GLP-1 Market Size, Share, & Industry Analysis Report

: By Route of Administration (Oral and Parenteral), By Type of Molecule, By Active Compound Used, By Type of GLP-1 Agonist Drug, By Target Indication, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5759

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

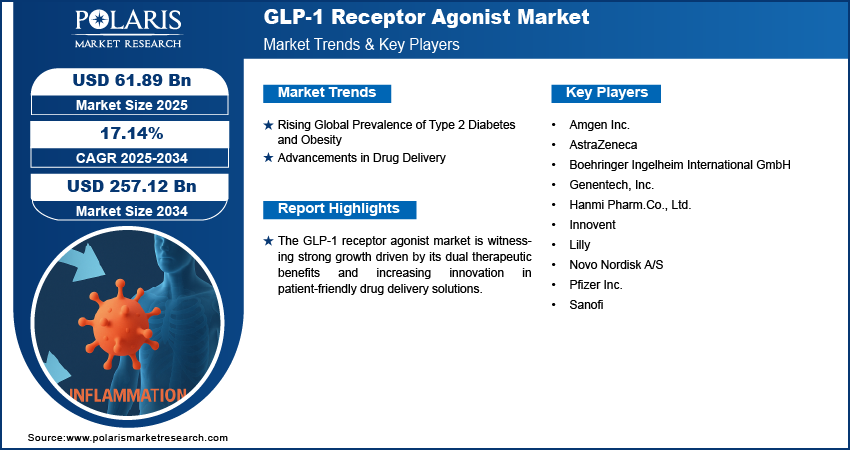

The global GLP-1 market size was valued at USD 47.74 billion in 2024, growing at a CAGR of 10.9% during 2025–2034. The growth is driven by expanding therapeutic applications beyond diabetes, such as obesity and cardiovascular diseases.

GLP-1 (glucagon-like peptide-1) is a hormone-based therapeutic class that improves insulin secretion and regulates blood sugar levels. It also slows gastric emptying and reduces appetite, making it effective for managing type 2 diabetes and obesity. The GLP-1 market is witnessing strong momentum, driven by advancements in drug formulations, particularly the development of oral and long-acting therapies. In June 2024, UBC launched under-the-tongue insulin drops with rapid absorption, potentially replacing traditional injections for diabetes treatment. These innovations are improving patient compliance and expanding treatment accessibility, especially for individuals who prefer autoinjectors options. Long-acting formulations further reduce dosing frequency, allowing for better observation and convenience. Collectively, these advancements are reshaping treatment protocols and boosting the role of GLP-1 therapies in chronic disease management.

The rise in partnerships, product launches, and an increasing focus on personalized medicine contribute to the growth opportunities. Leading pharmaceutical firms are actively collaborating to improve R&D efficiency, accelerate regulatory approvals, and bring novel therapies to market faster. In May 2025, UK-based CheqUp and WeightWatchers partnered to combine clinical GLP-1 medication support with behavioral lifestyle programs, offering integrated weight management solutions. The collaboration aims to enhance patient outcomes through combined pharmacological and behavioral interventions. Together, the introduction of differentiated products tailored to individual patient profiles reflects the sector’s focus on more targeted treatment approaches. The integration of genetic insights and digital tools into care delivery is further optimizing therapeutic outcomes, supporting the value of GLP-1 receptor agonists in personalized healthcare strategies.

Industry Dynamics

Rising Prevalence of Type 2 Diabetes Globally

The rising prevalence of type 2 diabetes worldwide is driving the GLP-1 development, as these therapies have a central role in improving glycemic control and reducing cardiovascular risk. There is a growing demand for effective, well-tolerated treatment options, with type 2 diabetes becoming increasingly common across both developed and emerging regions. According to a report from the WHO, in 2022, ~830 million people worldwide had diabetes, and over 95% of diabetes cases are type 2. GLP-1 receptor agonists offer dual benefits by improving insulin secretion and suppressing glucagon release in a glucose-dependent manner, thereby aligning well with current clinical management needs. Their ability to address both early-stage and progressive disease stages further reinforces their importance in diabetes care.

Increasing Rates of Obesity and Related Metabolic Disorders

GLP-1 receptor agonists have shown effectiveness in promoting weight loss and improving metabolic parameters. Obesity is a major risk factor for type 2 diabetes, cardiovascular diseases, and other comorbidities, creating a pressing need for therapeutic solutions that manage multiple conditions simultaneously. According to a May 2025 WHO report, 2.5 billion adults worldwide were overweight in 2022, including 890 million having obesity. GLP-1 therapies help regulate appetite and food intake and also support sustainable weight management. The utility of GLP-1 receptor agonists continues to expand as healthcare providers and patients seek holistic treatments for complex metabolic syndromes, strengthening their position in modern therapeutic regimens. Therefore, the increasing rates of obesity and related metabolic disorders are fueling demand for GLP-1 receptor agonists.

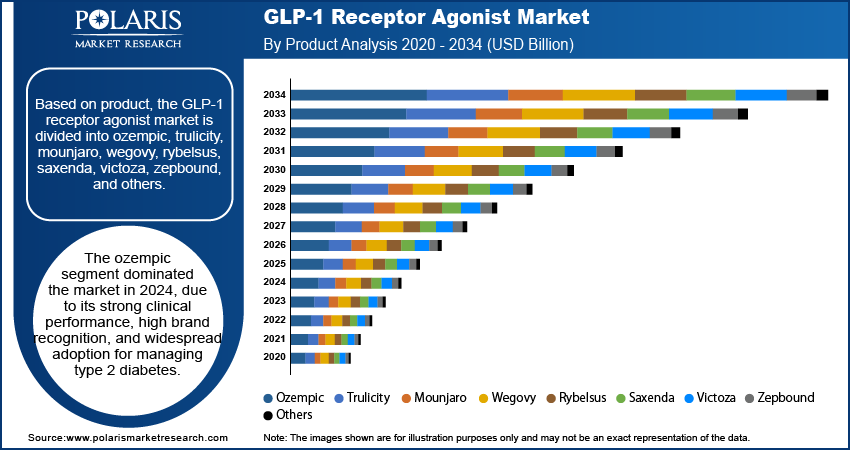

Segmental Insights

By Type of GLP-1 Agonist Drugs Analysis

The segmentation, based on type of GLP-1 agonist drugs, includes long-acting GLP-1 agonist and short-acting GLP-1 agonist. The long-acting GLP-1 agonist segment dominated the market in 2024 owing to its superior dosing convenience, improved patient observation, and sustained therapeutic efficacy. These formulations require less frequent administration, often once weekly, which reduces treatment burden and improves long-term compliance. Moreover, long-acting GLP-1 agonists show extended glycemic control and cardiovascular benefits, making them a preferred choice among healthcare providers. Their clinical advantage in managing both type 2 diabetes and obesity has positioned them strongly in treatment guidelines, contributing to their dominant share in the global sector.

By Route of Administration Analysis

Based on route of administration, the segmentation includes oral and parenteral. The oral segment is expected to witness a faster growth during the forecast period due to the rising demand for noninvasive and patient-friendly treatment options. Oral GLP-1 therapies eliminate the need for injections, which can often be a barrier to initiation and observation, especially for new or elderly patients. Improved drug delivery technologies have allowed the development of effective oral formulations with comparable efficacy to injectable counterparts. This growing shift toward oral therapies is expected to greatly expand market reach and improve access, especially in primary care settings and among populations with injection-related hesitations.

By Target Indication Analysis

The segmentation, based on target indication, includes Alzheimer’s disease, non-alcoholic steatohepatitis, obesity, sleep apnea, and type 2 diabetes. The obesity segment held the largest market share in 2024 as GLP-1 receptor agonists have proven highly effective in promoting weight loss and regulating appetite. The demand for multipurpose therapies is increasing, with obesity being a primary risk factor for numerous chronic conditions, such as type 2 diabetes and cardiovascular diseases. GLP-1 drugs offer a dual advantage by targeting both metabolic dysfunction and excess body weight, making them ideal for long-term weight management. Growing clinical acceptance and expanding regulatory approvals for obesity indications have reinforced this segment’s dominance.

By Type of Molecule Analysis

By type of molecule, the segmentation includes biologics and small molecules. The biologics segment is expected to witness substantial growth during the forecast period due to its strong clinical performance, precision targeting, and extended half-life properties. Biologic GLP-1 receptor agonists, derived from recombinant technologies, have demonstrated high efficacy in managing glycemic levels and weight reduction. These agents also tend to be more specific in their actions, minimizing adverse effects and enhancing patient outcomes. With ongoing innovation in biologic drug development and increased investments in biopharmaceutical pipelines, this segment is poised to grow significantly in the evolving GLP-1 therapeutic landscape.

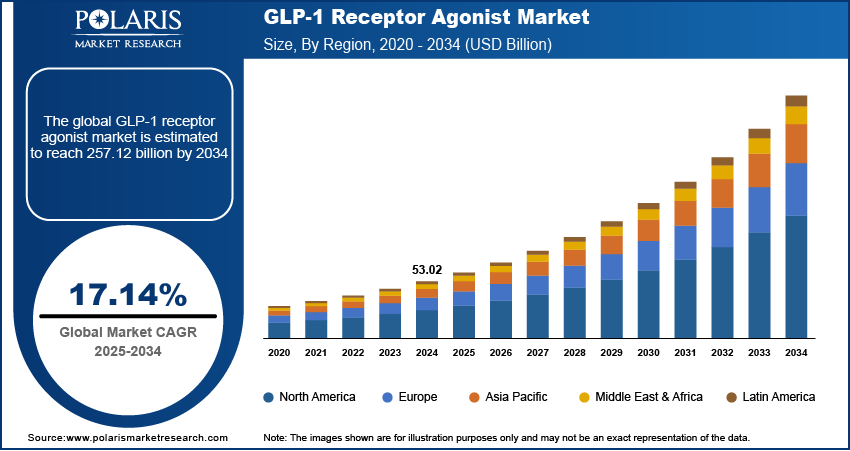

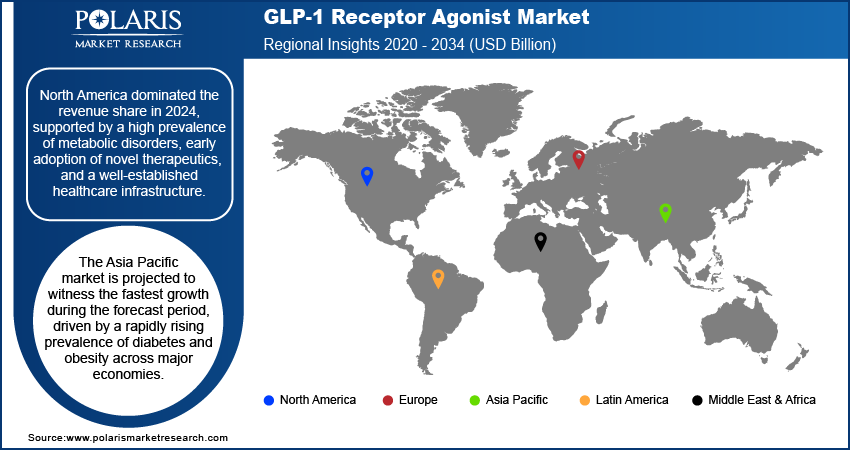

Regional Analysis

The report provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. The North America GLP-1 market dominated the revenue share in 2024, driven by high disease prevalence, advanced healthcare infrastructure, and early adoption of novel therapies. According to May 2024 CDC data, diabetes affects 11.6% of the US population (38.4 million), with 38% of adults (97.6 million) having prediabetes. The region benefits from a strong presence of major pharmaceutical companies, favorable reimbursement policies, and widespread awareness among both clinicians and patients.

The US GLP-1 market held the largest share in North America, due to its advanced healthcare infrastructure and high awareness among both healthcare providers and patients. The country benefits from the early adoption of innovative therapies, comprehensive insurance coverage, and established clinical guidelines that support GLP-1 use in diabetes and obesity treatment. Additionally, a growing focus on hyper-personalized medicine and preventative care continues to drive widespread acceptance and utilization of GLP-1 receptor agonists across multiple care settings.

The Asia Pacific GLP-1 market is projected to witness the fastest growth during the forecast period, owing to the rapid rise in lifestyle-related diseases and improving healthcare access. According to the November 2024 report, ICMR's 2023 study stated that India has 101 million diabetes cases. Increasing awareness of diabetes and obesity management, coupled with expanding urban populations and healthcare reforms, is boosting greater demand for effective treatments such as GLP-1 receptor agonists, with growing pharmaceutical investments and efforts to integrate advanced therapeutics into public health programs. Improved affordability and local production initiatives are further accelerating regional adoption.

The China GLP-1 market is experiencing growth supported by a rising prevalence of metabolic disorders and increasing investments in healthcare modernization. Government initiatives to improve chronic disease management and expand access to innovative treatments are accelerating demand for effective therapies such as GLP-1 receptor agonists.

The Europe GLP-1 market is projected to witness substantial growth during the forecast period, supported by a strong regulatory framework, structured disease management programs, and rising incidence of metabolic disorders. Healthcare systems in the region are increasingly prioritizing preventive and personalized care, boosting the growth of GLP-1 receptor agonists. Public health initiatives, favorable reimbursement schemes, and widespread clinical research further support market potential. Countries backed by high healthcare expenditure, increasing awareness of obesity, and sustained efforts in clinical adoption of advanced therapies further contribute to the expansion.

The UK GLP-1 market has emerged as a major sector due to its well-structured public healthcare system, strong clinical focus on chronic disease control, and evidence-based prescribing. The integration of GLP-1 therapies into national treatment guidelines for type 2 diabetes and obesity has supported their broad adoption.

Key Players & Competitive Analysis Report

The GLP-1 sector is witnessing competition, driven by revenue growth opportunities in both developed and emerging markets. Major players such as Novo Nordisk, Eli Lilly, and AstraZeneca are leveraging strategic investments to expand their product offerings, particularly in obesity and type 2 diabetes. Technological advancements, such as oral formulations and dual-target agonists, are reshaping competitive positioning, while patent expiries are opening doors for generics. Economic and geopolitical shifts, such as pricing pressures and regulatory policies, are influencing vendor strategies and encouraging collaborations. Sustainable value chains and pricing insights are becoming differentiators as payers prioritize cost-effectiveness. A few key players are AstraZeneca, Boehringer Ingelheim, D&D Pharmatech, Eli Lilly, Hanmi Pharmaceutical, Novo Nordisk, Pfizer, Roche, Sanofi, and Tonghua Dongbao Pharmaceutical.

Key Players

- AstraZeneca

- Boehringer Ingelheim

- D&D Pharmatech

- Eli Lilly

- Hanmi Pharmaceutical

- Novo Nordisk

- Pfizer

- Roche

- Sanofi

- Tonghua Dongbao Pharmaceutical

Industry Developments

February 2025: Biocon launched its GLP-1 peptide liraglutide in the UK under two brand names: Liraglutide Biocon (for diabetes, similar to Victoza) and Biolide (for chronic weight management, similar to Saxenda).

May 2025: Illumina and Ovation.io developed a clinical multiomic dataset from 25,000 GLP-1 therapy patients to support drug discovery. The dataset will be available to pharmaceutical researchers for advancing therapeutic development.

GLP-1 Market Segmentation

By Type of Molecule Outlook (Revenue, USD Billion, 2020–2034)

- Biologics

- Small Molecules

By Active Compound Used Outlook (Revenue, USD Billion, 2020–2034)

- Dulaglutide

- Liraglutide

- Orforglipron

- Retatrutide

- Semaglutide

- Survodutide

- Tirzepatide

- Other Active Compounds

By Type of GLP-1 Agonist Drugs Outlook (Revenue, USD Billion, 2020–2034)

- Long-acting GLP-1 Agonist

- Short-acting GLP-1 Agonist

By Route of Administration Outlook (Revenue, USD Billion, 2020–2034)

- Oral

- Parenteral

By Target Indication Outlook (Revenue, USD Billion, 2020–2034)

- Alzheimer’s Disease

- Non-Alcoholic Steatohepatitis

- Obesity

- Sleep Apnea

- Type 2 Diabetes

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

GLP-1 Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 47.74 billion |

|

Market Size in 2025 |

USD 52.82 billion |

|

Revenue Forecast by 2034 |

USD 133.92 billion |

|

CAGR |

10.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |