South Korea Industrial Microwave Heating Equipment Market Size, Share, Trends, Industry Analysis Report

By Equipment (RF Solid State Amplifiers, Magnetron), By Power, By Application – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM6260

- Base Year: 2024

- Historical Data: 2020-2023

Overview

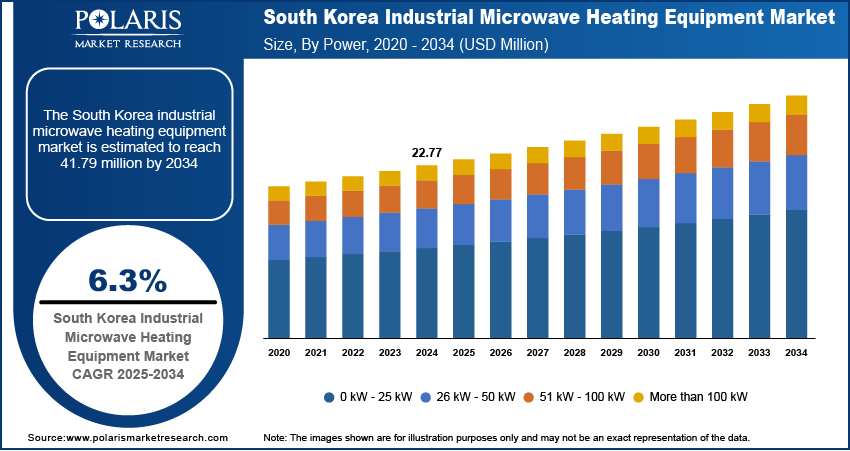

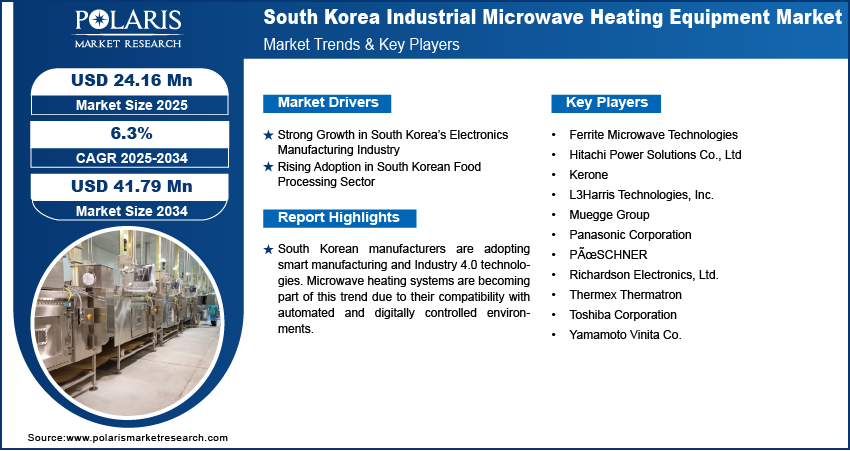

The South Korea industrial microwave heating equipment market size was valued at USD 22.77 million in 2024, registering a CAGR of 6.3% from 2025 to 2034. Key factors driving demand for industrial microwave heating equipment are Strong Growth in South Korea’s electronics manufacturing industry and rising adoption in the food processing sector.

Key Insights

- The RF solid state amplifiers segment is expected to register a CAGR of 8.4% during the forecast period, driven by their high efficiency, precision control, and long-lasting performance, which make them a preferred alternative to traditional magnetron-based systems.

- In 2024, the pharmaceutical segment accounted for 12.38% of the market revenue, supported by the rising adoption of microwave heating equipment for applications such as drying, sterilization, and the precise processing of active pharmaceutical ingredients under tightly controlled conditions

Industry Dynamics

- Strong growth of the South Korea electronics manufacturing industry propels the South Korea industrial microwave heating equipment market demand.

- Rising adoption in the South Korean food processing sector is driving the demand for industrial microwave heating equipment.

- Advantages such as faster processing times, energy efficiency, and improved product quality compared to conventional heating methods boost its adoption.

- High initial cost of equipment and installation restrains the adoption among small and medium-sized enterprises.

Market Statistics

- 2024 Market Size: USD 22.77 Million

- 2034 Projected Market Size: USD 41.79 Million

- CAGR (2025–2034): 6.3%

AI Impact on South Korea Industrial Microwave Heating Equipment Market

- Companies manufacturing microwave heating systems are rapidly adopting AI tools to enhance precision and reduce energy consumption.

- AI technology enables real-time monitoring and control of various microwave heating parameters, which improves uniformity and reduces waste.

- These AI-powered industrial microwave heating equipment optimize power usage and minimize human intervention, which reduces overall operational costs.

- Market players, such as LG Innotek, are pioneering AI-powered factories, which use deep learning to automate heating and curing processes.

The industrial microwave heating involves the use of microwave energy to heat, dry, or process materials in sectors such as food & beverage, pharmaceuticals, chemicals, and rubber. The heating equipment offers numerous advantages such as faster processing times, energy efficiency, and improved product quality compared to conventional heating methods.

The pharmaceutical and biotechnology industries in South Korea are rapidly growing, backed by government support and private investments. Industrial microwave heating is increasingly used in these sectors for applications such as sterilization, drying of active ingredients, and processing of temperature-sensitive compounds. The equipment’s ability to provide contamination-free, uniform, and precise heating is particularly valuable for pharmaceutical manufacturing, where quality control is critical. The demand for clean and advanced thermal technologies such as microwave heating is rising significantly as South Korea positions itself as a hub for biopharma innovation in Asia, thereby driving South Korea industrial microwave heating equipment market growth.

Manufacturers in South Korea are adopting smart manufacturing and Industry 4.0 technologies. Microwave heating systems are becoming part of this trend due to their compatibility with automated and digitally controlled environments. These systems are precisely monitored and integrated into production lines, ensuring consistent heating results and real-time adjustments. Microwave systems fit well into the evolving production infrastructure as factories move toward higher efficiency, lower labor dependency, and digital quality control. This integration improves production throughput and helps companies meet global standards, increasing the attractiveness of microwave heating solutions, thereby fueling the South Korea industrial microwave heating equipment market expansion.

Drivers & Opportunities

Strong Growth in South Korea’s Electronics Manufacturing Industry: South Korea is one of the world’s major electronics producers, with a robust demand for precise and uniform heating processes during manufacturing. According to the International Trade Organization, the added value of the manufacturing industry in the country is expected to reach USD 678 billion by 2030. Industrial microwave heating equipment offers the temperature control and energy efficiency needed for applications such as semiconductor drying, circuit board bonding, and material sintering. The demand for advanced thermal processing solutions continues to grow as local giants such as Samsung and LG expand operations and invest in automation. Microwave systems are preferred due to their ability to improve production speed and reduce defects, making them essential to maintaining competitiveness in the high-tech electronics sector.

Rising Adoption in South Korean Food Processing Sector: South Korea’s food industry is adopting industrial microwave heating for drying, pasteurization, and sterilization processes. These systems reduce processing times and energy consumption while maintaining the nutritional value and quality of food products. Food manufacturers are turning to microwave heating for faster, cleaner, and more controlled processing with growing domestic and export demands for packaged and ready-to-eat meals. Government food safety regulations and consumer expectations for high-quality products are further pushing producers for more efficient thermal technologies. This adoption is contributing significantly to the growth of the microwave heating equipment industry in the country.

Segmental Insights

Equipment Analysis

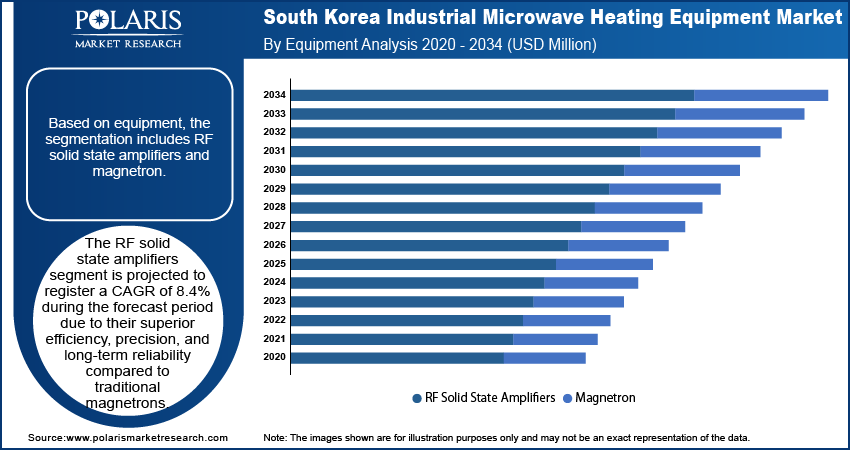

Based on equipment, the segmentation includes RF solid state amplifiers and magnetron. The RF solid state amplifiers segment is projected to register a CAGR of 8.4% during the forecast period due to their superior efficiency, precision, and long-term reliability compared to traditional magnetrons. RF solid state amplifiers are becoming the preferred choice for their ability to deliver consistent power and better control over heating processes as industries across the country adopt more advanced, automated, and high-frequency heating solutions. The country’s strong electronics and semiconductor sectors particularly benefit from this technology, as it supports sensitive applications that require exact temperature management. Additionally, the push for energy-efficient and low-maintenance systems further accelerates adoption in South Korean manufacturing, thereby fueling the segment growth.

Application Analysis

In terms of application, the segmentation includes pharmaceuticals, plastics & rubber, chemicals, paper, food & beverage, and others. The pharmaceutical segment held a significant revenue share of 12.38% in 2024, as microwave devices are increasingly used in pharmaceutical manufacturing for drying, sterilizing, and processing pharmaceutical active ingredients under controlled conditions. Its ability to offer contamination-free, precise, and rapid heating aligns with strict regulatory standards and quality expectations in the country’s drug manufacturing industry. Local companies are investing in advanced thermal processing technologies to improve productivity and maintain product integrity, with South Korea positioning itself as a leader in biopharmaceuticals and life sciences, thereby fueling the growth.

Key Players & Competitive Analysis

The South Korea industrial microwave heating equipment market features a competitive landscape shaped by both global leaders and specialized regional players. Key companies such as Hitachi Power Solutions Co., Ltd, Panasonic Corporation, Toshiba Corporation, and L3Harris Technologies, Inc. have a strong presence in the country, leveraging their advanced technologies and established industrial partnerships. These firms focus on delivering energy-efficient and high-performance microwave systems suitable for sectors such as electronics, food processing, and pharmaceuticals. Companies such as Muegge Group, Richardson Electronics, Ltd., and Ferrite Microwave Technologies cater to South Korea’s growing demand for RF solid-state amplifier systems, which are increasingly favored for their precision and durability. Meanwhile, niche players such as Kerone, Thermex Thermatron, Yamamoto Vinita Co., and PÜSCHNER serve specific industrial needs, offering customized solutions and technical support. Overall, the market is driven by innovation, with players focusing on compact design, automation compatibility, and energy efficiency to stay competitive in a technology-driven economy.

Key Players

- Ferrite Microwave Technologies

- Hitachi Power Solutions Co., Ltd

- Kerone

- L3Harris Technologies, Inc.

- Muegge Group

- Panasonic Corporation

- PÃœSCHNER

- Richardson Electronics, Ltd.

- Thermex Thermatron

- Toshiba Corporation

- Yamamoto Vinita Co.

South Korea Industrial Microwave Heating Equipment Industry Developments

In November 2023, Richardson Electronics expanded its microwave product range through a partnership with Junkosha Cable Assemblies.

South Korea Industrial Microwave Heating Equipment Market Segmentation

By Equipment Outlook (Revenue, USD Million, 2021–2034)

- RF Solid State Amplifiers

- Magnetron

By Power Outlook (Revenue, USD Million, 2021–2034)

- 0 kW–25 kW

- 26 kW–50 kW

- 51 kW–100 kW

- More than 100 kW

By Application Outlook (Revenue, USD Million, 2021–2034)

- Pharmaceutical

- Plastics & Rubber

- Chemicals

- Paper

- Food & Beverage

- Others

South Korea Industrial Microwave Heating Equipment Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 22.77 Million |

|

Market Size in 2025 |

USD 24.16 Million |

|

Revenue Forecast by 2034 |

USD 41.79 Million |

|

CAGR |

6.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2021–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 22.77 million in 2024 and is projected to grow to USD 41.79 million by 2034.

The market is projected to register a CAGR of 6.3% during the forecast period.

A few of the key players in the market are Ferrite Microwave Technologies; Hitachi Power Solutions Co., Ltd; Kerone; L3Harris Technologies, Inc.; Muegge Group; Panasonic Corporation; PÜSCHNER; Richardson Electronics, Ltd.; Thermex Thermatron; Toshiba Corporation; and Yamamoto Vinita Co.

The RF solid state amplifier segment dominated the market revenue share in 2024.

The pharmaceutical segment is projected to witness the fastest growth during the forecast period.