Semaglutide Market Size, Share, Trends, Industry Analysis Report

By Product (Ozempic, Wegovy, Rybelsus, Others), By Application, By Route of Administration, By Distribution Channel, By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 125

- Format: PDF

- Report ID: PM6374

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

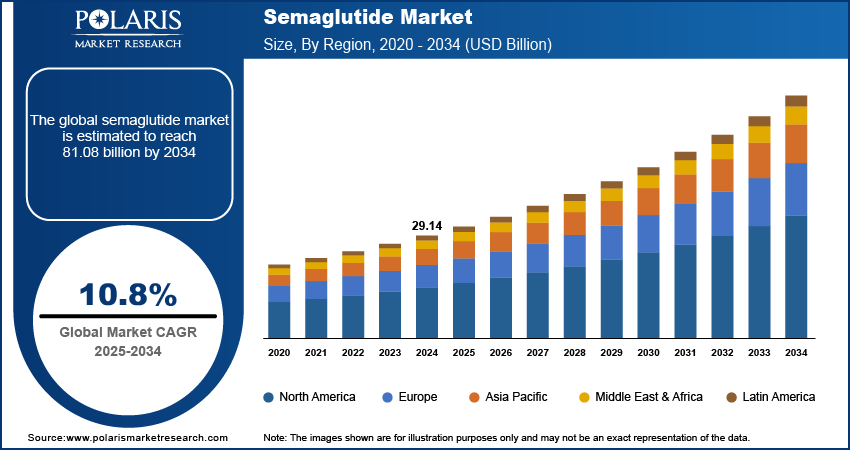

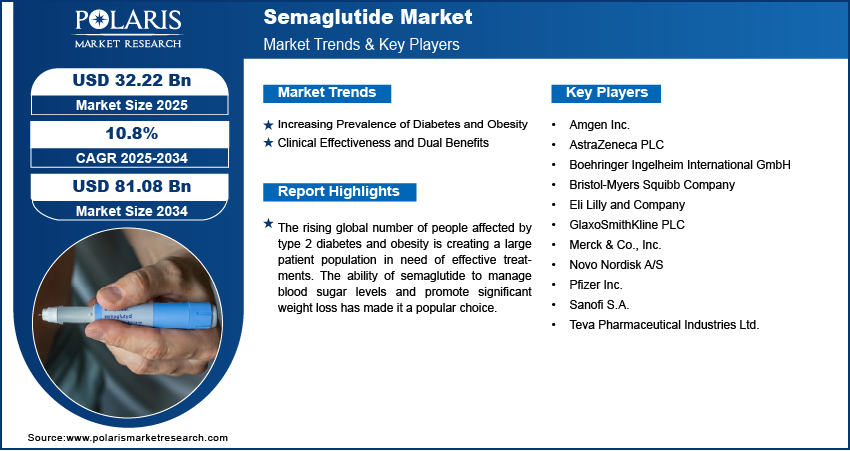

The global semaglutide market size was valued at USD 29.14 billion in 2024 and is anticipated to register a CAGR of 10.8% from 2025 to 2034. A few main growth factors are the increasing prevalence of type 2 diabetes and obesity worldwide. Additionally, the development of new methods for medication, such as an oral tablet, helps make it more convenient for patients.

Key Insights

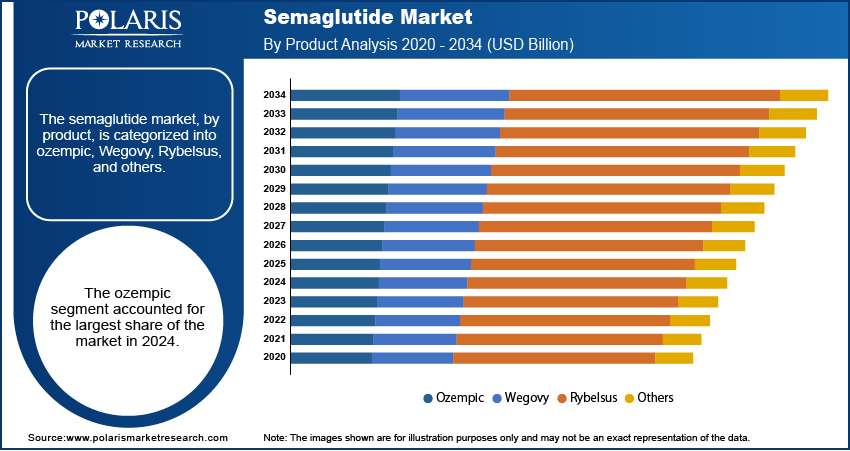

- By product, the ozempic segment held the largest share in 2024 due to its long history and proven effectiveness in treating type 2 diabetes.

- By application, the type 2 diabetes mellitus segment held the largest share as the drug was first approved for this condition.

- By route of administration, the parenteral route of administration segment held the largest share in 2024 because the first products on the market were injections.

- By distribution channel, the retail pharmacies segment held the largest share due to the presence and convenience of these pharmacies.

- By region, North America led the global revenue share in 2024 due to the high prevalence of diabetes and obesity,

Industry Dynamics

- The growing number of people affected by type 2 diabetes and obesity is a major driver. These chronic conditions have a significant impact on public health, leading to a higher demand for effective medications.

- The clinical effectiveness of the drug in managing blood sugar and promoting significant weight loss is a key factor. Studies have shown that it can lead to a considerable reduction in body weight, making it a popular choice for treating obesity. This dual benefit has expanded its use.

- New and more convenient ways of taking the medicine, such as an oral tablet, are helping to increase patient use. This makes the treatment more appealing for people who do not want to use an injectable form of the drug.

AI Impact on Semaglutide Market

- AI is transforming the Semaglutide market by accelerating drug discovery and optimizing clinical trials.

- It enhances patient targeting through data analytics, improving treatment personalization.

- AI-driven digital health tools support patient adherence and monitoring, boosting therapy effectiveness.

- Additionally, AI aids pharmaceutical companies in forecasting demand and streamlining supply chains, ensuring better market responsiveness and reduced costs.

Market Statistics

- 2024 Market Size: USD 29.14 billion

- 2034 Projected Market Size: USD 81.08 billion

- CAGR (2025–2034): 10.8%

- North America: Largest market in 2024

The semaglutide market includes the sales of drugs used to treat type 2 diabetes and chronic weight management. The medicine works by acting like a hormone in the body that controls blood sugar levels and appetite. It is available in various forms, including injections and oral tablets.

A few factors driving the demand for semaglutide are growing awareness on social media and the rise of telehealth services. Social media platforms have helped spread information about the drug's weight loss benefits. This has created a lot of public interest and demand, especially for people who want to lose weight. This trend has also caused an increase in off-label use, where the drug is prescribed for something other than its approved use.

Telehealth services have also played a role by making it easier for people to get a prescription. These online health platforms connect patients with doctors who can prescribe medicine without an in-person visit. This convenience has increased access for many, including those in remote areas. For instance, the use of telehealth has been shown to increase access to care for people suffering from diabetes, making it easier for them to get the right medications. This kind of improved access helps the market grow by bringing the drug to a wider group of patients.

Drivers and Trends

Increasing Prevalence of Diabetes and Obesity: The rising number of people suffering from type 2 diabetes and obesity globally fuels the demand for semaglutide. Both conditions are linked to lifestyle factors such as poor diet and lack of physical activity, and their prevalence has been increasing steadily. This growing patient population creates a large need for effective treatments. The drug's ability to address both conditions makes it a highly sought-after solution for a large and expanding patient base.

According to the World Health Organization (WHO), the number of diabetes cases worldwide was 830 million in 2022. Also, 14% of adults aged 18 and above were affected by diabetes in 2022. Moreover, in 2022, 1 in 8 people globally had obesity, and 2.5 billion adults (18 years and older) were overweight, and of those, 890 million had obesity. This means about 43% of adults were overweight, and 16% were suffering from obesity. This increasing global burden of metabolic diseases is a major force behind the demand for new treatments. As a result, the rising prevalence of diabetes and obesity fuels the growth of the industry.

Clinical Effectiveness and Dual Benefits: The proven clinical effectiveness of semaglutide in treating both diabetes and obesity is another important driver. The medicine helps patients control their blood sugar levels while also causing significant weight loss. This dual benefit makes it a valuable option for doctors and patients, especially since obesity is a common factor in type 2 diabetes. Its strong results in clinical trials have built confidence among healthcare providers.

According to the European Association for the Study of Obesity, a 4-year clinical study of semaglutide on weight in 17,000 adults with obesity shows a 10% weight loss. Its strong results in clinical trials have built confidence among healthcare providers. This benefit makes it a valuable option for doctors and patients, especially since obesity is a common disease worldwide. Additionally, the medicine helps patients control their blood sugar levels while also causing significant weight loss, further driving the demand for these drugs for the treatment of type 2 diabetes caused by obesity, thereby fueling the growth. The fact that this drug addresses both conditions in a single treatment makes it a very appealing option for doctors and patients alike. This effectiveness and the dual-benefit profile of the drug are key factors driving the semaglutide market expansion.

Semaglutide Clinical Trials – Pipeline Analysis

The current pipeline for semaglutide-based therapies reflects a strategic expansion into multiple indications beyond its established use in diabetes and obesity. While Ozempic and Wegovy remain central to treatment in these areas, ongoing clinical trials are exploring the potential of semaglutide in addressing conditions such as Alzheimer’s disease, non-alcoholic steatohepatitis (NASH), cardiovascular disease, and chronic kidney disease—targeting key unmet medical needs.

Advanced-phase studies (Phase 3 and 4) continue to support its core applications in diabetes and obesity, but early research into its use for neurodegenerative and liver-related disorders presents opportunities for future market growth. Investigational efforts also include novel drug combinations and targeted formulations, which may enhance semaglutide’s clinical utility and safety profile. These developments could significantly expand its therapeutic scope, positioning semaglutide as a potential treatment option across a wider range of chronic conditions.

|

NCT Number |

Study Title |

Conditions |

Sponsor |

Phases & Completion Date |

|

NCT07043361 |

Efficacy of Semaglutide in Glycemic Control, Weight Loss, and Improving Lipidogram- Role of Baseline Vitamin D Levels |

Metabolic Disease

|

Hillel Yaffe Medical Center |

Completed |

|

NCT06497049

|

Open Randomized Study of Comparative Pharmacokinetics and Biosimilarity of GP40221 (GEROPHARM LLC, Russia) and Ozempic. |

|

Geropharm |

PHASE 1 |

|

NCT06909006 |

Semaglutide Treatment in Type 1 Diabetes |

|

Nordsjaellands Hospital |

Phase 3 |

Off-Label Use and Counterfeit Semaglutide – Regulatory and Market Implications

The FDA has expressed growing concern over the off-label use of unapproved and compounded semaglutide. It cited serious risks such as dosing inaccuracies, safety uncertainties, and over 455 reported adverse events as of February 2025. Rising demand for GLP-1 receptor agonists, particularly for weight management, has led to the circulation of unauthorized and counterfeit products, including fake versions of Ozempic. The agency warns that compounded semaglutide, especially in salt forms, falls outside regulatory oversight and may pose efficacy and safety risks.

Regulatory interventions aimed at curbing counterfeit and compounded products may lead to disruptions in supply chains, changes in prescribing behaviors, and increased scrutiny of off-label prescribing. As semaglutide continues to gain popularity for weight loss—beyond its FDA-approved uses in diabetes—these developments are likely to influence both market access and clinical decisions.

The FDA had confiscated thousands of counterfeit Ozempic units and issued specific warnings for products labeled with lot number NAR0074 in December 2023. These counterfeit products contained non-sterile components and unverified ingredients, including needles, raising infection risks. Although five adverse events were reported, none were classified as serious. The FDA has advised pharmacies to procure Ozempic only from authorized distributors and urged patients to confirm the authenticity of their prescriptions.

The FDA has updated its stance on compounding, with the semaglutide shortage now resolved. As of February 21, 2025, physicians (503A facilities) and state-licensed pharmacies and are permitted to compound semaglutide until April 22, 2025, while outsourcing facilities (503B) may continue until May 22, 2025, or until a court decision is issued in the OFA v. FDA case. The agency retains authority to take enforcement actions against unsafe compounds or substandard products. These regulatory clarifications and ongoing legal proceedings are expected to influence compounding practices and reshape competition within the GLP-1 receptor agonist market, affecting both diabetes and weight-loss segments.

Patent Expiry Outlook and Market Implications

The upcoming patent expirations for key semaglutide products Ozempic, Rybelsus, and Wegovy between 2026 and 2032, present both strategic challenges and opportunities for market stakeholders. As exclusivity ends, generic and biosimilar competition is expected to intensify, potentially reducing market share and pricing flexibility for current manufacturers. However, this shift may also improve patient access and support overall industry expansion.

To remain competitive, companies will need to focus on innovation, expand indications, and explore novel delivery mechanisms. Differentiation strategies such as combination therapies and next-generation GLP-1 analogs will be critical in maintaining market relevance. Additionally, the patent expirations are likely to drive increased investments in new therapeutic platforms and technologies, further influencing the long-term dynamics of the semaglutide and broader GLP-1 receptor agonist markets.

Pricing Dynamics and Affordability Impact for Semaglutide-Based Treatments

The pricing of semaglutide-based therapies namely Ozempic, Wegovy, and Rybelsus plays a critical role in shaping industry access and adoption. Positioned within the high-cost segment of diabetes and obesity care, these treatments face affordability challenges that directly affect patient uptake and adherence. Insurance coverage, manufacturer discounts, and patient assistance programs significantly influence out-of-pocket costs, enabling broader access to therapy for insured populations.

For individuals without insurance or with limited benefits, savings programs help mitigate financial barriers, supporting sustained demand. These affordability measures are essential in ensuring continuity of care and improving therapeutic outcomes. As market competition intensifies within the weight loss and diabetes management segments, pricing strategies and increased cost transparency are becoming increasingly important for sustaining industry presence.

Ongoing revisions to pricing models and implementation of cost-saving initiatives are expected to shape both short- and long-term industry dynamics. Ensuring affordability remains a priority, particularly as the global prevalence of chronic conditions such as obesity and diabetes continues to rise. Accessible pricing will be a key determinant in expanding the reach of semaglutide treatments and driving their continued industry growth.

Market Concentration & Characteristics

The semaglutide market is evolving with advancements in drug formulations, delivery systems, and combination therapies. Developments such as extended-release versions, oral formulations, and novel co-therapies aim to improve patient compliance and clinical outcomes. These innovations are geared toward enhancing bioavailability, minimizing gastrointestinal side effects, and broadening therapeutic applications beyond diabetes and obesity to include cardiovascular and neurodegenerative conditions.

High entry barriers characterize the industry, driven by rigorous regulatory standards, substantial R&D expenditures, and Novo Nordisk’s robust intellectual property protections. The complexity of peptide drug development, specialized production requirements, and the need for long-term clinical data further limit new entrants. Novo Nordisk’s well-established global presence and control over supply chains continue to strengthen its industry position.

Regulatory bodies such as the FDA and EMA enforce strict guidelines for semaglutide, requiring comprehensive clinical trials to demonstrate long-term safety and efficacy. Pricing and reimbursement policies significantly impact industry access, as the high cost of treatment often requires favorable insurance coverage. Regional harmonization of regulations is crucial for broader adoption, especially in emerging markets.

Semaglutide faces competition from other GLP-1 receptor agonists, as well as DPP-4 inhibitors, SGLT2 inhibitors, and insulin therapies. Non-drug interventions such as bariatric surgery and lifestyle changes also serve as alternatives. However, semaglutide’s strong efficacy in weight reduction, cardiovascular advantages, and convenient dosing schedules support its growing industry share.

Novo Nordisk is actively expanding its semaglutide portfolio into emerging regions such as the Asia Pacific, Latin America, and the Middle East. Growth in these regions is fueled by rising obesity and diabetes rates alongside improved healthcare systems and obesity treatment. The company is focusing on obtaining regulatory approvals, aligning pricing and reimbursement strategies, and partnering with health authorities to enhance access. Local manufacturing and distribution investments are being made to address supply chain needs and support broader industry penetration.

Segmental Insights

Product Analysis

Based on product, the segmentation includes ozempic, Wegovy, Rybelsus, and others. The ozempic segment held the largest share in 2024. Its leading position is largely due to its proven effectiveness in managing type 2 diabetes, a condition with a very high number of patients worldwide. The product has a long history in the semaglutide market and has built strong trust with doctors and patients. Its once-a-week injection schedule is also a major convenience factor, which has helped with patient adherence and overall acceptance. The product's success has also been boosted by a lot of public interest in its off-label use for weight loss, which has made it a household name and increased its demand. This strong foundation in the diabetes treatment space, combined with its popularity for weight management, has enabled it to maintain its dominance.

The Rybelsus segment is anticipated to register the highest growth rate during the forecast period. Rybelsus is an oral tablet version of the drug, which is a major convenience for patients who prefer not to use injections. The development of a pill that works as well as an injection has opened up the treatment to a new group of patients. This oral option is seen as a big step forward in making this type of therapy more accessible and less intimidating. The product is attracting a growing number of people who are seeking an effective but easy-to-take option for managing their diabetes. This shift in patient preference toward a noninvasive form of treatment is expected to boost the rapid growth of the segment.

Application Analysis

Based on application, the segmentation includes type 2 diabetes mellitus, obesity, and others. The type 2 diabetes mellitus segment held the largest share in 2024. Semaglutide was first developed and approved as a diabetes drug, giving it a strong market foothold. With a significant and growing number of people diagnosed with type 2 diabetes around the world, there is a large and continuous demand for effective treatment options. The long-standing use of this drug in diabetes management has led to a lot of clinical data and trust from healthcare professionals, who often prescribe it as a go-to therapy. Its proven ability to improve blood sugar control makes it a standard part of treatment plans for many patients.

The obesity segment is anticipated to register the highest growth rate during the forecast period. The increasing awareness of obesity as a chronic disease that needs medical treatment, not just lifestyle changes, is a key reason for this trend. Recent approvals of the medication specifically for weight management have opened up a huge new group of patients. The drug's strong results in helping people lose a significant amount of weight have led to widespread media attention and public interest. This has created a surge in demand, which is quickly making the obesity application a major force in the industry. As more people and doctors see the drug's potential for weight loss, this segment is expected to continue its rapid expansion.

Route of Administration Analysis

Based on route of administration, the segmentation includes parenteral and oral. The parenteral segment held the largest share in 2024. This is because the initial products released, such as Ozempic and Wegovy, are both injectable. These products have been on the industry for a longer time and have built a strong base of patients and healthcare professional support. The established trust and proven effectiveness of these injectable forms, particularly for the treatment of type 2 diabetes and obesity, have solidified this segment's leading position. Many patients have become comfortable with the once-a-week injection schedule, which is more convenient than daily medication. The long-standing success and familiarity of these products in the medical community continue to drive the dominance of the parenteral route.

The oral segment is anticipated to register the highest growth rate during the forecast period. This is largely attributed to the introduction of a new tablet form of the drug, Rybelsus. This represents a significant step forward in making this treatment more accessible and appealing to a broader range of patients. Many people are not comfortable with needles, and an oral pill removes this barrier. This convenience is attracting a new group of patients who might have avoided the injectable versions. The oral option offers a simple and easy-to-use alternative, which can help improve patient adherence to their treatment plans. This shift in patient preference towards non-invasive and user-friendly medication is the primary reason for the rapid expansion of the oral route of administration in the industry.

Distribution Channel Analysis

Based on distribution channel, the segmentation includes hospital pharmacies, retail pharmacies, and online pharmacies. The retail pharmacies segment held the largest share in 2024. This is because most patients receive their prescriptions from their doctor and then fill them at a local pharmacy. The widespread presence of retail pharmacies, including both large chains and smaller independent stores, makes them the most accessible point of contact for patients. These pharmacies are a trusted part of the healthcare system and provide a direct and familiar way for people to get their medication. The convenience of picking up a prescription while running other errands, along with the ability to consult with a pharmacist in person, contributes to the segment's dominant position. This traditional distribution method remains the primary means by which the drug reaches the majority of patients.

The online pharmacies segment is anticipated to register the highest growth rate during the forecast period. This rapid growth is driven by the increasing popularity of telehealth and the general trend of people shopping online. Online pharmacies offer a level of convenience that traditional stores cannot match, allowing patients to order their medication from home and have it delivered directly to them. This is especially helpful for people who have difficulty traveling or live in remote areas. The rise of digital health platforms and direct-to-consumer services has also made it easier for people to get prescriptions online and have them fulfilled through this channel. This shift toward a more digital and convenient healthcare experience is a major factor fueling the fast expansion of the online pharmacies segment.

Regional Analysis

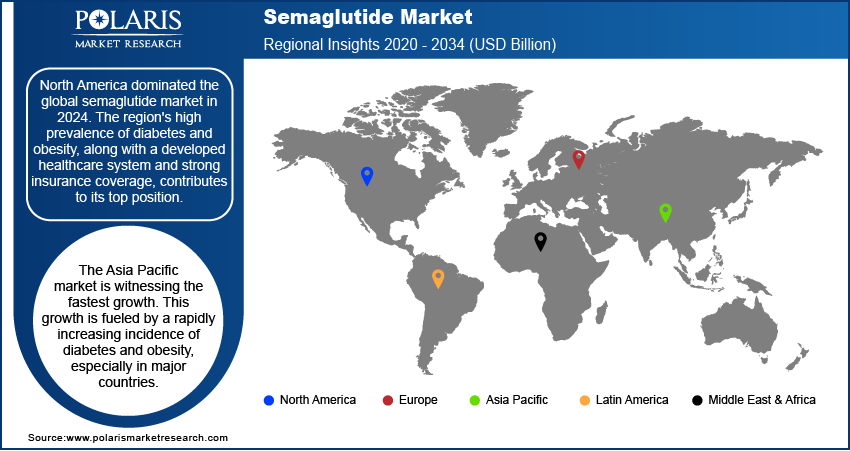

The North America semaglutide market accounted for the largest share in 2024. The high rates of diabetes and obesity in the region are a primary reason for this dominance. The healthcare infrastructure is well-developed, and there is a high level of patient and doctor awareness about advanced treatments. The region also benefits from a strong focus on pharmaceutical innovation and widespread insurance coverage that helps patients access these expensive medications.

U.S. Semaglutide Market Insights

The U.S. is a major part of the semaglutide market expansion in North America. The country has a high number of people affected by diabetes and obesity, which creates a huge patient base. The American healthcare system has also been quick to adopt new treatments. There is a lot of public and social media interest in the drug, especially for its weight loss benefits, which has helped create a strong demand. The industry in the U.S. is often a testing ground for new drugs and remains a main source of revenue for companies.

Europe Semaglutide Market Trends

The industry in Europe is showing steady growth, driven by increasing awareness of metabolic diseases and government health initiatives. Several European countries have strong public health systems that focus on managing chronic conditions such as diabetes and obesity. The region has a robust clinical research infrastructure, which helps with the adoption of new drug therapies. The availability of different drug formulations, including both injections and oral tablets, is also helping to expand the patient population in Europe.

A major country contributing to this market is Germany. The Germany semaglutide market is growing as the country has a well-structured healthcare system and a large number of people with type 2 diabetes and obesity. The country's medical community has been a leader in using new treatments, and there is high patient awareness about the benefits of GLP-1 drugs. This has made Germany a key player in the European market, with a consistent demand for semaglutide products.

Asia Pacific Semaglutide Market Overview

The Asia Pacific industry is witnessing the fastest growth, fueled by a rapidly increasing incidence of diabetes and obesity, especially in major countries. As healthcare spending rises and living standards improve, there is a greater focus on managing chronic diseases. The region is also seeing more regulatory approvals for these types of drugs, which makes them more widely available.

China Semaglutide Market Assessment

In Asia Pacific, China is a major country for industry expansion. China has a massive population and a rising prevalence of diabetes, which makes it an important industry. The country's large domestic pharmaceutical industry and growing investments in healthcare are also driving the industry forward. As more people gain access to advanced medical treatments, the demand for this drug is expected to rise significantly in the country.

Key Players and Competitive Insights

Novo Nordisk maintains a dominant position in the semaglutide market through its exclusive rights to develop, manufacture, and commercialize Ozempic, Wegovy, and Rybelsus. Its leadership is reinforced by ongoing innovation, global regulatory approvals, and significant investments in scaling up production to meet growing demand. Strategic initiatives, including the expansion of supply chain infrastructure and advancements in oral semaglutide research, continue to strengthen the company’s market control.

With no current branded competitors for semaglutide, Novo Nordisk retains influence over pricing, distribution, and market dynamics. This control has enabled consistent growth in the GLP-1 receptor agonist segment. However, with patent expiration approaching, the competitive landscape is expected to evolve. Emerging biosimilars and next-generation GLP-1 therapies or combination treatments may challenge the company’s position in the coming years.

Key Players

Competitive Landscape & Emerging Players

Lexicon Pharmaceuticals: Lexicon has licensed its obesity drug candidate LX9851 to Novo Nordisk, with plans to explore its use in combination with semaglutide. The deal includes potential milestone payments of up to USD 1 billion.

Viking Therapeutics: Viking’s investigational drug VK2735, a dual GLP-1/GIP receptor agonist, demonstrated promising weight loss results in Phase 1/2 studies, positioning it as a potential competitor to semaglutide.

Eli Lilly and Company: In the SURMOUNT-5 trial, Lilly’s weight-loss drug Zepbound showed greater efficacy than Wegovy, achieving 20.2% average weight reduction compared to Wegovy’s 13.7%, in individuals without diabetes.

Upcoming Biosimilars: With semaglutide's patent set to expire around 2032, several generic and biotech companies are preparing to introduce biosimilar versions. These upcoming entrants could significantly alter the competitive dynamics of the industry.

Semaglutide Industry Developments

February 2025: Novo Nordisk announced that the FDA officially declared the shortages of Wegovy and Ozempic resolved, confirming that supply in the U.S. now meets demand.

January 2025: Novo Nordisk reported that semaglutide 7.2 mg resulted in a 20.7% weight reduction in the STEP UP trial, outperforming both semaglutide 2.4 mg and placebo. The study also confirmed the drug’s safety and tolerability.

Semaglutide Market Segmentation

By Product Outlook (Revenue – USD Billion, 2020–2034)

- Ozempic

- Wegovy

- Rybelsus

- Others

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Type 2 Diabetes Mellitus

- Obesity

- Others

By Route of Administration Outlook (Revenue – USD Billion, 2020–2034)

- Parenteral

- Oral

By Distribution Channel Outlook (Revenue – USD Billion, 2020–2034)

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Semaglutide Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 29.14 billion |

|

Market Size in 2025 |

USD 32.22 billion |

|

Revenue Forecast by 2034 |

USD 81.08 billion |

|

CAGR |

10.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 29.14 billion in 2024 and is projected to grow to USD 81.08 billion by 2034.

The global market is projected to register a CAGR of 10.8% during the forecast period.

North America dominated the market share in 2024.

Novo Nordisk is a key player in the market.

The ozempic segment accounted for the largest share of the market in 2024.

The obesity segment is expected to witness the fastest growth during the forecast period.