Connected Car Market Size, Share, Trends, Industry Analysis Report

: By Application Type, Sales Channel Type (OEM and Aftermarket), Communication Type, Connectivity, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Feb-2025

- Pages: 119

- Format: PDF

- Report ID: PM3869

- Base Year: 2024

- Historical Data: 2020-2023

Connected Car Market Overview

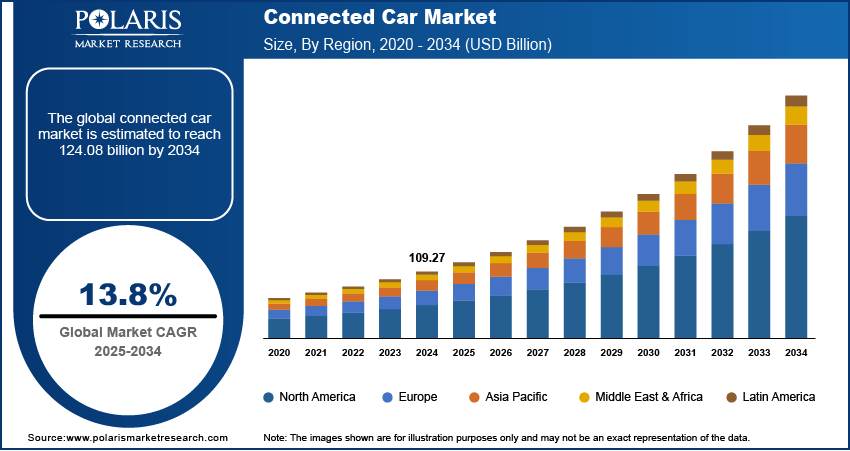

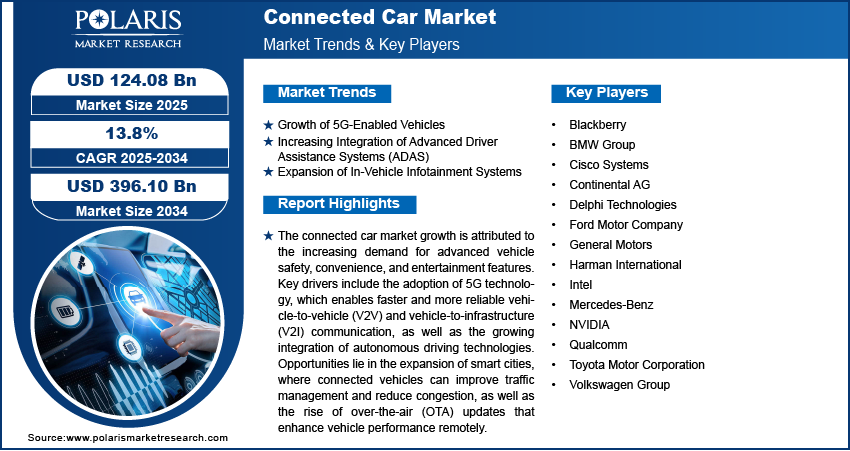

The connected car market size was valued at USD 109.27 billion in 2024. The market is projected to grow from USD 124.08 billion in 2025 to USD 396.10 billion by 2034, exhibiting a CAGR of 13.8% during 2025–2034.

The connected car market refers to the integration of advanced communication technologies and services within vehicles, enabling real-time connectivity with external systems, other vehicles, and devices. This market is driven by factors such as the increasing adoption of Internet of Things (IoT) technologies, rising consumer demand for in-vehicle infotainment, and the growing focus on road safety and driver assistance systems. Key trends include the development of 5G-enabled vehicles, advancements in autonomous driving technology, and collaborations between automotive and technology companies to enhance connectivity features. Regulatory mandates for vehicle safety and emission control are further fueling the adoption of connected car technologies globally.

To Understand More About this Research: Request a Free Sample Report

Connected Car Market Dynamics

Growth of 5G-Enabled Vehicles

The adoption of 5G technology is revolutionizing the connected car market by enabling faster and more reliable communication between vehicles and their environment. With significantly reduced latency and higher data transfer rates compared to 4G, 5G allows seamless operation of advanced features such as vehicle-to-everything (V2X) communication, real-time navigation updates, and enhanced in-vehicle infotainment systems.

Increasing Integration of Advanced Driver Assistance Systems (ADAS)

ADAS technologies are becoming a standard feature in connected cars due to rising consumer demand for safety and convenience. These systems include adaptive cruise control, lane-keeping assistance, automated braking, and parking assistance. According to the European New Car Assessment Programme (Euro NCAP), vehicles equipped with ADAS features demonstrated a 40% reduction in accidents compared to vehicles without such technologies. The adoption of ADAS is further driven by government regulations mandating the inclusion of safety features such as emergency braking and lane departure warnings in vehicles, particularly in Europe and North America. Thus, the increasing integration of ADAS boosts the connected cars market development.

Expansion of In-Vehicle Infotainment Systems

The growing consumer preference for personalized and connected driving experiences has led to the rapid expansion of in-vehicle infotainment systems. These systems combine entertainment, navigation, and communication capabilities, offering drivers and passengers features such as voice assistants, app integration, and streaming services. Furthermore, advancements in artificial intelligence (AI) are enhancing the functionality of infotainment systems, enabling them to learn user preferences and provide tailored recommendations. Hence, the expansion of in-vehicle infotainment systems propels the connected car market development.

Connected Car Market Segment Insights

Connected Car Market Outlook – Application Type-Based Insights

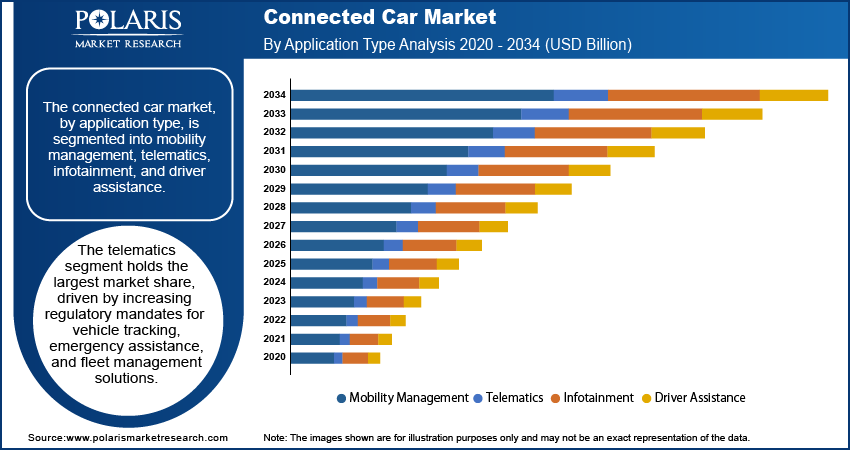

By application type, the connected car market segmentation includes mobility management, telematics, infotainment, and driver assistance. The telematics segment holds the largest market share, driven by increasing regulatory mandates for vehicle tracking, emergency assistance, and fleet management solutions. Telematics systems are widely adopted in commercial vehicles to improve operational efficiency, monitor vehicle diagnostics, and ensure compliance with safety standards. The widespread deployment of GPS-enabled services and real-time data monitoring further boosts the growth of this segment. Government regulations, particularly in regions such as North America and Europe, mandating telematics in vehicles for enhanced safety and efficiency, have accelerated adoption.

The driver assistance segment is registering the highest growth, supported by advancements in sensor technologies, machine learning algorithms, and increased awareness of vehicle safety. The integration of Advanced Driver Assistance Systems (ADAS), including adaptive cruise control, lane-keeping systems, and automated braking, is becoming more prevalent due to rising consumer demand and stringent safety regulations. Increasing investments in autonomous driving technologies and partnerships between automotive manufacturers and technology providers are further propelling the adoption of driver assistance applications, particularly in developed markets. These factors are expected to continue driving growth in the segment as safety remains a key priority in connected car innovations.

Connected Car Market Assessment – Sales Channel Type-Based Insights

The connected car market, by sales channel type, is bifurcated into original equipment manufacturers (OEMs) and aftermarket. The OEM segment holds the largest market share, driven by the increasing focus of automakers on integrating advanced connectivity features during vehicle production. OEMs are actively collaborating with technology providers to offer factory-installed solutions such as telematics, in-vehicle infotainment, and driver assistance systems. These pre-installed systems cater to growing consumer demand for seamless connectivity and ensure compliance with safety and emission regulations, particularly in developed regions such as North America and Europe. Additionally, the strategic emphasis on enhancing customer experience through value-added services such as over-the-air updates and predictive maintenance strengthens the dominance of the OEM segment.

The aftermarket segment is registering a higher growth rate, supported by the rising adoption of connected car solutions in existing vehicles. This growth is fueled by increasing consumer awareness of the benefits of upgrading vehicles with modern connectivity features, such as GPS trackers, dash cameras, and advanced infotainment systems. The affordability and availability of aftermarket solutions in developing regions are also contributing to their rising demand. Furthermore, advancements in plug-and-play devices and wireless connectivity technologies have simplified the integration of these features, encouraging adoption in passenger and commercial vehicles. As the global vehicle fleet ages, the demand for aftermarket solutions is expected to rise in the future.

Connected Car Market Evaluation – Communication Type-Based Insights

The connected car market, segmented by communication type, includes vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communication. The vehicle-to-infrastructure (V2I) segment holds a larger market share, driven by its critical role in enhancing road safety, traffic management, and vehicle efficiency. V2I communication enables real-time data exchange between vehicles and infrastructure elements such as traffic lights, road sensors, and parking systems, optimizing traffic flow and reducing congestion. Governments and municipal authorities globally are investing in smart city initiatives that integrate V2I technologies, further fueling the growth of this segment. These systems are widely adopted in urban regions to address traffic-related challenges and improve overall transportation infrastructure.

The vehicle-to-vehicle (V2V) segment is experiencing a higher growth rate due to advancements in communication protocols and increasing regulatory support for cooperative safety applications. V2V communication facilitates the direct exchange of information between vehicles, enabling features such as collision avoidance, cooperative adaptive cruise control, and platooning. These technologies are gaining momentum as automakers and technology providers invest in improving vehicle automation and safety. Rising consumer awareness of V2V’s potential to reduce road accidents and enhance driving efficiency is further contributing to its rapid adoption. As the global deployment of connected vehicle ecosystems continues to expand, V2V technologies are expected to see significant advancements and widespread implementation.

Connected Car Market Regional Analysis

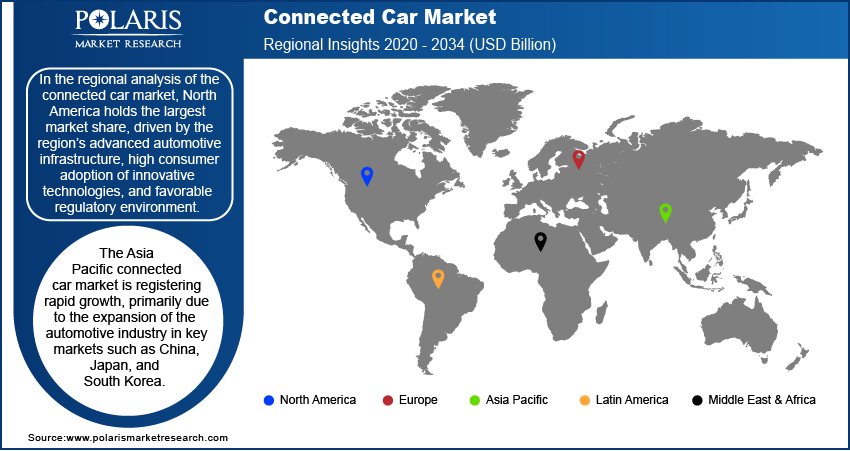

By region, the study provides connected car market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest share of the global connected car market revenue, driven by the region’s advanced automotive infrastructure, high consumer adoption of innovative technologies, and favorable regulatory environment. The presence of leading automotive manufacturers and technology companies has accelerated the development and deployment of connected car solutions, including telematics, driver assistance systems, and in-vehicle infotainment. Government mandates, such as the inclusion of electronic logging devices (ELDs) and vehicle safety technologies, further support market growth in this region. Additionally, the rising penetration of 5G networks and strong demand for autonomous and electric vehicles have contributed to North America's leadership in the connected car market expansion.

The Europe connected car market is experiencing steady growth, driven by stringent regulations and a high level of technological adoption. European governments are actively pushing for the implementation of advanced driver assistance systems (ADAS) and other safety features through regulatory mandates, enhancing the adoption of connected vehicle technologies. Additionally, the strong presence of automotive giants, such as Volkswagen, BMW, and Mercedes-Benz, contributes to the region's dominance in connected car innovation. The increasing integration of smart city initiatives and investments in infrastructure to support vehicle-to-infrastructure (V2I) communication are boosting market expansion in Europe. Moreover, the rising consumer preference for electric vehicles (EVs), many of which feature advanced connectivity, is driving the regional market growth.

The Asia Pacific connected car market is registering rapid growth, primarily due to the expansion of the automotive industry in key markets such as China, Japan, and South Korea. China, in particular, is a major contributor to the regional market development, with the government pushing for smart mobility solutions and the widespread adoption of electric and autonomous vehicles. The region's strong technological base, combined with the increasing demand for enhanced vehicle safety, infotainment systems, and telematics, is driving the market. Additionally, partnerships between automotive manufacturers and technology companies in countries such as Japan and South Korea are accelerating the development of connected car solutions, including 5G-enabled vehicles and autonomous driving technologies. As a result, Asia Pacific is expected to remain one of the fastest-growing regions in the connected car market.

Connected Car Market – Key Market Players and Competitive Insights

Key players in the connected car market include a mix of automotive manufacturers, technology providers, and telecommunications companies. A few notable players are General Motors, Ford Motor Company, Volkswagen Group, BMW Group, Toyota Motor Corporation, and Mercedes-Benz. Technology companies such as Qualcomm, NVIDIA, Intel, and Cisco Systems are also actively contributing to the market by providing critical hardware and software solutions for vehicle connectivity. Other significant players include Harman International, Continental AG, Delphi Technologies, Blackberry, TomTom, Telenav, and Autotalks. These companies are involved in the development of telematics, infotainment systems, advanced driver assistance systems (ADAS), and in-vehicle connectivity solutions. A few players, such as Harman International, are subsidiaries of Samsung Electronics, while Uber Technologies acquired TomTom for their navigation software.

The connected car market is highly competitive, with companies from various industries collaborating and competing to deliver innovative solutions. Automotive manufacturers are increasingly partnering with technology firms to integrate advanced connectivity and automation features into their vehicles, a strategy that has led to a high level of investment in R&D. The demand for connected car solutions is growing rapidly due to consumer preferences for enhanced safety, convenience, and entertainment features. As the market matures, companies that can deliver seamless, secure, and high-performance systems will continue to hold a competitive edge.

Competition is intensifying with the rise of autonomous driving technologies and the need for real-time data processing. As companies such as NVIDIA and Intel focus on providing AI and machine learning solutions to improve vehicle automation, other firms such as Qualcomm are focusing on developing 5G-enabled solutions for faster and more reliable vehicle communication. These technologies are expected to reshape the competitive landscape by offering greater collaboration across traditional automotive companies and tech firms, while also prompting further investments in infrastructure to support connected car ecosystems.

General Motors (GM) is a global automotive manufacturer based in the US. GM has been focused on integrating advanced connectivity features into its vehicles, offering services such as in-vehicle navigation, telematics, and infotainment systems. The company has also made efforts to enhance safety features and driver assistance systems in its vehicles.

BMW Group, a well-known German automaker, has been at the forefront of incorporating connected technology into its vehicles, with features such as real-time traffic updates, remote diagnostics, and integrated infotainment systems. The company has been actively working to develop and deploy autonomous driving technologies.

List of Key Companies in Connected Car Market

- Blackberry

- BMW Group

- Cisco Systems

- Continental AG

- Delphi Technologies

- Ford Motor Company

- General Motors

- Harman International (a subsidiary of Samsung Electronics)

- Intel

- Mercedes-Benz

- NVIDIA

- Qualcomm

- Toyota Motor Corporation

- Volkswagen Group

Connected Car Industry Developments

- In August 2024, BMW launched an upgraded version of its iDrive system. It includes enhanced connectivity options and artificial intelligence to better personalize the user experience for drivers and passengers. This move reflects BMW’s continued investment in connectivity and automation for its vehicles.

- In July 2024, GM announced its plans to expand its partnership with Qualcomm to introduce 5G-enabled connected car solutions, aiming to improve vehicle-to-vehicle and vehicle-to-infrastructure communication capabilities in its future models.

Connected Car Market Segmentation

By Application Type Outlook

- Mobility Management

- Telematics

- Infotainment

- Driver Assistance

By Sales Channel Type Outlook

- OEM

- Aftermarket

By Communication Type Outlook

- Vehicle to Vehicle

- Vehicle to Infrastructure

By Connectivity Outlook

- Embedded

- Tethered

- Integrated

By Technology Outlook

- 3G

- 4G

- 5G

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Connected Car Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 109.27 billion |

|

Market Size Value in 2025 |

USD 124.08 billion |

|

Revenue Forecast by 2034 |

USD 396.10 billion |

|

CAGR |

13.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The connected car market has been segmented into detailed segments of application type, sales channel type, communication type, connectivity, and technology. Moreover, the study provides the reader with a detailed understanding of the different segments at both the and regional levels.

Growth/Marketing Strategy

The growth strategy for the connected car market focuses on expanding the adoption of advanced technologies like 5G, AI, and autonomous driving solutions. Companies are increasingly forming partnerships between automotive manufacturers and technology providers to enhance vehicle connectivity, offering services such as real-time data exchange, in-car infotainment, and safety features. Marketing efforts are also directed toward educating consumers on the benefits of connected vehicles, such as improved safety and convenience. In addition, automakers are integrating more personalized experiences through AI-driven systems, while expanding smart city and infrastructure solutions to support connectivity. This approach aims to strengthen market presence and drive consumer demand for connected vehicles.

FAQ's

? The market size was valued at USD 109.27 billion in 2024 and is projected to grow to USD 396.10 billion by 2034.

? The market is projected to register a CAGR of 13.8% during the forecast period.

? North America had the largest market share in 2024.

? A few notable players are General Motors, Ford Motor Company, Volkswagen Group, BMW Group, Toyota Motor Corporation, and Mercedes-Benz. Technology companies such as Qualcomm, NVIDIA, Intel, and Cisco Systems are also actively contributing to the market by providing critical hardware and software solutions for vehicle connectivity.

? The telematics segment accounted for the largest share of the market in 2024.

? The OEM segment accounted for a larger share of the market in 2024.

? A connected car refers to a vehicle equipped with internet connectivity and its ability to communicate with external systems, other vehicles, and devices. This connectivity enables a wide range of features, such as real-time navigation, in-vehicle infotainment, remote diagnostics, vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communication, and advanced driver assistance systems (ADAS). Through this technology, connected cars can provide enhanced safety; improve the driving experience; and enable functions such as over-the-air software updates, remote control of certain car features, and seamless integration with smartphones and other devices.

A few key connected car market trends are described below: 5G Integration: Adoption of 5G technology for faster and more reliable vehicle communication, enabling real-time data exchange and enhanced vehicle-to-everything (V2X) capabilities. Advancements in Autonomous Driving: Increased focus on integrating autonomous driving technologies with connected vehicle systems to improve safety and reduce human intervention. Vehicle-to-Everything (V2X) Communication: Growing implementation of V2V and V2I technologies to enhance road safety, traffic management, and vehicle efficiency. In-Vehicle Infotainment Systems: Expanding demand for advanced infotainment features, including voice assistants, app integration, and streaming services, creating a more personalized driving experience.

? A new company entering the connected car market could focus on emerging areas such as 5G-enabled connectivity and autonomous driving technologies, as these are key drivers of market growth. By developing advanced vehicle-to-everything (V2X) solutions, including vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communication systems, the company could offer innovative safety and traffic management features. Focusing on cybersecurity for connected vehicles would also be a strategic move, as ensuring data protection is becoming increasingly important. Additionally, offering customizable in-vehicle infotainment systems with AI-based personalization could appeal to consumers seeking more integrated, intuitive driving experiences.

? Companies manufacturing, distributing, or purchasing connected cars and related products and other consulting firms must buy the report.