U.S. Phosphoramidite Market Size, Share, Trends, & Industry Analysis Report

By Type (DNA Phosphoramidites, RNA Phosphoramidites), By Application, By End User, and By Country – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 130

- Format: PDF

- Report ID: PM6271

- Base Year: 2024

- Historical Data: 2020 - 2023

Market Overview

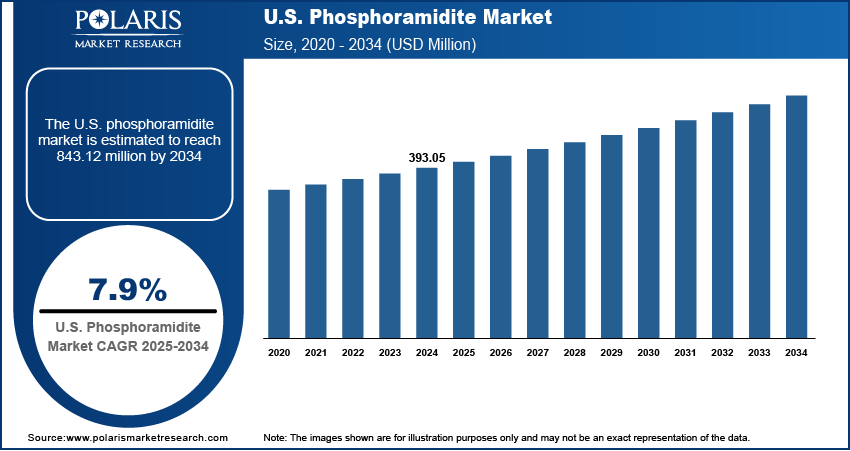

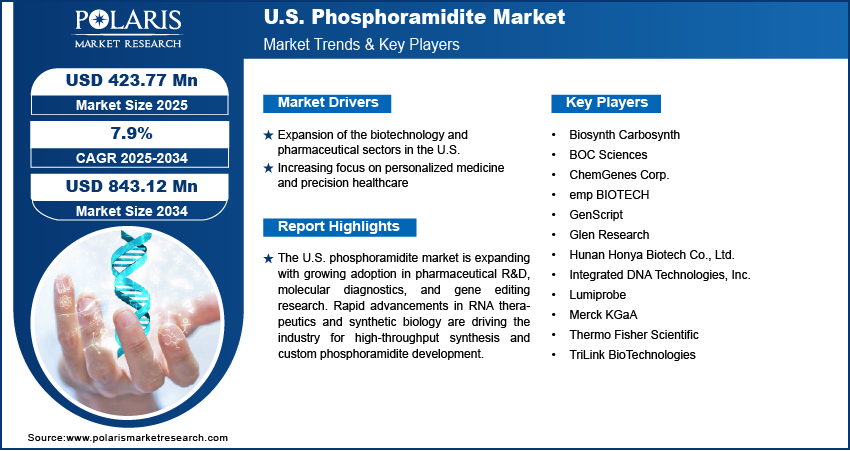

The U.S. phosphoramidite market size was valued at USD 393.05 million in 2024, growing at a CAGR of 7.9% during 2025–2034. The biotechnology and pharmaceutical sectors in the U.S. are expanding rapidly. This growth is driven by an increasing focus on personalized medicine and precision healthcare.

Key Insights

- The DNA phosphoramidites dominated the U.S. market in 2024 due to high demand in oligonucleotide synthesis for therapeutics and diagnostics.

- The gene editing and synthetic biology are projected to grow fastest, driven by CRISPR research and high-throughput phosphoramidite synthesis.

Industry Dynamics

- Expansion of biotechnology and pharmaceutical research, including gene therapies, RNA-based therapeutics and molecular diagnostics is driving demand for phosphoramidites in the U.S.

- Increasing focus on personalized medicine and precision healthcare fuels market growth by creating demand for customized oligonucleotide synthesis.

- Rising adoption of automated synthesis platforms and high-purity reagents creates opportunities for improved efficiency and scalability in phosphoramidite production.

- High production costs and complex manufacturing processes along with strict regulatory requirements, restrain market growth by limiting accessibility for smaller players.

Market Statistics

- 2024 Market Size: USD 393.05 Million

- 2034 Projected Market Size: USD 843.12 Million

- CAGR (2025–2034): 7.9%

To Understand More About this Research: Request a Free Sample Report

The U.S. phosphoramidite industry is driven by the growing adoption of nucleic acid-based therapeutics and diagnostics. Phosphoramidites serve as key building blocks for oligonucleotide synthesis, supporting applications in gene therapy, RNA interference, and DNA-based diagnostics. Manufacturers are investing in high-purity reagents, automated synthesis platforms, and process optimization to ensure consistent quality, reduce synthesis errors, and meet increasing demand from pharmaceutical and biotechnology companies. Sustainability measures, including solvent recycling and green chemistry approaches are implemented to minimize environmental impact and comply with regulatory standards.

Rising research activities in precision medicine and molecular diagnostics are expanding the application of phosphoramidites in personalized therapies, companion diagnostics, and next-generation sequencing. Innovations in reagent chemistry and process automation are improving yield, stability, and compatibility with high-throughput oligonucleotide synthesis. Key players are introducing customized phosphoramidite derivatives to meet specific therapeutic or diagnostic requirements, enhancing the ability to deliver targeted and efficient nucleic acid products.

Government and institutional support for advanced therapeutics and biotechnology research is boosting market growth. For instance, in April 2025, the U.S. congressional commission announced a USD 15 million federal biotech investment to boost U.S. biopharmaceutical manufacturing, which is expected to increase domestic demand for phosphoramidites used in oligonucleotide therapies. Funding for genomic research, RNA-based drug development and diagnostic infrastructure is enabling accelerated adoption of phosphoramidite-based synthesis. The focus on rapid, scalable, and cost-efficient production to meet industry standards for large-volume supply, high reproducibility and regulatory compliance. Thus, the combination of technological advancement, increasing therapeutic pipelines, and supportive policy frameworks positions the U.S. phosphoramidite market for its expansion.

Drivers & Opportunities

Expansion of the biotechnology and pharmaceutical sectors in the U.S.: The U.S. biotechnology and pharmaceutical sectors are experiencing significant growth due to rising investments in research, development, and advanced therapeutics. In July 2025, AstraZeneca announced a USD 50 million U.S. investment by 2030 to expand manufacturing and R&D for chronic disease treatments, boosting domestic production. This expansion impacts the demand for phosphoramidites, essential for synthesizing oligonucleotide-based therapies in their pipeline. Expanding R&D facilities and collaborations with academic institutions are accelerating innovation in nucleic acid-based therapies. Increased funding for clinical trials and regulatory support for novel drugs are driving demand for high-purity phosphoramidites used in oligonucleotide synthesis. Growth in the number of biotech startups and the scaling of existing pharmaceutical companies is creating consistent demand for reliable reagent supply, automated synthesis platforms, and customized chemical intermediates.

Increasing focus on personalized medicine and precision healthcare: The growing focus on personalized medicine is boosting demand for phosphoramidites as essential building blocks in targeted therapies and diagnostics. Advances in genomic profiling, RNA-based therapeutics, and biomarker-driven treatment strategies are expanding applications for oligonucleotide synthesis. Pharmaceutical and biotechnology companies are rapidly adopting customized phosphoramidite derivatives to develop patient-specific therapies. High-throughput and automated synthesis systems are integrated to support rapid development cycles. This focus on precision healthcare is driving demand for consistent quality, scalability, and innovative reagents to meet the evolving needs of individualized treatment approaches.

Segmental Insights

Type Analysis

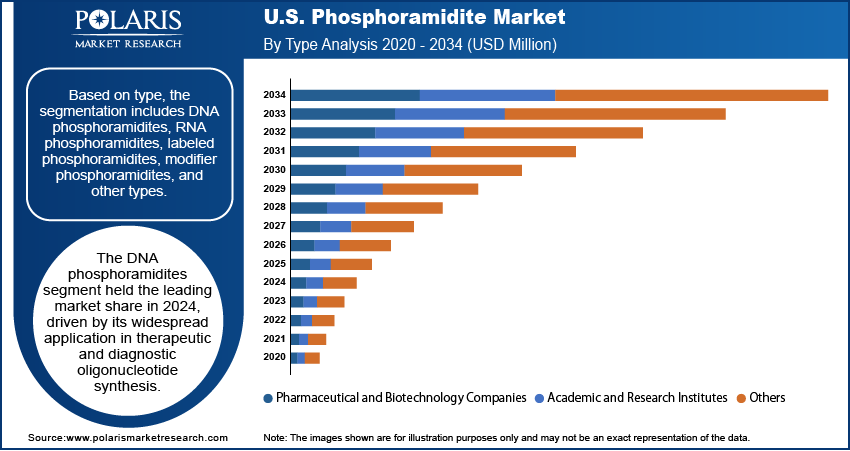

Based on type, the segmentation includes DNA phosphoramidites, RNA phosphoramidites, labeled phosphoramidites, modifier phosphoramidites, and other types. The DNA phosphoramidites segment dominated the market in 2024, driven by its extensive use in oligonucleotide synthesis for gene therapies, RNA interference, and diagnostic applications. High demand from pharmaceutical and biotechnology companies for high-purity reagents ensures steady revenue growth. Advances in automated synthesis and improved reagent stability further support market leadership. Manufacturers are optimizing production processes to meet stringent quality requirements, minimize errors, and enable large-scale supply, maintaining DNA phosphoramidites as the preferred choice for most nucleic acid-based applications.

The RNA phosphoramidites segment is projected to grow at the fastest CAGR during the forecast period. Rising adoption of RNA-based therapeutics, including mRNA vaccines and RNA interference therapies, is driving demand. Technological improvements in RNA synthesis, reagent stabilization, and high-throughput automation are supporting rapid market expansion. Increasing research in personalized medicine and gene regulation further fuels uptake. Manufacturers are investing in process optimization and custom RNA derivatives, enabling precise and scalable synthesis to meet growing industry requirements.

Application Analysis

By application, the segment includes drug discovery & development, diagnostics development, gene editing & synthetic biology and other applications. The drug discovery and development segment dominated the market in 2024, driven by the extensive use of phosphoramidites in synthesizing oligonucleotides for therapeutic research. Pharmaceutical companies rely on high-purity reagents for early-stage screening, preclinical studies, and clinical trials. Integration of automated synthesis platforms ensures reproducibility and efficiency, supporting large-scale research pipelines. Growing focus on gene therapy, RNA therapeutics, and nucleic acid-based drugs strengthens demand. Investments in high-throughput synthesis, quality control, and reagent customization maintain the segment’s leadership in revenue generation.

The gene editing and synthetic biology segment is projected to expand at the fastest CAGR. CRISPR-based research, synthetic gene constructs, and RNA-guided therapies are increasing the need for precise phosphoramidite reagents. Rising academic and industrial research in genome engineering, functional genomics, and synthetic biology platforms is driving demand. Innovations in reagent stability, yield optimization, and automation are supporting rapid adoption. Custom phosphoramidites for targeted gene modifications enable high specificity and efficiency, positioning this segment for accelerated growth during the forecast period.

End User Analysis

Based on end user, the segmentation includes pharmaceutical and biotechnology companies, academic and research institutes, and other end users. The pharmaceutical and biotechnology companies dominated the market in 2024, driven by large-scale R&D operations and increasing therapeutic pipelines. These companies require high-purity phosphoramidites for drug discovery, RNA therapeutics, and diagnostic development. Strategic collaborations with reagent suppliers and adoption of automated synthesis platforms enhance productivity and quality control. Growing investment in oligonucleotide-based drug development, coupled with rising demand for scalable and reproducible synthesis, positions this segment as the leading revenue contributor.

The academic and research institutes are projected to expand at the fastest CAGR during the forecast period. Increasing focus on gene editing, molecular diagnostics, and synthetic biology is driving phosphoramidite consumption in laboratories. As per the National Center for Science and Engineering Statistics (NCSES), the U.S. universities and colleges dedicated 236.1 million square feet to research facilities in 2021, up from 202.2 million in 2011. It also invested USD 12.8 million in 2022–2023 to add 10.6 million square feet of new research space. Advancements in high-throughput oligonucleotide synthesis and cost-effective reagent access support research scalability. Funding for genomic research and personalized medicine projects fuels demand. Institutes are adopting customized phosphoramidite derivatives and automation tools to conduct precise, reproducible experiments, accelerating adoption and positioning this segment for strong growth.

Key Players & Competitive Analysis Report

The U.S. phosphoramidite industry is moderately competitive, driven by growing demand from pharmaceutical, biotechnology, and academic research applications. Leading manufacturers are focusing on high-purity reagent production, automated oligonucleotide synthesis, and robust supply chains to meet diverse customer requirements. Competitive positioning is influenced by investments in custom phosphoramidite derivatives, scalable production processes, and process optimization for improved yield and stability. Companies are enhancing operational efficiency through high-throughput synthesis platforms, digital process monitoring, and integrated inventory systems. Additionally, rising partnerships with research institutes and biotech firms are expanding market reach, while adoption of sustainable production practices supports regulatory compliance and environmental responsibility.

Key companies in the U.S. phosphoramidite industry include Glen Research, TriLink BioTechnologies, Thermo Fisher Scientific, ChemGenes Corp., Biosynth Carbosynth, BOC Sciences, emp BIOTECH, Lumiprobe, Hunan Honya Biotech Co., Ltd., GenScript, Integrated DNA Technologies, Inc., and Merck KGaA.

Key Players

- Biosynth Carbosynth

- BOC Sciences

- ChemGenes Corp.

- emp BIOTECH

- GenScript

- Glen Research

- Hunan Honya Biotech Co., Ltd.

- Integrated DNA Technologies, Inc.

- Lumiprobe

- Merck KGaA

- Thermo Fisher Scientific

- TriLink BioTechnologies

Industry Developments

September 2025: Ansa Biotechnologies synthesized a 1,005-base oligonucleotide using its enzymatic platform, offering a more accurate and scalable alternative to traditional phosphoramidite methods.

May 2024: Codexis showcased its enzymatic oligonucleotide synthesis platform as a more efficient, sustainable alternative to traditional phosphoramidite methods for producing RNA therapeutics.

U.S. Phosphoramidite Market Segmentation

By Type Outlook (Revenue, USD Million, 2020–2034)

- DNA Phosphoramidites

- RNA Phosphoramidites

- Labeled Phosphoramidites

- Modifier Phosphoramidites

- Other Types

By Application Outlook (Revenue, USD Million, 2020–2034)

- Drug Discovery & Development

- Diagnostics Development

- Gene Editing & Synthetic Biology

- Other Applications

By End User Outlook (Revenue, USD Million, 2020–2034)

- Pharmaceutical and Biotechnology Companies

- Academic and Research Institutes

- Other End Users

U.S. Phosphoramidite Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 393.05 Million |

|

Market Size in 2025 |

USD 423.77 Million |

|

Revenue Forecast by 2034 |

USD 843.12 Million |

|

CAGR |

7.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The U.S. market size was valued at USD 393.05 million in 2024 and is projected to grow to USD 843.12 million by 2034.

The U.S. market is projected to register a CAGR of 7.9% during the forecast period.

A few of the key players in the market are Glen Research, TriLink BioTechnologies, Thermo Fisher Scientific, ChemGenes Corp., Biosynth Carbosynth, BOC Sciences, emp BIOTECH, Lumiprobe, Hunan Honya Biotech Co., Ltd., GenScript, Integrated DNA Technologies, Inc., and Merck KGaA.

The DNA phosphoramidites segment dominated the market in 2024, driven by its extensive use in oligonucleotide synthesis for therapeutic research, RNA interference, and diagnostic applications.

The gene editing and synthetic biology segment is projected to grow at the fastest CAGR, due to increasing research in CRISPR-based therapies, synthetic gene constructs, and precision medicine applications.