Packaged Wastewater Treatment Market Size, Share, Trends, & Industry Analysis Report

By Technology (Extended Aeration, Moving Bed Biofilm Reactor), By System Type, By End User, and By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 128

- Format: PDF

- Report ID: PM5903

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

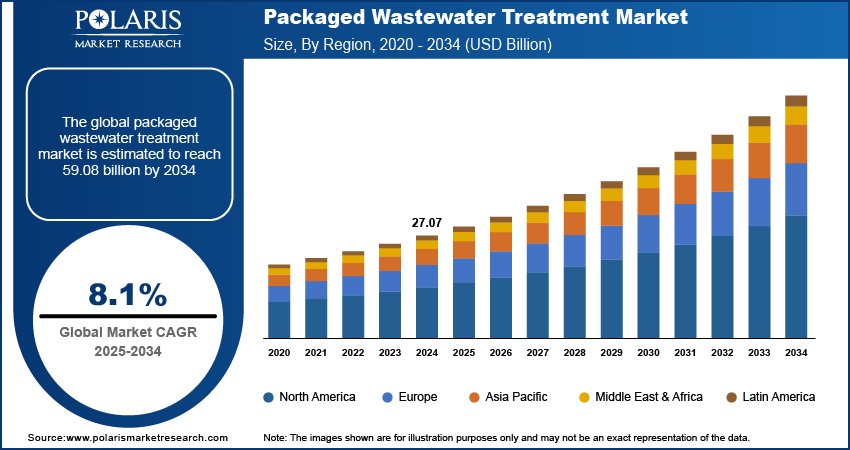

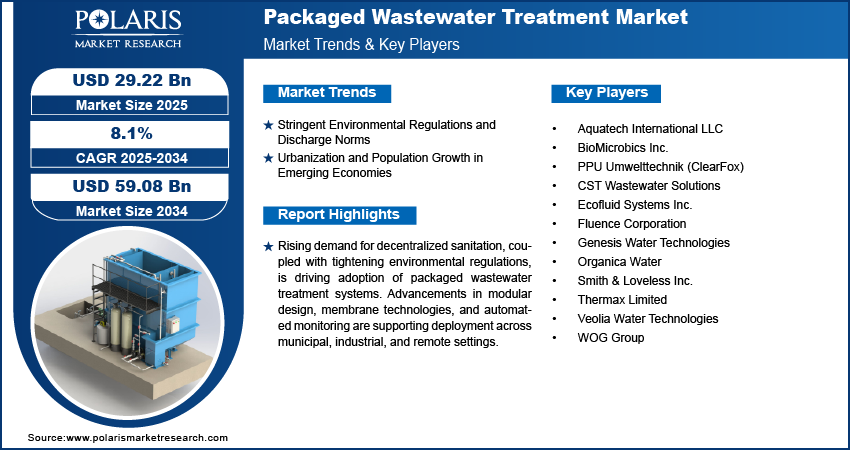

The global packaged wastewater treatment market size was valued at USD 27.07 billion in 2024, growing at a CAGR of 8.1% from 2025–2034. Strict environmental regulations combined with rapid urbanization in emerging economies are driving the adoption of packaged wastewater treatment systems to meet growing sanitation needs.

Packaged wastewater treatment systems are pre-engineered, compact units designed to manage wastewater in decentralized settings such as industrial parks, residential complexes, and remote locations. These systems combine primary, secondary, and tertiary treatment processes within a single setup, allowing for efficient installation and reduced infrastructural requirements. Modular layouts and automation features are incorporated to improve process stability, minimize manual intervention, and enable remote supervision. The adoption of real-time monitoring tools, advanced sensors, and energy-efficient components is enhancing operational control while addressing cost and space constraints. Membrane bioreactors, improved aeration systems, and optimized sludge handling mechanisms are contributing to better effluent quality and regulatory compliance.

The industry is responding to environmental mandates by integrating corrosion-resistant materials, odor management systems, and noise-reduction features to meet safety and sustainability standards. These systems are becoming a practical solution for areas with limited central infrastructure, offering flexibility in treating varying wastewater volumes and compositions. Manufacturers are focusing on standardized components, quick installation, and ease of maintenance to support broader market deployment. Features such as integrated chemical dosing units, enhanced nutrient removal, and remote diagnostics are further improving reliability and extending equipment life, making packaged wastewater treatment systems a dependable option for modern water management requirements.

To Understand More About this Research: Request a Free Sample Report

Expanding public infrastructure and smart cities planning are creating favorable conditions for the deployment of packaged wastewater treatment systems in residential, institutional, and urban development projects. For instance, in December 2024, H2O Innovation secured multiple North American projects totaling 22.55 MGD capacity, including its largest-ever wastewater plant in Canada, a 17.7 MGD ultrafiltration system in Innisfil and several membrane-based treatment facilities across Canada and the US. Municipal bodies and infrastructure developers are prioritizing systems that ensure rapid deployment, require minimal land area, and support compliance with sanitation benchmarks. In mixed-use and transit-oriented developments, packaged systems offer a practical solution for localized water and wastewater treatment equipment where centralized networks are unavailable or overburdened. The ability to integrate seamlessly into varied construction footprints makes these systems suitable for phased or space-constrained projects.

Rising advancements in prefabrication and standardized module design are supporting faster installation timelines and streamlined approvals to meet the operational requirements of large-scale developments. Equipment manufacturers are introducing compact plant layouts and integrated monitoring platforms that enhance ease of use for facility operators. In public-private partnership (PPP) models, packaged wastewater systems offer cost transparency and scalable deployment, allowing for predictable performance and simplified lifecycle management. Additionally, as urban planners prioritize infrastructure resilience and service continuity, decentralized systems are considered for emergency preparedness and redundancy in critical locations. These trends are significantly boosting the role of packaged wastewater treatment systems in future-ready infrastructure frameworks.

Industry Dynamics

Stringent Environmental Regulations and Discharge Norms

Governments across various regions are implementing stricter environmental policies to address the growing impact of untreated or inadequately treated wastewater on ecosystems and public health. Regulatory agencies are mandating compliance with effluent quality standards that specify permissible levels of contaminants, nutrients, and biological load in discharged water. As per the Environmental Protection Agency (EPA), approximately 42 million people get drinking water from sources likely polluted by coal plant wastewater. Over 23,000 miles of waterways were once affected, including 400 used for drinking. A new EPA rule aims to stop over 660 million pounds of pollutants from entering U.S. waters yearly. This regulatory shift is pushing industries, municipalities, and private developers to adopt treatment technologies that ensure consistent output quality under varying operational conditions. Non-compliance with these standards often results in financial penalties, license revocations, or reputational damage, further compelling end-users to seek reliable wastewater treatment systems.

Packaged wastewater treatment systems are recognized as an effective approach to meet these discharge norms without requiring extensive infrastructure upgrades. These units are designed to deliver standardized treatment performance and are often pre-tested to meet national or regional wastewater codes. Features such as real-time quality monitoring, enhanced sludge management, and nutrient removal capabilities are helping end-users maintain regulatory adherence with minimal supervision. The compact design and automation-integrated control mechanisms further reduce operational errors, ensuring consistent performance in compliance-sensitive environments. As regulatory frameworks become more rigorous, the packaged treatment segment is expected to gain wider acceptance as a dependable solution for long-term environmental compliance.

Urbanization and Population Growth in Emerging Economies

Urban expansion in emerging economies, driven by population growth and infrastructure development is boosting demand for decentralized wastewater treatment. According to the United Nations, the world’s population reached 8 billion and it is expected to reach 9 billion by 2037. Thus, this is impacting urbanization while putting pressure on existing sanitation networks that are outdated or insufficient to support growing demand. In regions lacking centralized wastewater infrastructure, there is a growing need for scalable and decentralized solutions to ensure quick and efficient deployment. Packaged wastewater treatment systems offer an ideal response to these challenges, as they do not require large-scale civil construction and can be adapted to various site conditions.

Population growth is also contributing to the expansion of residential townships, industrial parks, and public facilities, all of which require reliable sanitation infrastructure. Developers and municipal planners are seeking wastewater treatment options that are flexible, modular, and capable of accommodating fluctuations in wastewater volume and composition. Packaged systems can be adjusted based on demand, making them a flexible option for growing urban areas. Their ability to function independently while meeting environmental discharge requirements makes them a strategic choice in regions undergoing demographic transition and urban growth. As such developments continue, demand for compact, pre-engineered treatment units is expected to strengthen across the urban landscapes of developing nations.

Segmental Insights

Technology Analysis

The segmentation, based on technology includes, extended aeration, moving bed biofilm reactor (MBBR), reverse osmosis (RO), Membrane Bioreactor (MBR), sequential batch reactor (SBR), membrane aerated biofilm reactor (MABR), and other technology. The extended aeration segment is projected to grow substantially by 2034. This growth is attributed to its proven efficiency, operational simplicity, and low sludge production. Its ability to handle variable flows and organic loads makes it a preferred choice in small to medium-sized applications across decentralized municipal and institutional setups. In December 2024, Southland secured USD 60 million project to build a new wastewater treatment plant in the U.S. Southwest, which will include an extended aeration basin to improve treatment, along with new pump stations and support facilities. The process requires minimal operator input and offers consistent effluent quality, which supports compliance with discharge norms. Extended aeration systems are widely adopted due to their low capital cost, easy maintenance, and adaptability to different site conditions, making them a practical solution for long-term use in fixed-capacity installations.

The membrane bioreactor segment is projected to grow at a robust pace in the coming years, owing to their high-quality effluent output, compact footprint, and suitability for reuse applications. MBR technology integrates membrane filtration with biological treatment, allowing for superior separation of solids and enhanced nutrient removal. This makes it well-suited for industrial units and water-stressed regions focused on recycling treated wastewater. The increasing demand for advanced treatment performance in space-constrained environments, along with rising regulatory pressures, is contributing to the growing adoption of MBR systems across high-density urban areas and industrial zones.

System Type Analysis

The segmentation, based on system type includes, modular treatment plants, containerized systems, and skid-mounted systems. The modular treatment plants segment accounted for second largest revenue share in 2024, owing to their scalable design, ease of integration into infrastructure projects, and adaptability across diverse applications. These systems are engineered for phased expansion and are commonly used in residential complexes, commercial facilities, and municipal sites where treatment capacity may evolve over time. Their standardized configuration supports reduced construction time, streamlined logistics, and faster commissioning, which appeals to developers and operators managing growing urban infrastructure or changing population loads.

The containerized systems segment is projected to grow at a significant pace during the assessment phase, due to their mobility, compact design, and plug-and-play operation. These systems are widely used in remote locations, temporary construction sites, and emergency deployments where rapid setup is essential. Their transportability and minimal installation requirements make them ideal for off-grid or difficult-to-access areas. As governments and private players invest in decentralized sanitation solutions, containerized systems are becoming more popular for providing reliable treatment without needing permanent infrastructure.

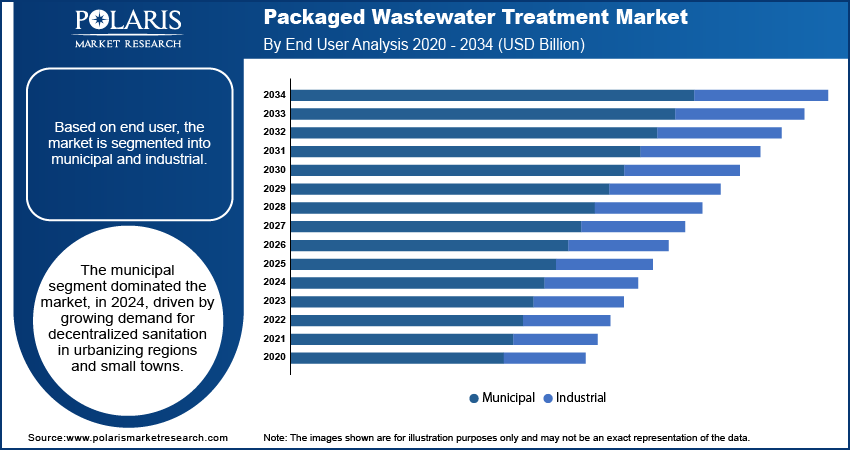

End User Analysis

The segmentation, based on end user includes, municipal and industrial The municipal segment dominated the market, in 2024, driven by growing demand for decentralized sanitation in urbanizing regions and small towns. Local governments and utility providers are adopting pre-engineered systems to bridge infrastructure gaps, meet environmental regulations, and serve expanding populations. For instance, in March 2025, El Paso started building the first U.S. plant that will turn wastewater directly into drinking water. By 2028, the project is expected to supply 10 million gallons of water per day and will meet approximately 9% of the city's total water requirements. These systems allow municipalities to deploy cost-effective and modular treatment solutions in areas where extending central networks may not be feasible, thereby improving access to safe and compliant wastewater management.

The industrial segment is estimated to hold a substantial market share in 2034, fueled by rising environmental compliance requirements and the need for on-site treatment in manufacturing units, food processing facilities, and pharmaceutical plants. Industries are increasingly investing in packaged systems to treat and recycle wastewater for internal use, reduce discharge volumes, and comply with sustainability targets. The flexibility of these systems to handle complex effluents and operate with minimal footprint is supporting their rapid adoption across multiple industrial sectors.

Regional Analysis

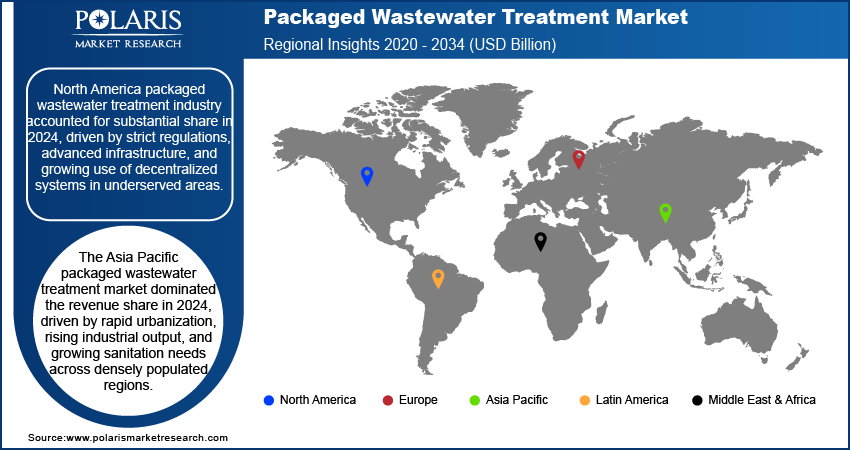

North America packaged wastewater treatment industry accounted for substantial share in 2024, driven by strict regulations, advanced infrastructure, and growing use of decentralized systems in underserved areas. The region is increasingly adopting compact treatment units across residential, commercial, and municipal applications, where central sewer access is limited. Demand is fueled by increasing focus on water reuse and modernizing old treatment systems. High funding capacity and strong technological capabilities further contribute to the market's expansion.

US Packaged Wastewater Treatment Market Insight

The US packaged wastewater treatment industry, captured significant regional share, due to robust environmental enforcement by the Environmental Protection Agency (EPA), rising water stress in multiple states, and increasing demand for flexible treatment options in growing urban and rural developments. Strong infrastructure funding and clear rules including the Clean Water Act are helping drive adoption in municipal and industrial sectors. For instance, in August 2024, the U.S. Department of Commerce announced USD 4 million to Independence, Oregon, to upgrade its wastewater plant, helping protect against natural disasters, support 250 jobs, and bring in USD 25 million in private investment. Many decentralized communities, industrial parks, and off-grid developments are deploying packaged systems to manage wastewater without extensive network expansion. Additionally, the focus on water reuse in states such as California, Texas, and Arizona is creating sustained demand for high-efficiency systems with advanced filtration and nutrient removal capabilities.

Asia Pacific Packaged Wastewater Treatment Market

The Asia Pacific packaged wastewater treatment market dominated the revenue share in 2024, driven by rapid urbanization, rising industrial output, and growing sanitation needs across densely populated regions. UN-HABITAT stated that Asia is home to over half of the world’s urban population, with 2.2 billion people, and this number is expected to grow by 1.2 billion by 2050. Countries such as India, China, Indonesia, and Vietnam are investing heavily in decentralized wastewater treatment infrastructure to serve expanding residential and industrial zones. Many peri-urban and rural areas still lack access to central sewage systems, creating high demand for compact and scalable treatment options. Government-led programs targeting smart cities, clean water access, and environmental protection are fueling the deployment of modular systems in schools, hospitals, residential colonies, and economic corridors.

Europe Packaged Wastewater Treatment Market Overview

Europe packaged wastewater treatment market growth is fueled by stringent wastewater management regulations, strong institutional frameworks, and widespread implementation of sustainable sanitation practices. As per the EU parliament, by 2035, all EU urban areas with greater than or equal to 1,000 population equivalent must apply secondary wastewater treatment, followed by tertiary treatment by 2039 and full micropollutant removal by 2045. The region long adopted decentralized systems in rural and semi-urban areas, and the demand is expanding due to increasing retrofitting requirements and the need for wastewater reuse. National policies that comply with the European Union's Urban Waste Water Treatment Directive are pushing for modern, compact systems that enable high-efficiency treatment and comply with nutrient removal targets. In regions with aging infrastructure, packaged systems are used to supplement or replace legacy units with minimal disruption.

Key Players & Competitive Analysis Report

The packaged wastewater treatment industry is highly competitive, driven by rising demand for decentralized and efficient sanitation solutions across residential, industrial, and infrastructure projects. Key manufacturers are focusing on modular design, compact layouts, and automation to support fast deployment, regulatory compliance, and space efficiency. Companies are expanding capacities, improving logistics, and offering tailored systems for varied load conditions. Emphasis on energy-saving technologies, sludge reduction, and real-time monitoring is enhancing system performance and environmental compliance. Sustainable innovation, including low-energy components and water reuse features, is gaining importance amid tightening discharge norms. Strategic partnerships and continued investment in smart control platforms and membrane technologies are reinforcing market growth and competitiveness.

Key companies in the packaged wastewater treatment industry include Fluence Corporation, Veolia Water Technologies, PPU Umwelttechnik (ClearFox), Organica Water, Aquatech International LLC, BioMicrobics Inc., WOG Group, Thermax Limited, Smith & Loveless Inc., Genesis Water Technologies, CST Wastewater Solutions, and Ecofluid Systems Inc.

Key Players

- Aquatech International LLC

- BioMicrobics Inc.

- PPU Umwelttechnik (ClearFox)

- CST Wastewater Solutions

- Ecofluid Systems Inc.

- Fluence Corporation

- Genesis Water Technologies

- Organica Water

- Smith & Loveless Inc.

- Thermax Limited

- Veolia Water Technologies

- WOG Group

Industry Developments

July 2025: Veolia launched a USD 38 million project in West Milford, New Jersey, to replace two aging wastewater plants with advanced membrane technology, aiming for improved efficiency and environmental protection by mid-2027.

January 2025: Axius Water acquired Aero‑Mod, a Kansas-based specialist in mechanical and biological wastewater treatment systems, to bolster its packaged nutrient removal solutions for small to mid‑scale municipal and industrial applications.

August 2024: Econse Water Technologies introduced Waterhorse MBR, a compact, cost-effective, packaged membrane bioreactor system for on-site wastewater treatment. It helps to suppor sustainable growth in developments ranging from small communities to resorts with modular scalability, real-time monitoring, and remote support.

Packaged Wastewater Treatment Market Segmentation

By Technology Outlook (Revenue, USD Billion, 2020–2034)

- Extended Aeration

- Moving Bed Biofilm Reactor (MBBR)

- Reverse Osmosis (RO)

- Membrane Bioreactor (MBR)

- Sequential Batch Reactor (SBR)

- Membrane Aerated Biofilm Reactor (MABR)

- Other Technology

By System Type Outlook (Revenue, USD Billion, 2020–2034)

- Modular Treatment Plants

- Containerized Systems

- Skid-Mounted Systems

By End User Type Outlook (Revenue, USD Billion, 2020–2034)

- Municipal

- Industrial

- Chemical and Pharma

- Oil and Gas

- Food, Pulp, and Paper

- Metal and Mining

- Power Generation

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Packaged Wastewater Treatment Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 27.07 Billion |

|

Market Size in 2025 |

USD 29.22 Billion |

|

Revenue Forecast by 2034 |

USD 59.08 Billion |

|

CAGR |

8.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 27.07 billion in 2024 and is projected to grow to USD 59.08 billion by 2034.

The global market is projected to register a CAGR of 8.1% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are Fluence Corporation, Veolia Water Technologies, ClearFox, Organica Water, Aquatech International LLC, BioMicrobics Inc., WOG Group, Thermax Limited, Smith & Loveless Inc., Genesis Water Technologies, CST Wastewater Solutions, and Ecofluid Systems Inc.

The municipal segment dominated the market, in 2024

The membrane bioreactor segment is projected to grow at a robust pace in the coming years.