GLP-1 Receptor Agonist Market Size, Share, & Industry Analysis Report

: By Route of Administration (Parenteral and Oral), By Product, By Application, By Distribution Channel, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5758

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

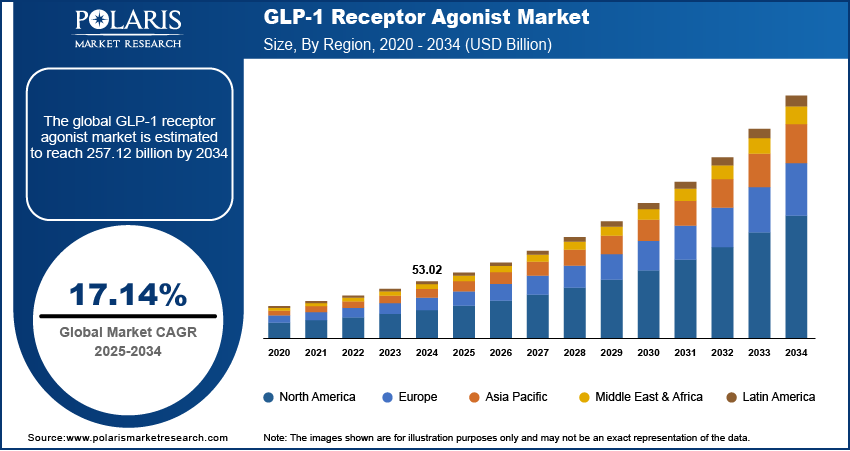

The global GLP-1 receptor agonist market size was valued at USD 53.02 billion in 2024, growing at a CAGR of 17.14% during 2025–2034. The market growth is driven by dual efficacy of the drug in glycemic control and weight loss.

Glucagon-like peptide-1 (GLP-1) receptor agonists are a class of drugs that mimic the action of natural GLP-1 hormones to improve insulin secretion and regulate blood glucose levels, primarily used in the management of type 2 diabetes and obesity. The market for GLP-1 receptor agonists is witnessing growth, supported by favorable government policies and global health initiatives. Many national healthcare systems and international health bodies are actively promoting diabetes and obesity management programs, which are increasingly integrating GLP-1 therapies as standard treatment options. For instance, in April 2021, the WHO launched the Global Diabetes Compact to improve diabetes prevention and care worldwide, prioritizing low and middle-income countries, as over 95% of diabetes cases are type 2, highlighting the need for targeted interventions. This institutional support has improved access to these therapies and it has also boosted research and development investments in the sector.

The growing range of therapeutic applications beyond glycemic control further contributes to the expansion of opportunities. GLP-1 receptor agonists are being recognized for their effectiveness in treating obesity, cardiovascular diseases, and even non-alcoholic steatohepatitis (NASH) developed with type 2 diabetes. For instance, in November 2023, the FDA approved Zepbound (tirzepatide) for chronic weight management in adults with obesity or overweight with weight-related conditions. Tirzepatide, also approved as Mounjaro for type 2 diabetes, must be used with diet and exercise. This development of clinical utility is reshaping the competitive landscape and attracting interest from pharmaceutical developers and investors. The positioning of GLP-1 receptor agonists as multi-functional therapeutics is expected to accelerate their integration into diverse treatment protocols as new clinical data continues to support their benefits across multiple indications. This expanding scope of use reflects an evolution in clinical strategies and underscores the potential of GLP-1 therapies to address complex, comorbid health conditions on a global scale.

Industry Dynamics

Rising Global Prevalence of Type 2 Diabetes and Obesity

The rising global prevalence of type 2 diabetes and obesity is boosting the need for the GLP-1 receptor agonist, as these conditions represent the primary therapeutic targets for this drug class. According to a report from WHO, in 2022, approximately 830 million people worldwide had diabetes, while 1 in 8 individuals globally were affected by obesity. There is a growing demand for effective treatments that go beyond traditional insulin therapy, as sedentary lifestyles, unhealthy diets, and aging populations contribute to the increasing incidence of metabolic disorders worldwide. These drugs offer dual benefits, improving glycemic control while boosting weight loss, which makes them a preferred option in managing both type 2 diabetes and obesity. The growing patient numbers directly lead to higher adoption rates, encouraging pharmaceutical companies to scale production and innovate within this segment to meet expanding clinical needs.

Advancements in Drug Delivery

Advancements in drug delivery play a major role in driving the market forward. Innovations such as once-weekly formulations, auto-injectors, and oral delivery systems have greatly improved patient convenience with treatment. For instance, in June 2024, UBC launched under-the-tongue insulin drops with rapid absorption, potentially replacing traditional injections for diabetes treatment. These improvements reduce the burden associated with frequent injections and make GLP-1 therapies more accessible to a broader population, such as those who may be hesitant about injectable medications. Furthermore, the integration of smart drug delivery platforms and patient-centric designs is further boosting acceptance among both patients and healthcare providers. Therefore, as delivery technologies continue to evolve, they are expected to differentiate GLP-1 therapies in an increasingly competitive sector.

Segmental Insights

By Product Analysis

The segmentation, based on product, includes ozempic, trulicity, mounjaro, wegovy, rybelsus, saxenda, victoza, zepbound, and others. The ozempic segment dominated the market in 2024 due to its strong clinical performance, high brand recognition, and widespread adoption for managing type 2 diabetes. Its once-weekly dosing regimen has improved patient observation compared to daily injections, while its proven benefits in weight reduction and cardiovascular risk minimization have expanded its clinical use. Healthcare providers have increasingly preferred Ozempic for its balanced efficacy and tolerability profile, further supported by favorable formulary placements and broad insurance coverage. These factors combined have positioned Ozempic as a preferred therapy within the GLP-1 treatment landscape.

By Service Analysis

The segmentation, based on service, includes type 2 diabetes mellitus and obesity. The obesity segment is expected to witness substantial growth during the forecast period as the global burden of obesity continues to escalate, driving demand for effective pharmacological interventions. GLP-1 receptor agonists have revealed notable weight loss outcomes, leading to their increasing use beyond diabetes care. Regulatory approvals for obesity-specific indications and the shifting perception of obesity as a chronic medical condition rather than a lifestyle issue are further improving market momentum. Additionally, rising awareness, coupled with broader access to treatment, is boosting more individuals to seek medical support for weight management, thereby strengthening growth in this segment.

By Route of Administration Analysis

The segmentation, based on route of administration, includes parenteral and oral. The oral segment is expected to grow rapidly during the forecast period due to its convenience and noninvasive administration, which improves patient observation. Traditional injectable formulations often reflect psychological and practical barriers to treatment initiation and continuation. The introduction of oral GLP-1 therapies addresses these concerns, making treatment more accessible and acceptable to a wider population, particularly among newly diagnosed or injection-averse patients. This segment is expected to attract a growing share of prescriptions and patient interest as more oral formulations enter the market with proven efficacy.

By Distribution Channel Analysis

The segmentation, based on distribution channel, includes hospital pharmacies, retail pharmacies, and online pharmacies. The online pharmacies segment growth is driven by the increasing digitalization of healthcare services and shifting consumer preferences toward home delivery and convenience. Online platforms offer ease of access to medications, often at competitive pricing, while ensuring privacy, an appealing feature for patients managing chronic conditions such as diabetes or obesity. Additionally, the rise of e-prescriptions, telehealth integration, and subscription-based refill models have further supported the transition to digital pharmacy channels. This evolving distribution model is especially relevant in urban areas, where tech-savvy populations are more inclined to adopt e-commerce solutions for healthcare.

Regional Analysis

The report provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. The North America GLP-1 receptor agonist market dominated the revenue share in 2024, supported by a high prevalence of metabolic disorders, early adoption of novel therapeutics, and a well-established healthcare infrastructure. The region benefits from advanced diagnostic capabilities, strong clinical awareness among healthcare providers, and robust reimbursement systems, which contribute to a higher uptake of GLP-1 therapies. For instance, in February 2024, the Ministry of Health, Canada, introduced Bill C-64 to establish universal pharmacare, covering diabetes drug such as insulin USD 900-USD 1,700/year, metformin ~USD 100/year, and adjunct therapies USD 100-USD 1,000+/year for type 1 and type 2 diabetes patients under single-payer insurance. In addition, the presence of major pharmaceutical companies and ongoing innovation in drug development and delivery technologies have boosted North America’s leadership position in this space.

The US GLP-1 receptor agonist market held the largest share in North America in 2024, due to its patient population, favorable regulatory environment, and high healthcare spending per capita. According to a December 2024 CMS report, in the US, healthcare spending grew 7.5% in 2023, totaling USD 4.9 trillion (USD 14,570 per capita). The country’s proactive perspective in treating type 2 diabetes and obesity, along with strong marketing efforts and access to cutting-edge therapies, has accelerated the adoption of GLP-1 receptor agonists.

The Asia Pacific GLP-1 receptor agonist market is projected to witness the fastest growth during the forecast period, driven by a rapidly rising prevalence of diabetes and obesity across major economies such as China, India, and Japan. Increasing healthcare awareness, growing disposable incomes, and expanding access to modern therapeutics are accelerating demand for advanced treatment options. Government initiatives aimed at supporting chronic disease management and the ongoing development of healthcare infrastructure are also supporting expansion opportunities. Furthermore, the rising adoption of lifestyle-related conditions and the growing presence of global pharmaceutical companies in the region are expected to boost the growth of GLP-1 therapies during the forecast period.

The Japan GLP-1 receptor agonist market is expected to grow steadily during the forecast period, driven by a rising elderly population and a high prevalence of type 2 diabetes. According to World Bank data, Japan's diabetes prevalence among adults aged 20–79 was 6.6% of the total population in 2021. The country’s advanced healthcare infrastructure, combined with a strong focus on early diagnosis and chronic disease management, supports the increasing adoption of GLP-1 therapies. Moreover, the preference for innovative and less invasive treatment options aligns well with the ongoing development of oral and long-acting formulations. Japan presents a helping environment for market expansion in this segment with a strong regulatory framework that enables the introduction of novel therapies.

The Europe GLP-1 receptor agonist market is projected to witness substantial growth during the forecast period due to strong healthcare systems, widespread clinical acceptance of GLP-1 therapies, and rising focus on integrating diabetes devices and obesity management. The region’s focus on evidence-based treatment protocols, with favorable reimbursement policies, is boosting wider adoption of GLP-1 drugs. Additionally, increasing investments in research and a growing focus on preventative healthcare are enabling innovation and therapeutic expansion within this class.

The UK GLP-1 receptor agonist market is projected to expand during the forecast period due to growing public health efforts to combat obesity and diabetes, supported by government-backed awareness campaigns and treatment guidelines. The National Health Service (NHS) continues to promote evidence-based interventions, creating a favorable setting for the wider adoption of GLP-1 drugs. Furthermore, increasing clinical trust in the benefits of GLP-1 therapies for weight and cardiovascular management is affecting prescribing patterns.

Key Players and Competitive Analysis

The GLP-1 receptor agonist sector is witnessing competition, driven by revenue growth opportunities in both developed and emerging markets. Players are leveraging investments and expansion opportunities to capitalize on the rising demand for diabetes and obesity treatment. Competitive intelligence reveals that companies are focusing on future development strategies, such as novel formulations and broader indications, to strengthen their positioning. Economic and geopolitical shifts are impacting region-wise market size projections. Technological advancements in delivery systems and oral formulations are creating disruptions and trends, forcing competitors to adapt their product offerings. Revenue share analysis indicates dominant players are expanding through mergers and acquisitions, while smaller firms target niche emerging market segments. Sustainable value chains and pricing insights are becoming critical differentiators as payer’s pressure costs. However, supply chain disruptions and regulatory policies impact competitive positioning, making vendor strategies and regional footprint optimization essential for long-term success. A few key players are Amgen Inc.; AstraZeneca; Boehringer Ingelheim International GmbH; Genentech, Inc.; Hanmi Pharm.Co., Ltd.; Innovent; Lilly; Novo Nordisk A/S; Pfizer Inc.; and Sanofi.

Key Players

- Amgen Inc.

- AstraZeneca

- Boehringer Ingelheim International GmbH

- Genentech, Inc.

- Hanmi Pharm.Co., Ltd.

- Innovent

- Lilly

- Novo Nordisk A/S

- Pfizer Inc.

- Sanofi

Industry Developments

In May 2025, Illumina and Ovation.io announced plans to develop a 25,000-patient clinical multiomic dataset from GLP-1 therapy users to aid drug discovery. The dataset will help study nonresponders (40% of Type 2 diabetes patients) and identify new biomarkers and drug targets.

November 2024: Ascendis Pharma licensed its TransCon technology to Novo Nordisk for metabolic and cardiovascular drug development, including a monthly GLP-1 agonist for obesity and diabetes. Ascendis would receive up to USD 285 million in payments.

August 2024: Eli Lilly reported that tirzepatide (Zepbound/Mounjaro) reduced type 2 diabetes risk by 94% and led to sustained weight loss (22.9% average reduction at 15 mg dose) in adults with obesity or overweight and pre-diabetes over three years.

GLP-1 Receptor Agonist Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Ozempic

- Trulicity

- Mounjaro

- Wegovy

- Rybelsus

- Saxenda

- Victoza

- Zepbound

- Others

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Type 2 Diabetes Mellitus

- Obesity

By Route of Administration Outlook (Revenue, USD Billion, 2020–2034)

- Parenteral

- Oral

By Distribution Channel Outlook (Revenue, USD Billion, 2020–2034)

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

GLP-1 Receptor Agonist Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 53.02 billion |

|

Market Size in 2025 |

USD 61.89 billion |

|

Revenue Forecast by 2034 |

USD 257.12 billion |

|

CAGR |

17.14% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 53.02 billion in 2024 and is projected to grow to USD 257.12 billion by 2034.

The global market is projected to register a CAGR of 17.14% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are Amgen Inc.; AstraZeneca; Boehringer Ingelheim International GmbH; Genentech, Inc.; Hanmi Pharm.Co., Ltd.; Innovent; Lilly; Novo Nordisk A/S; Pfizer Inc.; and Sanofi.

The ozempic segment dominated the market in 2024.

The obesity segment is expected to witness the fastest growth during the forecast period.