Patient Lift Pendant Market Size, Share, Trends, Industry Analysis Report

By Product (Wired, Wireless), By Patient Lift Type, By Channel, By End Use, and By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 124

- Format: PDF

- Report ID: PM6506

- Base Year: 2024

- Historical Data: 2020-2023

Overview

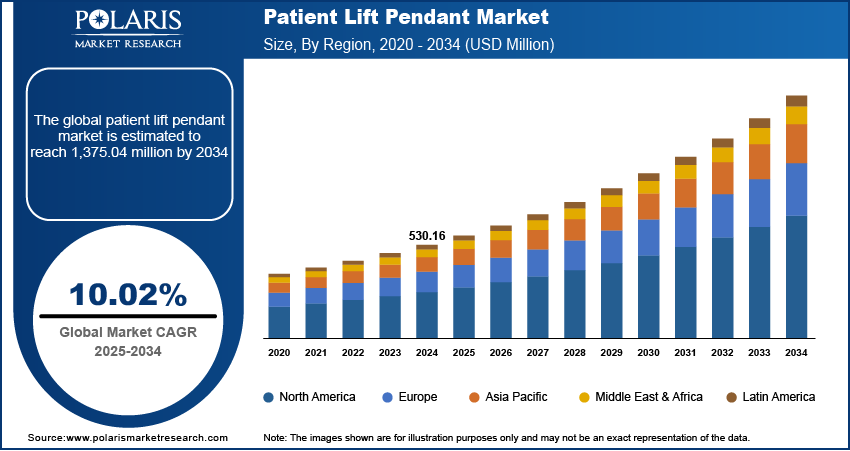

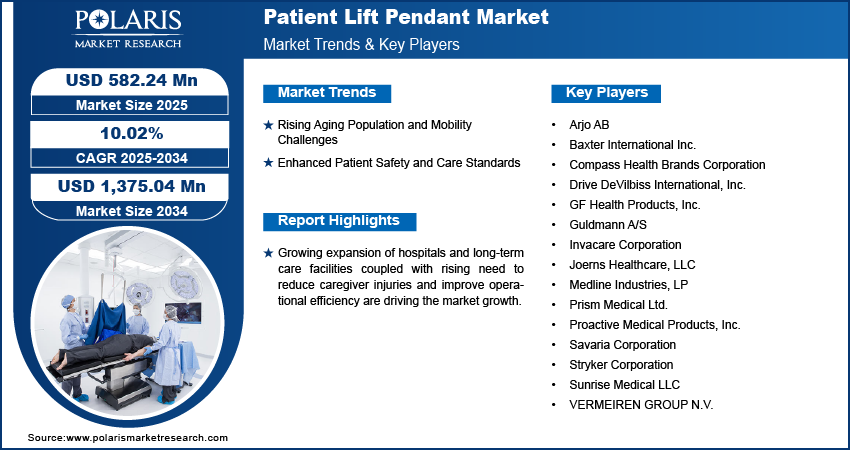

The global patient lift pendant market size was valued at USD 530.16 million in 2024, growing at a CAGR of 10.02% from 2025 to 2034. Rising aging population and mobility challenges coupled with enhanced patient safety and care standards is propelling the market growth.

Key Insights

- Wired segment had the largest share in 2024, fueled by its dependability, unchanging signal transmission, and robust uptake in hospitals and long-term care facilities.

- Mobile electric lifts anticipated to grow rapidly, due to its portability and convenience to move between several patient rooms.

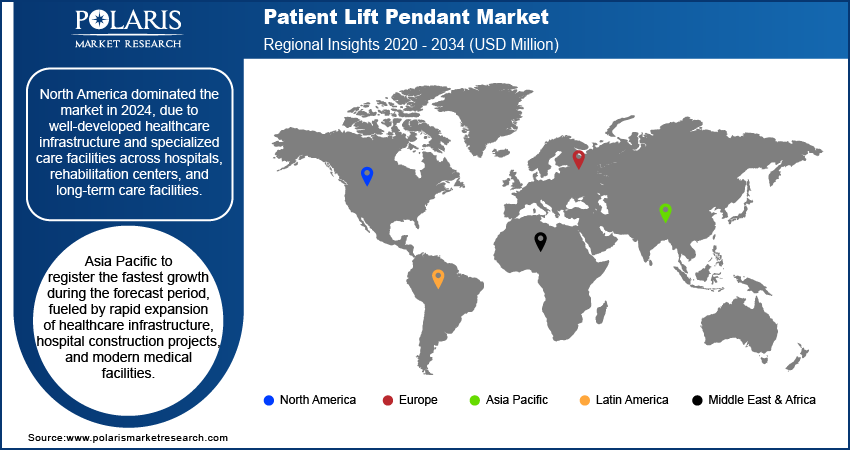

- North America dominated the patient lift pendant market in 2024, supported by sophisticated healthcare infrastructure and availability of specialized treatment centers.

- The U.S. dominated the region, fueled by government policies to improve patient safety and encourage ergonomic health care practices.

- Asia Pacific projected to experience robust growth over the forecast period, driven by fast-developing hospital infrastructure and growing investments in advanced medical facilities.

- China emerged as a prominent market in the region, fueled by an aging population and rising number of mobility disorders.

Industry Dynamics

- The growing aging population and rising mobility issues are driving the growth of patient lift pendants in hospitals and long-term care settings.

- Increasing emphasis on patient safety and caregiver injury prevention is also contributing to high demand for effective patient handling systems.

- High up-front investment and installation costs continue to restrain the market growth for small and medium-sized healthcare institutions.

- AI-powered smart lift systems with intelligent motion sensing and detection of patient position are creating market opportunities.

Market Statistics

- 2024 Market Size: USD 530.16 Million

- 2034 Projected Market Size: USD 1,375.04 Million

- CAGR (2025–2034): 10.02%

- North America: Largest Market Share

The patient lift pendant industry includes supportive and durable medical equipment intended to transfer patients of reduced mobility safely between beds, wheelchairs, and other care locations with negligible caregiver effort. Pendants are extensively utilized in hospitals, rehabilitation facilities, care homes, and home healthcare to enhance patient handling safety and comfort. Improvements in ergonomic design, remote control, and adaptation with ceiling and mobile lift systems are facilitating easy operation, efficiency, and cleanliness.

Increasing development of hospitals and long-term care centers is fueling large investment in patient lift equipment. Modern healthcare infrastructure places a greater emphasis on equipment that promotes patient mobility and facilitates effective caregiving. For instance, hospitals in India, represented 50% of healthcare FDI in FY24 versus 24% in FY21, capturing increasing interest in facility upgradation and patient care technology.

Health professionals are increasingly recognizing the importance of minimizing caregiver injury and optimizing operational efficiency. Utilization of patient lift pendants allows for a reduction in physical stress on caregivers, simplifies patient handling, and optimizes overall clinical workflow.

Drivers & Opportunities

Rising Aging Population and Mobility Challenges: The rising aging population and mobility impairments are generating a consistent demand for patient handling technologies. The United Nations estimates that the world population aged 65 years and above is likely to be 2.2 million by the late 2070s. This growth highlights the surging demand for assistive care technologies and ergonomic lifting devices.

Enhanced Patient Safety and Care Standards: Hospitals and healthcare units are increasingly embracing patient safety guidelines and ergonomic care standards. In April 2024, the World Health Organization (WHO) introduced its first-ever Patient Safety Rights Charter, a historic effort to enhance patient safety standards worldwide. The Charter highlights ten essential rights of patients, such as safe care processes, skilled workforce, timely and effective treatment, and participatory patient and family roles in healthcare decisions.

Segmental Insights

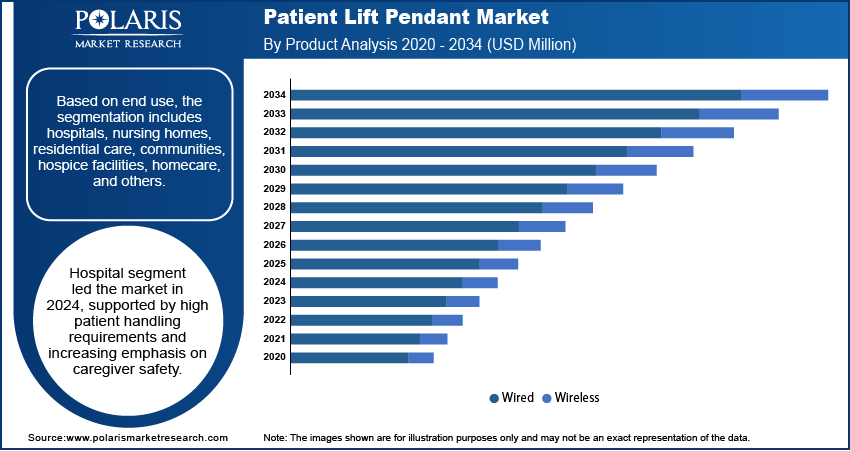

By Product

On the basis of product, the patient lift pendants market is divided into wired and wireless systems. Wired systems dominated in 2024 due to their ability to provide consistent signals without interruptions and their prevailing usage in hospitals and long-term care institutions.

Wireless systems are likely to see rapid growth during the forecast period due to the growing preference of healthcare providers for flexible, plug-and-play solutions that enable smooth mobility and alleviate infrastructure constraints.

By Patient Lift Type

Based on patient lift type, the market is divided into ceiling lifts, mobile electric lifts, sit-to-stand lifts, and bath/shower lifts. Ceiling lifts led the market in 2024, due to its capacity to transfer patients securely with limited manual labor while maximizing floor space within medical facilities.

Mobile electric lifts are expected to increase gradually, fueled by its convenience and application in multi-room patient management.

By Channel

On the basis of channel, the market is divided into two-channel and four-channel systems. Two-channel systems dominated the market in 2024, propelled by its rising sage in hospitals and care facilities for general patient transfer requirements.

Four-channel systems are anticipated to grow at a significant rate, owing to its sophisticated lifting configuration and greater load capabilities, and hence they are suitable for bariatric care and complicated transfer requirements.

By End Use

In terms of end use, the market is segmented into hospitals, nursing homes, residential care communities, hospice care facilities, homecare, and others. The hospitals segment held dominating market share in 2024, driven by high patient handling needs and growing focus on caregiver safety.

Homecare is anticipated to grow at a robust pace during the forecast period owing to the growing preference of elderly populations and patients with chronic mobility impairments for home healthcare.

Regional Analysis

North America led the market for patient lift pendants due to the highly developed healthcare infrastructure and specialized care facilities within hospitals, rehabilitation equipment, and long-term care centers. Increasing focus on caregiver ergonomics and patient safety is also significantly pushing the implementation of technologically advanced lift solutions.

The U.S. Patient Lift Pendant Market Overview

The U.S. led the market in North America, fueled by government efforts to improve patient safety and support ergonomic care within healthcare facilities. In May 2022, the National Safety Council (NSC) released the Declaration to Advance Patient Safety, calling on healthcare leaders to reaffirm their commitment to advancing patient and workforce safety through a holistic systems approach, as the National Action Plan. These initiatives emphasize greater institutional importance on safe patient handling solutions.

Asia Pacific Patient Lift Pendant Market Insights

The Asia Pacific region is anticipated to witness rapid growth in the patient lift pendant market, driven by fast development of healthcare infrastructure, hospital construction activities, and new-generation medical facilities. Growing awareness of patient safety, caregiver ergonomics, and mobility assistance across emerging markets is fueling growth in the market.

China Patient Lift Pendant Market Analysis

China dominates the Asia Pacific market, propelled by the increasing population of elderly and rising incidence of mobility disorders across the country. As per the World Health Organization (WHO), by 2040 the Chinese population aged above 60 years to reach 28%, fueled by longer lifespan and decreasing fertility rate, thereby further increasing the demand for patient handling and mobility-assist devices.

Europe Patient Lift Pendant Market Assessment

Europe held substantial market share in patient lift pendant. Hospital renovations, modernization initiatives, and the implementation of ergonomic patient care solutions are boosting the market growth. For example, in December 2024, Sweco contracted to deliver architecture and engineering services for two large hospital developments in Germany. The projects involve building a new Parent-Child Medical Care Centre at the University Medical Center Göttingen and renovating and enlarging the Martha-Maria Hospital in Nuremberg. These infrastructure developments are increasing investments in state-of-the-art, patient-centric hospital facilities that incorporate advanced lift technology.

Key Players & Competitive Analysis

The global patient lift pendant market is moderately competitive, with manufacturers investing in enhancing patient safety, ease of use, and ergonomic design of the lift systems. Some of the innovations involve easy-to-use controls, light materials, and adaptable configurations for caregiver efficiency and patient comfort. Strategic collaborations with hospitals, rehabilitation centers, and healthcare distributors are assisting companies to expand their market reach, while ongoing product development strives to meet changing healthcare standards and user needs.

Key players operating in the global patient lift pendant market include Arjo AB, Baxter International Inc., Compass Health Brands Corporation, Drive DeVilbiss International, Inc., GF Health Products, Inc., Guldmann A/S, Invacare Corporation, Joerns Healthcare, LLC, Medline Industries, LP, Prism Medical Ltd., Proactive Medical Products, Inc., Savaria Corporation, Stryker Corporation, Sunrise Medical LLC, and VERMEIREN GROUP N.V.

Key Players

- Arjo AB

- Baxter International Inc.

- Compass Health Brands Corporation

- Drive DeVilbiss International, Inc.

- GF Health Products, Inc.

- Guldmann A/S

- Invacare Corporation

- Joerns Healthcare, LLC

- Medline Industries, LP

- Prism Medical Ltd.

- Proactive Medical Products, Inc.

- Savaria Corporation

- Stryker Corporation

- Sunrise Medical LLC

- VERMEIREN GROUP N.V.

Patient Lift Pendant Industry Developments

In April 2025, Arjo launched the new Maxi Move 5 Patient Floor Lift, which is aimed at increasing safety, efficiency, and comfort with patient transfers. With enhanced ergonomics, increased lifting capacity, and clear controls, the Maxi Move 5 addresses caregivers' and patients' needs.

In September 2024, Medline increased its Chicagoland footprint by adding 110,000 square feet to its current office space, enhancing operational and distribution capabilities. The expansion is consistent with Medline's approach to expand market reach, maximize supply chain efficiency, and serve healthcare facilities in the region.

Patient Lift Pendant Market Segmentation

By Product Outlook (Revenue, USD Million, 2020–2034)

- Wired

- Wireless

By Patient Lift Type Outlook (Revenue, USD Million, 2020–2034)

- Ceiling Lifts

- Mobile Electric Lifts

- Sit-to-Stand Lifts

- Bath/Shower Lifts

By Channel Outlook (Revenue, USD Million, 2020–2034)

- Two

- Four

By End Use Outlook (Revenue, USD Million, 2020–2034)

- Hospitals

- Nursing Homes

- Residential Care Communities

- Hospice Facilities

- Homecare

- Others

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Patient Lift Pendant Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 530.16 Million |

|

Market Size in 2025 |

USD 582.24 Million |

|

Revenue Forecast by 2034 |

USD 1,375.04 Million |

|

CAGR |

10.02% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million, Volume in Kilotons and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 530.16 million in 2024 and is projected to grow to USD 1,375.04 million by 2034.

The global market is projected to register a CAGR of 10.02% during the forecast period.

North America dominated the market in 2024.

A few of the key players in the market are Arjo AB, Baxter International Inc., Compass Health Brands Corporation, Drive DeVilbiss International, Inc., GF Health Products, Inc., Guldmann A/S, Invacare Corporation, Joerns Healthcare, LLC, Medline Industries, LP, Prism Medical Ltd., Proactive Medical Products, Inc., Savaria Corporation, Stryker Corporation, Sunrise Medical LLC, and VERMEIREN GROUP N.V.

The wired segment dominated the market revenue share in 2024.

The mobile electric lifts segment is projected to witness the fastest growth during the forecast period.