SUV Market Size, Share, Trends, Industry Analysis Report

: By Type (Compact, Full-Size, Mid-Size, MPV, and Sub-Compact), Seating Capacity, Propulsion, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2024 - 2032

- Published Date:Oct-2024

- Pages: 116

- Format: PDF

- Report ID: PM5123

- Base Year: 2023

- Historical Data: 2019-2022

SUV Market Overview

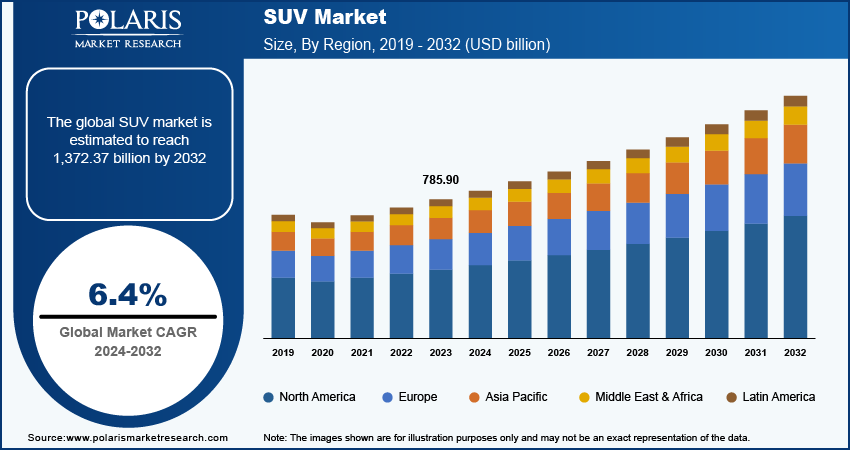

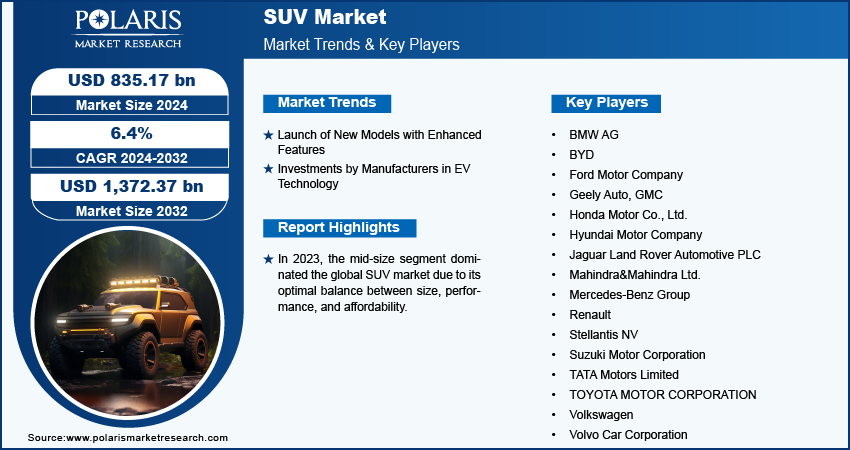

Global SUV market size was valued at USD 785.90 billion in 2023. The market is projected to grow from USD 835.17 billion in 2024 to USD 1,372.37 billion by 2032, exhibiting a CAGR of 6.4% during the forecast period.

An SUV (Sports Utility Vehicle) is a type of automobile designed to combine elements of passenger cars with off-road vehicles. The growth of the SUV market is driven by the increasing disposable income of the population across the globe. The growing income levels are enabling consumers to afford more expensive and feature-rich vehicles. For instance, according to the National Bureau of Statistics of China, in 2023, the per capita disposable income across China reached USD 5,500.72, representing a rise of 6.3% compared to the preceding year. This enhanced purchasing power allows consumers to prioritize the comfort, safety, and versatility qualities of SUVs. Thus, the increase in disposable income, especially in emerging economies, has resulted in inclined investments in SUVs, thereby driving the SUV market growth.

For Specific Research Requirements: Request a Free Sample Report

The growing automotive industry due to the increased automobile production is driving significant growth in the SUV market. Car manufacturers are heightening the production of cars to meet growing consumer demand for luxurious cars. For instance, according to IBEF, in January 2024, the total production of two-wheelers, three-wheelers, passenger vehicles, and quadricycles was 23,28,329 units, and it was increased to 23,58,041 units by April 2024. Such growth in automotive production facilitates the development and availability of more affordable and varied SUV options, making these vehicles accessible to a broader audience. Thus, the expansion in SUV offerings propels market growth by attracting new buyers of SUVs globally.

SUV Market Drivers and Trends

Launch of New Models with Enhanced Features

Automakers are continuously innovating and introducing models that incorporate advanced technologies, safety systems, and luxurious amenities to meet the demand of consumers seeking modern and high-performing vehicles. For instance, in August 2024, Nissan launched the X-Trail SUV in the Indian market. The model features a 1.5-liter three-cylinder turbo-petrol engine paired with a 12V mild-hybrid system for enhanced power and efficiency. These types of innovations are attracting new customers and encouraging existing SUV owners to upgrade. Thus, the automakers drive consumer interests and maintain a competitive edge by improving SUV offerings with advanced features, thereby driving the expansion of the SUV market.

Investments by Manufacturers in EV Technology

Automobile manufacturers are allocating a substantial amount of funds to develop electric SUVs that combine the benefits of zero-emission and features of standard SUVs. For instance, in May 2024, Mahindra & Mahindra Ltd., an Indian SUV maker, announced the allocation of USD 1.4 billion to support sustainable transportation and to grow the electric vehicle (EV) business. Such investments lead to improvements in battery technology, resulting in longer driving ranges, faster charging times, and enhanced performance. Therefore, the growing investments in EV technologies are meeting the evolving demands of the market and positioning the SUV category at the forefront of the broader transition to electric mobility, driving SUV market growth.

SUV Market Segment Insights

SUV Market Analysis by Type Insights

The global SUV market segmentation, based on type, includes compact, full-size, mid-size, MPV, and sub-compact. In 2023, the mid-size segment dominated the global SUV market due to its optimal balance between size, performance, and affordability. Mid-size SUVs offer a spacious interior that comfortably accommodates passengers, providing enough cargo space without the higher cost associated with full-size SUVs. This segment also ensures better maneuverability and fuel efficiency compared to larger models, making them a practical alternative for both urban and rural driving. Additionally, mid-size SUVs come with a range of features and options that plead to a broad spectrum of consumers, from safety enhancements to advanced infotainment systems. Thus, all these factors have contributed to the dominance of the mid-size SUV segment in the global market.

SUV Market Analysis by Propulsion Insights

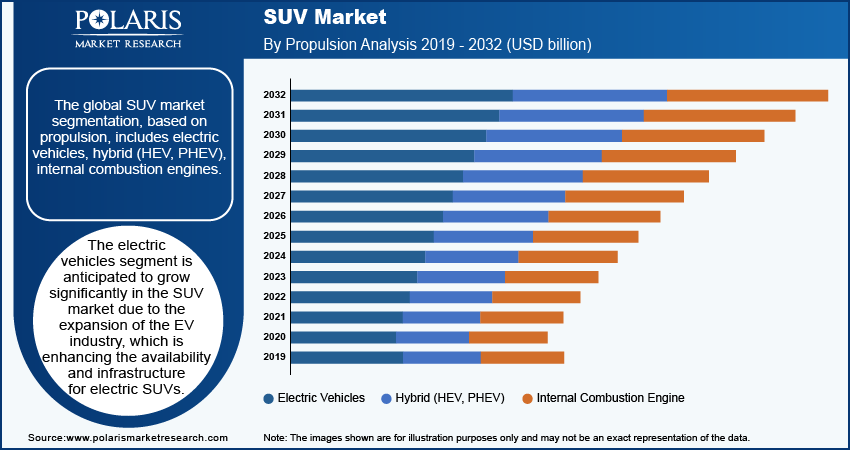

The global SUV market segmentation, based on propulsion, includes electric vehicles, hybrid (HEV, PHEV), internal combustion engines. The electric vehicles segment is anticipated to grow significantly in the SUV market due to the expansion of the EV industry, which is enhancing the availability and infrastructure for electric SUVs. The countries worldwide are experiencing increased sales because of the growing demand for EVs. For instance, according to the Society of Manufacturers of Electric Vehicles, in FY2023, the sales of electric vehicles (EVs) in India totaled 47,499 units and represented a subsequent increase of around 90% by achieving sales of 90,432 units in FY2024. This expansion is a result of improved battery technology, a developed network of charging stations, and supportive government policies. Consequently, the increasing consumer demand for EVs, along with government initiatives to expand the EV network, are expected to drive the growth of the electric vehicle segment with a significant CAGR over the forecast period.

SUV Market Analysis by Regional Insights

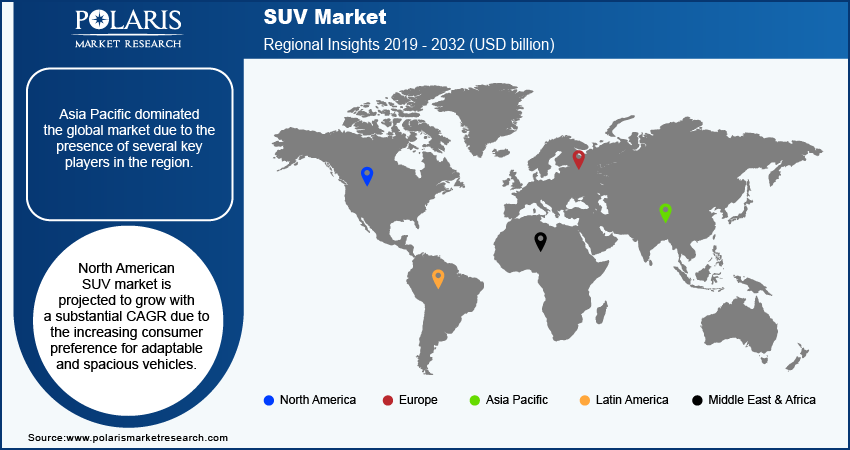

By region, the study provides SUV market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific dominated the global market due to the presence of several key players in the region. Major automotive companies, such as BYD; TOYOTA MOTOR CORPORATION; Hyundai Motor Company; Honda Motor Co., Ltd.; Mahindra & Mahindra Ltd.; and Tata Motors Limited; based in countries including Japan, South Korea, and India, are at the forefront of SUV development, investing heavily in research and development to deliver advanced technologies and fuel-efficient models. These manufacturers are catering to the growing consumer demand within the region and also expanding their presence across other regions. Thus, the dynamic environment of the region has fostered a high level of competition that contributed to the region's dominance in the global SUV market.

The future of SUV market in India is anticipated to grow significantly due to the increasing focus of global manufacturers on agreements, partnerships, and collaboration in the country. The automobile firms are signing an agreement with the India-based automotive companies to exchange technologies and share platforms. For instance, in February 2024, Mahindra & Mahindra and the Volkswagen Group agreed to supply Volkswagen's MEB platform for use in Mahindra's custom electric platform, INGLO. The collaboration includes the provision of electric components and standardized cells. Such agreements foster innovation and enhance the product portfolio by the introduction of new vehicles, including SUVs. Thus, the market for SUVs in India is expected to grow significantly over the next ten years.

North American SUV market is projected to grow with a substantial CAGR due to the increasing consumer preference for adaptable and spacious vehicles. In the region, SUVs are becoming popular because of their larger interior space, higher seating position, and improved cargo capacity. This growing popularity is further fueled by a combination of changing family dynamics, such as high disposable income and the desire for enhanced comfort and utility, leading to a robust demand for SUVs. Consequently, the SUV market in North America is expected to grow significantly over the forecast period.

SUV Key Market Players & Competitive Insights

The global sports utility vehicle market is highly competitive, driven by a diverse array of manufacturers ranging from established automotive giants to innovative newcomers. Key players are dominating the market with their extensive portfolios of well-established SUV models, leveraging brand loyalty and extensive distribution networks. Similarly, luxury brands are intensifying competition with advanced technology and high-performance features.

Shifting consumer preferences towards electric and hybrid vehicles are reshaping the competitive dynamics, pushing both global and new players to invest heavily in sustainable technologies, such as EV and hybrid, and innovative designs. Major players in the SUV market include BMW AG; BYD; Ford Motor Company; Geely Auto; GMC; Honda Motor Co., Ltd.; Hyundai Motor Company; Jaguar Land Rover Automotive PLC; Mahindra&Mahindra Ltd.; Mercedes-Benz Group; Renault; Stellantis NV; Suzuki Motor Corporation; TATA Motors Limited; TOYOTA MOTOR CORPORATION; Volkswagen; and Volvo Car Corporation.

Tata Motors Limited is an automotive company. The company has a range of automotive vehicles encompassing various market segments. The company’s diverse product portfolio includes passenger cars, which cater to a wide spectrum of consumers. Additionally, the company offers an array of sports utility vehicles (SUVs) and commercial vehicles. Tata Motors offers supplementary services such as information technology solutions and vehicle financing services. The company has a global presence in several countries, including India, China, the United States, and the United Kingdom. In August 2024, Tata Motors launched the Tata Curvv.ev coupe SUV in the Indian market with five variants and two battery packs.

Geely Auto is an investment holding company that primarily operates as an automobile manufacturer in China. The company is involved in research and development, production, marketing, and sales of automobile parts, passenger vehicles, and related components, as well as the provision of after-sales and technical services. Geely offers a range of vehicles, including sedans, sport utility cars, wagons, and electric vehicles under various brands. The company also provides logistics, engineering, and technology consulting services and storage services. It is also engaged in technology research and development and procures electrical and mechanical equipment, automobile parts, and components. The company operates in various regions across the globe, including Eastern Europe, Malaysia, Northern Europe, the Middle East, Central and South America, the Philippines, and Africa. In August 2024, Geely Auto introduced the E5, an electric SUV, in Guiyang, China. The E5 has advanced features and a minimalist design and meets regulatory standards in 89 countries.

Key Companies in SUV Market

- BMW AG

- BYD

- Ford Motor Company

- Geely Auto

- GMC

- Honda Motor Co., Ltd.

- Hyundai Motor Company

- Jaguar Land Rover Automotive PLC

- Mahindra&Mahindra Ltd.

- Mercedes-Benz Group

- Renault

- Stellantis NV

- Suzuki Motor Corporation

- TATA Motors Limited

- TOYOTA MOTOR CORPORATION

- Volkswagen

- Volvo Car Corporation

SUV Industry Developments

June 2024: Hyundai introduced the Hyundai Inster EV micro SUV, a new entry-level electric vehicle. The vehicle is built on a modified platform derived from the Casper sub-compact micro SUV.

March 2024: Citroen, the French car manufacturer, partnered with BluSmart Mobility, an Indian EV company, to bolster the domestic firm's electric vehicle fleet in India. The collaboration involves an MoU for the procurement of 4,000 units of Citroen e-C3, an all-electric compact SUV.

March 2024: Mahindra & Mahindra joined forces with Adani Total Energies E-Mobility Ltd (ATEL) to bolster India's electric vehicle (EV) charging infrastructure.

Future of SUV Market Segmentation

By Type Outlook

- Compact

- Full-Size

- Mid-Size

- MPV

- Sub-Compact

By Seating Capacity Outlook

- 4 Seater

- 5 Seater

- > 5 Seater

By Propulsion Outlook

- Electric Vehicles

- Hybrid (HEV, PHEV)

- Internal Combustion Engine

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Sports Utility Vehicle Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 785.90 billion |

|

Market Size Value in 2024 |

USD 835.17 billion |

|

Revenue Forecast in 2032 |

USD 1,372.37 billion |

|

CAGR |

6.4% from 2024 to 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019 – 2022 |

|

Forecast Period |

2024 – 2032 |

|

Quantitative Units |

Revenue in USD billion, Volume in million units, and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global SUV market size was valued at USD 785.90 billion in 2023 and is projected to grow to USD 1,372.37 billion by 2032.

The global market registers a CAGR of 6.4% during the forecast period, 2024-2032.

Asia Pacific had the largest share of the global market

The key players in the market are BMW AG; BYD; Ford Motor Company; Geely Auto; GMC; Honda Motor Co., Ltd.; Hyundai Motor Company; Jaguar Land Rover Automotive PLC; Mahindra & Mahindra Ltd.; Mercedes-Benz Group; Renault; Stellantis NV; Suzuki Motor Corporation; TATA Motors Limited; TOYOTA MOTOR CORPORATION; Volkswagen; and Volvo Car Corporation.

In 2023, the mid-size segment held the largest revenue share of the SUV market due to its optimal balance between size, performance, and affordability.

The electric vehicles segment is projected to grow substantially in the global market because of the expansion of the EV industry, which is enhancing the infrastructure for electric SUVs.