Molecular Quality Controls Market Share, Size, Trends, Industry Analysis Report

By Product (Independent Controls, and Instrument-specific Controls); By Technology; By Application; By End-Use; By Region; Segment Forecast, 2022 - 2030

- Published Date:Aug-2022

- Pages: 114

- Format: PDF

- Report ID: PM2533

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

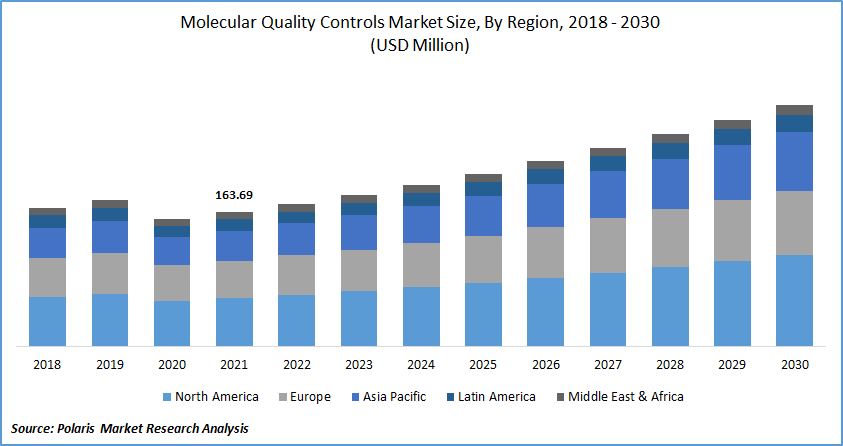

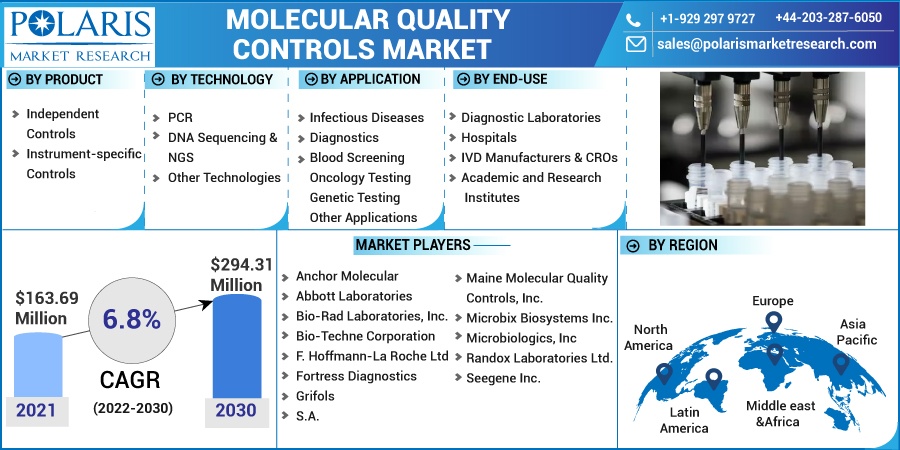

The global molecular quality controls market was valued at USD 163.69 million in 2021 and is expected to grow at a CAGR of 6.8% during the forecast period. The main applications of molecular quality controls are the surveillance of in vitro nucleic testing protocols for virologic assays, healthcare-associated infections (HAIs), such as infections caused, urinary infections, tuberculosis, as well as other infectious diseases associated with sexually transmitted disorders.

Contamination can occur at different stages in molecular microbiology. It can happen during specimen collection or transport or in the course of initial specimen handling by the laboratory. Also, the specimen can get contaminated during the extraction and amplification stages. The possible sources of contamination can take the form of amplified product, positive control material, operator who has the disease, and operator DNA. Currently, the three basic areas for controlling contamination are operator competency, lab design, and using controls to check for contamination.

In clinical microbiology, advances in the detection and quantification of nucleic acid have resulted in significant improvements in the monitoring and management of infectious diseases. Clinicians often use molecular diagnostic methods to monitor the effectiveness of a therapeutic method and make decisions regarding how and when to treat a patient. As such, the reliability of the results offered by the lab to the clinician is of paramount importance. Therefore, apt quality assurance and quality control methods are used to ensure that the lab methods meet the required regulatory requirements. The inclusion of additional tests by businesses in their portfolio is one of the primary factors driving the molecular quality controls market demand.

Know more about this report: Request for sample pages

The primary goal of molecular quality controls is to examine molecular diagnostic goods, find flaws, and notify management authorities about these. The rising adoption of molecular quality controls testing across various applications is driving industry growth over the forecast period.

Testing and reporting any irregularity in diagnostic products, which may have an impact on judgments about whether to approve the product for use in laboratories, is referred to as molecular quality controls. In-depth Quality Control (QC) processes are used by molecular laboratories to monitor testing for both systematic and random errors, identify sudden changes in data, and spot anomalies in long-term patterns.

The industry is favorably impacted by the rise in demand for efficient treatments, rise in healthcare costs, prevalence of HIV infection, population growth, lifestyle changes, and rise in need for external quality assessment help. The proliferation of studies on cancer and its related biomarkers is a key factor in this expansion.

For instance, as per the World Health Organization (WHO), roughly 10 million deaths, or about one in six deaths, will be caused by cancer in 2020, making it the top leading cause of death globally. The search for biomarkers by the major players is also progressing quickly. For instance, in October 2021, Roche announced the AVENIO Tumor Tissue CGP Kit's release.

The Component allows laboratories to increase their in-house oncology investigation while completing the CGP offering that Roche and Foundation Medicine currently offer. In the end, a new iteration of the kit might result in more tools for doctors to utilize in the detection and treatment of cancer.

The COVID-19 pandemic had a significant impact on business sales. Lockdowns impacted by the COVID-19 pandemic made people put off getting health checks, which had an impact on the volume of tests run. Responding to infectious diseases has emerged as a critical medical concern worldwide due to the COVID-19 pandemic.

Governments and healthcare providers are facing unheard-of issues as a result of COVID-19, which has also had an impact on the regulatory environment and procedures. Methods were used by regulatory authorities to expedite the approval of diagnostic products.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The World Health Organization (WHO) recommends that early detection and treatment can avoid 30 to 50 percent of cancer-related fatalities. The most successful strategy in this situation to treat diseases that have not been known to respond well to current treatments or solutions is personalized medicine. This factor is boosting the market growth over the forecast period.

Furthermore, several businesses have also added additional tests to their portfolio. For instance, in February 2022, ZeptoMetrix introduced the SARS-CoV-2 Omicron Control. The company's extensive lineup of communicable diseases quality controls now includes molecular quality controls.

Moreover, in August 2020, the UK Department of Health and Social Care (DHSC) partnered with Oxford Nanopore Technologies to supply LamPORE SARS-CoV-2 tests to the NHS to support the country's efforts to reduce the number of COVID-19 cases. As a result, the growing adoption of COVID-19 tests based on molecular control quality technologies, particularly RT-PCR, by the end users is expected to support the growth of the industry.

We strive to offer our clients the finest in market research with the most reliable and accurate research findings. We use industry-standard methodologies to offer a comprehensive and authentic analysis of the molecular quality controls market. Besides, we have stringent data-quality checks in place to enable data-driven decision-making for you.

Report Segmentation

The market is primarily segmented based on product, technology, application, end-use, and region.

|

By Product |

By Technology |

By Application |

By End-Use |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

The diagnostic Laboratories segment is expected to witness the fastest growth

The market saw the biggest revenue share earned by the diagnostic laboratories segment. In the upcoming years, there should be a rise in accredited diagnostic laboratories, offering prospective opportunities. The diagnostic laboratories segment is a significant market segment because of the growing demand for the molecular quality controls market, growing used of QC techniques, increasing frequency of regulatory actions, and increasing cost of molecular diagnostics.

In June 2022, Orange Health, a prominent health-tech start-up developing India's fastest diagnostic lab service, announced that the business had begun offering its system in New Delhi. Customers in the NCR region may now make use of a variety of diagnostic solutions in the convenience of their own homes in only 60 minutes, with reports available in 6 hours, owing to this introduction. Thus, the major player's contribution to the growth of the market is boosting the growth over the forecast period.

Independent controls accounted for the second-largest market share in 2021

The independent controls category held the biggest market share for molecular quality controls. The molecular quality controls market is expanding as a result of the rising number of laboratories and regulatory agencies' need for the implementation of QC controls to guarantee the correctness of test results.

For instance, ILAC organization, In 2021, ILAC MRA Signatories accredited about 85,000 laboratories, nearly 13,000 inspecting bodies, over 600 quality assurance providers, and 250 suppliers of reference materials. Thus, the rising number of such laboratories has increased the demand for the molecular quality controls market to check the result of the test.

The Infectious Diseases sector is expected to hold the significant revenue share

The advancement of assays for infectious diseases, the sharp rise in the incidences of infectious diseases, and the growing understanding of the efficacy of using molecular quality control technologies to prevent the emergence of infectious diseases are all credited with the large share of this market.

As per the World Economic Forum, the respiratory disease may be brought on by COVID-19, a coronavirus that has been identified. More than 1.5 million people have become infected with it in only a few short months. Over 89,000 people have died.

The fatal infectious disease is tuberculosis (TB). In 2016, more than 600,000 patients acquired drug-resistant TB. Up to 5 million individuals per year contract influenza. Sub-Saharan Africa accounts for 94 percent of malaria deaths worldwide. Thus, the rising infectious disease has increased the demand for diagnostic technologies.

The demand in North America is expected to witness significant growth

North America is anticipated to dominate the global molecular quality controls market. The region's market is expected to be fueled by a high adoption rate of cutting-edge infrastructure, growth in the number of diagnostic facilities, and recognized clinical laboratories. Due to a larger patient pool, the United States has the biggest market share in North America.

For instance, according to a U.S. Department of Health & Human Services report released in 2020, approximately 37,832 people in the U.S. received an HIV diagnosis in 2018, and 38,000 new HIV infections continue to occur in the U.S. This causes the rapid spread of various infectious diseases like meningitis and urinary tract infections, which fuel the market and help it contribute its outstanding share of the global market revenue over the forecast period.

China and Japan, and this market's expansion are mostly due to companies' significant R&D expenditures and an increase in the use of cutting-edge molecular quality control methods. Due to the rising awareness of chronic diseases and the rising disposable income of these economies, Australia and India are anticipated to become lucrative markets.

Competitive Insight

Some of the major players operating in the global market include Anchor Molecular, Abbott Laboratories, Bio-Rad Laboratories, Incorporation, Bio-Techne Corporation, F. Hoffmann-La Roche Ltd, Fortress Diagnostics, Grifols, S.A., Maine Molecular Quality Controls, Inc., Microbix Biosystems Inc., Microbiologics, Inc, Randox Laboratories Ltd., and Seegene Inc

Recent Developments

In June 2021, SeraCare collaborated with the International Quality Network for Pathology (IQN Path to produce and distribute a variety of highly characterized cell line genomic DNA and formalin-fixed.

Furthermore, in March 2020, Abbott Laboratories spent USD 2.4 billion on research and development, of which USD 10.80 billion went toward creating technologically cutting-edge diagnostic tools to bolster its product line.

Molecular Quality Controls Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 163.69 million |

|

Revenue forecast in 2030 |

USD 294.31 million |

|

CAGR |

6.8% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2022 to 2030 |

|

Segments Covered |

By Product, By Technolgy, By Application, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Anchor Molecular, Abbott Laboratories, Bio-Rad Laboratories, Inc., Bio-Techne Corporation, F. Hoffmann-La Roche Ltd, Fortress Diagnostics, Grifols, S.A., Maine Molecular Quality Controls, Inc., Microbix Biosystems Inc., Microbiologics, Inc, Randox Laboratories Ltd., and Seegene Inc. |

Navigate through the intricacies of the 2024 molecular quality controls market with precision, thanks to the comprehensive statistics on market share, size, and revenue growth rate assembled by Polaris Market Research Industry Reports. This thorough analysis not only provides a glimpse into the historical context but also extends its reach with a market forecast outlook until 2029. Immerse yourself in the richness of this industry analysis by securing a complimentary PDF download of the sample report.