Smart Manufacturing Market Share, Size, Trends, Industry Analysis Report

By Component (Hardware, Software, Services); By Technology; By End-Use; By Region; Segment Forecast, 2025 - 2034

- Published Date:Sep-2025

- Pages: 114

- Format: PDF

- Report ID: PM2005

- Base Year: 2024

- Historical Data: 2020 - 2023

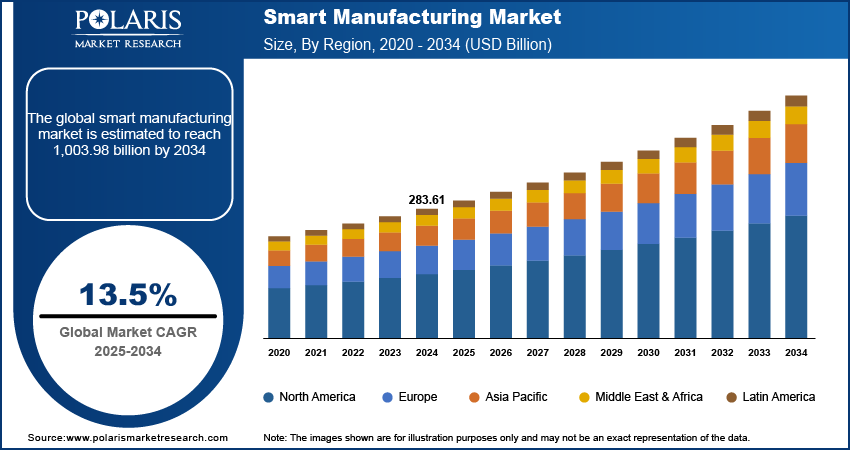

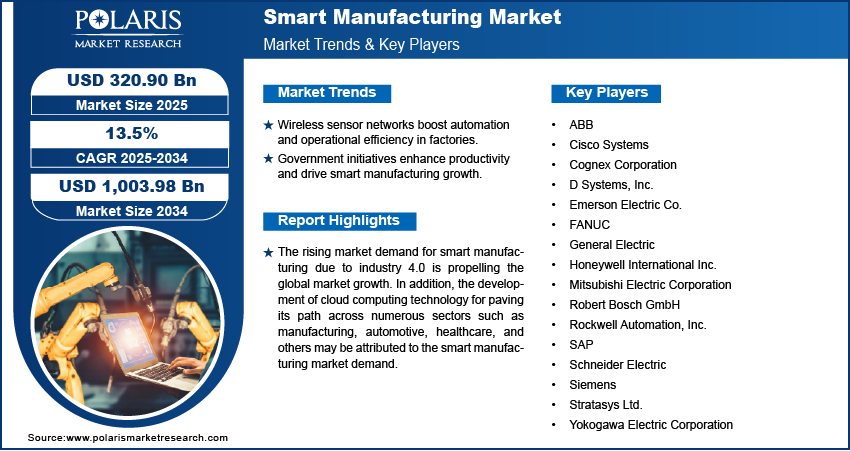

The global smart manufacturing market was valued at USD 283.61 billion in 2024 and is expected to grow at a CAGR of 13.5% during the forecast period. Key factors driving the demand includes rising emphasis on smart manufacturing in manufacturing processes, increasing government involvement in supporting smart manufacturing, growing expenditures on research and development activities, and rising investment in technical improvements.

Key Insights

- In 2024, the distributed control system (DCS) segment held the largest market share. This is due to its features, such as flexibility, scalability, visualization, and system availability with reliability.

- The automotive segment dominated the market share in 2024. This is due to benefits, such as sustainability, premium quality, enhanced asset competence, and reduced operational costs

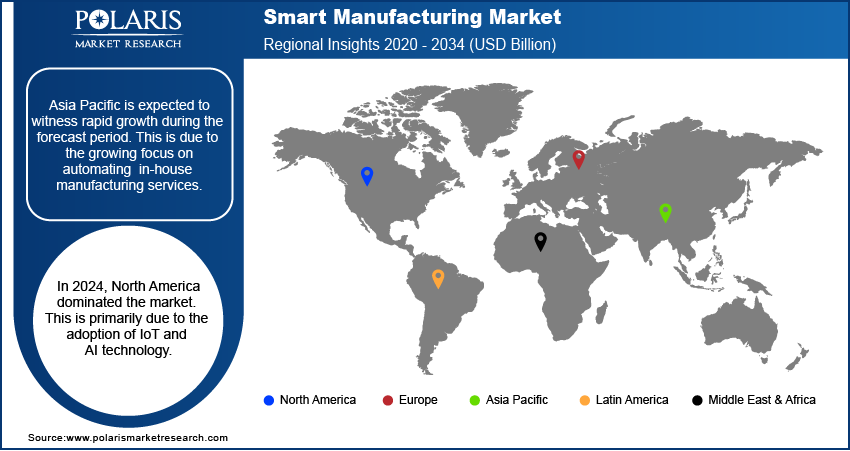

- Asia Pacific is expected to witness rapid growth during the forecast period. This is due to the growing focus on automating in-house manufacturing services.

- In 2024, North America dominated the market. This is primarily due to the adoption of IoT and AI technology.

Industry Dynamics

- Advances in wireless sensor networks (WSNs) and the use in smart factories enable greater automation and operational efficiency, accelerating market growth.

- The government's aim to enhance productivity, strengthen supply chain resilience, and create high-skilled jobs has driven growth in the smart manufacturing market.

- The high initial investment and complexity of integrating new technologies create a challenge.

- The integration of AI and analytics enables automated factories to operate 24/7.

Market Statistics

- 2024 Market Size: USD 283.61 billion

- 2034 Projected Market Size: USD 1,003.98 billion

- CAGR (2025-2034): 13.5%

- North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

AI Impact on Smart Manufacturing Market

- Unplanned downtime, reduction in maintenance cost, and the lifespan of machinery are managed by analyzing sensor data.

- Improvement in product quality and reduction of waste are expected to be achieved through the automation of vision systems, which enables the maintenance of accuracy and speed.

- An increase in output and a reduction in operational costs are achieved through demand forecasting, supply chain data, and machine availability.

- Real-time insights from supply chain disruptions, delays, and material shortages.

The rising market demand for smart manufacturing due to industry 4.0 is propelling the global market growth. In addition, the development of cloud computing technology for paving its path across numerous sectors such as manufacturing, automotive, healthcare, and others may be attributed to the smart manufacturing market demand.

Furthermore, growing expenditures on research and development activities and rising investment in technical improvements by the market's leading competitors are major variables that will catalyze the smart manufacturing market's growth in the coming years. Consequently, several governments regulate mandatory lockdown in various areas, which develops a decisive gap among supply chain and production units and reduces the smart factories' shipment of solutions and components.

To overcome this impact, enterprises are reforming their business models, discovering automation prospects, and investing in installing up-grade supply chain and manufacturing models. Therefore, the smart manufacturing market demand is projected to grow due to rising energy, resource, and intelligent automation efficiency. Consequently, long-term market growth is influenced by the rearrangement of the manufacturing market and strategic developments by the leading players, which, in turn, fuels the market growth of intelligent manufacturing in the coming years.

Industry Dynamics

Growth Drivers

The increasing number of technological advancements in wireless sensor networks and their penetration across smart factories is a major driving factor that accelerates the market growth of smart manufacturing over the forecast period. Integration of wireless networks with dispersed autonomous devices comprises sensors for analyzing environmental and physical circumstances and is often recognized as a wireless sensor network (WSN). This sensor is usually adopted in the sectors such as water & wastewater treatment, oil & gas, and pharmaceutical.

In an oil & gas vertical plants, generators, tanks, separators, and compressors are managed, checked, and controlled with the help of sensors deployed in a WSN. The adoption of the WSN decreases the spending linked with the deployment of a communication system and sensor network. Growing usage of WSN in a supervisory control and data acquisition (SCADA) system and other smart factory solutions and components facilitates real-time data monitoring and process control.

Therefore, increasing research and development activities for WSN and vigorous implementation in the smart factories boost the growth of application areas in smart factories. Thus, these factors may contribute to the growth of smart manufacturing in the forecasting period owing to the constant updates in wireless sensor networks.

Report Segmentation

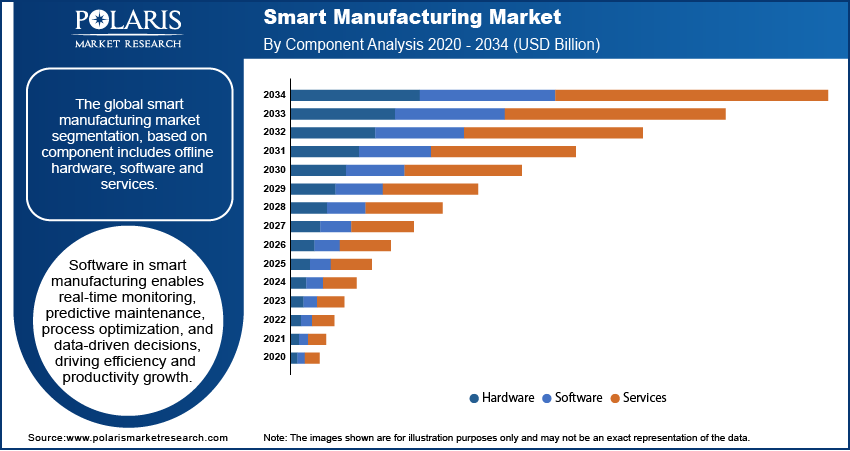

The market is primarily segmented based on component, technology, end-use and region.

|

By Component |

By Technology |

By End-Use |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Segmental Insights

Technology Analysis

The distributed control system (DCS) segment dominated the market in 2024. This is due to its features, such as flexibility, scalability, visualization, and ease of use in processes like monitoring, controlling, and reporting. It also enhances system availability and reliability.

DCS is proficient in managing core operations, safety roles, and maintenance across different plant applications and procedures. Furthermore, the DC systems across various industries can be easily implemented without compromising performance and process safety, leading to the segment's dominance worldwide.

The 3D printing segment is expected to witness substantial growth in the forecast period, as it enables the production of sophisticated components with convenient physical and functional attributes at every stage. Additionally, it provides pace, potency, and quality throughout the entire production process, supporting a wide range of applications and industries.

End-Use Analysis

The automotive segment held the largest market share in 2024. This is due to the numerous benefits, such as sustainability, premium quality, enhanced asset competence, and reduced operational costs, which are the prominent factors that boost segment growth, in turn increasing the market for smart manufacturing further.

Moreover, the increasing penetration of industrial robots and growing investments in smart factories are likely to provide several benefits, such as improved product quality, stable employee retention, increased productivity, and rising market supplies of products. Therefore, the automation of production plants creates a lucrative segment for growth worldwide, boosting market demand for the smart manufacturing industry.

The aerospace and defense industry segment is expected to show the highest CAGR in the near future due to increasing investment in smart manufacturing solutions, rising optimization & visibility in the supply chain, and product samples.

Regional Analysis

Asia Pacific Smart Manufacturing Market Assessment

Asia Pacific is expected to witness fastest growth during the forecst period. Growing focus on automating in-house manufacturing services and lessening reliance on other regions are the chief driving factor for the regional growth. In addition, deploying smart manufacturing solutions leads to growing manufacturers' focus on reforming their supply chains to enhance workplace safety and decrease operational costs in the manufacturing process. Countries like Japan are the leading manufacturing centers for creating factory automation solutions and delivering them to other nations across the region, leading to the availability of the solutions at a reasonable price for developing countries India and China. Therefore, these factors create a productive smart manufacturing market demand for smart manufacturing in the Asia Pacific. Moreover, the Middle East and Africa are projected to grow at the highest CAGR globally in the upcoming years. The factors such as the rising number of government initiatives for technological advancement and increasing spending by the leading players for smart manufacturing development create a curative market demand for smart manufacturing in the coming years.

North America Smart Manufacturing Market Insights

In 2024, North America held the largest market share, largely due to the incentives provided for technology adoption and investment. The adoption of IoT and AI technology is promoted with initiatives, such as the Advanced Manufacturing Partnership. Moreover, the region already boasts a well-developed industrial base, with major automotive and aerospace companies playing a major role in facilitating this transition to automation, which leading technology companies support. Further supporting this is a strong commitment to R&D and a need to enhance the resilience of the supply chain and operational efficiency, all of which position North America for dominance.

Competitive Insight

Some of the major players operating in the global smart manufacturing market include 3D Systems, Inc., ABB., Cisco Systems, Cognex Corporation, Emerson Electric Co., FANUC, General Electric, Honeywell International Inc., Mitsubishi Electric Corporation, Robert Bosch GmbH, Rockwell Automation, Inc., SAP, Schneider Electric, Siemens, Stratasys Ltd., and Yokogawa Electric Corporation.

Recent Developments

- July 2024: 3D Systems Inc. (US) and Precision Resources (US) formed a strategic alliance in order to expand and speed up additive manufacturing. According to 3D Systems, the extensive application knowledge of both organizations with 3D System’s Direct Metal Printing (DMP) platform is going to enable a faster route to market for applications in high-criticality sectors.

- June 2024: ABB (Switzerland) unveiled OmniCore, an advanced automation platform developed to be faster, more accurate, and more sustainable. With its unique, single-control architecture, the platform integrates ABB’s complete range of hardware and software.

Smart Manufacturing Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 283.61 Billion |

| Market size value in 2025 | USD 320.90 Billion |

|

Revenue forecast in 2034 |

USD 1,003.98 Billion |

|

CAGR |

13.5% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Component, By Technology, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

D Systems, Inc., ABB.Cisco Systems, Cognex Corporation, Emerson Electric Co., FANUC, General Electric, Honeywell International Inc., Mitsubishi Electric Corporation, Robert Bosch GmbH, Rockwell Automation, Inc., SAP, Schneider Electric, Siemens, Stratasys Ltd., and Yokogawa Electric Corporation |

FAQ's

• The global market size was valued at USD 283.61 billion in 2024 and is projected to grow to USD 1,003.98 billion by 2034.

• The global market is projected to register a CAGR of 13.5% during the forecast period.

• North America dominated the global market share in 2024.

• A few key players are D Systems, Inc., ABB.Cisco Systems, Cognex Corporation, Emerson Electric Co., FANUC, General Electric, Honeywell International Inc., Mitsubishi Electric Corporation, Robert Bosch GmbH, Rockwell Automation, Inc., SAP, Schneider Electric, Siemens, Stratasys Ltd., and Yokogawa Electric Corporation.

• In 2024, the distributed control system (DCS) segment held the largest market share.

• The automotive segment dominated the market share in 2024.