABB Ltd.

- Advantech Co., Ltd.

- Beijer Electronics Group AB

- Cisco Systems, Inc.

- Eaton Corporation plc

- Emerson Electric Co.

- Indu-Sol GmbH

- Kyland Technology Co., Ltd.

- Moxa Inc.

- Omron Corporation

- Phoenix Contact GmbH & Co. KG

- Rockwell Automation, Inc.

- Schneider Electric SE

- Siemens AG

- TELTONIKA Networks UAB

PROFINET Managed Switch Industry Developments

In August 2025: TELTONIKA introduced the SWM28-series managed switches with PROFINET, EtherNet/IP, MRP, Layer 2/3 features, PoE+, SFP, and integration with TswOS and RMS for end-to-end network management.

In October 2024: Moxa released the SDS-3000/G3000 and EDS-4000/G4000 industrial switches featuring PROFINET, Modbus, and EtherNet/IP compatibility, simple integration, robust cybersecurity, and IEC 62443 compliance for secure industrial networks.

PROFINET Managed Switch Market Segmentation

By Product Type Outlook (Revenue, USD Million, 2020–2034)

- Standalone Managed PROFINET Switches

- Advanced/Layer 3 Managed PROFINET Switches

- Industrial Managed PROFINET Switches

By End Use Outlook (Revenue, USD Million, 2020–2034)

- Manufacturing

- Communication

- Energy & Power

- Others

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

PROFINET Managed Switch Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1,528.78 Million |

|

Market Size in 2025 |

USD 1,635.20 Million |

|

Revenue Forecast by 2034 |

USD 3,019.51 Million |

|

CAGR |

7.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million, Volume in Kilotons and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 1,528.78 million in 2024 and is projected to grow to USD 3,019.51 million by 2034.

The global market is projected to register a CAGR of 7.1% during the forecast period.

North America dominated the market in 2024.

A few of the key players in the market are ABB Ltd., Advantech Co., Ltd., Beijer Electronics Group AB, Cisco Systems, Inc., Eaton Corporation plc, Emerson Electric Co., Indu-Sol GmbH, Kyland Technology Co., Ltd., Moxa Inc., Omron Corporation, Phoenix Contact GmbH & Co. KG, Rockwell Automation, Inc., Schneider Electric SE, Siemens AG, and TELTONIKA Networks UAB.

The standalone managed switches segment dominated the market revenue share in 2024

The communication segment is projected to witness the fastest growth during the forecast period.