Synthetic Biology Market Size, Share, Trends, Industry Analysis Report

: By Product (Oligonucleotide/Oligo Pools & Synthetic DNA, Enzymes, Cloning Technologies Kits, Xeno-Nucleic Acids, and Chassis Organism), Technology, Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 118

- Format: PDF

- Report ID: PM3239

- Base Year: 2024

- Historical Data: 2020-2023

Synthetic Biology Market Overview

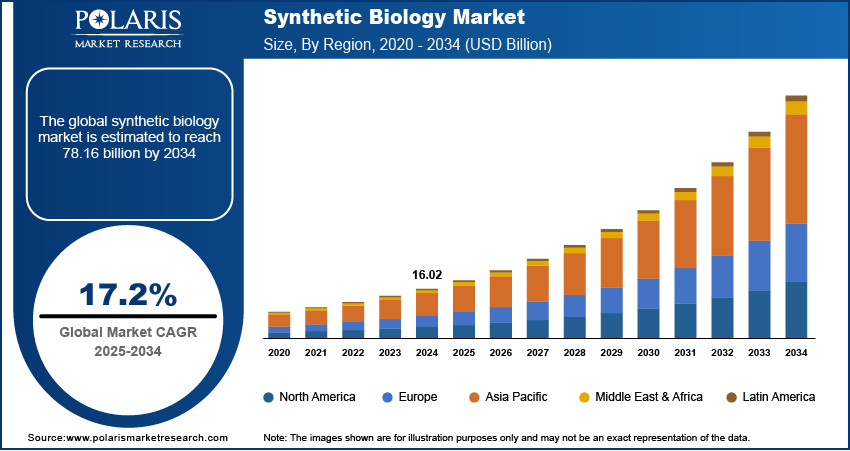

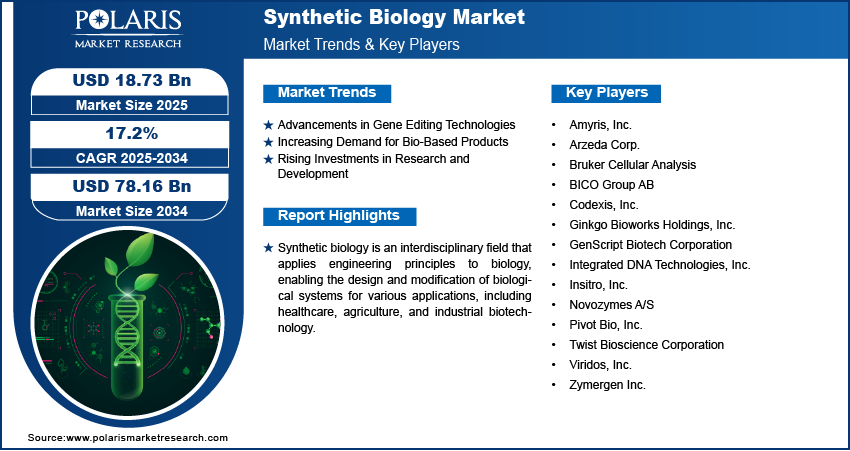

The synthetic biology market size was valued at USD 16.02 billion in 2024. The market is projected to grow from USD 18.73 billion in 2025 to USD 78.16 billion by 2034, exhibiting a CAGR of 17.2% during 2025–2034.

The synthetic biology market involves the design and engineering of biological systems for applications in healthcare, agriculture, industrial biotechnology, and environmental sustainability. Key drivers include advancements in gene editing technologies, increasing demand for bio-based products, and rising investments in research and development. The market is also influenced by the growing adoption of synthetic biology in drug discovery, personalized medicine, and sustainable bio-manufacturing, which is further contributing to the market growth. Emerging synthetic biology market trends include the integration of artificial intelligence in genetic engineering, expansion of CRISPR-based applications, and the development of cell-free synthetic biology systems.

To Understand More About this Research: Request a Free Sample Report

Synthetic Biology Market Dynamics

Advancements in Gene Editing Technologies

The synthetic biology market is significantly propelled by continuous advancements in gene editing technologies, notably CRISPR-Cas9. These tools have revolutionized the precision and efficiency of genetic modifications, enabling researchers to engineer organisms with desired traits more effectively. The National Institutes of Health highlights that such technologies have accelerated the development of therapeutic applications and agricultural innovations, contributing to the synthetic biology market demand.

Increasing Demand for Bio-Based Products

There is a growing consumer and industrial demand for bio-based products as sustainable alternatives to traditional petrochemical-based goods. Synthetic biology facilitates the production of biofuels, biodegradable plastics, and other environmentally friendly materials. The World Economic Forum emphasizes that leveraging synthetic biology can address critical challenges in manufacturing and agriculture, promoting a more sustainable and resilient bioeconomy.

Rising Investments in Research and Development

The expansion of the synthetic biology market is driven by substantial investments in research and development from both governmental and private sectors. In July 2022, SynBioVen committed USD 5.7 million to SynbiCITE, the UK's National Centre for the Industrial Translation of Synthetic Biology. This influx of funding supports the advancement of synthetic biology applications across various industries, fostering innovation and accelerating the commercialization of new technologies.

Synthetic Biology Market Segment Insights

Synthetic Biology Market Assessment by Product Outlook

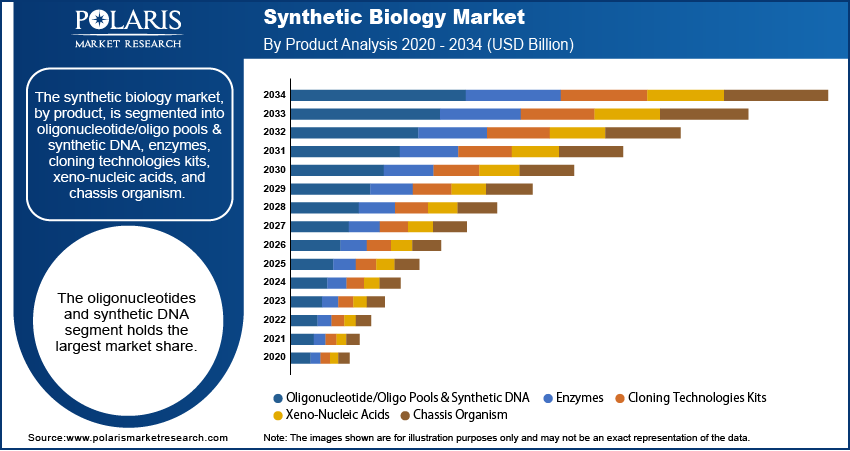

The synthetic biology market, by product, is segmented into oligonucleotide/oligo pools & synthetic DNA, enzymes, cloning technologies kits, xeno-nucleic acids, and chassis organisms. The oligonucleotides and synthetic DNA segment held the largest share in 2024. This dominance is attributed to the increasing demand for synthetic DNA and RNA, which are essential in various applications such as gene synthesis, cloning, and molecular diagnostics. The widespread adoption of these products in research and development activities across biotechnology and pharmaceutical industries further reinforces their market position. Additionally, advancements in DNA synthesis technologies have made the production of oligonucleotides more efficient and cost-effective, thereby boosting their utilization.

The enzymes segment is experiencing the highest growth within the synthetic biology market. Enzymes play a crucial role as biocatalysts in numerous biochemical reactions, facilitating processes such as DNA replication, transcription, and repair. The surge in applications of enzymes spans across various sectors, including industrial biotechnology, where they are employed in the production of biofuels and bioplastics, as well as in healthcare for drug development and diagnostics. The growing emphasis on sustainable industrial processes and the development of novel therapeutics contributes to the escalating demand for specialized enzymes, thereby propelling the growth of this segment.

Synthetic Biology Market Evaluation by Technology Outlook

The synthetic biology market, by technology, is segmented into NGS technology, PCR technology, genome editing technology, bioprocessing technology, and other technologies. The polymerase chain reaction (PCR) technology segment dominated the synthetic biology market share in 2024. PCR's widespread application in amplifying DNA sequences has made it indispensable in various fields, including medical research, diagnostics, and the food and beverage industry. Its ability to rapidly and accurately replicate DNA segments has solidified its position as a cornerstone technology in modern life sciences. The versatility and reliability of PCR have driven its extensive adoption, contributing significantly to its dominant market presence.

The genome editing technology segment is experiencing the highest growth. Techniques such as CRISPR-Cas9 have revolutionized the ability to precisely modify genetic material, enabling advancements in therapeutic development, agriculture, and industrial biotechnology. The potential to correct genetic defects, enhance crop resilience, and engineer microorganisms for biofuel production has spurred significant interest and investment in genome editing technologies. This surge in applications and ongoing research efforts underscore the rapid expansion and promising future of the genome editing segment in synthetic biology.

Synthetic Biology Market Assessment by Application Outlook

The synthetic biology market, by application, is segmented into healthcare and non-healthcare. The healthcare segment holds the largest market share in 2024, due to its pivotal role in advancing innovative therapies and diagnostics. Synthetic biology has significantly enhanced treatment options for chronic and rare diseases through developments in gene editing, personalized medicine, and biopharmaceuticals. The increasing demand for targeted therapies and efficient drug development processes has driven substantial investment and research in this field. Moreover, synthetic biology enables the creation of customized biologics and improved vaccines, as evidenced during the COVID-19 pandemic. This focus on healthcare innovation, coupled with supportive regulatory environments, has solidified the healthcare segment's leadership in the synthetic biology industry.

The non-healthcare segment is experiencing the highest growth within the synthetic biology market. This surge is attributed to expanding applications in industries such as agriculture, energy, and materials. Innovations in synthetic biology facilitate the development of biofuels, sustainable bioplastics, and enhanced crop solutions, driving demand for eco-friendly alternatives. As companies aim to reduce environmental impact and improve efficiency, investments in synthetic biology techniques are on the rise.

Synthetic Biology Market Regional Outlook

By region, the study provides synthetic biology market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest share of the synthetic biology market revenue, primarily due to its robust research infrastructure and significant investments in biotechnology. The presence of leading companies, such as Ginkgo Bioworks, headquartered in Boston, Massachusetts, has fostered innovation and accelerated the adoption of synthetic biology applications across various industries. Additionally, substantial funding from public and private sectors has propelled synthetic biology market expansion in the region.

The Europe synthetic biology market is experiencing significant growth, driven by a robust research infrastructure and substantial investments in biotechnology. Countries such as Germany, the UK, and France are at the forefront, with numerous research institutions and universities engaged in advanced biotechnological research. For instance, Germany's emphasis on innovation and sustainable industrial processes has propelled the adoption of synthetic biology applications across various sectors. Additionally, supportive government policies and funding initiatives, such as the European Union's Horizon Europe program, bolster research and development activities, further accelerating market expansion in the region.

The Asia Pacific synthetic biology market is witnessing rapid advancements, fueled by increasing investments in biotechnology and a growing demand for eco-friendly solutions. Nations such as China, India, and Japan are implementing strategic initiatives to integrate synthetic biology into sectors such as agriculture, healthcare, and energy. China, in particular, has seen a surge in biotechnology innovation, supported by government initiatives and significant investments in precision medicine. Collaborations between academic institutions and industry players are supporting a dynamic ecosystem, enhancing research outputs and commercial applications of synthetic biology in the region.

Synthetic Biology Market – Key Players and Competitive Insights

The competitive landscape of the synthetic biology market is defined by intense innovation, strategic collaborations, and increasing investments in research and development. Market players are focusing on advancements in gene editing, DNA synthesis, and bioengineering to develop novel solutions across industries such as healthcare, agriculture, and industrial biotechnology. The growing integration of artificial intelligence (AI) and machine learning in synthetic biology is enhancing precision and efficiency, driving competition among key stakeholders. Strategic mergers and acquisitions, and partnerships are prevalent, enabling companies to expand product portfolios, enhance research capabilities, and accelerate commercialization efforts. The demand for sustainable and bio-based alternatives is shaping the synthetic biology market trends, with companies developing synthetic biology solutions for biopharmaceuticals, biofuels, and biodegradable materials. Regulatory compliance, intellectual property rights, and ethical considerations remain crucial factors influencing competition. As technological advancements continue to evolve, companies are striving for scalability, cost reduction, and enhanced biosafety, intensifying competition in the synthetic biology market.

Several key players in the synthetic biology market are actively contributing to advancements across various sectors. These include Amyris, Inc.; Bruker Cellular Analysis; BICO Group AB; Codexis, Inc.; Ginkgo Bioworks Holdings, Inc.; GenScript Biotech Corporation; Integrated DNA Technologies, Inc.; Insitro, Inc.; Novozymes A/S; Pivot Bio, Inc.; Twist Bioscience Corporation; Viridos, Inc.; and Zymergen Inc. (Acquired by Ginkgo Bioworks Holdings, Inc.

Ginkgo Bioworks Holdings, Inc., established in 2008 and headquartered in Boston, Massachusetts, specializes in cell programming and biosecurity. The company offers end-to-end services across various industries, including pharmaceuticals, agriculture, and industrial chemicals. Ginkgo's platform enables the design and engineering of custom organisms to address specific needs in these sectors. Ginkgo Bioworks specializes in synthetic biology by programming cells to create bio-based products for industries such as pharmaceuticals, food, and agriculture. Its platform leverages DNA code design and debugging to enable sustainable manufacturing and living medicines

Twist Bioscience Corporation, founded in 2013 and based in South San Francisco, California, focuses on synthetic DNA production. Utilizing a proprietary silicon-based DNA synthesis platform, Twist manufactures a wide range of products, such as synthetic genes, next-generation sequencing tools, and antibody libraries. These offerings serve diverse applications in healthcare, industrial chemicals, agriculture, and academic research. Twist Bioscience utilizes a proprietary silicon-based DNA synthesis platform to produce synthetic DNA for applications like drug discovery, diagnostics, and data storage. The company offers long genes, NGS tools, and antibody libraries for industries including healthcare and agriculture.

List of Key Companies in Synthetic Biology Market

- Amyris, Inc.

- Bruker Cellular Analysis

- BICO Group AB

- Codexis, Inc.

- Ginkgo Bioworks Holdings, Inc.

- GenScript Biotech Corporation

- Integrated DNA Technologies, Inc.

- Insitro, Inc.

- Novozymes A/S

- Pivot Bio, Inc.

- Twist Bioscience Corporation

- Viridos, Inc.

- Zymergen Inc. (Acquired by Ginkgo Bioworks Holdings, Inc.

Synthetic Biology Industry Developments

- November 2024: Ginkgo Bioworks achieved the first milestone in its collaboration with Merck, aimed at enhancing biologics manufacturing. This milestone resulted in a $9 million payment to Ginkgo and marked progress in improving production efficiency and yield for biologic therapies.

- August 2024: Integrated DNA Technologies enhanced synthetic biology portfolio with the introduction of rapid genes and substantial enhancements to gene synthesis capabilities.

Synthetic Biology Market Segmentation

By Product Outlook (Revenue – USD Billion, 2020–2034)

- Oligonucleotide/Oligo Pools & Synthetic DNA

- Enzymes

- Cloning Technologies Kits

- Xeno-Nucleic Acids

- Chassis Organism

By Technology Outlook (Revenue – USD Billion, 2020–2034)

- NGS Technology

- PCR Technology

- Genome Editing Technology

- Bioprocessing Technology

- Other Technologies

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Healthcare

- Non-Healthcare

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Synthetic Biology Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 16.02 billion |

|

Market Size Value in 2025 |

USD 18.73 billion |

|

Revenue Forecast by 2034 |

USD 78.16 billion |

|

CAGR |

17.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy: The synthetic biology market has been broadly segmented on the basis of product, technology, and application. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Growth/Marketing Strategy: The synthetic biology market growth and marketing strategy focuses on technological advancements, strategic collaborations, and expanding application areas. Companies invest in research and development to enhance gene synthesis, genome editing, and bio-manufacturing capabilities. Partnerships with pharmaceutical, agricultural, and industrial sectors drive commercialization and large-scale adoption. Market players also focus on mergers, acquisitions, and funding initiatives to strengthen their positions. Additionally, regulatory compliance and sustainability initiatives play a key role in market expansion. Targeted marketing efforts highlight cost-effective solutions and industry-specific applications to attract customers.

FAQ's

The synthetic biology market size was valued at USD 16.02 billion in 2024 and is projected to grow to USD 78.16 billion by 2034.

The market is projected to register a CAGR of 17.2% during 2025–2034.

North America held the largest share of the market in 2024.

Several key players are actively contributing to advancements across various sectors. These include Amyris, Inc.; Bruker Cellular Analysis; BICO Group AB; Codexis, Inc.; Ginkgo Bioworks Holdings, Inc.; GenScript Biotech Corporation; Integrated DNA Technologies, Inc.; Insitro, Inc.; Novozymes A/S; Pivot Bio, Inc.; Twist Bioscience Corporation; Viridos, Inc.; and Zymergen Inc. (Acquired by Ginkgo Bioworks Holdings, Inc.).

The oligonucleotide/oligo pools & synthetic DNA segment accounted for the largest share of the market in 2024.

Synthetic biology is an interdisciplinary field that combines biology, engineering, and computational science to design and construct new biological parts, systems, and organisms or modify existing ones for specific applications. It involves techniques such as gene synthesis, genome editing, and metabolic engineering to develop customized biological solutions. Applications of synthetic biology span various industries, including healthcare, agriculture, biofuels, and industrial biotechnology, enabling advancements in drug development, sustainable materials, and environmentally friendly bio-manufacturing processes.

A few key trends in the market are described below: Advancements in Genome Editing Technologies – The increasing adoption of CRISPR and other gene-editing tools is driving innovations in synthetic biology applications, particularly in healthcare and agriculture. Growing Focus on Sustainable Bio-Manufacturing – Companies are leveraging synthetic biology to develop bio-based alternatives for chemicals, plastics, and fuels, reducing reliance on fossil resources. Rising Investments and Collaborations – Public and private funding, along with strategic partnerships between biotech firms, academic institutions, and industrial players, are accelerating research and commercialization. Expansion in Personalized Medicine and Drug Discovery – Synthetic biology is being used to develop customized therapies, biosensors, and engineered cell therapies for targeted disease treatment.

A new company entering the synthetic biology market can focus on niche areas such as AI-driven bioengineering, cost-effective DNA synthesis, or sustainable bio-manufacturing. Investing in advanced genome editing tools, such as CRISPR-based platforms, can provide a competitive edge in healthcare and agriculture. Developing bio-based alternatives to petrochemicals, plastics, and pharmaceuticals can align with increasing sustainability demands. Collaborating with pharmaceutical and industrial biotech firms for customized synthetic biology solutions can drive market penetration. Additionally, ensuring regulatory compliance and prioritizing biosecurity measures can enhance credibility and long-term growth.