Plasmid DNA Manufacturing Market Size, Share, Trends, Industry Analysis Report

By Grade (R&D Grade, GMP Grade), By Development Phase, By Application, By Disease, By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 125

- Format: PDF

- Report ID: PM6259

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

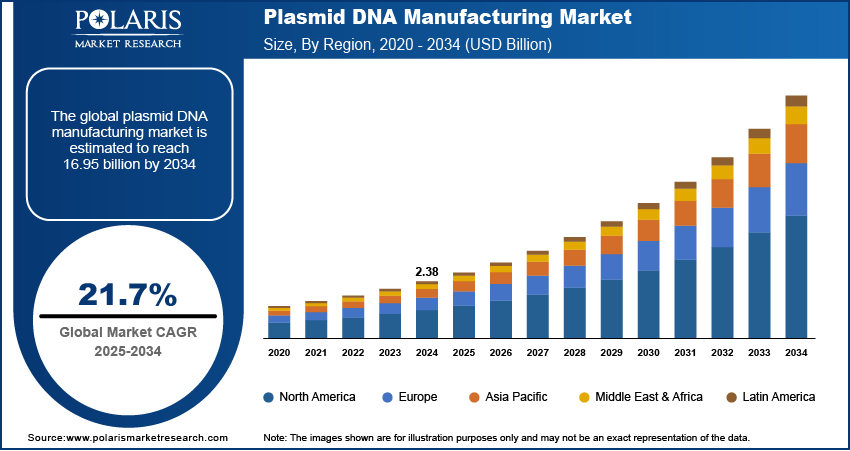

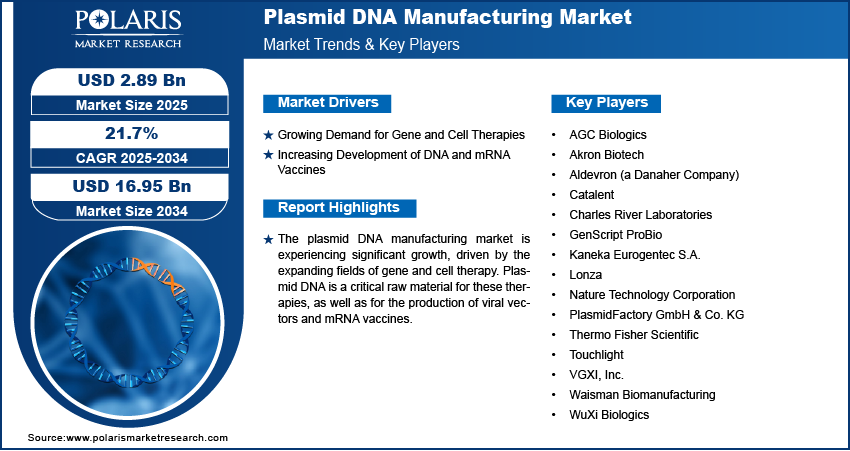

The global plasmid DNA manufacturing market size was valued at USD 2.38 billion in 2024 and is anticipated to register a CAGR of 21.7% from 2025 to 2034. The demand for gene and cell therapies drives the growth of the plasmid DNA manufacturing industry, as these advanced treatments rely on high-quality plasmid DNA. Another major driver is the growing need for vaccines, particularly DNA and mRNA vaccines, which use plasmid DNA as a critical component.

Key Insights

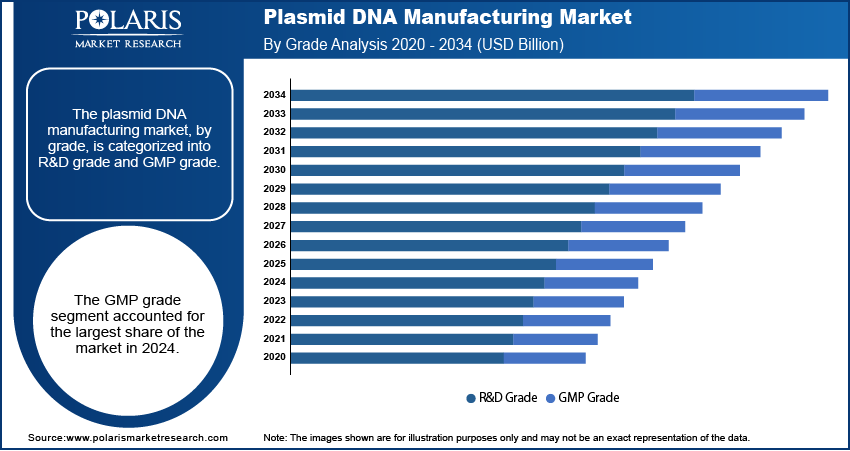

- By grade, the GMP grade segment held the largest share in 2024 due to the high demand for clinical and commercial use in advanced therapies. These plasmids must meet strict regulatory standards for safety and quality, which makes this segment essential for bringing new treatments to market.

- By development phase, the clinical therapeutics segment held the largest share in 2024, driven by the large and growing number of gene and cell therapies currently in various stages of clinical trials. The need for a consistent and high-quality supply of plasmids for these trials is a major factor contributing to this segment's leading position.

- By application, the cell and gene therapy segment held the largest share in 2024, as plasmid DNA is a core component for creating these innovative treatments. The rising number of gene and cell therapies being developed and commercialized for diseases such as cancer and genetic disorders is the main reason for its market dominance.

- By disease, the cancer segment held the largest share in 2024 because of the increasing use of plasmid DNA in developing gene therapies, immunotherapies, and vaccines for various cancers. The high prevalence of cancer and continuous research efforts in this area create a substantial and ongoing demand for plasmid DNA.

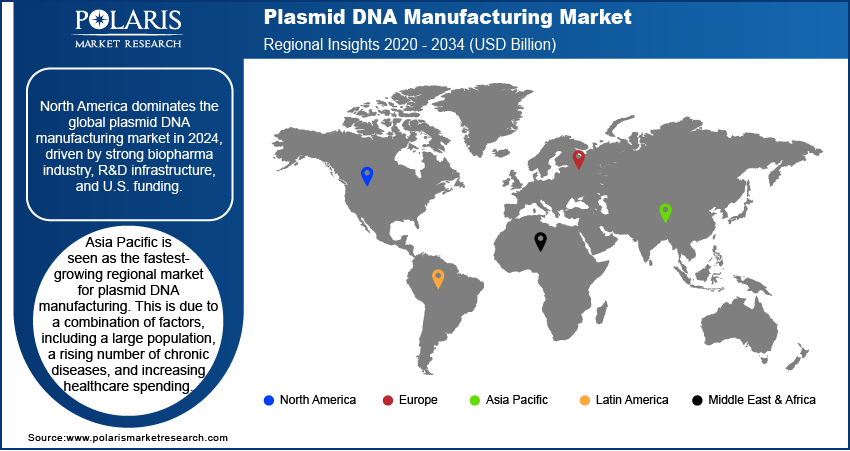

- North America leads the regional market for plasmid DNA manufacturing. This is attributed to the presence of a strong biopharmaceutical industry, extensive research and development infrastructure, and significant funding for advanced therapeutic development, particularly in the U.S.

Industry Dynamics

- A major growth factor is the rising demand for gene and cell therapies. These advanced treatments for various genetic disorders, cancers, and other diseases rely on high-quality plasmid DNA as a key component for delivering therapeutic genes into cells, which drives the need for efficient production.

- The increasing use of plasmid DNA in the development of vaccines, especially DNA and mRNA-based vaccines, is another important driver. Recent global health events have highlighted the importance of rapid vaccine development, leading to greater investments in technologies that use plasmid DNA as a starting material.

- The growth is also fueled by advancements in biotechnology and research. Ongoing research and development in areas such as synthetic biology and gene editing technologies, including CRISPR, require a consistent supply of plasmid DNA, creating a steady demand for manufacturing services.

Market Statistics

- 2024 Market Size: USD 2.38 billion

- 2034 Projected Market Size: USD 16.95 billion

- CAGR (2025–2034): 21.7%

- North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

AI Impact on Plasmid DNA Manufacturing Market

- Artificial intelligence (AI) integrates bioreactor sensor data to adjust pH, feeds, and aeration for maximum plasmid yield.

- AI algorithms help streamline upstream and downstream processes, improving purity, yield, and reproducibility.

- AI-based robotic process automation (RPA) enables high-throughput plasmid DNA production.

- Biotech companies invest in AI systems to gain competitive advantages in cost-efficiency, speed, and regulatory compliance.

The plasmid DNA manufacturing industry involves the production of small, circular DNA molecules called plasmids. These plasmids are a key component in biotechnology and genetic analysis and research. They are used as vectors to carry and replicate genetic material, which is essential for developing a range of advanced therapeutic products and for various scientific applications.

The rising adoption of synthetic biology drives the growth of the industry. This field focuses on creating new biological parts, devices, and systems, as well as redesigning existing biological systems for useful purposes. Plasmid DNA is a basic building block for these synthetic biology projects. The growth of this field, especially in areas such as creating biofuels and new materials, is boosting demand for custom-made plasmid DNA.

Another driver with a growing impact is the use of plasmid DNA in academic and commercial research and development, including nucleic acid isolation and purification. While this is a broad area, it is not always highlighted as much as gene therapy or vaccines. Researchers use plasmids for cloning genes, expressing proteins, and studying gene function. This work is fundamental to the discovery of new drugs and therapies. For example, the National Institutes of Health (NIH) supports research that uses plasmid DNA for gene cloning to produce human proteins such as insulin. This helps scientists understand diseases and develop new biopharmaceuticals.

Drivers and Trends

Growing Demand for Gene and Cell Therapies: The increasing focus on gene and cell therapies is a significant driver of the plasmid DNA manufacturing industry. Plasmid DNA serves as a fundamental component, often used to create the viral vectors that deliver therapeutic genes into a patient's cells. As research and development in this area continue to grow and more therapies receive approval, the need for high-quality, clinical-grade plasmid DNA is rising, along with DNA sequencing kits. This trend is pushing manufacturers to scale up their production and improve their processes to meet the stringent quality and safety standards required for human use.

The market for gene and cell therapies is expanding, which directly increases the demand for plasmid DNA. According to a study published in the journal Human Gene Therapy in 2024, titled "Human Gene Therapy Clinical Trials on the Rise: A Retrospective Analysis," there has been a steady rise in the number of gene therapy clinical trials globally. This increase in clinical research and the subsequent development of new therapies drives the need for large volumes of highly pure plasmid DNA for both preclinical and clinical studies. Therefore, the growth in gene and cell therapy directly influences the expansion of the plasmid DNA manufacturing sector.

Increasing Development of DNA and mRNA Vaccines: The rise in the development of DNA and mRNA vaccines is another major factor contributing to the growth of the plasmid DNA manufacturing industry. Both types of vaccines rely on plasmid DNA as a starting material. For DNA vaccines, the plasmid itself is the active ingredient, carrying the genetic code for an antigen. For mRNA vaccines, plasmid DNA is used as a template to produce the messenger RNA molecule. The speed and flexibility of these vaccine platforms, demonstrated during recent global health events, have made them a popular choice for managing infectious diseases and even cancer.

This rapid development of DNA and mRNA vaccines has created a high demand for plasmid DNA. A 2023 article from the National Library of Medicine (NLM), "DNA Vaccines: Their Formulations, Engineering and Delivery," noted that DNA vaccine technology has advanced significantly since its introduction in the early 1990s. The article highlights that plasmid engineering has progressed, allowing for more robust promoters and improved designs. This progress, combined with the proven potential of DNA and mRNA vaccines, is driving the need for scalable and efficient plasmid DNA production to support ongoing research, clinical trials, and commercial manufacturing.

Segmental Insights

Grade Analysis

Based on grade, the segmentation includes R&D grade and GMP grade. The GMP grade segment held the largest share in 2024. This is mainly due to the increasing number of advanced therapies, such as gene and cell therapies, that are moving from clinical trials to commercial production. These applications require plasmids that meet strict regulatory standards for purity, safety, and consistency. As a result, biopharmaceutical companies need GMP grade plasmids for their clinical development and commercial manufacturing processes. The high costs and complexity involved in meeting these rigorous standards also contribute to this segment’s dominant position, as manufacturing facilities must invest heavily in specialized equipment, quality control measures, and skilled personnel. The ongoing clinical development of new treatments and the eventual commercialization of these products are key factors driving the demand for GMP grade plasmid DNA, which is essential for ensuring product quality and patient safety.

The R&D grade segment is anticipated to register the highest growth rate during the forecast period. This can be attributed to the continuous expansion of research and development activities, particularly in early-stage drug discovery and preclinical studies. R&D grade plasmids are used by a wide range of researchers in academic institutions and biotech startups because they are less expensive and have faster turnaround times compared to their GMP grade counterparts. This allows for quick and flexible experimentation during the initial phases of therapeutic development. The growing number of research projects focused on gene editing, synthetic biology, and new vaccine platforms, coupled with increasing funding for these areas, is fueling the demand for R&D grade plasmid DNA. This rapid growth in the early stages of research and development is setting the stage for future advancements and is making this segment a key area of expansion for the industry.

Development Phase Analysis

Based on development phase, the segmentation includes pre-clinical therapeutics, clinical therapeutics, and marketed therapeutics. The clinical therapeutics segment held the largest share in 2024. This dominance is driven by the significant number of gene and cell therapies currently in various stages of clinical trials. These therapies, which are designed to treat a wide range of diseases, rely heavily on plasmid DNA as a critical starting material. As a result, there is a high and continuous demand for clinical-grade plasmids that meet stringent regulatory requirements. The sheer volume of ongoing clinical research and development activities, particularly in oncology and rare genetic disorders, creates a large and steady need for manufacturing services. This makes the clinical therapeutics phase a dominant force in the market, as companies invest heavily in producing high-quality plasmids to support the development of potential breakthrough treatments.

The pre-clinical therapeutics subsegment is anticipated to register the highest growth rate during the forecast period. This accelerated growth is primarily attributed to the expanding pipeline of new gene therapy and vaccine candidates in the early stages of development. As more academic research groups and biotechnology startups explore innovative therapeutic approaches, they require a reliable supply of plasmids for initial studies and proof-of-concept experiments. These early-stage projects often use R&D grade plasmids, which have lower manufacturing costs and quicker production times. The increasing investment in these early research phases and the rapid pace of scientific discovery are driving the demand for pre-clinical plasmids. This robust activity at the beginning of the therapeutic development pipeline is fueling the growth of this segment, positioning it for rapid expansion in the coming years.

Application Analysis

Based on application, the segmentation includes DNA vaccines, cell & gene therapy, immunotherapy, and others. The cell & gene therapy segment held the largest share in 2024. This is because plasmid DNA is a key building block for developing these advanced therapies. It is used as a vector to deliver therapeutic genes into a patient's cells or as a template to produce the viral vectors that carry these genes. The growing number of clinical trials and the increasing commercialization of gene and cell therapies for diseases such as cancer and genetic disorders are the main reasons for the high demand in this segment. The complex and specific requirements for manufacturing clinical-grade plasmids for these applications also contribute to this segment’s dominant position in the industry.

The DNA vaccines segment is anticipated to register the highest growth rate during the forecast period. This growth is being driven by the renewed interest in DNA and mRNA vaccine platforms, especially after recent global health crises. DNA vaccines use a plasmid to directly introduce the genetic material of an antigen into the body, which then triggers an immune response. The advantages of this technology, such as its quick development time, low cost, and stability, are making it an attractive option for addressing infectious diseases and a variety of other health conditions. The ongoing research and investments in new DNA vaccine candidates for both humans and animals are fueling the rapid expansion of this segment.

Disease Analysis

Based on disease, the segmentation includes infectious disease, cancer, genetic disorder, and others. The cancer segment held the largest share in 2024. The increasing use of advanced therapies, such as gene therapy, immunotherapy, and DNA vaccines, to treat various types of cancer is the main reason for this. Plasmid DNA is essential for these treatments, as it is used to develop cancer vaccines that stimulate the immune system or to create gene therapies that target and destroy cancer cells. The high prevalence of cancer worldwide and the ongoing focus of researchers and biopharmaceutical companies on finding new, more effective treatments are key drivers. This has led to a large and consistent demand for high-quality plasmids to support the extensive number of clinical trials and commercial production for cancer therapies.

The genetic disorder segment is anticipated to register the highest growth rate during the forecast period. This growth is largely driven by the progress in gene editing technologies and the increasing number of clinical studies for inherited diseases. Plasmid DNA is used to correct genetic mutations or replace faulty genes that cause these disorders. As research in this area advances and more therapies move through the development pipeline, the need for plasmid DNA is rapidly increasing. The potential for these therapies to offer long-term or curative treatments for conditions that were previously untreatable is a powerful motivator for both researchers and investors, which, in turn, fuels the demand for specialized plasmid manufacturing services.

Regional Analysis

The North America plasmid DNA manufacturing market accounted for the largest share in 2024. The region holds a leading position in the plasmid DNA manufacturing industry, mainly due to a high concentration of biopharmaceutical and biotechnology companies. The region has a strong infrastructure for research and development, which supports a large number of clinical trials for gene and cell therapies. Additionally, significant funding from private and public sectors, including from institutions such as the National Institutes of Health, drives innovation and demand for high-quality plasmid DNA. The presence of major players and contract manufacturing organizations further solidifies the region's strong market position.

U.S. Plasmid DNA Manufacturing Market Insights

The U.S. is the primary driver of the North American market, with a robust ecosystem of biotech companies and academic research centers. The country has a very active pipeline of gene therapies and DNA-based vaccines in development, which directly fuels the need for plasmid DNA manufacturing services. Favorable government policies and a supportive regulatory framework from the FDA encourage investment and innovation in advanced therapeutics. This environment allows for the rapid development and commercialization of new products, making the U.S. a key hub for plasmid DNA production.

Europe Plasmid DNA Manufacturing Market Trends

Europe is a significant region in the plasmid DNA manufacturing industry, known for its strong academic research base and growing number of biopharmaceutical companies. The region benefits from supportive government initiatives and funding for gene therapy research, which boosts the demand for plasmids. A robust ecosystem of contract development and manufacturing organizations (CDMOS) across Europe provides the specialized services needed to produce GMP-grade plasmids for clinical and commercial use. This supportive environment helps to drive innovation and the expansion of manufacturing capabilities within the region.

The Germany plasmid DNA manufacturing market is a key contributor in Europe. Germany has a well-established biotechnology sector and a high number of clinical trials for advanced therapies. The country’s strong focus on research and a solid manufacturing infrastructure make it a central location for plasmid DNA production. This is supported by the presence of a number of key players and an emphasis on adhering to high manufacturing standards, which helps accelerate the development and commercialization of new biopharmaceutical products.

Asia Pacific Plasmid DNA Manufacturing Market Overview

Asia Pacific is seen as the fastest-growing regional market for plasmid DNA manufacturing. This is due to a combination of factors, including a large population, rising prevalence of chronic diseases, and increasing healthcare spending. The region is seeing more investments in research and development, and governments are putting more effort into building their domestic biotechnology sectors. While the market is still developing in some areas, the growing awareness and adoption of advanced therapies are creating strong demand for plasmid DNA.

China Plasmid DNA Manufacturing Market Assessment

In the Asia Pacific market, China is a major contributor. The country has a large and rapidly expanding biotechnology industry with a focus on gene and cell therapy development. Favorable government policies, significant funding for biotech companies, and a large patient population are contributing to a surge in clinical trials and commercial production. This is leading to substantial investments in manufacturing facilities and the expansion of local capabilities, positioning China as a key player in the regional and global market.

Key Players and Competitive Insights

The competitive landscape of the plasmid DNA manufacturing industry is made up of a few major players and numerous smaller, specialized firms. Key players such as Lonza, Thermo Fisher Scientific, Catalent, Charles River Laboratories, and VGXI are actively expanding their manufacturing capabilities to meet the growing demand from gene and cell therapy companies. The market is highly dynamic, with competition centered on speed, scalability, and the ability to produce high-quality, GMP-grade plasmids. Companies are focusing on strategic investments, facility expansions, and technological innovations to stay ahead in this fast-growing sector.

A few prominent companies in the industry include AGC Biologics, Aldevron (a Danaher Company), Akron Biotech, Catalent, Charles River Laboratories, GenScript ProBio, Kaneka Eurogentec S.A., Lonza, Nature Technology Corporation, PlasmidFactory GmbH & Co. KG, Thermo Fisher Scientific, and WuXi Biologics.

Key Players

- AGC Biologics

- Akron Biotech

- Aldevron (a Danaher Company)

- Catalent

- Charles River Laboratories

- GenScript ProBio

- Kaneka Eurogentec S.A.

- Lonza

- Nature Technology Corporation

- PlasmidFactory GmbH & Co. KG

- Thermo Fisher Scientific

- WuXi Biologics

Plasmid DNA Manufacturing Industry Developments

November 2024: Lonza announced an expansion of its bioconjugation capabilities in Visp, Switzerland, with two new manufacturing suites

January 2023: Charles River Laboratories introduced its new plasmid platform, eXpDNA, leveraging the company's extensive experience in biological testing.

Plasmid DNA Manufacturing Market Segmentation

By Grade Outlook (Revenue – USD Billion, 2020–2034)

- R&D Grade

- GMP Grade

By Development Phase Outlook (Revenue – USD Billion, 2020–2034)

- Pre-Clinical Therapeutics

- Clinical Therapeutics

- Marketed Therapeutics

By Application Outlook (Revenue – USD Billion, 2020–2034)

- DNA Vaccines

- Cell & Gene Therapy

- Immunotherapy

- Others

By Disease Outlook (Revenue – USD Billion, 2020–2034)

- Infectious Disease

- Cancer

- Genetic Disorder

- Others

By Regional Outlook (Revenue-USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Plasmid DNA Manufacturing Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 2.38 billion |

|

Market Size in 2025 |

USD 2.89 billion |

|

Revenue Forecast by 2034 |

USD 16.95 billion |

|

CAGR |

21.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 2.38 billion in 2024 and is projected to grow to USD 16.95 billion by 2034.

The global market is projected to register a CAGR of 21.7% during the forecast period.

North America dominated the market share in 2024.

A few key players in the market include AGC Biologics, Aldevron (a Danaher Company), Akron Biotech, Catalent, Charles River Laboratories, GenScript ProBio, Kaneka Eurogentec S.A., Lonza, Nature Technology Corporation, PlasmidFactory GmbH & Co. KG, Thermo Fisher Scientific, Touchlight, and VGXI, Inc.

The GMP grade segment accounted for the largest share of the market in 2024.

The pre-clinical therapeutics segment is expected to witness the fastest growth during the forecast period.