Smart Inhalers Market Size, Share, Trend, Industry Analysis Report

By Type (Dry Powdered Inhalers, Metered Dose Inhaler), By Indication, By Distribution Channel, By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 126

- Format: PDF

- Report ID: PM6377

- Base Year: 2024

- Historical Data: 2020-2023

Overview

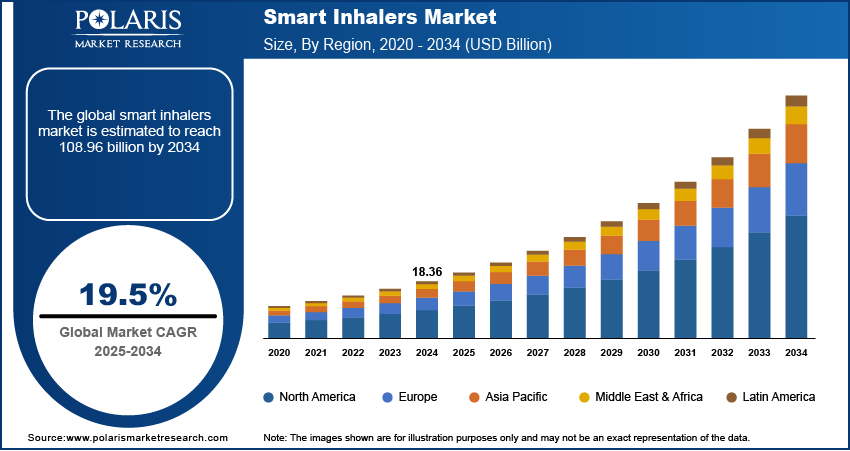

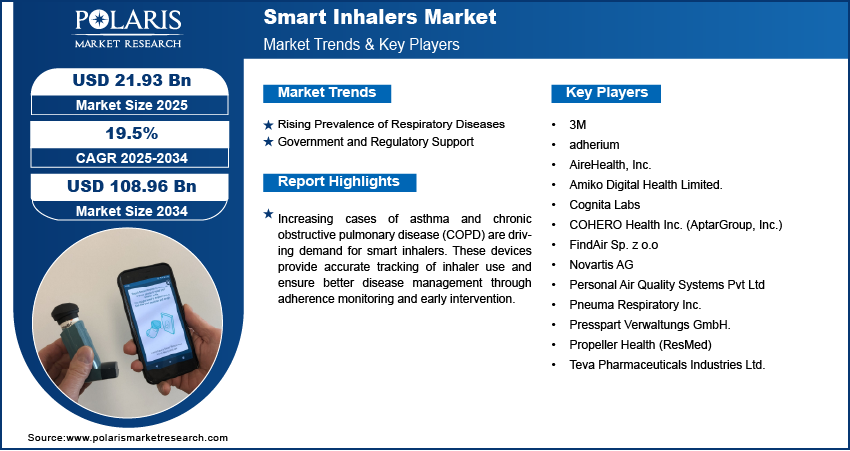

The global smart inhalers market size was valued at USD 18.36 billion in 2024, growing at a CAGR of 19.5% from 2025 to 2034. Increasing cases of asthma and chronic obstructive pulmonary disease (COPD) are driving demand for smart inhalers. These devices provide accurate tracking of inhaler use and ensure better disease management through adherence monitoring and early intervention.

Key Insights

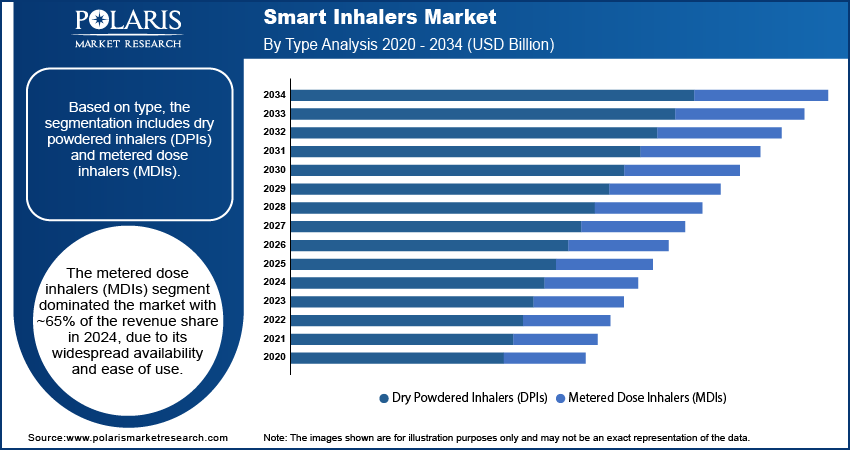

- The metered dose inhalers (MDIs) segment held ~65% of the market share in 2024, driven by widespread availability and ease of use.

- The COPD segment captured ~60% of the revenue share in 2024, fueled by the rising prevalence of chronic respiratory diseases in aging populations.

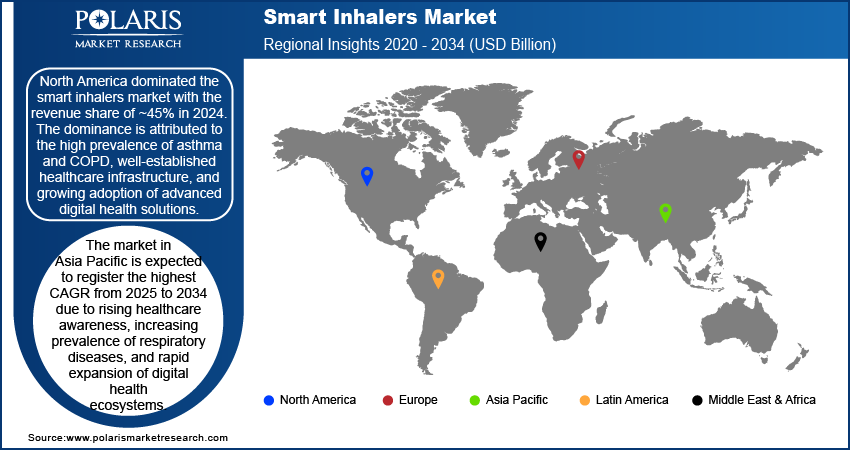

- North America led with ~45% share in 2024, supported by high asthma and COPD rates and strong adoption of digital health technologies.

- The U.S. industry is projected to grow significantly from 2025 to 2034, driven by digital health integration and connected medical device adoption.

- The market in Asia Pacific is expected to register the highest CAGR from 2025 to 2034, due to rising respiratory disease rates and digital health expansion.

- China held a major share in the region, driven by a large patient pool, government-backed digital health initiatives, and healthcare modernization.

Industry Dynamics

- Increasing prevalence of asthma and COPD is driving demand for smart inhalers that improve medication adherence and patient outcomes.

- Growing integration of digital health platforms and telemedicine is boosting the adoption of connected inhalers for remote patient monitoring.

- Expansion into pediatric and elderly care enables personalized respiratory management through real-time usage tracking and feedback systems.

- High device costs and lack of reimbursement policies limit widespread adoption, especially in low-income and emerging markets.

Market Statistics

- 2024 Market Size: USD 18.36 billion

- 2034 Projected Market Size: USD 108.96 billion

- CAGR (2025–2034): 19.5%

- North America: Largest market in 2024

AI Impact on Smart Inhalers

- AI helps smart inhalers understand individual habits, triggers, and symptoms, ensuring timely, personalized medication.

- Smart inhalers with AI track breathing patterns and inhaler use in real time, helping catch warning signs early and reducing the risk of sudden, serious respiratory episodes.

- AI-driven reminders and feedback features encourage users to stick to their medication schedule, making daily inhaler use feel more natural and less of a chore.

- By analyzing usage data, AI gives doctors a clearer picture of how treatments are working, leading to more accurate adjustments and better long-term respiratory care.

The smart inhalers market refers to digitally enabled inhalation devices integrated with sensors and connectivity features that monitor medication usage, track adherence, and provide real-time data. These devices improve asthma and COPD management through personalized treatment insights and better patient outcomes. Integration of Bluetooth, mobile applications, and cloud-based platforms enhances connectivity, enabling real-time data sharing with healthcare providers, which supports precision treatment and promotes adoption of smart inhalers among both patients and medical professionals.

Smart inhalers support individualized treatment plans by capturing detailed usage data and lung function metrics, helping clinicians tailor therapies, adjust dosages, and improve patient engagement, thereby fueling adoption in both primary care and specialized healthcare settings. Moreover, alliances between pharmaceutical companies, medtech firms, and digital health providers are driving innovation, combining drug delivery systems with advanced software, leading to more effective smart inhaler solutions and accelerating their availability in the global market.

Drivers & Opportunities

Rising Prevalence of Respiratory Diseases: The growing burden of asthma and chronic obstructive pulmonary disease (COPD) has created an urgent need for advanced solutions that can enhance patient outcomes. According to the Centers for Disease Control and Prevention (CDC), in 2023, the prevalence of chronic obstructive pulmonary disease (COPD), including emphysema and chronic bronchitis, among adults is approximately 4.3%. Smart inhalers help in enabling accurate tracking of medication usage and ensuring proper inhalation technique. These devices support adherence to prescribed therapies and also provide real-time data that helps healthcare professionals intervene early in case of worsening symptoms. Patients benefit from improved disease control, reduced hospital visits, and a more personalized approach to care. This trend positions smart inhalers as a critical tool in modern respiratory disease management.

Government and Regulatory Support: Supportive healthcare policies and initiatives are strengthening the adoption of smart inhalers in clinical practice. Governments and regulatory bodies are promoting digital health tools to improve chronic disease management, with favorable reimbursement frameworks making connected inhaler solutions more accessible. For instance, in January 2025, Governor Kathy Hochul announced a preliminary investment of up to USD 188 million as part of the Healthcare Safety Net Transformation Program. Integration into public health programs further accelerates adoption, ensuring that patients suffering from asthma and COPD benefit from advanced monitoring technologies. Regulatory encouragement for interoperability and data-driven care also enhances the value proposition of these devices. This strong policy support creates an environment where smart inhalers move beyond niche applications, becoming a standard part of respiratory healthcare delivery worldwide.

Segmental Insights

Type Analysis

Based on type, the segmentation includes dry powdered inhalers (DPIs) and metered dose inhalers (MDIs). The metered dose inhalers (MDIs) segment dominated the market with ~65% of the revenue share in 2024. The dominance is driven by their widespread availability and ease of use. These inhalers deliver a controlled amount of medication directly into the lungs, making them highly reliable for patients requiring immediate relief. Their compatibility with smart inhaler technology enhances monitoring and adherence tracking, which further strengthens their adoption in clinical practice. Healthcare providers also prefer MDIs due to their effectiveness in managing both asthma and COPD, which continues to drive their demand as the leading inhaler type in the market.

The dry powdered inhalers (DPIs) segment is projected to register the highest CAGR of 18.9% from 2025 to 2034, driven by increasing patient preference for breath-actuated delivery systems that eliminate the need for hand-breath coordination. Their ability to deliver medication without propellants makes them more environmentally sustainable, aligning with global efforts toward eco-friendly healthcare solutions. The integration of smart sensors into DPIs further improves usage tracking and treatment personalization, which is attracting patients and providers. Rising awareness about convenient and accurate drug delivery methods is positioning DPIs as a high-growth segment.

Indication Analysis

In terms of Indication, the segmentation includes asthma, COPD, and others. The COPD segment held the largest revenue share of ~60% in 2024, fueled by the growing burden of chronic respiratory diseases among the aging population. COPD patients require long-term treatment and frequent inhaler use, making smart inhalers highly beneficial for improving adherence and reducing hospitalizations. The capability of these devices to monitor usage patterns and provide real-time feedback helps physicians manage the disease more effectively. Increasing healthcare costs associated with COPD management are also encouraging adoption of smart inhalers as a cost-effective tool for better disease control, which supports the segment’s leading market position.

The asthma segment is anticipated to register the highest CAGR from 2025 to 2034, supported by the rising prevalence of asthma among children and young adults worldwide. Smart inhalers provide significant advantages in asthma management by enabling early detection of symptoms and reducing risks of severe flare-ups through adherence monitoring. Growing awareness about the role of digital health tools in preventing emergency visits is further driving patient adoption. In addition, integration of inhalers with mobile apps allows parents and caregivers to closely track medication usage in children, which is expected to contribute strongly to segment growth.

Distribution Channel Analysis

In terms of distribution channel, the segmentation includes hospital pharmacies, retail pharmacies, and online pharmacies. The hospital pharmacies segment held the largest revenue share in 2024, reflecting its central role in distributing advanced respiratory care devices. Hospitals remain the primary point of treatment for both asthma and COPD patients, making them key channels for dispensing smart inhalers. The availability of trained professionals in hospitals ensures correct device usage and patient education, which encourages adoption of these inhalers at the point of care. Additionally, hospital-based healthcare systems often integrate smart inhalers into broader disease management programs, reinforcing their dominance in the distribution channel segment of the market.

The online pharmacies segment is projected to record the highest CAGR from 2025 to 2034, driven by growing preference for convenient and cost-effective access to medications. Patients increasingly turn to online platforms to refill prescriptions, which often provide smart inhalers with value-added services such as reminders and app integrations. The rise of e-health platforms and improved digital infrastructure is making it easier for patients to order devices from home. Enhanced accessibility for chronic patients, combined with discounts and subscription-based models, is positioning online pharmacies as a rapidly expanding distribution channel in the smart inhalers market.

End Use Analysis

In terms of end use, the segmentation includes hospitals, homecare settings, and others. The hospitals segment held the largest revenue share of ~45% in 2024 due to its critical role in managing severe cases of asthma and COPD. Physicians in hospitals increasingly rely on smart inhalers to monitor patient compliance and optimize treatment strategies. Their ability to integrate these devices into patient records allows for better disease tracking and follow-up care. Additionally, hospitals serve as key centers for initial device training, ensuring patients and caregivers understand proper usage. The concentration of advanced respiratory care services within hospitals continues to support their strong position as the largest end-user segment.

The homecare settings segment is expected to register the highest CAGR from 2025 to 2034, fueled by the rising trend of remote patient monitoring and preference for at-home disease management. Smart inhalers enable patients to track their medication use independently, reducing reliance on hospital visits. Integration with mobile applications and digital platforms makes these devices highly compatible with home-based care. Growing emphasis on reducing healthcare costs and improving patient comfort is further accelerating adoption in the homecare settings. Increasing awareness of the convenience and effectiveness of self-management tools is likely to drive strong growth in this segment.

Regional Analysis

The North America smart inhalers market accounted for the largest revenue share of ~45% in 2024. The dominance is attributed to the high prevalence of asthma and COPD, well-established healthcare infrastructure, and growing adoption of advanced digital health solutions. Strong reimbursement policies, awareness programs, and integration of connected healthcare technologies further strengthened the region’s dominance. Additionally, rising investments by pharmaceutical companies in digital therapeutics, partnerships with technology firms, and favorable regulatory support encouraged widespread use. Increasing demand for patient-centric care and high penetration of mobile health apps created a supportive environment, allowing smart inhalers to become a preferred choice in disease monitoring and management.

U.S. Smart Inhalers Market Insights

The industry in the U.S. is expected to grow significantly from 2025 to 2034 due to the strong emphasis on digital health adoption and rapid integration of connected medical devices. Increasing healthcare spending, supportive FDA approvals, and active collaborations between pharmaceutical giants and tech companies continue to drive innovation in smart inhalers. A growing patient pool suffering from asthma and COPD, combined with the push toward value-based care, creates strong opportunities for adoption. Expanding use of telemedicine and remote patient monitoring further encourages acceptance of connected inhalers as they enhance treatment adherence, reduce hospitalizations, and support data-driven decision-making across the healthcare ecosystem.

Asia Pacific Smart Inhalers Market Trends

The industry in Asia Pacific is expected to register the highest CAGR from 2025 to 2034 due to rising healthcare awareness, increasing prevalence of respiratory diseases, and rapid expansion of digital health ecosystems. Governments are actively investing in healthcare infrastructure while encouraging technology-driven solutions to improve patient outcomes. For instance, according to the International Trade Association, in 2023, Hong Kong's healthcare spending was USD 25.6 billion, or 7.3% of 2022 GDP. The 2022/2023 budget allocated USD 11.8 billion to the Hospital Authority, an increase of USD 1.15 billion. Growing middle-class populations with rising disposable incomes are seeking advanced and personalized healthcare solutions, fueling the adoption of smart inhalers. Pharmaceutical companies and device manufacturers are expanding their presence in key markets, leveraging partnerships and affordability-focused innovations. Increasing smartphone penetration and digital literacy further accelerate the integration of smart inhalers into everyday disease management.

China Smart Inhalers Market Overview

China held a significant share of the Asia Pacific market in 2024, due to its rapidly growing healthcare system, government-backed digital health initiatives, and high patient population suffering from asthma and COPD. Strong adoption of mobile health applications, coupled with nationwide healthcare digitization programs, has accelerated the acceptance of connected inhaler solutions. Pharmaceutical and technology companies are collaborating to offer cost-effective, AI-enabled smart inhalers to meet the needs of large patient bases. A robust domestic manufacturing base, increasing clinical trials, and strategic partnerships with global players continue to expand accessibility, making China a central hub for smart inhaler adoption and innovation.

Europe Smart Inhalers Market Assessment

The industry in Europe is expanding at a rapid pace due to favorable healthcare policies, growing focus on digital therapeutics, and rising investments in connected medical devices. High disease burden from asthma and COPD across multiple countries has encouraged early adoption of smart inhalers. Supportive reimbursement models, strong regulatory frameworks, and emphasis on patient adherence monitoring are driving market growth. Pharmaceutical companies are actively launching advanced devices with cloud-based integration, while research collaborations across the region further accelerate innovation. Rising awareness among patients, coupled with increasing use of mobile health apps, positions Europe as a strong growth contributor to the industry.

Key Players & Competitive Analysis

The competitive landscape of the smart inhalers market is shaped by continuous innovation, strategic partnerships, and evolving business models. Industry analysis highlights a strong emphasis on technology advancements, with companies focusing on integrating sensors, Bluetooth connectivity, and data analytics for improved patient outcomes. Market expansion strategies include joint ventures and strategic alliances to strengthen distribution networks and enhance product portfolios. Mergers and acquisitions are being actively pursued, followed by careful post-merger integration to maximize synergies and efficiency. Collaborative efforts between healthcare providers and digital health platforms are fostering adoption, while consistent investments in R&D ensure competitive differentiation in this rapidly growing market.

Key Players

- 3M

- adherium

- AireHealth, Inc.

- Amiko Digital Health Limited.

- Cognita Labs

- COHERO Health Inc. (AptarGroup, Inc.)

- FindAir Sp. z o.o

- Novartis AG

- Personal Air Quality Systems Pvt Ltd

- Pneuma Respiratory Inc.

- Presspart Verwaltungs GmbH.

- Propeller Health (ResMed)

- Teva Pharmaceuticals Industries Ltd.

Smart Inhalers Industry Developments

April 2024: Adherium received FDA clearance for its Hailie Smartinhaler to be used with AstraZeneca’s Breztri and Airsupra inhalers, enabling real-time monitoring of inhaler technique and medication adherence.

March 2024: AstraZeneca Pharma India and Mankind Pharma entered an exclusive agreement for Mankind to distribute Symbicort (budesonide and formoterol) in India.

Smart Inhalers Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Dry Powdered Inhalers (DPIs)

- Metered Dose Inhalers (MDIs)

By Indication Outlook (Revenue, USD Billion, 2020–2034)

- Asthma

- COPD

- Others

By Distribution Channel Outlook (Revenue, USD Billion, 2020–2034)

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Hospitals and Clinics

- Sports Institutes

- Home Care

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Smart Inhalers Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 18.36 billion |

|

Market Size in 2025 |

USD 21.93 billion |

|

Revenue Forecast by 2034 |

USD 108.96 billion |

|

CAGR |

19.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 18.36 billion in 2024 and is projected to grow to USD 108.96 billion by 2034.

The global market is projected to register a CAGR of 19.5% during the forecast period.

North America accounted for the largest revenue share of ~45% due to the high prevalence of asthma and COPD, well-established healthcare infrastructure, and growing adoption of advanced digital health solutions.

A few of the key players in the market are 3M; adherium; AireHealth, Inc.; Amiko Digital Health Limited.; Cognita Labs; COHERO Health Inc. (AptarGroup, Inc.); FindAir Sp. z o.o; Novartis AG; Personal Air Quality Systems Pvt Ltd; Pneuma Respiratory Inc.; Presspart Verwaltungs GmbH.; Propeller Health (ResMed); and Teva Pharmaceuticals Industries Ltd.

The metered dose inhalers (MDIs) segment dominated the market with ~65% of the revenue share in 2024, driven by their widespread availability and ease of use.

The COPD segment held the largest revenue share of ~60% in 2024, fueled by the growing burden of chronic respiratory diseases among the aging population.