Lithium Market Size, Share, Trends, Industry Analysis Report

By Product (Carbonates, Hydroxide, Others), By Application (Automotive, Consumer Electronics, Grid Storage, Glass & Ceramics, Others), By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 124

- Format: PDF

- Report ID: PM6380

- Base Year: 2024

- Historical Data: 2020-2023

Overview

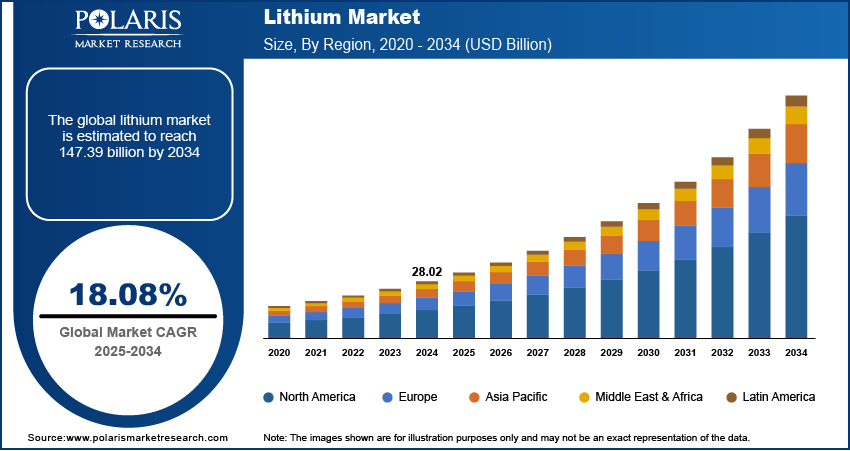

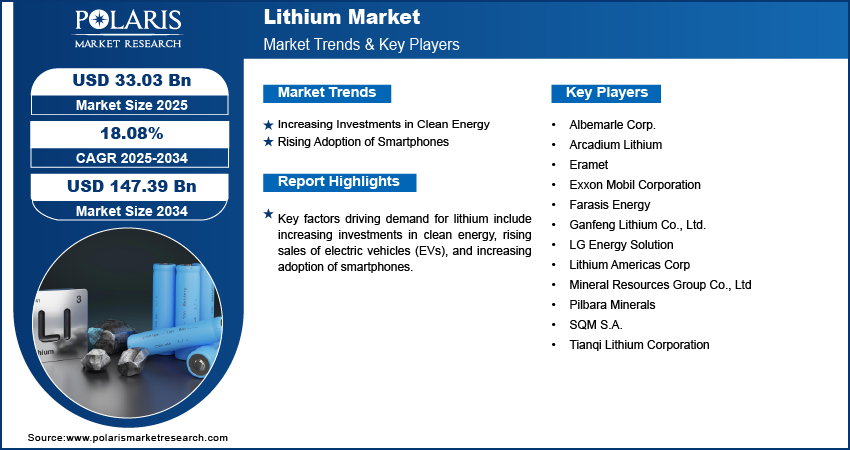

The global lithium market size was valued at USD 28.02 billion in 2024, growing at a CAGR of 18.08 % from 2025 to 2034. Key factors driving demand for lithium include increasing investments in clean energy, rising sales of electric vehicles (EVs), and increasing adoption of smartphones.

Key Insights

- The carbonates segment accounted for a major revenue share in 2024 due to rising demand for rechargeable batteries and ceramic glass.

- The consumer electronics segment is expected to register a CAGR of 25.42% from 2025 to 2034, owing to rising demand for laptops, wearables, and other portable devices.

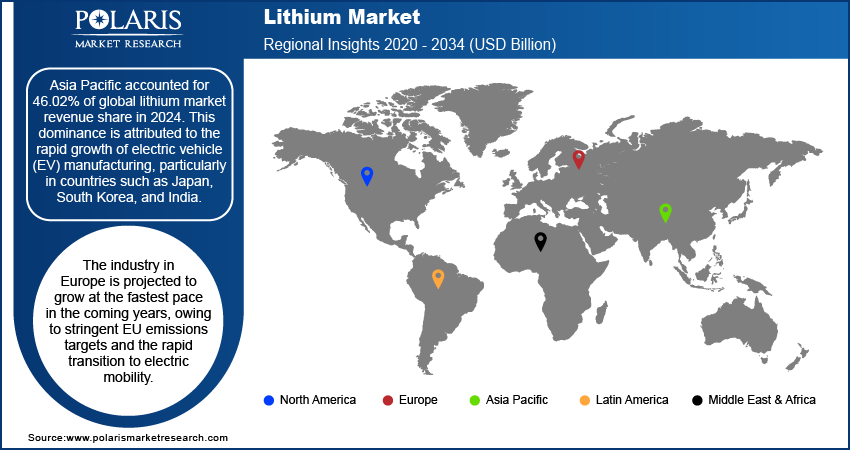

- Asia Pacific accounted for 46.02% of global lithium market revenue share in 2024, owing to the rapid growth of electric vehicle (EV) manufacturing.

- China held the largest revenue share in the Asia Pacific lithium landscape in 2024, due to strict carbon emission norms and growing production of EVs.

- The industry in Europe is projected to grow at the fastest pace in the coming years, owing to stringent EU emissions targets and the rapid transition to electric mobility.

Industry Dynamics

- The increasing investments in clean energy worldwide is fueling the demand for lithium as clean energy projects require large-scale lithium battery storage systems to manage intermittent supply.

- The rising adoption of smartphones is driving the lithium market, as lithium-ion batteries power nearly all modern mobile devices.

- The strict carbon emission norms are expected to create a lucrative market opportunity during the forecast period.

- The high capital cost required for lithium production hinders the market growth by restricting new entrants.

Artificial Intelligence (AI) Impact on Lithium Market

- AI-driven technologies such as data centers, EVs, and smart devices rely on lithium-ion batteries, boosting lithium demand.

- AI enhances lithium extraction efficiency by analyzing geological data, reducing costs, and improving supply.

- AI predicts lithium price trends and supply-demand gaps, helping investors and producers make data-driven decisions.

- AI accelerates R&D in lithium batteries, improving energy density and lifespan, further driving demand.

Market Statistics

- 2024 Market Size: USD 28.02 Billion

- 2034 Projected Market Size: USD 147.39 Billion

- CAGR (2025–2034): 18.08%

- Asia Pacific: Largest Market Share

Lithium is a soft, silvery-white alkali metal and highly reactive. It is found in minerals such as spodumene and brine deposits and is extracted for industrial use. Its excellent electrochemical potential is making it practical for rechargeable lithium-ion batteries, which power smartphones, laptops, and electric vehicles (EVs). Additionally, lithium is used in ceramics, glass, and lubricants due to its heat resistance. In medicine, lithium compounds treat bipolar disorder by stabilizing mood. The demand for lithium has surged with the rise of clean energy technologies, as EVs and renewable storage systems rely on lithium batteries. However, mining and processing raise environmental concerns, including water depletion and pollution.

Lithium’s lightweight and high energy density make it ideal for aerospace applications, where efficiency is crucial. It’s used in aircraft alloys to reduce weight and in spacecraft power systems. Lithium serves as a coolant in nuclear reactors due to its high heat absorption. Researchers are also exploring sustainable alternatives such as lithium recycling and solid-state batteries to reduce environmental impact.

The global demand for lithium is driven by the rising sales of electric vehicles (EVs). International Energy Agency, in its report, stated that global electric car sales exceeded 17 million in 2024. This drove demand for lithium as EV batteries require significant amounts of lithium to store and deliver energy efficiently. Governments worldwide are also pushing for cleaner transportation, further accelerating EV adoption and lithium demand. Therefore, as more consumers switch to EVs, automakers ramp up production, leading to higher consumption of lithium for battery manufacturing.

Drivers & Opportunities

Increasing Investments in Clean Energy: Governments and companies across the globe are expanding solar, wind, and other green energy projects through their heavy investment in clean energy. These projects require large-scale battery storage systems to manage intermittent supply, driving up lithium consumption. As per International Energy Agency, global energy investment exceeded USD 3 trillion for the first time in 2024, with USD 2 trillion going to clean energy technologies and infrastructure. Additionally, the growing adoption of electric vehicles, supported by clean energy policies, is further escalating the need for lithium, as it is a key component in EV batteries.

Rising Adoption of Smartphones: The rising adoption of smartphones is fueling the demand for lithium as lithium-ion batteries power nearly all modern mobile devices. According to the GSMA’s annual State of Mobile Internet Connectivity Report 2023, over half (54%) of the global population now owns a smartphone. Features such as larger screens, faster processors, and longer battery life are further increasing lithium consumption per device. Additionally, the expansion of 5G networks is encouraging smartphone replacements, accelerating demand for lithium-ion batteries.

Segmental Insights

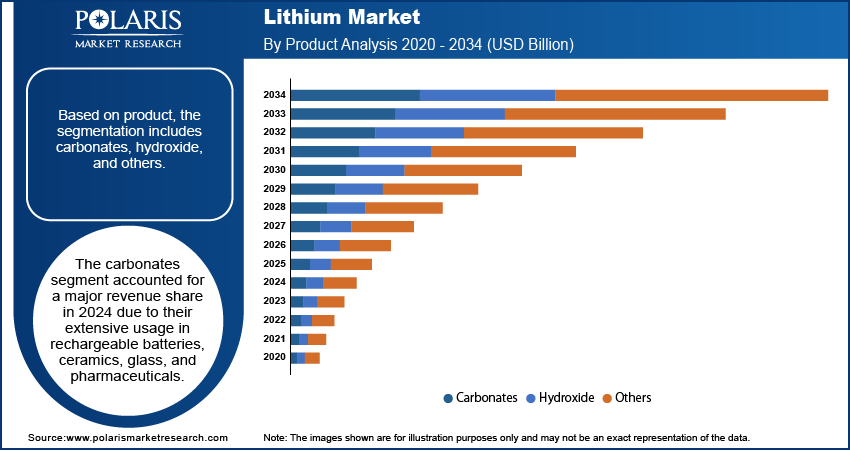

Product Analysis

Based on product, the segmentation includes carbonates, hydroxide, and others. The carbonates segment accounted for a major revenue share in 2024 due to their extensive usage in rechargeable batteries, ceramics, glass, and pharmaceuticals. Battery manufacturers preferred lithium carbonate as a critical raw material for producing cathode materials used in electric vehicles and energy storage systems. The rising adoption of electric mobility across North America, Europe, and the Asia Pacific further boosted demand, while the growth of renewable energy projects supported consumption in grid storage applications. Producers in the glass and ceramics industry also relied on carbonates for their ability to enhance durability and thermal resistance, which strengthened their overall demand.

The hydroxide segment is projected to grow at a robust pace in the coming years, owing to its increasing use in high-nickel cathode chemistries that power next-generation electric vehicles. Automakers are shifting toward nickel-rich battery formulations to achieve higher energy density and longer driving ranges, which is projected to significantly increase hydroxide consumption. Governments are also introducing stringent emission targets and offering incentives for electric vehicle adoption, further pushing demand for high-performance batteries that primarily utilize hydroxide. Additionally, advancements in battery recycling and refining technologies are improving the supply chain, making hydroxide more accessible and cost-efficient, contributing to segment growth.

Application Analysis

In terms of application, the segmentation includes automotive, consumer electronics, grid storage, glass & ceramics, and others. The consumer electronics segment is expected to register a CAGR of 25.42% from 2025 to 2034, owing to rising demand for smartphones, laptops, wearables, and other portable devices. The growth of remote work, digital learning, and smart home ecosystems is further intensifying the need for efficient power solutions in electronic devices. Moreover, innovations in 5G-enabled devices, augmented reality tools, and next-generation computing systems are estimated to expand the role of lithium batteries in the electronics sector. The growing disposable income levels in emerging economies are also fueling the segment growth by driving the adoption of premium devices.

Regional Analysis

The Asia Pacific lithium market accounted for 46.02% of global lithium revenue share in 2024. This dominance is attributed to the rapid growth of electric vehicle (EV) manufacturing, particularly in countries such as Japan, South Korea, and India. According to the International Trade Administration, EVs' share of automobile production reached 11% in Korea as of July 2025. Governments in the region also implemented strict emissions regulations and offered subsidies to accelerate EV adoption, which led to market growth. Additionally, renewable energy storage projects and consumer electronics manufacturing contributed to lithium demand in the region in 2024.

China Lithium Market Insights

China held the largest revenue share in the Asia Pacific lithium landscape in 2024, due to its strong position in EV and battery production. The Chinese government’s aggressive push for carbon neutrality, along with subsidies and mandated EV use, has led to high demand for lithium. Companies such as CATL and BYD are major global battery supply chains, while China’s control over lithium refining strengthens its market influence. Additionally, energy storage systems for solar and wind power are increasing lithium-ion battery usage in China.

North America Lithium Market Trends

The market in North America is projected to hold a substantial revenue share in 2034 due to the rapid expansion of the EV sector, led by automakers such as Tesla, Ford, and GM. The U.S. and Canada are investing heavily in domestic battery production to reduce reliance on Asian suppliers, which is increasing the use of lithium. Government incentives, such as the U.S. Inflation Reduction Act (IRA), are accelerating EV adoption and lithium mining projects.

U.S. Lithium Market Overview

The demand for lithium in the U.S. is being driven by federal and state policies promoting clean energy and EV adoption. The Biden administration’s push for a domestic battery supply chain has led to new lithium mining and refining projects. Tesla, GM, and Ford are scaling up EV production, while companies such as Redwood Materials are focusing on battery recycling. The U.S. is also investing in lithium-based energy storage to support the integration of solar and wind power.

Europe Lithium Market Assessment

The industry in Europe is projected to grow at the fastest pace in the coming years, owing to stringent EU emissions targets and the rapid transition to electric mobility. Automakers such as Volkswagen, BMW, and Mercedes-Benz are shifting to EVs, increasing battery needs. The EU is creating a local battery supply chain through initiatives such as the European Battery Alliance, reducing dependence on China, leading to market growth. Additionally, renewable energy storage and portable electronics are contributing to growing lithium consumption, with major Gigafactories being built across the region.

Key Players & Competitive Analysis

The global lithium market is highly competitive, with key players such as Albemarle Corp., SQM S.A., and Ganfeng Lithium Co., Ltd. dominating production and refining. Albemarle and SQM leverage large-scale brine operations in Chile, while Ganfeng leads in integrated lithium processing, from mining to battery materials. Emerging producers such as Lithium Americas Corp. and Pilbara Minerals are expanding hard-rock lithium projects in North America and Australia, increasing supply diversification. Battery giants such as LG Energy Solution drive demand through EV partnerships, while Chinese firms such as Tianqi Lithium and Mineral Resources control significant upstream assets. Specialty producers such as Arcadium Lithium focus on high-purity lithium for niche applications. Meanwhile, Farasis Energy and other battery manufacturers push for cost-efficient lithium alternatives. Geopolitical tensions, ESG concerns, and technological shifts in extraction are reshaping competition, with firms racing to secure sustainable supply chains amid soaring EV demand.

A few major companies operating in the lithium market include Albemarle Corp.; Arcadium Lithium; Eramet; Exxon Mobil Corporation; Farasis Energy; Ganfeng Lithium Co., Ltd.; LG Energy Solution; Lithium Americas Corp; Mineral Resources Group Co., Ltd; Pilbara Minerals; SQM S.A.; and Tianqi Lithium Corporation.

Key Companies

- Albemarle Corp.

- Arcadium Lithium

- Eramet

- Exxon Mobil Corporation

- Farasis Energy

- Ganfeng Lithium Co., Ltd.

- LG Energy Solution

- Lithium Americas Corp

- Mineral Resources Group Co., Ltd

- Pilbara Minerals

- SQM S.A.

- Tianqi Lithium Corporation

Lithium Industry Developments

In August 2024, Eramet inaugurated its direct lithium extraction plant in Argentina, becoming the first European company to produce battery-grade lithium carbonate at an industrial scale.

In November 2023, Exxon Mobil Corporation began the company’s first phase of North America lithium production in southwest Arkansas.

Lithium Market Segmentation

By Product Outlook (Revenue, USD Billion, Volume, Kilotons, 2020–2034)

- Carbonates

- Hydroxide

- Others

By Application Outlook (Revenue, USD Billion, Volume, Kilotons, 2020–2034)

- Automotive

- Consumer Electronics

- Grid Storage

- Glass & Ceramics

- Others

By Regional Outlook (Revenue, USD Billion, Volume, Kilotons, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Lithium Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 28.02 Billion |

|

Market Size in 2025 |

USD 33.03 Billion |

|

Revenue Forecast by 2034 |

USD 147.39 Billion |

|

CAGR |

18.08% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion, Volume in Kilotons, and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 28.02 billion in 2024 and is projected to grow to USD 147.39 billion by 2034.

The global market is projected to register a CAGR of 18.08% during the forecast period.

Asia Pacific dominated the market in 2024

A few of the key players in the market are Albemarle Corp.; Arcadium Lithium; Eramet; Exxon Mobil Corporation; Farasis Energy; Ganfeng Lithium Co., Ltd.; LG Energy Solution; Lithium Americas Corp; Mineral Resources Group Co., Ltd; Pilbara Minerals; SQM S.A.; and Tianqi Lithium Corporation.

The carbonate segment dominated the market revenue share in 2024.

The consumer electronics segment is projected to witness the fastest growth during the forecast period.