Microwave Devices Market Size, Share, Trend, Industry Analysis Report

By Product (Active Microwave Devices, Passive Microwave Devices), By Frequency, By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 125

- Format: PDF

- Report ID: PM2310

- Base Year: 2024

- Historical Data: 2020-2023

Overview

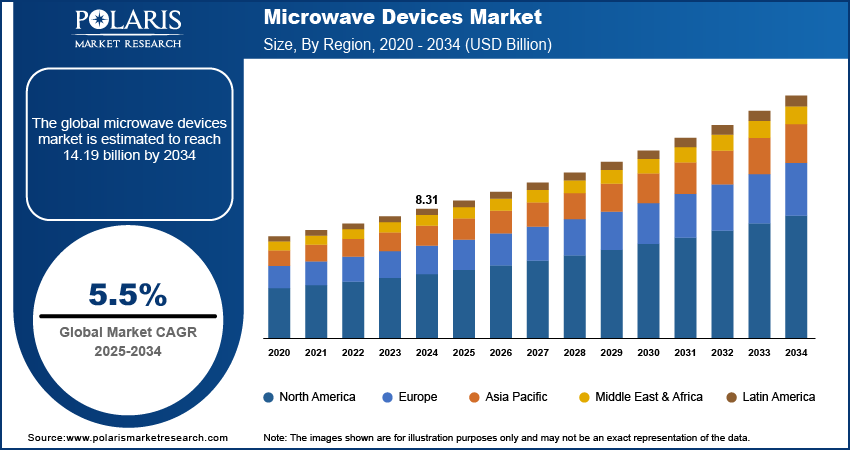

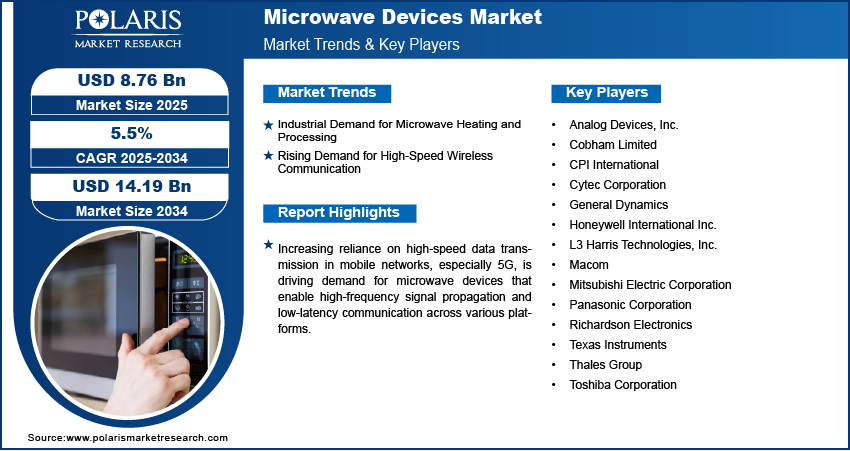

The global microwave devices market size was valued at USD 8.31 billion in 2024, growing at a CAGR of 5.5% from 2025 to 2034. Increasing reliance on high-speed data transmission in mobile networks, especially 5G, is driving demand for microwave devices that enable high-frequency signal propagation and low-latency communication across various platforms.

Key Insights

- The active microwave devices segment held ~62% of the market share in 2024, driven by their role in signal amplification, frequency conversion, and high-power applications in radar and telecom.

- The military & defense segment led with ~40% share in 2024, fueled by deployment in electronic warfare, surveillance, tactical communications, and countermeasure systems.

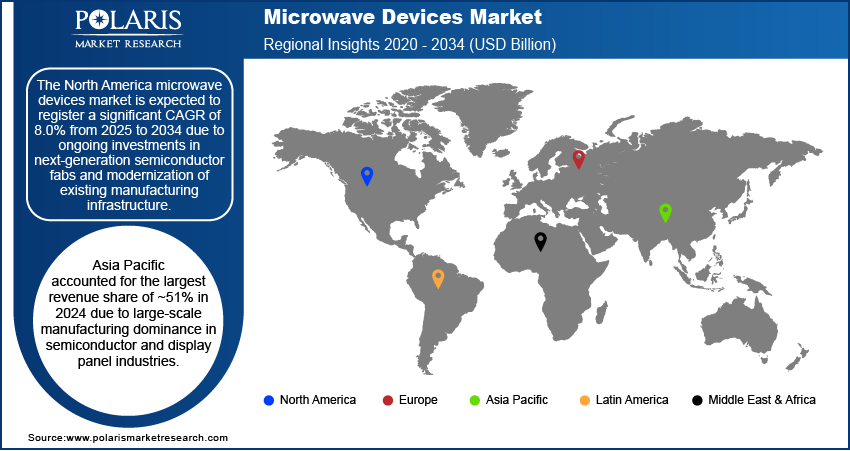

- North America held the largest global market share of ~41% in 2024, supported by a strong presence of defense and aerospace companies.

- The U.S. dominated the regional market in 2024 due to high defense spending on modernizing radar and communication systems.

- The market in Asia Pacific is projected to register the highest CAGR of 8.0% from 2025 to 2034, driven by defense modernization, space programs, and 5G expansion.

- The market in Europe is growing steadily due to upgrades in border security, air defense, and radar networks across key nations.

Industry Dynamics

- Rising deployment of 5G networks is increasing demand for microwave components in backhaul and fronthaul communication infrastructure globally.

- Growing use of radar and satellite systems in defense and aerospace is driving adoption of high-frequency microwave devices across mission-critical platforms.

- Expansion into millimeter-wave bands enables ultra-fast wireless links for next-gen telecom and autonomous systems with enhanced bandwidth and low latency.

- High R&D and manufacturing costs for high-frequency components limit scalability and accessibility for small and mid-sized technology providers.

Market Statistics

- 2024 Market Size: USD 8.31 billion

- 2034 Projected Market Size: USD 14.19 billion

- CAGR (2025–2034): 5.5%

- North America: Largest market in 2024

AI Impact on Microwave Devices Market

- AI enhances real-time signal processing in microwave systems, enabling faster, more accurate decision-making in applications like radar, communications, and sensing across defense, aerospace, and industrial sectors.

- Predictive maintenance powered by AI reduces downtime and operational costs in microwave-based infrastructure by identifying faults early and optimizing system performance.

- AI-driven design automation accelerates the development of microwave components, improving efficiency, reducing prototyping cycles, and optimizing performance across RF, semiconductor, and antenna systems.

- Integration of AI with microwave devices supports adaptive systems that learn from environmental inputs, allowing for dynamic calibration, energy efficiency, and smart functionality in both consumer and industrial technologies.

The microwave devices market comprises electronic components and systems that operate within the microwave frequency spectrum, typically between 300 MHz and 300 GHz. These devices are essential in applications such as communication systems, radar, satellite transmission, medical diagnostics, and industrial processing. Advanced radar systems in military and aerospace sectors rely on microwave devices for surveillance, navigation, and targeting. Growing defense modernization initiatives are boosting investments in high-frequency technologies.

Growth in satellite internet, navigation, and broadcasting services is elevating the use of microwave devices for uplink and downlink signal transmission, ensuring robust connectivity in remote and underserved areas. Moreover, transition from vacuum tube-based systems to solid-state microwave devices is enhancing performance, reliability, and miniaturization, making them suitable for next-generation compact electronics and IoT-enabled devices.

Drivers & Opportunities

Industrial Demand for Microwave Heating and Processing: Microwave devices are increasingly being adopted in industrial applications due to their ability to deliver rapid, uniform, and energy-efficient heating. Industries involved in material processing, ceramic sintering, chemical synthesis, and food manufacturing are integrating microwave systems to improve product consistency and reduce operational costs. These devices offer precise temperature control and faster processing times compared to conventional thermal methods. Industries are also leveraging the non-contact nature of microwave heating, which minimizes contamination and enhances safety. This growing focus on process optimization, energy savings, and environmentally friendly technologies is pushing manufacturers to adopt microwave-based solutions across a wide range of applications.

Rising Demand for High-Speed Wireless Communication: Growing demand for faster and more reliable wireless communication is significantly influencing the uptake of microwave devices. The rollout of 5G networks, which depend on high-frequency signals, has increased the need for microwave components that support low-latency and high-bandwidth transmission. For instance, according to the U.S. Federal Communications Commission, in 2024, over 90% of U.S. 5G mid-band deployments relied on microwave backhaul systems to ensure low-latency connectivity, accelerating demand for high-performance microwave components. Telecom infrastructure providers are incorporating microwave radios and antennas to bridge connectivity gaps and extend network coverage, particularly in remote and urban-dense areas. Additionally, the rise of smart cities, connected cars, and IoT ecosystems further reinforces the requirement for microwave technology that enables seamless communication. The ongoing shift toward next-generation wireless systems continues to drive strong demand across this sector.

Segmental Insights

Product Analysis

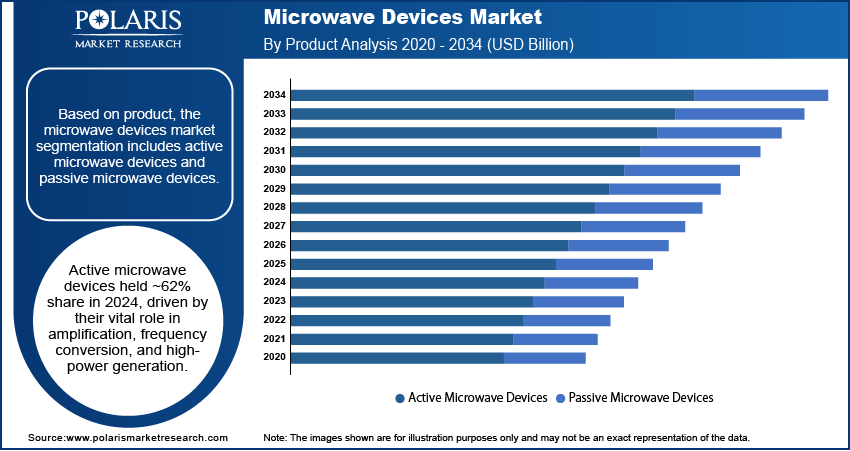

Based on product, the segmentation includes active microwave devices and passive microwave devices. The active microwave devices segment dominated the market with ~62% of the revenue share in 2024 due to their critical role in signal amplification, frequency conversion, and high-power generation across radar, satellite, and telecommunication systems. These devices, including power amplifiers and oscillators, are extensively integrated into complex systems requiring precise signal transmission and control, particularly in aerospace, defense, and communication sectors. The demand for high-frequency, low-noise, and compact components further supported the growth of this segment.

The passive microwave devices segment is expected to register the highest CAGR from 2025 to 2034 driven by their rising deployment in RF front-end modules and satellite systems. Increasing need for miniaturized and thermally stable components such as filters, attenuators, couplers, and isolators across 5G infrastructure, space electronics, and industrial microwave systems is driving growth. Advancements in packaging technology and low-insertion-loss design techniques are improving performance reliability, enabling broader adoption across commercial and military platforms.

Frequency Analysis

In terms of frequency, the segmentation includes, Ku-Band, C-Band, Ka-Band, L-Band, X-Band, S-Band, and others. The C-band segment held the ~30% of the revenue share in 2024 due to its widespread use in satellite communication, radar installations, and weather-monitoring systems. Its favorable propagation characteristics and resistance to signal degradation make it ideal for long-range and high-reliability communication systems. Adoption in broadcasting services and air traffic control radar systems further reinforces its market share dominance.

The X-band segment is expected to register the highest CAGR of 7.5% during 2025–2034 due to expanding applications in high-resolution imaging radar, naval surveillance, and missile guidance systems. Compactness, frequency agility, and superior target discrimination capability of X-band microwave systems make them indispensable for next-generation military and remote sensing applications. Growing investments in radar modernization and autonomous defense platforms are strengthening demand.

End Use Analysis

In terms of end use, the segmentation includes space & communication, military & defense, healthcare, and others. The military & defense segment held the largest revenue share of ~40% in 2024 due to extensive deployment of microwave devices in electronic warfare, surveillance radar, tactical communication, and countermeasure systems. Their high-frequency performance, secure data transmission capabilities, and resilience in contested electromagnetic environments make them mission-critical. Integration of advanced radar technologies into land, air, and naval platforms continues to support this dominance.

The healthcare segment is expected to register the highest CAGR of 7.5% from 2025 to 2034, fueled by increasing adoption of microwave ablation systems, hyperthermia cancer treatment, and diagnostic imaging tools. Precision, non-invasiveness, and tissue-selective heating capabilities of microwave-based therapies are gaining traction in oncology and cardiology. Technological improvements in miniaturized antennas and portable microwave therapeutic devices are accelerating clinical integration and expanding procedural use cases across global healthcare systems.

Regional Analysis

The North America microwave devices market accounted for the largest revenue share of ~41% in 2024 due to strong presence of defense contractors and aerospace firms in North America. Increasing investments in radar systems, electronic warfare, and satellite communications has pushed the adoption of high-frequency devices. According to the U.S. Department of Defense, in 2023, defense spending on electronic warfare and radar systems exceeded USD 25 billion, driving demand for advanced microwave devices in radar and secure communications. Government initiatives to modernize military infrastructure have further supported the use of sophisticated microwave equipment. The region also benefits from early deployment of 5G networks and strong demand from industrial sectors, including semiconductor manufacturing and automotive radar systems. Presence of technologically mature suppliers and robust R&D infrastructure further strengthen North America’s position.

U.S. Microwave Devices Market Insights

The U.S. dominated the North America market in 2024. Extensive defense expenditure in the U.S., focused on upgrading radar and communication capabilities, has directly boosted the adoption of microwave-based systems. Growth in commercial aerospace activities and rapid advancements in wireless communication infrastructure, including 5G and satellite networks, support broader usage of microwave devices across industries. Leading defense OEMs and technology companies headquartered in the U.S. actively collaborate on microwave innovation, ensuring fast commercialization of new designs. Federal funding for military modernization programs and robust procurement of microwave-based radar and surveillance systems provide long-term demand stability. The country also leads in testing, standardization, and deployment of high-frequency technologies.

Asia Pacific Microwave Devices Market Trends

The industry in Asia Pacific is expected to register the highest CAGR of 8.0% from 2025 to 2034. Rising investments in defense modernization, space exploration, and 5G rollout across Asia Pacific are driving the adoption of microwave devices in the region. Increasing industrial automation and the expansion of telecommunications infrastructure, especially in countries such as China, India, and South Korea, are creating sustained demand. Governments are actively funding radar and satellite programs for national security and disaster management, fueling demand for high-frequency technologies. In addition, local production capabilities are expanding, supported by domestic semiconductor and electronic component industries. According to South Korea’s Ministry of Trade, Industry and Energy, in 2024, domestic production of high-frequency semiconductor components grew by 18% year-on-year, supporting local microwave device manufacturing for 5G and satellite applications. This manufacturing maturity and growing need for advanced communication systems contribute to the region’s strong growth trajectory in the coming years.

China Microwave Devices Market Overview

In 2024. China led the Asia Pacific market. Robust domestic defense initiatives and aggressive investments in aerospace and satellite communication technologies have positioned China as the regional leader in microwave device deployment. National programs focused on 5G expansion, smart cities, and electronic surveillance use high-frequency microwave components extensively. Strong manufacturing base for RF and microwave components supports internal demand while reducing dependency on imports. Chinese firms are increasingly integrating microwave systems into industrial robotics and automotive radar technologies. The government's emphasis on technological self-reliance and innovation also leads to heavy R&D investment in this space, allowing China to scale both production and adoption across civilian and military sectors.

Europe Microwave Devices Market Assessment

The market in Europe is growing significantly due to ongoing upgrades in defense capabilities, especially for border security, radar systems, and air defense networks. Growth in the aerospace and satellite communication sectors supports high adoption of high-frequency components. European governments are investing in 5G infrastructure development, driving demand for microwave devices to support high-speed and low-latency communication. Technological partnerships across EU nations for research in quantum and microwave technologies further enhance regional innovation. Industrial automation, especially in Germany and France, is also adopting microwave-based sensors and instruments, adding a strong commercial dimension to the market’s regional growth.

Key Players & Competitive Analysis

The competitive landscape of the microwave devices market is shaped by continuous innovation, strategic alliances, and market expansion strategies aimed at capturing emerging opportunities across sectors such as defense, telecommunications, and industrial processing. Industry analysis reveals a shift toward high-frequency, compact, and energy-efficient systems, prompting players to invest heavily in technology advancements. Companies are increasingly entering into joint ventures and forging strategic alliances to accelerate product development and expand geographic reach. Mergers and acquisitions are common, particularly among firms seeking to consolidate intellectual property portfolios and enhance vertical integration. Post-merger integration strategies are focused on streamlining operations, optimizing supply chains, and leveraging synergies to drive profitability. These efforts are further reinforced by investments in R&D and pilot production lines, enabling market players to respond to evolving application requirements and stringent performance standards. Competitive intensity remains high as companies seek to differentiate through innovation, customization, and rapid response to shifting end-user demands.

Key Players

- Analog Devices, Inc.

- Cobham Limited

- CPI International

- Cytec Corporation

- General Dynamics

- Honeywell International Inc.

- L3 Harris Technologies, Inc.

- Macom

- Mitsubishi Electric Corporation

- Panasonic Corporation

- Richardson Electronics

- Texas Instruments

- Thales Group

- Toshiba Corporation

Microwave Devices Industry Developments

June 2025: Quantic X-Microwave, a division of Quantic Electronics, launched its enhanced Layout Tool for RF and microwave engineers. This advanced design platform simplifies part selection and layout for signal chains using X-MWblocks, optimizing the microwave circuit design process.

June 2024: Quantic X-Microwave partnered with Nuvotronics, a Cubic company known for its microwave and millimeter-wave innovations, to enhance RF and microwave solution development.

Microwave Devices Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Active Microwave Devices

- Solid-State

- Gallium Arsenide (GAAS)

- Silicon

- Gallium Nitride (GAN)

- Silicon Carbide (SIC)

- Other Materials

- Vacuum Electron

- Travelling Wave Tube Amplifier (TWTA)

- Klystron

- Magnetron

- Crossed-Field Amplifier

- Others

- Passive Microwave Devices

By Frequency Outlook (Revenue, USD Billion, 2020–2034)

- Ku-Band

- C-Band

- Ka-Band

- L-Band

- X-Band

- S-Band

- Others

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Space & Communication

- Military & Defense

- Healthcare

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Microwave Devices Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 8.31 billion |

|

Market Size in 2025 |

USD 8.76 billion |

|

Revenue Forecast by 2034 |

USD 14.19 billion |

|

CAGR |

5.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 8.31 billion in 2024 and is projected to grow to USD 14.19 billion by 2034.

The global market is projected to register a CAGR of 5.5% during the forecast period.

North America accounted for the largest revenue share of ~41% in 2024 due to strong presence of defense contractors and aerospace firms in North America.

A few of the key players in the market are Analog Devices, Inc.; Cobham Limited; CPI International; Cytec Corporation; General Dynamics; Honeywell International Inc.; L3 Harris Technologies, Inc.; Macom; Mitsubishi Electric Corporation; Panasonic Corporation; Richardson Electronics; Texas Instruments; Thales Group; and Toshiba Corporation.

The active microwave devices segment dominated the market with ~62% of the revenue share in 2024 due to their critical role in signal amplification, frequency conversion, and high-power generation across radar, satellite, and telecommunication systems.

The C-band segment held the ~30% of the revenue share in 2024 due to its widespread use in satellite communication, radar installations, and weather-monitoring systems.