Rehabilitation Equipment Market Size, Share, & Industry Analysis Report

: By Type, By Application (Physical Rehabilitation & Training and Occupational Rehabilitation & Training), By End Use, and By Region – Market Forecast, 2025–2034

- Published Date:May-2025

- Pages: 129

- Format: PDF

- Report ID: PM5676

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

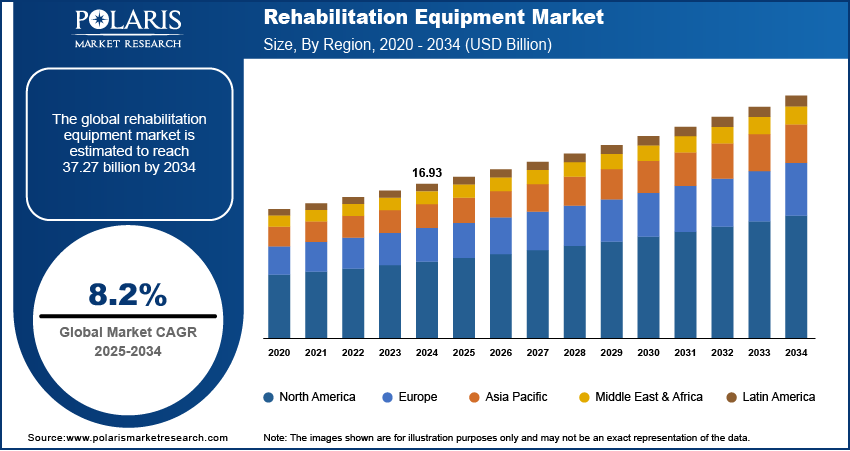

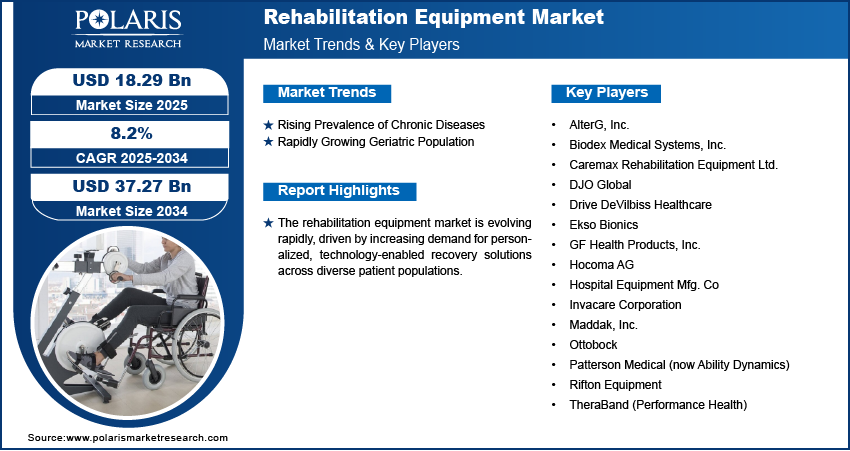

The global rehabilitation equipment market was valued at USD 16.93 billion in 2024 and is expected to register a CAGR of 8.2% from 2025 to 2034. The market is witnessing steady growth, primarily driven by ongoing technological advancements and the increasing incidence of injuries and trauma across diverse demographics. In addition, the rising adoption of advanced technologies in rehabilitation therapies, including robotic-assisted therapy devices, telehealth platforms, and wearables, is expected to offer growth opportunities for the market during the forecast period.

Rehabilitation equipment refers to a range of medical devices designed to support individuals in regaining physical, occupational, or cognitive functions lost due to injury, illness, or disability. The integration of robotics, sensor-based systems, and artificial intelligence-enabled therapy tools has transformed conventional rehabilitation methods, improving both precision and patient outcomes. In November 2023, Syrebo launched two rehabilitation robots—the upper limb robot SY-UEA2 with mobile chassis and optical positioning for functional training and the BCI-based SY-BR09 hand robot, allowing neural reshaping through brain stimulation, advancing neurorehabilitation technology. Innovations such as robotic exoskeletons, virtual reality-based rehabilitation programs, and remote monitoring solutions are increasing the effectiveness of therapy, reducing recovery time, and promoting personalized treatment. These advancements play a crucial role in the adoption of modern rehabilitation solutions as healthcare providers prioritize efficiency and outcome-based care.

Rising occurrences of road accidents, sports-related injuries, workplace mishaps, and age-related physical impairments have led to a higher demand for rehabilitation services and equipment. According to a June 2024 World Health Organization (WHO) report, injuries such as accidental and violence-related cases account for ∼4.4 million global deaths annually, representing close to 8% of total worldwide mortality. Additionally, the growing geriatric population, which is more susceptible to musculoskeletal and neurological disorders, further fuels the need for continuous rehabilitation support. This rise in demand is driving healthcare systems to integrate advanced rehabilitation equipment to facilitate faster patient recovery and reduce long-term disability. As a result, the market is evolving to meet the complex rehabilitation needs of an expanding and diverse patient base.

To Understand More About this Research: Request a Free Sample Report

Market Dynamics

Rising Prevalence of Chronic Diseases

Chronic diseases such as stroke, cardiovascular disorders, diabetes, and arthritis often result in long-term physical impairments that necessitate continuous rehabilitative care. According to the WHO's December 2024 report, noncommunicable diseases caused 43 million deaths in 2021, accounting for 75% of global non-pandemic mortality. Notably, 18 million premature NCD deaths occurred before age 70, with 82% concentrated in low- and middle-income countries. These chronic conditions limit mobility, strength, and functional independence, creating sustained demand for durable medical equipment that aids recovery and supports daily activities. Rehabilitation tools, such as mobility aids, exercise therapy devices, and assistive technologies, play an important role in improving quality of life and preventing further physical decline. Therefore, as healthcare systems shift toward long-term management and recovery-oriented care, the integration of specialized rehabilitation equipment becomes increasingly essential. Therefore, the rising prevalence of chronic diseases is boosting the demand for rehabilitation equipment.

Rapidly Growing Geriatric Population

Aging is naturally associated with declining musculoskeletal strength, reduced balance, and an increased risk of falls and injuries, all of which contribute to a higher need for rehabilitation support. The WHO's October 2024 report stated that by 2030, 1 in 6 people will be 60 or above, rising from 1 billion in 2020 to 1.4 billion. By 2050, this population will double to 2.1 billion, with those aged 80 and above tripling to 426 million. Moreover, older adults are more inclined to develop chronic illnesses and undergo surgical interventions, such as joint replacements or cardiovascular procedures, which require post-acute rehabilitative therapy. This demographic shift is driving healthcare providers and caregivers to invest in equipment that improves mobility, supports daily functioning, and promotes independent living among elderly patients. Thus, the rising geriatric population is accelerating the rehabilitation equipment market growth.

Segment Insights

Market Assessment by Type

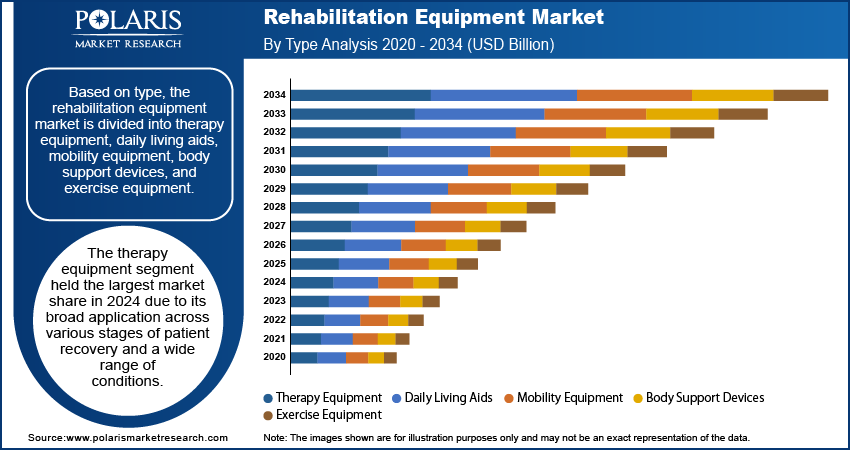

The global rehabilitation equipment market segmentation, based on type, includes therapy equipment, daily living aids, mobility equipment, body support devices, and exercise equipment. The therapy equipment segment held the largest revenue share in 2024, due to its broad application across various stages of patient recovery and a wide range of conditions. This category includes advanced devices used in physiotherapy, electrotherapy, hydrotherapy, and continuous passive motion therapy, all of which are essential in structured rehabilitation protocols. Healthcare facilities increasingly rely on these solutions to accelerate patient recovery, improve mobility, and reduce pain following surgeries or neurological incidents. The versatility and clinical effectiveness of therapy equipment make it a core component of modern rehabilitation practices, supporting its dominant position in the industry.

Market Evaluation by Application

The global rehabilitation equipment market segmentation, based on application, includes physical rehabilitation & training and occupational rehabilitation & training. The physical rehabilitation & training segment is expected to witness the fastest growth during the forecast period, driven by the rising demand for recovery solutions following injuries, surgeries, and chronic physical conditions. This segment encompasses interventions aimed at restoring physical function, mobility, and muscular strength through structured exercise, movement therapy, and specialized equipment. The growing focus on early intervention and evidence-based physical therapy to reduce long-term disability has boosted the demand for targeted rehabilitation programs. Therefore, as patient outcomes become a focal point of healthcare delivery, this segment is gaining traction among hospitals, rehabilitation centers, and outpatient clinics globally.

Regional Analysis

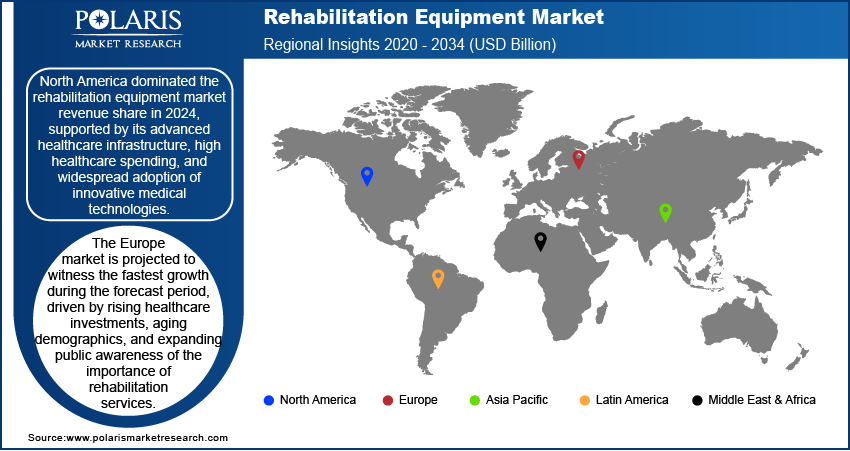

By region, the report provides industry insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the industry in 2024, supported by its advanced healthcare infrastructure, high healthcare spending, and widespread adoption of telerehabilitation. According to a December 2024 CMS report, US national health expenditures reached USD 4.9 trillion in 2023, reflecting a 7.5% growth to USD 14,570 per capita and representing 17.6% of the nation's GDP. The region benefits from strong regulatory support, reimbursement frameworks, and the presence of market players offering technologically advanced rehabilitation solutions. Additionally, the increasing majority of lifestyle-related chronic diseases and a growing aging population have contributed to sustained demand for rehabilitation equipment. These factors, coupled with the availability of skilled professionals and integration of digital health tools, boost the North America rehabilitation equipment market expansion.

The Europe rehabilitation equipment market is projected to witness the highest growth during the forecast period, owing to rising healthcare investments, aging demographics, and expanding public awareness of the importance of rehabilitation services. A 2023 WHO initiative in Georgia trained ∼1,000 healthcare professionals across all regions, primarily targeting primary care physicians and neurologists. The workshops promoted integrating patient-centered rehabilitation services into national health and social care systems. The region is increasingly focusing on patient-centric care models and home-based rehabilitation, which is fueling the demand for user-friendly and portable rehabilitation devices. Additionally, supportive government initiatives promoting physical therapy and disability care are accelerating penetration across both Western and Eastern European countries. These factors, combined with ongoing advancements in rehabilitation technologies, are expected to drive robust market expansion across the region.

Key Players and Competitive Analysis

The rehabilitation equipment market is witnessing growth driven by emerging markets, technological advancements, and rising latent demand for mobility solutions. Key players such as Invacare, Ekso Bionics, and Hocoma AG dominate developed markets with robotic exoskeletons and AI-driven therapy devices. Meanwhile, SMEs such as Rifton Equipment and Caremax leverage niche segments such as pediatric rehab. Disruptions and trends, such as telehealth integration and wearable rehab tech, are reshaping revenue opportunities. Strategic market entry assessments highlight untapped potential in Asia Pacific and Latin America, where economic and geopolitical shifts favor localized manufacturing. Competitive intelligence reveals aggressive strategic investments by Ottobock and DJO Global in sustainable value chains and mergers to consolidate vendor share. However, supply chain disruptions and pricing pressures challenge expansion opportunities. Expert insights highlight collaborative ecosystems and digitalization as critical to long-term competitive positioning. A few of the key players in the market are AlterG, Inc.; Biodex Medical Systems, Inc.; Caremax Rehabilitation Equipment Ltd.; DJO Global; Drive DeVilbiss Healthcare; Ekso Bionics; GF Health Products, Inc.; Hocoma AG; Hospital Equipment Mfg. Co; Invacare Corporation; Maddak, Inc.; Ottobock; Patterson Medical (now Ability Dynamics); Rifton Equipment; and TheraBand (Performance Health).

Biodex Medical Systems, Inc., headquartered in Shirley, New York, is a manufacturer specializing in rehabilitation equipment for physical medicine and physiotherapy professionals worldwide. The company has established itself into innovative solutions to aid in the assessment, treatment, and recovery of patients affected by diverse physical impairments. Their rehabilitation product portfolio includes advanced systems such as the Biodex System 4 Pro isokinetic dynamometer, Balance System SD, Gait Trainer 3, and the NxStep Unweighing System, all engineered to provide objective measurement, precise therapy, and reliable documentation throughout the rehabilitation process. These devices are widely used in sports medicine, orthopedics, neuro-rehabilitation, pediatrics, and geriatric care, offering clinicians the ability to improve balance, gait, muscle strength, and neuromuscular control. Biodex’s equipment is recognized for its versatility, accuracy, and adaptability, supporting evidence-based protocols and facilitating faster, more effective patient recovery. The company also provides comprehensive training and ongoing support to ensure optimal use of its technology. Now part of Mirion Medical, Biodex continues to drive advancements in rehabilitation, helping healthcare providers deliver superior outcomes and improve patient independence.

GF Health Products, Inc., also known as Graham-Field, is a US based manufacturer and distributor of medical and rehabilitation equipment, serving hospitals, extended care facilities, clinics, and homecare markets worldwide. Headquartered in Atlanta, Georgia, with multiple manufacturing and distribution facilities across the US, the company offers a comprehensive portfolio of over 50,000 products designed to improve patient mobility, comfort, and care outcomes. In the rehabilitation equipment sector, GF Health Products is renowned for its Everest & Jennings wheelchairs, Lumex patient aids and healthcare seating, and Gendron bariatric equipment, all of which support physical therapy, mobility training, and patient recovery. The company’s product range also includes beds, patient lifts, bathroom safety solutions, support surfaces, and stretchers, addressing the diverse needs of rehabilitation and extended care environments. GF Health Products highlights quality, durability, and user-centered design, with a strong commitment to increasing US based manufacturing for faster delivery and greater product reliability. Their rehabilitation solutions are widely trusted by clinicians and caregivers for allowing patient independence, promoting safe transfers, and facilitating effective rehabilitation protocols.

List of Key Companies in Rehabilitation Equipment Market

- AlterG, Inc.

- Biodex Medical Systems, Inc.

- Caremax Rehabilitation Equipment Ltd.

- DJO Global

- Drive DeVilbiss Healthcare

- Ekso Bionics

- GF Health Products, Inc.

- Hocoma AG

- Hospital Equipment Mfg. Co

- Invacare Corporation

- Maddak, Inc.

- Ottobock

- Patterson Medical (now Ability Dynamics)

- Rifton Equipment

- TheraBand (Performance Health)

Rehabilitation Equipment Industry Developments

March 2025: Syrebo expanded its collaboration with ITO Physiotherapy & Rehabilitation to combine robotic rehabilitation technology with physiotherapy solutions, building on existing partnerships to improve therapeutic outcomes.

January 2025: Genrobotics launched India's first pediatric robotic gait trainer, the G Gaiter Pediatric, designed for children suffering from cerebral palsy, muscular dystrophy, and spinal injuries. The device employs advanced technology to provide customized, interactive mobility therapy for improved rehabilitation outcomes.

January 2025: IIT Madras and CMC Vellore researchers introduced PLUTO, a cost-effective, portable hand rehabilitation robot. Commercialized by Thryv Rehab Solutions, the plug-and-train device addresses accessibility gaps and has already served over 1,000 patients in clinical and home settings.

Rehabilitation Equipment Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Therapy Equipment

- Daily Living Aids

- Medical Beds & Related Products

- Reading, Writing, and Computing Aids

- Bathroom and Toilet Assist Devices

- Other Daily Living Aids

- Mobility Equipment

- Wheelchairs & Scooters

- Walking Assist Devices

- Body Support Devices

- Patient Lifts

- Slings

- Other Body Support Devices

- Exercise Equipment

- Lower-Body Exercise Equipment

- Upper-Body Exercise Equipment

- Full-Body Exercise Equipment

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Physical Rehabilitation & Training

- Occupational Rehabilitation & Training

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Hospitals & Clinics

- Rehabilitation Centers

- Home-Care Settings

- Physiotherapy Centers

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Rehabilitation Equipment Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 16.93 billion |

|

Market Size Value in 2025 |

USD 18.29 billion |

|

Revenue Forecast by 2034 |

USD 37.27 billion |

|

CAGR |

8.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 16.93 billion in 2024 and is projected to grow to USD 37.27 billion by 2034.

The global market is projected to register a CAGR of 8.2% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are AlterG, Inc.; Biodex Medical Systems, Inc.; Caremax Rehabilitation Equipment Ltd.; DJO Global; Drive DeVilbiss Healthcare; Ekso Bionics; GF Health Products, Inc.; Hocoma AG; Hospital Equipment Mfg. Co; Invacare Corporation; Maddak, Inc.; Ottobock; Patterson Medical (now Ability Dynamics); Rifton Equipment; and TheraBand (Performance Health).

The therapy equipment segment held the largest market share in 2024.

The physical rehabilitation & training segment is expected to witness a faster growth during the forecast period.