Dewatering Pumps Market Share, Size, Trends & Industry Analysis Report

By Type (Submersible Dewatering Pumps, Non-Submersible Dewatering Pumps); By Application; By Capacity; By Region; Segment Forecast, 2025 - 2034

- Published Date:Jun-2025

- Pages: 130

- Format: PDF

- Report ID: PM3515

- Base Year: 2024

- Historical Data: 2020-2023

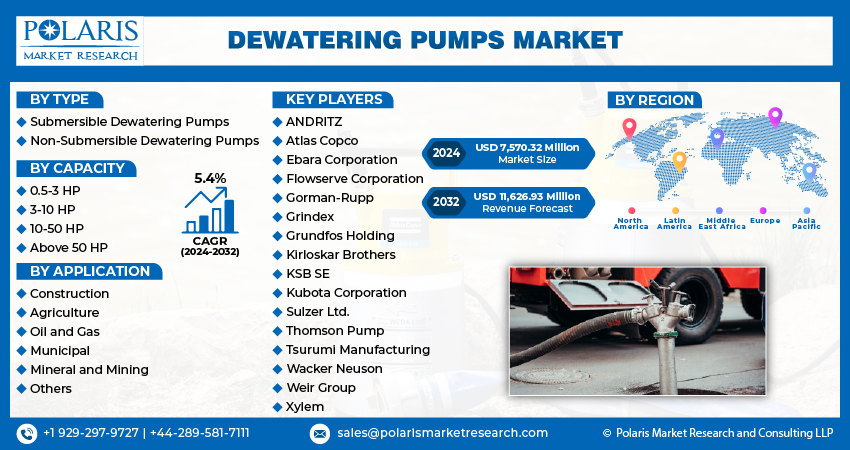

The global Dewatering Pumps Market was valued at USD 6.8 billion in 2024 and is anticipated to grow at a CAGR of 7.20% from 2025 to 2034. Infrastructure development and mining activities are major contributors to market expansion.

Dewatering pumps are multipurpose tools utilized in various industries for the purpose of moving and removing water and other materials. Different types of dewatering pumps offer high flow rates, portability, and the capability to handle different liquids. The various types include surface, cutter, submersible, and auto prime pumps, each designed with distinct features for specific applications. These pumps are essential for maintaining water levels in mining and construction sites, lowering water tables, and removing floodwater in municipal areas. In the mining industry, dewatering pumps are crucial for ensuring safe and productive working conditions.

To Understand More About this Research: Request a Free Sample Report

A dewatering pump has several applications across various industries, including mining, mills, construction, and municipal operations. Dewatering pumps are used in agriculture to manage water levels in fields, preventing waterlogging and improving crop yields. They also help with drainage after heavy rainfall. In addition, in construction and excavation sites, dewatering pumps help maintain dry work areas. They enable construction to continue without delays caused by water accumulation, ensuring project timelines are met.

The demand for dewatering pumps is increasing due to the growing need for efficient industrial infrastructure in emerging countries. There is also an emphasis on retrofitting, upgrading, and replacing aging components. As a result, the growth and development of industries will contribute to the expansion of the machinery and equipment industry. This, in turn, will improve the overall growth of the submersible dewatering pumps market.

Most multinational companies grow their connections with local and regional distributors in order to build their local networks. To increase profitability and lower operating costs, many investors are now investing in the construction of infrastructure in developing nations. Wilo has recently expanded its business by establishing a new headquarters and production facility in Cedarburg, Wisconsin, USA, in May 2020. This new facility will unite all the operations of Weil Pump, Wilo USA, Scot Pump, and Wilo Machine Co. at a single production location.

Growth Drivers

An increase in extreme weather conditions such as heavy rainfall and flooding and rising water demand to meet the needs of growing populations globally are driving the market.

During the monsoon season, heavy rainfall and floods often lead to clogging and waterlogging in industrial areas, posing significant challenges. These issues can result in operational disruptions and, financial losses. However, dewatering pumps offer an effective solution, particularly in the harsh weather conditions of the monsoon. These pumps play a vital role in addressing flooding and excess water issues.

Dewatering pumps are specifically designed to quickly remove water from flooded areas. This efficient water removal not only prevents further damage to structures, infrastructure, and materials but also reduces the risk of structural instability. Moreover, it minimizes the potential for health hazards such as mildew, mosquitoes, and other pests.

Flooded areas often face considerable disruptions in daily activities, including transportation, commerce, and essential services. High-capacity dewatering pumps, designed for large flooded spaces, are indispensable in minimizing these disruptions by accelerating water removal. By rapidly clearing water from roads, public areas, and critical facilities, these pumps contribute to the swift restoration of normalcy in affected regions.

Dewatering pumps also enhance safety by lowering water levels, mitigating the risks of electrical accidents and structural failures. Additionally, the removal of floodwater with dewatering pumps helps eliminate water contamination, creating a safer environment for people and animals. Smart autoprime pumps, specifically engineered for quick dewatering in flooded areas, offer portability and high performance simultaneously.

These pumps significantly expedite recovery efforts by efficiently extracting water from residential, commercial, and industrial areas. Their ability to swiftly pump out flooded spaces aids in faster cleanup, drying, and restoration activities, enabling affected communities to recover and rebuild more expeditiously.

As the global population continues to grow, the demand for effective water management has also increased. Dewatering pumps find widespread use in water treatment plants for various applications. Typically, they are working to transport water from one location to another or circulate water within the plant. Apart from their capacity to move substantial volumes of water with ease, these pumps are well-suited for water disinfection due to their robust construction and resistance to corrosion and wear over time. Many municipal plants rely on dewatering pumps, particularly when treating wastewater before discharging it into lakes or rivers, where water quality must meet specific standards

Report Segmentation

The market is primarily segmented based on type, capacity, application, and region.

|

By Type |

By Capacity |

By Application |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

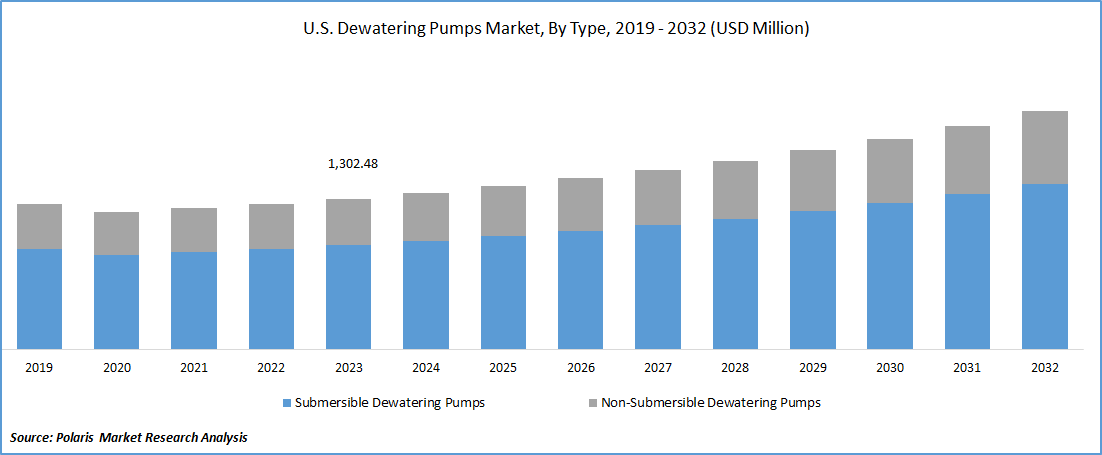

Submersible dewatering pumps held the largest market share in 2024

Submersible dewatering pumps offer several advantages, including their ability to handle a wide range of water levels, from shallow to deep, without the need for frequent repositioning. Their submersion capability also reduces the risk of pump cavitation, ensuring consistent and efficient performance. These pumps are available in various sizes and power capacities, making them versatile and suitable for both small and large-scale dewatering tasks. They are often favored for their reliability and durability in demanding environments.

The demand for submersible dewatering pumps is rising due to their effectiveness, versatility, and reliability. With infrastructure development and construction projects increasing globally, the need for efficient water removal solutions remains high, further driving the adoption of submersible dewatering pumps across various industries. Also, several competitors are also actively developing innovative technologies to enhance pump performance and durability.

By Application Analysis

The construction segment acquired highest market share over the forecast period

Dewatering pumps play a critical role in the construction process, specifically in the phase of removing groundwater from a construction site before the foundation of a building is established. This essential step ensures a safe and stable workplace and environment by eliminating groundwater from trenches, excavations, and areas with insufficient natural drainage.

One of the most common and cost-effective techniques for dewatering construction sites is the use of a wellpoint system. This system involves drilling several small wells to a predetermined depth and strategically spacing them around the excavation area. These wells are connected to the surface through pipes that incorporate valves and pumps designed to draw water from below the ground surface.

Regional Insights

Asia Pacific region held the largest share of the global market in 2024

The dominance of the Asia Pacific region in the market for dewatering pumps can be attributed to the rapid urbanization and industrialization seen across major developing countries, including India and China. This surge in urban and industrial development has led to increased construction activities, mining operations, and water management projects. Furthermore, the region is experiencing a growing need to combat the effects of natural disasters such as floods and heavy rainfall. Additionally, the migration of people from urban to rural areas is further propelling the market's growth in this region.

Dewatering pumps in the Asia-Pacific region have a wide range of applications across various industries, including water and wastewater, oil and gas, chemicals, food, and beverages. They play a crucial role in the transfer of different fluids from one location to another. The demand for these pumps is primarily driven by increased investments in building and construction, as well as water infrastructure. It has led to consistent expansion in access to water supply and sanitation systems, resulting in increased pump utilization across diverse end-use industries such as chemical and wastewater treatment plants, mining, pulp and paper manufacturing, food and beverages, and power generation.

Recent reports indicate that a significant hydropower project is in the works on the mainstream of the Mekong River. This 2.4 billion USD project, produced by Thailand's Charoen Energy and Water Asia (CEWA) and potentially built by two South Korean construction corporations, Korea Western Power (KOWEPO) and Doosan Heavy Industries & Construction, is expected to be completed by 2029 if approved. Such large-scale developments are expected to boost the demand for dewatering pumps.

Key Market Players & Competitive Insights

The dewatering pumps market is characterized by intense competition, with numerous manufacturers holding a significant portion of the market share. Key business strategies employed by market participants to sustain and expand their global presence include product launches, approvals, strategic acquisitions, and innovations.

Some of the major players operating in the global market include:

- ANDRITZ

- Atlas Copco

- Ebara Corporation

- Flowserve Corporation

- Gorman-Rupp

- Grindex

- Grundfos Holding

- Kirloskar Brothers

- KSB SE

- Kubota Corporation

- Sulzer Ltd.

- Thomson Pump

- Tsurumi Manufacturing

- Wacker Neuson

- Weir Group

- Xylem

Recent Developments

- In February 2024, Cosmos Pumps introduced the Giant Dewatering Pump featuring 650 HP, 130m head, and a capacity of 1 million liters per hour, designed to address water challenges in deep mining operations worldwide.

- In August 2023: Xylem launched new Godwin HL270M Dri-Prime Pump enhanced efficiency, lowers costs and reduces downtime for construction and mining, potentially saving up to 10% in comparison to competitors. Field tests demonstrate simplified operations, reduced maintenance, and a positive impact on carbon emissions.

- October 2022: Flowserve Corporation and pump equipment manufacturing Chart Industries, Inc., have joined forces to promote the growth of hydrogen as a cleaner fuel source. Under this partnership, Flowserve will take over the in-process research and development associated with Chart's liquid hydrogen fueling pump, including dewatering equipment.

- In August 2023: Atlas Copco has agreed to acquire Sykes Group Pty Ltd, a prominent worldwide producer of pumps of de-watering, primarily employed for the transportation of water containing solids and abrasives in the wastewater and mining industries.

Dewatering Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 7.3 Billion |

|

Revenue forecast in 2034 |

USD 12.9 Billion |

|

CAGR |

7.20% from 2025– 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Type, By Capacity, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

Explore the market dynamics of the 2025 Dewatering Pumps Market share, size, and revenue growth rate, meticulously examined in the insightful reports crafted by Polaris Market Rersearch Industry Reports. The analysis of Dewatering Pumps Market extends to a comprehensive market forecast up to 2034, coupled with a retrospective examination. Avail yourself of a complimentary PDF download to sample this in-depth industry analysis.

Browse Our More Top Selling Reports:

Non-Invasive Prenatal Testing (Nipt) Market Size & Share

Dental Laboratory Welders Market Size & Share

Molecular Quality Controls Market Size & Share

FAQ's

The global Dewatering Pumps market size is expected to reach USD 12.9 Billion by 2034

Atlas Copco, Ebara Corporation, Gorman-Rupp, Weir Group, Wacker Neuson, Flowserve Corporation are the top market players in the Dewatering Pumps Market

Asia Pacific region contribute notably towards the global Dewatering Pumps Market

The global Dewatering Pumps market is expected to grow at a CAGR of 7.20% during the forecast period

The Dewatering Pumps Market report covering key segments are type, capacity, application, and region.