Automotive Crankshaft Market Size, Share, Trends, Industry Analysis Report

By Crankshaft Type (Forged Crankshaft, Cast Crankshaft, Billet Crankshaft), By Material, By Manufacturing Process, By Vehicle Type, By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 130

- Format: PDF

- Report ID: PM6106

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

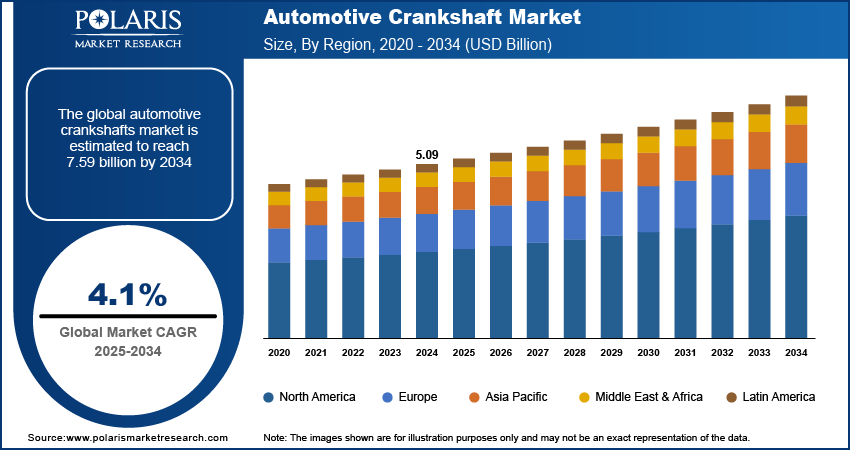

The global automotive crankshaft market size was valued at USD 5.09 billion in 2024 and is anticipated to register a CAGR of 4.1% from 2025 to 2034. The global automotive crankshaft market is growing steadily due to rising vehicle production, increased demand for fuel-efficient engines, and technological advancements in manufacturing. Key drivers include engine downsizing trends, lightweight component development, and growing adoption of hybrid and electric vehicles.

Key Insights

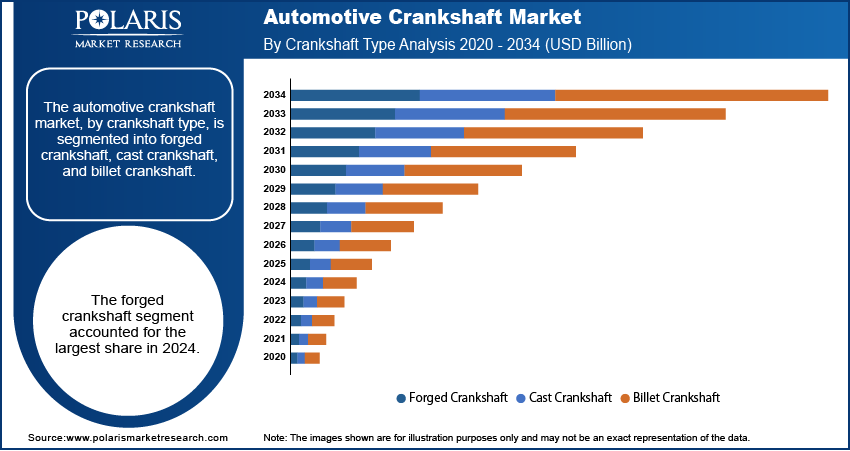

- By crankshaft type, the forged crankshafts segment held the largest share in 2024 due to their superior strength, durability, and resistance to fatigue. This manufacturing method yields components robust enough to meet the stringent demands of various vehicle applications.

- By material, the cast iron segment held the largest share in 2024, primarily owing to its cost-effectiveness and suitability for mass production. It provides a good balance of strength and vibration-damping properties.

- By manufacturing process, the precision forging segment held the largest share in 2024 due to its ability to produce crankshafts with enhanced material properties. This method results in a dense, uniform grain structure that significantly boosts the component's strength and fatigue resistance.

- By vehicle type, the passenger vehicles segment held the largest share in 2024, driven by the massive global production and sales volumes of cars, SUVs, and other personal vehicles. The sheer scale of manufacturing in this segment translates directly into the highest overall demand for crankshafts, underpinning its leading position.

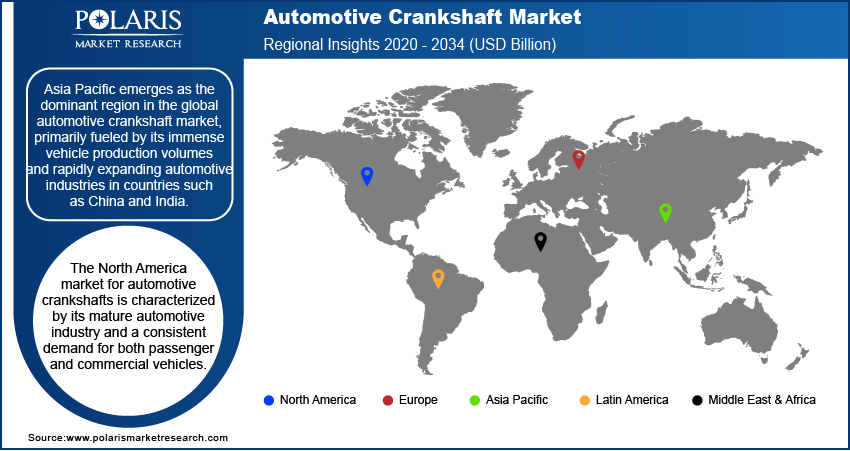

- By region, Asia Pacific emerges as the dominant force in the global industry, primarily fueled by its immense vehicle production volumes and rapidly expanding automotive industries in countries such as China and India.

Industry Dynamics

- The increasing global output of vehicles, including both passenger and commercial types, drives the demand for crankshafts.

- Growing demand for lighter and more durable materials in engine components fuels the industry growth.

- Ongoing innovations in engine technology and manufacturing processes would propel market expansion during the forecast period.

Market Statistics

- 2024 Market Size: USD 5.09 billion

- 2034 Projected Market Size: USD 7.59 billion

- CAGR (2025–2034): 4.1%

- Asia Pacific: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

A crankshaft is a vital mechanical part in an internal combustion engine. Its main job is to change the up-and-down movement of the pistons into a spinning motion, which then powers the vehicle's wheels.

The steady demand for replacement parts in the aftermarket propels the demand for automotive crankshaft. As vehicles get older and their components wear out, there is a continuous need for new crankshafts for repairs and maintenance. This segment provides ongoing revenue streams for manufacturers, separate from new vehicle production.

Another significant factor shaping the growth is the increasing focus on stringent quality and safety standards. Automotive parts, especially critical engine components such as crankshafts, must meet very high benchmarks for durability and performance. Standards set by organizations, including the International Organization for Standardization such as ISO 26262 for functional safety in road vehicles, directly influence how these components are designed, tested, and manufactured. This ensures that crankshafts can withstand extreme conditions and function reliably over a long lifespan, reducing the risk of failures that could lead to accidents, as highlighted by various government and regulatory bodies concerned with vehicle safety.

Drivers and Opportunities

Increasing Global Vehicle Production: The primary driver for the automotive crankshaft is the consistent growth in worldwide vehicle manufacturing. As more cars, trucks, and buses are produced, the demand for core engine components such as crankshafts naturally increases. This trend is directly tied to global economic growth, rising disposable incomes in emerging economies, and the expansion of transportation infrastructure.

Both passenger and commercial vehicle segments contribute to this demand. The European Automobile Manufacturers' Association (ACEA) reported in their "World motor vehicle production," updated in May 2023, that 85.4 million motor vehicles were produced globally in 2022, marking a 5.7% increase compared to 2021. This overall expansion in vehicle output directly propels the need for crankshafts, as every internal combustion engine vehicle requires at least one. The continuous rise in global vehicle production thus acts as a fundamental driver for the expansion.

Demand for Lightweight Materials and Fuel Efficiency: The growing push for lightweight materials and improved fuel efficiency in vehicles boosts the industry expansion. Stricter environmental regulations and increasing consumer awareness about fuel consumption are compelling automotive manufacturers to reduce vehicle weight without compromising safety or performance. This shift directly impacts the materials and design of crankshafts.

Advanced materials such as high-strength steel, aluminum alloys, and composites are increasingly being used to make crankshafts lighter and more durable. The U.S. Department of Energy's "Lightweight Materials for Cars and Trucks" publication highlights that replacing traditional steel components with lightweight materials can reduce vehicle body and chassis weight by up to 50%, leading to significant fuel economy improvements. For example, The U.S. Environmental Protection Agency (EPA) updated its “Multi-Pollutant Emissions Standards for Model Years 2027 and Later Light-Duty and Medium-Duty Vehicles” in March 2024. These regulations emphasize lower emissions and improved fuel economy, driving the adoption of lightweight engine components. This ongoing push for greater fuel efficiency and reduced emissions through material innovation is a key factor fueling growth in the automotive component segment.

Segmental Insights

Crankshaft Type Analysis

Based on crankshaft type, the segmentation includes forged crankshaft, cast crankshaft, and billet crankshaft. The forged crankshaft segment held the largest share in 2024. These crankshafts are produced by shaping metal under intense pressure, which results in a dense, uniform grain structure. This process enhances the material's strength, durability, and resistance to fatigue, making forged crankshafts highly reliable for a wide range of applications. They are extensively used in both passenger vehicles and heavy-duty commercial vehicles, where robustness and longevity are paramount. Their ability to withstand the demanding conditions of continuous engine operation, including high temperatures and significant rotational stresses, has made them a preferred choice for original equipment manufacturers globally, establishing their dominance in terms of overall volume within the sector.

The billet crankshaft segment is anticipated to witness the highest growth rate during the forecast period. This growth is driven by the superior strength, enhanced stress resistance, and design flexibility that billet crankshafts offer, making them well-suited for high-horsepower, racing, and specialty vehicles. Key factors supporting this trend include rising demand for high-performance engines, increasing use of billet crankshafts in motorsport and custom vehicle applications, advancements in CNC machining for precision manufacturing, and expanding R&D efforts in electric vehicle (EV) prototypes that require customized drivetrain components.

Material Analysis

Based on material, the segmentation includes steel alloy, cast iron, billet steel, and other materials. The steel alloy segment held the largest share in 2024. These materials, encompassing various grades of steel, are widely favored due to their exceptional strength, high fatigue resistance, and overall durability, which are critical for crankshafts operating under the intense stresses of modern internal combustion engines. Unlike cast iron, steel alloys offer superior mechanical properties that allow for more compact and lighter crankshaft designs while maintaining robust performance. They are extensively utilized across a broad spectrum of vehicles, including passenger cars, high-performance sports cars, and heavy-duty commercial vehicles, where reliability and longevity are paramount. The ability of steel alloys to withstand greater loads and higher engine speeds makes them a preferred choice for manufacturers aiming to meet both performance demands and increasingly stringent regulatory standards, firmly establishing their commanding position.

The billet steel segment is anticipated to register the highest growth rate during the forecast period. While billet steel crankshafts are typically machined from a single block of high-grade steel alloy, their distinct manufacturing process and superior performance set them apart, contributing to their accelerated growth. These crankshafts offer various benefits such as high strength, precision, and customizability, making them ideal for high-performance, motorsports, and specialized aftermarket applications where no compromises can be made on engine power output and durability. The increasing consumer demand for vehicle customization, extreme performance tuning, and the specific needs of professional racing teams drive the adoption of billet steel. Although often at a higher cost due to the intensive machining required, their unparalleled ability to handle extreme engine conditions ensures their growing prominence in niche but rapidly expanding segments of the automotive sector.

Manufacturing Process Analysis

Based on manufacturing process, the segmentation includes precision forging, casting, CNC machining, and heat treatment & surface finishing. The precision forging segment held the largest share in 2024. This method involves shaping metal under high pressure and temperature, resulting in a crankshaft with a highly refined grain structure. This internal structure greatly enhances the component's strength, fatigue resistance, and overall durability, making forged crankshafts exceptionally reliable. Precision forging is widely adopted for producing a vast number of crankshafts for various vehicle types, ranging from passenger cars to heavy-duty trucks, where components must withstand immense stress and last for a long time. The process allows for efficient mass production while ensuring the critical mechanical properties required for the heart of an internal combustion engine, cementing its leading position.

The CNC Machining segment is anticipated to register the highest growth rate during the forecast period. This advanced method involves cutting and shaping crankshafts from solid metal billets using computer-controlled tools, allowing for extreme precision and the creation of highly complex geometries. CNC machining is particularly crucial for producing specialized crankshafts for high-performance vehicles, racing applications, and custom engine builds, where exact dimensions, superior balance, and minimal material imperfections are paramount. The increasing demand for enhanced engine performance, customization options, and the ability to rapidly prototype new designs are key factors driving the expansion of CNC machining in crankshaft production. This technology offers manufacturers the flexibility to meet evolving design requirements and produce components with superior characteristics.

Vehicle Type Analysis

Based on vehicle type, the segmentation includes passenger vehicles and commercial vehicles. The passenger vehicles segment held the largest share in 2024. This dominance stems from the sheer volume of passenger cars, SUVs, and other personal mobility vehicles manufactured and sold worldwide each year. Passenger vehicles cater to a vast consumer base across all regions, leading to significantly higher production numbers compared to commercial counterparts. The continuous introduction of new models, technological advancements in engine design, and a steady replacement cycle for older vehicles ensure a consistent and substantial demand for crankshafts in this segment. This high-volume manufacturing translates directly into the passenger vehicle category, commanding the largest portion of crankshaft production and consumption.

The commercial vehicles segment is anticipated to record the highest growth rate during the forecast period. This surge is driven by several global trends, including rapid urbanization, expanding e-commerce activities, and significant investments in infrastructure development. As economies grow, there is an increasing need for robust transportation solutions to move goods and people, leading to higher production of light commercial vehicles, heavy-duty trucks, and buses. Furthermore, the development of specialized commercial vehicles for construction, logistics, and public transport in emerging fuels this expansion. The ongoing evolution of commercial vehicle technology, including a focus on durability and efficiency to meet demanding operational requirements, further contributes to the accelerating growth of this particular segment.

Regional Analysis

The Asia Pacific automotive crankshaft market accounted for the largest share in 2024. The region is a powerhouse in the global automotive sector and, consequently, a dominant force in the crankshaft. It benefits from rapid economic development, increasing disposable incomes, and a booming middle class, leading to substantial growth in vehicle production and sales. Countries within Asia Pacific serve as major manufacturing hubs for both domestic consumption and global export, contributing immense volumes to the crankshaft demand. The sheer scale of vehicle manufacturing across various segments, from entry-level passenger cars to a growing number of commercial vehicles, underpins the region's prominent position.

China Automotive Crankshaft Market Insights

In Asia Pacific, China held a significant position in the automotive crankshaft industry in 2024. As the world's largest automotive producer and consumer, China's domestic demand for crankshafts is immense. The country's robust manufacturing capabilities, coupled with continuous investments in automotive technology and expanding vehicle ownership, drive unparalleled volumes. The rapid growth of both passenger and commercial vehicle segments in China, alongside the increasing focus on developing advanced engine technologies to meet domestic and export demands, ensures that it remains a critical country in Asia Pacific.

North America Automotive Crankshaft Market Trends

The North America market for automotive crankshafts is characterized by its mature automotive industry and a consistent demand for both passenger and commercial vehicles. The region, particularly the U.S. and Canada, has a strong manufacturing base for light trucks and sport utility vehicles (SUVs), which typically require robust crankshafts. This segment contributes significantly to the overall demand. Furthermore, the emphasis on vehicle performance and technological advancements in engine design within North America drives the adoption of more sophisticated and durable crankshafts. Despite a growing shift toward electric vehicles, the large existing fleet of internal combustion engine vehicles and steady new vehicle sales maintain a strong place for crankshafts.

U.S. Automotive Crankshaft Market Overview

In North America, the U.S. stands as a major contributor to the demand for automotive crankshafts. The country's automotive sector is known for its high volume production of pickup trucks and SUVs, which are popular among consumers and require powerful and durable engine components. The U.S. market also benefits from a strong aftermarket for vehicle repairs and maintenance, ensuring a continuous need for replacement crankshafts. While the country is increasingly focusing on commercial electric vehicle transition, the substantial existing fleet of gasoline-powered vehicles and ongoing production of hybrid models underpin a significant and steady demand for crankshafts. Innovation in engine technology, often driven by a competitive domestic manufacturing landscape, further influences the demand for advanced crankshaft types.

Europe Automotive Crankshaft Market Assessment

Europe represents a sophisticated and highly regulated market for automotive crankshafts. The region is home to several leading automotive manufacturers known for their premium and luxury vehicles, as well as high-performance engines, which demand high-quality and often specialized crankshafts. Stringent emission norms and fuel efficiency regulations across the European Union consistently prompt manufacturers toward developing lighter and more efficient engine components, including crankshafts made of advanced materials and through precise manufacturing processes. This focus on technological innovation and adherence to environmental standards significantly shapes the demand in Europe.

In Europe, the Germany automotive crankshaft market stands out as a pivotal country. As a global leader in automotive engineering and the production of high-end vehicles, Germany drives demand for precision-engineered crankshafts. Its strong emphasis on research and development, coupled with a robust manufacturing infrastructure, ensures a continuous need for advanced and durable components for both its domestic production and export. German automakers' commitment to performance, reliability, and increasingly, fuel efficiency, directly translates into a substantial for high-quality crankshafts. The ongoing investments in advanced internal combustion engine technology, even amidst the push for electrification, maintains a significant requirement for sophisticated crankshaft solutions in the country.

Key Players and Competitive Insights

The automotive crankshaft market features a competitive landscape shaped by a mix of established global players and specialized regional manufacturers. Key participants include companies such as ThyssenKrupp AG, Rheinmetall AG, Bharat Forge Ltd., NSI Crankshaft Company, Kellogg Crankshaft Company, and Maschinenfabrik Alfing Kessler GmbH. These companies compete on factors such as product quality, technological innovation, manufacturing capability, and global supply chain efficiency. The sector is characterized by ongoing advancements in materials and manufacturing processes, driven by the continuous demand for lighter, stronger, and more fuel-efficient engines for both traditional and hybrid vehicles.

A few prominent companies in the industry include ThyssenKrupp AG; Rheinmetall AG; Bharat Forge Limited (Kalyani Group); NSI Crankshaft Company; Kellogg Crankshaft Company; Maschinenfabrik Alfing Kessler GmbH; Tianrun Crankshaft Co., Ltd.; Sandvik AB; Crower Cams & Equipment Co., Inc.; Arrow Precision Ltd.; and SCAT Enterprises, Inc.

Key Players

- Arrow Precision Ltd.

- Bharat Forge Limited (Kalyani Group)

- Crower Cams & Equipment Co., Inc.

- Kellogg Crankshaft Company

- Maschinenfabrik Alfing Kessler GmbH

- NSI Crankshaft Company

- Rheinmetall AG

- Sandvik AB

- SCAT Enterprises, Inc.

- Tianrun Crankshaft Co., Ltd.

- ThyssenKrupp AG

Automotive Crankshaft Industry Development

February 2025: Thyssenkrupp Polysius entered into a Letter of Intent with Sweden-based SaltX to jointly develop fully electrified, zero-emission production facilities utilizing Electric Arc Calciner (EAC) technology.

Automotive Crankshaft Market Segmentation

By Crankshaft Type Outlook (Revenue – USD Billion, 2020–2034)

- Forged Crankshaft

- Cast Crankshaft

- Billet Crankshaft

By Material Outlook (Revenue – USD Billion, 2020–2034)

- Steel Alloy

- Cast Iron

- Billet Steel

- Other Materials

By Manufacturing Process Outlook (Revenue – USD Billion, 2020–2034)

- Precision Forging

- Casting

- CNC Machining

- Heat Treatment & Surface Finishing

By Vehicle Type Outlook (Revenue – USD Billion, 2020–2034)

- Passenger Vehicles

- Commercial Vehicles

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest of Latin America

Automotive Crankshaft Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 5.09 billion |

|

Market Size in 2025 |

USD 5.29 billion |

|

Revenue Forecast by 2034 |

USD 7.59 billion |

|

CAGR |

4.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

By Crankshaft Type

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 5.09 billion in 2024 and is projected to grow to USD 7.59 billion by 2034.

The global market is projected to register a CAGR of 4.1% during the forecast period.

Asia Pacific dominated the share in 2024.

A few key players include ThyssenKrupp AG; Rheinmetall AG; Bharat Forge Limited (Kalyani Group); NSI Crankshaft Company; Kellogg Crankshaft Company; Maschinenfabrik Alfing Kessler GmbH; Tianrun Crankshaft Co., Ltd.; Sandvik AB; Crower Cams & Equipment Co., Inc.; Arrow Precision Ltd.; and SCAT Enterprises, Inc.

The forged crankshaft segment accounted for the largest share in 2024.

The billet steel segment is expected to witness the fastest growth during the forecast period.