U.S. Lithium Market Size, Share, Trends, Industry Analysis Report

By Product (Carbonates, Hydroxide, Others), By Application (Automotive, Consumer Electronics, Grid Storage, Glass & Ceramics, Others) – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 125

- Format: PDF

- Report ID: PM6381

- Base Year: 2024

- Historical Data: 2020-2023

Overview

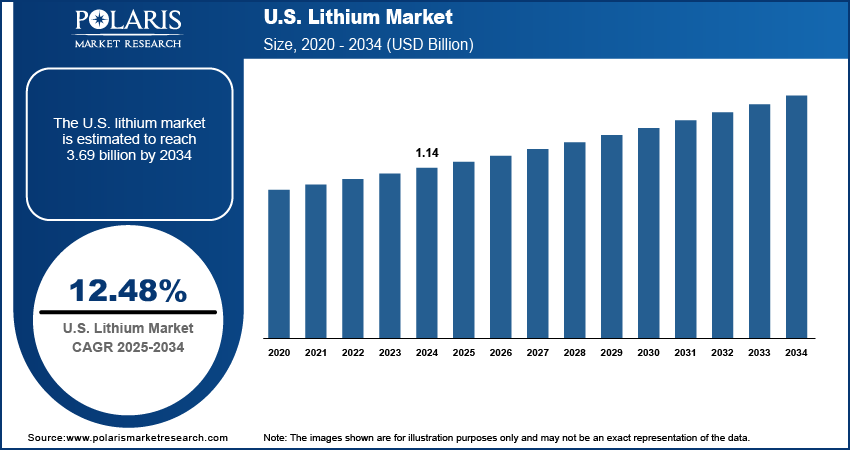

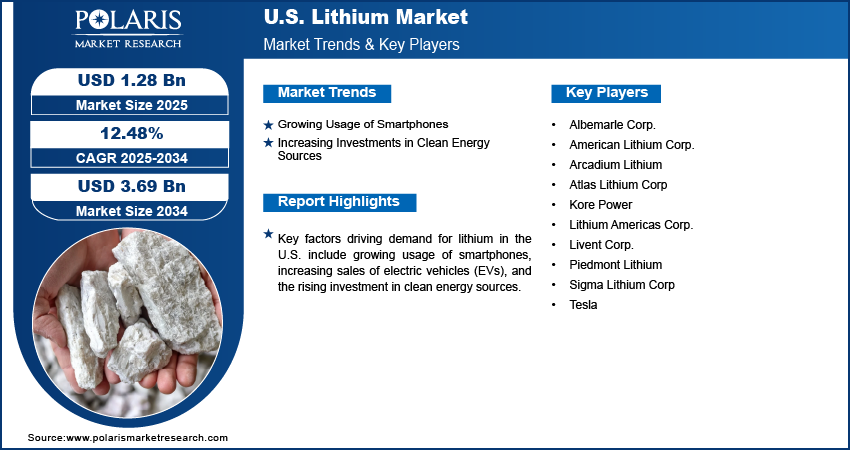

The U.S. lithium market size was valued at USD 1.14 billion in 2024, growing at a CAGR of 12.48% from 2025 to 2034. Key factors driving demand for the lithium in the U.S. include growing usage of smartphones, increasing sales of electric vehicles (EVs), and the rising investments in clean energy sources.

Key Insights

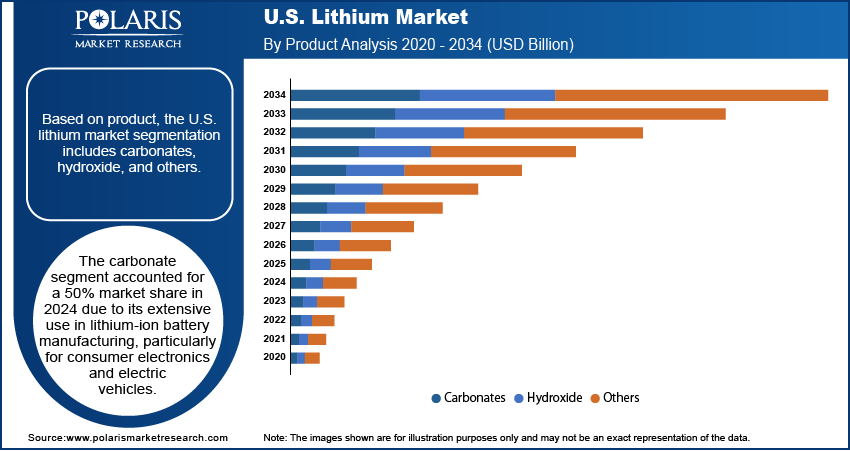

- The carbonate segment accounted for a 50% U.S. lithium market share in 2024 due to its use in lithium-ion battery manufacturing.

- The consumer electronics segment is expected to grow at the fastest CAGR from 2025 to 2034, owing to the growing usage of laptops, wearables, and other connected devices.

Industry Dynamics

- The growing usage of smartphones is driving the demand for lithium as every smartphone relies on a lithium-ion battery.

- The increasing investment in clean energy sources is fueling the U.S. lithium market, as clean energy sources such as solar and wind power need large-scale battery storage to store energy during periods of low sunlight or wind.

- The strict carbon emission norms are expected to create a lucrative market opportunity during the forecast period.

- The high capital cost required for lithium production hinders the market growth.

Market Statistics

- 2024 Market Size: USD 1.14 Billion

- 2034 Projected Market Size: USD 3.69 Billion

- CAGR (2025–2034): 12.48%

Artificial Intelligence (AI) in U.S. Lithium Market

- Artificial intelligence enhances the U.S. lithium market by optimizing exploration and mining operations through predictive analytics that identify high-yield reserves.

- It improves battery manufacturing efficiency by monitoring production lines in real time and reducing defects.

- AI also supports recycling by enabling advanced sorting and recovery of lithium from used batteries.

- AI strengthens demand forecasting and supply chain management, helping companies reduce costs and mitigate shortages.

Lithium is a lightweight, highly reactive alkali metal known for its silvery-white appearance and exceptional electrochemical properties. It occurs naturally in minerals such as spodumene and lepidolite and in brines. Lithium is classified into two main types: lithium carbonate and lithium hydroxide, both of which serve distinct industrial purposes. Lithium carbonate is widely used in pharmaceuticals, ceramics, and glass production, while lithium hydroxide plays a critical role in manufacturing high-performance lithium-ion batteries. The metal’s lightweight nature and high energy density make it crucial in electric vehicles, consumer electronics, and renewable energy storage systems.

In the U.S., lithium plays a strategic role in advancing clean energy initiatives and reducing dependence on fossil fuels. The demand for lithium-ion batteries has surged in the U.S. with growing adoption of electric vehicles and renewable energy storage. The country focuses on expanding domestic lithium production to reduce reliance on imports, particularly from South America and Australia. The U.S. lithium resources, concentrated in Nevada and North Carolina, are being actively developed, supported by federal investments and private sector partnerships.

The U.S. lithium market demand is driven by the increasing sales of electric vehicles (EVs). According to the International Energy Agency, the electric car sales increased to 1.6 million in 2024 in the U.S. This drove the adoption of lithium as each electric vehicle requires a large battery pack that contains significant amounts of lithium to ensure high energy density, long driving range, and faster charging. Government in the country is also supporting EV adoption through subsidies and emission regulations, further accelerating lithium demand. Hence, as consumers shift from gasoline-powered cars to EVs, manufacturers increase battery production, which propels the need for raw lithium.

Drivers & Opportunities

Growing Usage of Smartphones: The rising use of smartphones is driving the demand for lithium as every smartphone relies on a lithium-ion battery. These batteries power the device, offering high energy density, longer life, and lighter weight compared to older battery technologies. Smartphones with larger screens or faster processors are also creating the need for powerful and efficient lithium-ion batteries. Additionally, the rapid turnover of smartphones, with consumers upgrading every few years, is boosting lithium consumption. According to consumeraffairs, over 98% of Americans owned a cellphone in 2024, compared with 81% in 2015. Therefore, as more people in the country buy smartphones, the number of lithium-powered batteries produced each year surges.

Increasing Investments in Clean Energy Sources: Clean energy sources such as solar and wind power need large-scale battery storage to store energy during periods of low sunlight or wind, and lithium-ion batteries remain the most efficient solution for this purpose. The push for cleaner transportation and energy grids is also leading to the development of lithium batteries, for which the extraction of lithium is increasing to meet the soaring requirements, contributing to the market growth. Therefore, as governments and companies in the country invest in expanding renewable energy capacity, they also invest in massive battery storage projects, all of which require substantial amounts of lithium.

Segmental Insights

Product Analysis

Based on product, the segmentation includes carbonates, hydroxide, and others. The carbonate segment accounted for a 50% U.S. lithium market share in 2024. The dominance is attributed to its extensive use in lithium-ion battery manufacturing, particularly for consumer electronics and electric vehicles. The surge in EV adoption, supported by government incentives and automaker commitments to electrification, created strong demand for lithium carbonate. Additionally, the pharmaceutical and glass industries added to the demand, as carbonate compounds serve as essential raw materials in drug formulations and specialty glass production.

The hydroxide segment is expected to grow at a rapid pace from 2025 to 2034, owing to its superior compatibility with high-nickel cathode chemistries such as NCM 811, which deliver higher energy density and longer battery life. Automakers in the U.S. increasingly favor these chemistries to extend driving ranges and reduce charging frequencies, directly driving hydroxide consumption. Moreover, large-scale investments in domestic battery gigafactories and strategic partnerships between miners and battery manufacturers are ensuring greater supply security, further boosting hydroxide demand. The shift toward renewable energy storage systems that require high-performance batteries is also accelerating the segment’s expansion.

Application Analysis

In terms of application, the segmentation includes automotive, consumer electronics, grid storage, glass & ceramics, and others. The automotive segment held the largest U.S. lithium market share in 2024 due to rising EV production to meet stringent emission regulations and to align with national clean energy goals. Federal and state-level incentives for EV purchases, along with major investments in domestic battery manufacturing facilities, further strengthened the dominance of the segment. The rapid expansion of charging infrastructure also encouraged consumers to shift toward electric mobility, creating sustained demand for battery materials such as lithium.

The consumer electronics segment is expected to register the highest CAGR from 2025 to 2034, owing to the growing usage of smartphones, laptops, wearables, and other connected devices. Rising dependence on portable gadgets, combined with the rollout of 5G technology and increasing adoption of smart home products, is estimated to accelerate the consumption of compact, high-energy-density lithium batteries. Remote work and digital learning trends are also fueling long-term demand for devices powered by rechargeable lithium batteries. Additionally, innovations in consumer electronics, such as foldable phones, advanced gaming consoles, and AI-integrated gadgets, are projected to push manufacturers to secure a reliable lithium supply.

Key Players & Competitive Analysis

The U.S. lithium market is rapidly evolving as domestic production becomes a strategic priority amid rising EV demand and supply chain security concerns. Industry leaders such as Albemarle Corp. and Livent Corp. dominate with integrated refining capabilities. Emerging players such as Lithium Americas Corp. and Piedmont Lithium are advancing new projects to reduce reliance on imports. Sigma Lithium and Atlas Lithium Corp. explore additional U.S. opportunities, while battery makers such as Kore Power and automakers such as Tesla invest in localized supply chains. The Inflation Reduction Act’s critical minerals incentives further intensify competition, though permitting delays and ESG challenges persist. China’s influence in processing looms large, pushing U.S. firms to innovate in lithium extraction and recycling to secure a sustainable foothold.

A few major companies operating in the U.S. lithium market include Albemarle Corp., American Lithium Corp., Arcadium Lithium, Atlas Lithium Corp, Kore Power, Lithium Americas Corp., Livent Corp., Piedmont Lithium, Sigma Lithium Corp, and Tesla.

Key Companies

- Albemarle Corp.

- American Lithium Corp.

- Arcadium Lithium

- Atlas Lithium Corp

- Kore Power

- Lithium Americas Corp.

- Livent Corp.

- Piedmont Lithium

- Sigma Lithium Corp

- Tesla

U.S. Lithium Industry Developments

In February 2024, Albemarle Corporation announced a definitive agreement with the BMW Group to deliver battery-grade lithium to help the automaker pursue high-performance, premium electric vehicles (EVs).

In September 2023, American Lithium Corp announced a new lithium discovery from the initial drill hole at Community of Quelcaya.

U.S. Lithium Market Segmentation

By Product Outlook (Revenue, USD Billion, Volume, Kilotons, 2020–2034)

- Carbonates

- Hydroxide

- Others

By Application Outlook (Revenue, USD Billion, Volume, Kilotons, 2020–2034)

- Automotive

- Consumer Electronics

- Grid Storage

- Glass & Ceramics

- Others

U.S. Lithium Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.14 Billion |

|

Market Size in 2025 |

USD 1.28 Billion |

|

Revenue Forecast by 2034 |

USD 3.69 Billion |

|

CAGR |

12.48% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion, Volume in Kilotons, and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 1.14 billion in 2024 and is projected to grow to USD 3.69 billion by 2034.

The market is projected to register a CAGR of 12.48% during the forecast period.

A few of the key players in the market are Albemarle Corp., American Lithium Corp., Arcadium Lithium, Atlas Lithium Corp, Kore Power, Lithium Americas Corp., Livent Corp., Piedmont Lithium, Sigma Lithium Corp, and Tesla.

The carbonate segment dominated the market share in 2024.

The consumer electronics segment is expected to witness the fastest growth during the forecast period.