Diabetes Devices Market Size, Share, Trends, Industry Analysis Report

: By Type, Distribution Channel, End Use (Hospitals, Diagnostic Centers, and Homecare), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Jan-2025

- Pages: 125

- Format: PDF

- Report ID: PM1326

- Base Year: 2024

- Historical Data: 2020-2023

Diabetes Devices Market Overview

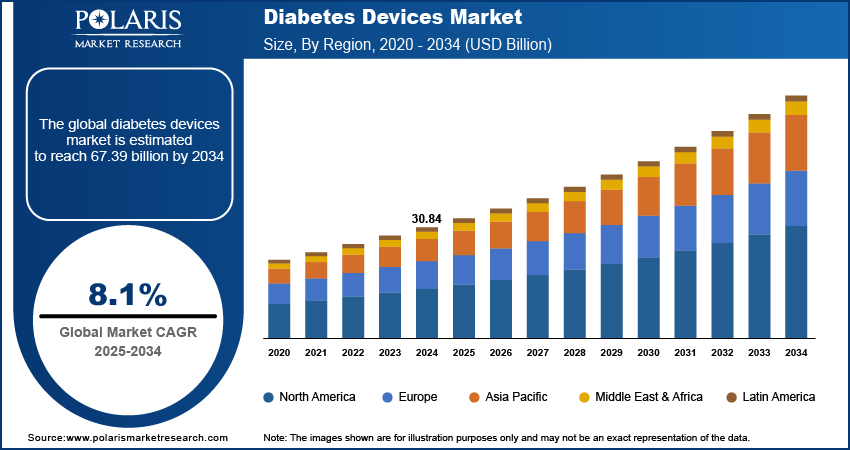

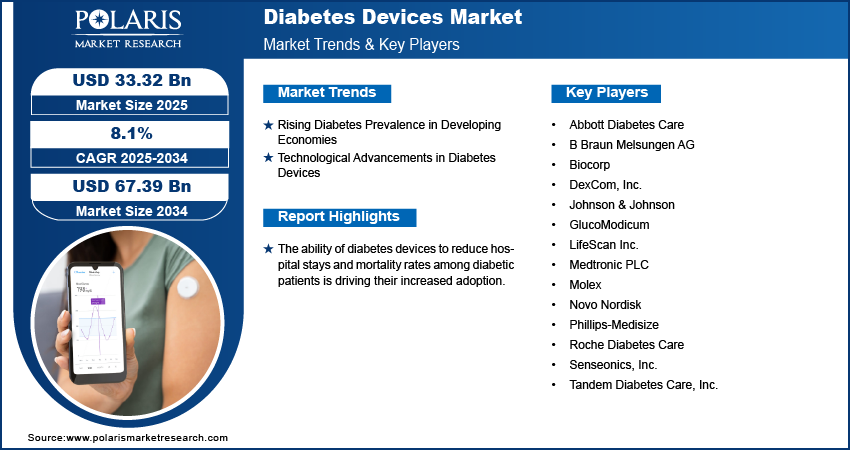

The global diabetes devices market size was valued at USD 30.84 billion in 2024. The market is projected to grow from USD 33.32 billion in 2025 to USD 67.39 billion by 2034, exhibiting a CAGR of 8.1% during 2025–2034.

Diabetes devices are medical instruments used to monitor and manage blood sugar levels in individuals suffering from diabetes. These devices aid in maintaining glucose control, preventing complications, and enhancing overall quality of life.

Unhealthy lifestyles, aging, and obesity are among the crucial factors driving the diabetes devices market expansion. As per studies done by the NCBI, obesity is the major cause of diabetes. According to the National Institutes of Health in January 2024, obesity and excess body fat, especially around the abdomen, are strongly linked to type 2 diabetes. Accumulating too much fat can lead to insulin resistance, where the body fails to respond effectively to insulin, complicating blood sugar regulation and increasing the risk of type 2 diabetes. The study emphasizes the importance of weight management and reducing body fat as key preventive measures. It also highlights the role of a healthy lifestyle, including regular blood sugar management using diabetes devices and a balanced diet, in reducing the risk and effectively managing diabetes. Thus, the rising prevalence of diabetes due to the increasing obese population drives the market growth.

To Understand More About this Research: Request a Free Sample Report

The growing demand for diabetes devices is being fueled by their ability to reduce hospital stays and mortality rates among diabetic patients. These devices allow for continuous monitoring and management of blood sugar levels, empowering patients to proactively address their condition and avoid severe complications that often require extended hospitalization. By enabling timely adjustments to treatment regimens, diabetes devices contribute to improved disease management and outcomes, ultimately enhancing the quality of life for individuals affected by diabetes. The increasing adoption of diabetes devices highlights their crucial role in improving patient care and well-being. In February 2023, Abbott launched the FreeStyle Libre 3 system, which offers real-time continuous glucose monitoring with the world's smallest sensor, improving diabetes management accuracy and convenience.

Diabetes Devices Market Dynamics

Rising Diabetes Prevalence in Developing Economies

The prevalence of diabetes is rising globally, with significant increases observed in developing economies such as China and India. This is mainly driven by the rapid urbanization and growth of sedentary lifestyles. Changes in lifestyle and diet are also associated with urban living, which contributes to the increasing rates of diabetes cases in these regions.

As of March 2024, the World Health Organization (WHO) estimates that 77 million adults in India have type 2 diabetes, with nearly 25 million being prediabetic. Alarmingly, over half of those suffering from diabetes in India are unaware of their condition. Thus, the increasing prevalence of diabetes in emerging economies propels the diabetes devices market growth.

Technological Advancements in Diabetes Devices

Continuous innovation in diabetes device technology is improving safety, bioanalytical performance, wearing duration, bio-compatibility, and other clinical features. These advancements enable patients to understand their condition better and make informed decisions about controlling their blood sugar levels. To fulfill the rising demand for advanced diabetes devices, market players are launching innovative products. For instance, in March 2024, Dexcom announced the launch of the very first CGM system in the market, which can be connected directly to the Apple Watch. Additionally, Afon Technology, a medical device manufacturer, focuses on developing a noninvasive, continuous blood glucose monitor named Glucowear to track and record changes in blood glucose levels. Thus, rising technological advancements in diabetes devices are leading to the diabetes devices market expansion.

Diabetes Devices Market Segment Analysis

Diabetes Devices Market Assessment by Type Insights

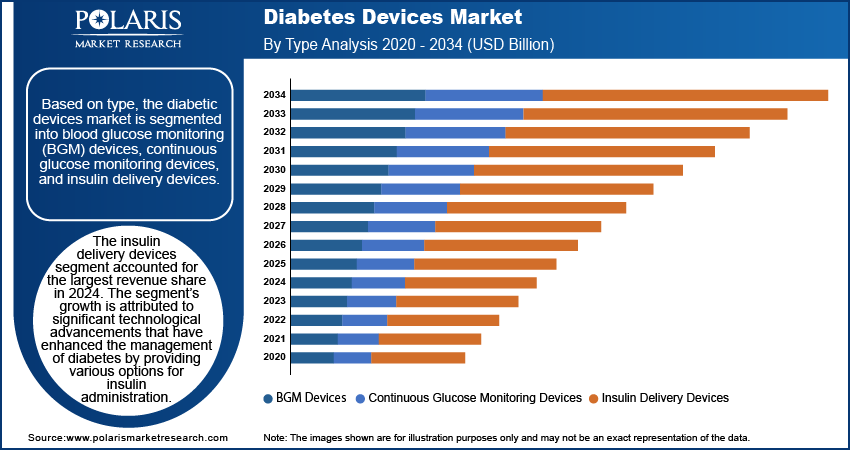

The global diabetes devices market segmentation, based on type, includes BGM devices, continuous glucose monitoring devices, and insulin delivery devices. The insulin delivery devices segment dominated the market with the largest revenue share in 2024. This is attributed to significant technological advancements, such as insulin patches, pumps, and automated insulin delivery (AID) systems. These advancements enhance the management of diabetes by providing various options for insulin administration, addressing the needs of a large global diabetic population.

In May 2023, Medtronic announced that it had acquired EOFlow, a South Korean company renowned for its EOPatch wearable insulin patch. The acquisition is intended to improve Medtronic's diabetes management offerings by integrating EOFlow's technology with Medtronic's advanced continuous glucose monitoring and insulin delivery systems.

The blood glucose monitoring (BGM) devices segment is expected to experience the highest growth during the forecast period. The growth is attributed to factors such as the affordability of BGM devices and their precision in determining the body's glucose level. Moreover, technological advancements and the introduction of creative, integrated solutions are causing businesses to introduce affordable, advanced, and user-friendly items.

Diabetes Device Market Outlook by Distribution Channel Insights

The global diabetes devices market, based on distribution channel, is segmented into hospital pharmacies, retail pharmacies, diabetes clinics/centers, online pharmacies, and others. The hospital pharmacies segment led the market with the largest revenue share of 56.33% in 2024. This is due to the high volume of patients and the availability of new innovative products. Further, the rising use of continuous glucose monitoring devices for outpatient monitoring and ICU patients in hospitals contributes to the growth of the segment.

The retail pharmacies segment is expected to register a significant CAGR during the forecast period due to their accessibility for patients. These pharmacies offer a range of diabetes care products, including medications, glucose monitoring supplies, insulin delivery systems, and over-the-counter items. Stocking decisions are influenced by physician and patient preferences, profit margins, and insurance coverage.

Diabetes Devices Market Regional Insights

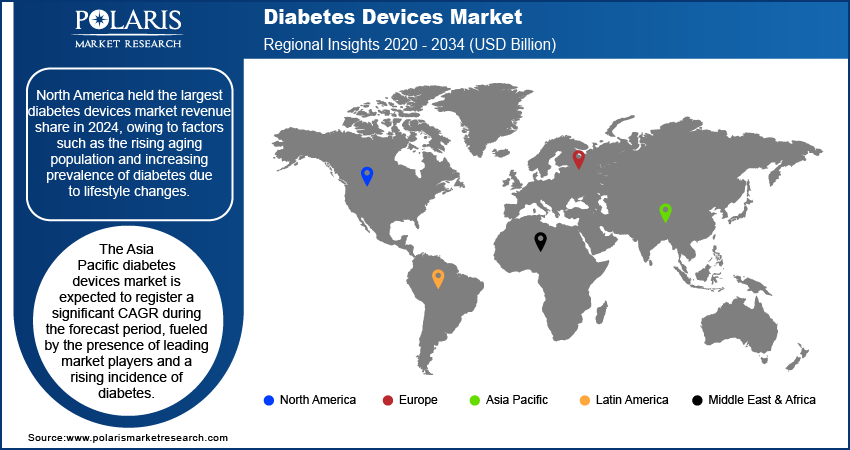

By region, the study provides the diabetes devices market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America held the largest revenue share of 41.80% in the global diabetes device market in 2024 due to various factors such as the rising aging population, increasing incidence of diabetes due to lifestyle changes, growing prevalence of obesity, and high costs of treatment.

According to the National Diabetes Report in May 2024, 38.4 million people, or about 11.6% of the US population, have diabetes. Among US adults, 38.1 million people have diabetes, out of which 8.7 million adults are undiagnosed. Additionally, 97.6 million adults have prediabetes, with significant risk factors including smoking, obesity, and high blood pressure.

The Asia Pacific diabetes devices market is expected to register a significant CAGR of 7.45% during the forecast period. This growth is driven by the presence of leading market players and a rising prevalence of diabetes. Additionally, advancements in blood glucose monitoring technology are expected to propel the diabetes device market share of Asia Pacific, enhancing both the accessibility and effectiveness of diabetes management solutions in the region.

In November 2020, Medtronic, an Asia Pacific-based company, introduced the InPen (a smart insulin pen). The pen is integrated with real-time Guardian Connect CGM data. This innovation provides a special combination of real-time glucose monitoring and dose calculation to improve diabetes management for individuals who use multiple daily injections.

Diabetes Devices Market – Key Players and Competitive Insights

Leading market players are investing heavily in research and development to expand their offerings, which will boost the diabetes devices market growth during the forecast period. Market participants are also undertaking a variety of strategic activities such as innovative product launches, international collaborations, higher investments, and mergers and acquisitions to expand their global footprint. To expand and survive in a more competitive and rising market climate, the diabetes device industry players must offer cost-effective solutions.

The diabetes devices market faces competition from major global players. These players dominate the market with their extensive production capacities and advanced technologies. Competition is further heightened by fluctuating raw material prices, stringent environmental regulations, and the necessity for technological advancements to improve device efficiency. A few major players in the diabetes devices market are Abbott Diabetes Care; B Braun Melsungen AG; Biocorp; DexCom, Inc.; Johnson & Johnson; GlucoModicum; LifeScan Inc.; Medtronic PLC; Molex; Novo Nordisk; Phillips-Medisize; Roche Diabetes Care; Senseonics, Inc.; and Tandem Diabetes Care, Inc.

Johnson & Johnson offers a wide range of medical, pharmaceutical, and consumer products and devices. With a focus on innovation, the company provides solutions for various health needs, including vision care, medical technology, and specialty care. In February 2024, Johnson & Johnson highlighted innovations in the treatment of low vision, an important consideration for diabetes patients, showcasing new advancements that could improve daily life navigation.

Tandem Diabetes Care focuses on offering advanced insulin pumps integrated with smart technology to simplify diabetes management. Collaborating with industry leaders such as Dexcom, Abbott, and Unomedical, the company creates forward-thinking products tailored to the real needs of users, making it a trusted leader in diabetes care. In February 2024, Tandem Diabetes Care launched the Tandem Mobi, the world’s smallest, durable automated insulin delivery system.

List of Key Companies in Diabetes Devices Market

- Abbott Diabetes Care

- B Braun Melsungen AG

- Biocorp

- DexCom, Inc.

- Johnson & Johnson

- GlucoModicum

- LifeScan Inc.

- Medtronic PLC

- Molex

- Novo Nordisk

- Phillips-Medisize

- Roche Diabetes Care

- Senseonics, Inc.

- Tandem Diabetes Care, Inc.

Diabetes Device Industry Developments

April 2023: Undbio, a South Korean company, announced a USD 100 million investment to construct an insulin manufacturing plant in West Virginia, USA. The new facility will specialize in producing insulin and distributing its products across the US.

January 2024: Tandem Diabetes Care announced the integration of its t:slim X2 insulin pump (an automated insulin delivery system) with Abbott's FreeStyle Libre 2 Plus sensor. The company stated that this collaboration enhances glucose monitoring with 15-day sensor wear and advanced Control-IQ technology.

August 2020: Medtronic announced its acquisition of Companion Medical, a move aimed at enhancing its capabilities in serving people affected by diabetes who use multiple daily injections, thereby expanding its diabetes care portfolio.

Diabetes Devices Market Segmentation

By Type Outlook

- BGM Devices

- Self-Monitoring Devices

- Blood Glucose Meters

- Testing Strips

- Lancets

- Continuous Glucose Monitoring Devices

- Sensors

- Transmitters

- Receiver

- Self-Monitoring Devices

- Insulin Delivery Devices

- Pumps

- Pens

- Syringes

- Jet Injectors

By Distribution Channel Outlook

- Hospital Pharmacies

- Retail Pharmacies

- Diabetes Clinics/Centers

- Online Pharmacies

- Others

By End Use Outlook

- Hospitals

- Diagnostic Centers

- Homecare

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Diabetes Devices Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 30.84 billion |

|

Market Size Value in 2025 |

USD 33.32 billion |

|

Revenue Forecast by 2034 |

USD 67.39 billion |

|

CAGR |

8.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global diabetes devices market size was valued at USD 30.84 billion in 2024 and is projected to grow to USD 67.39 billion by 2034.

The global market is projected to register a CAGR of 8.1% during the forecast period.

North America held the largest share of the global market in 2024.

A few key players in the market are Abbott Diabetes Care; B Braun Melsungen AG; Biocorp; DexCom, Inc.; Johnson & Johnson; GlucoModicum; LifeScan Inc.; Medtronic PLC; Molex; Novo Nordisk; Phillips-Medisize; Roche Diabetes Care; Senseonics, Inc.; and Tandem Diabetes Care, Inc.

The insulin delivery devices held the largest share in the market in 2024 due to significant technological advancements.

The hospital pharmacies segment is expected to record the highest CAGR in the global market during the forecast period.