U.S. Chillers Market Size, Share, Trend, Industry Analysis Report

By Product (Water-Cooled, Air-Cooled), By Application, By Compressor Type – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 128

- Format: PDF

- Report ID: PM6261

- Base Year: 2024

- Historical Data: 2020-2023

Overview

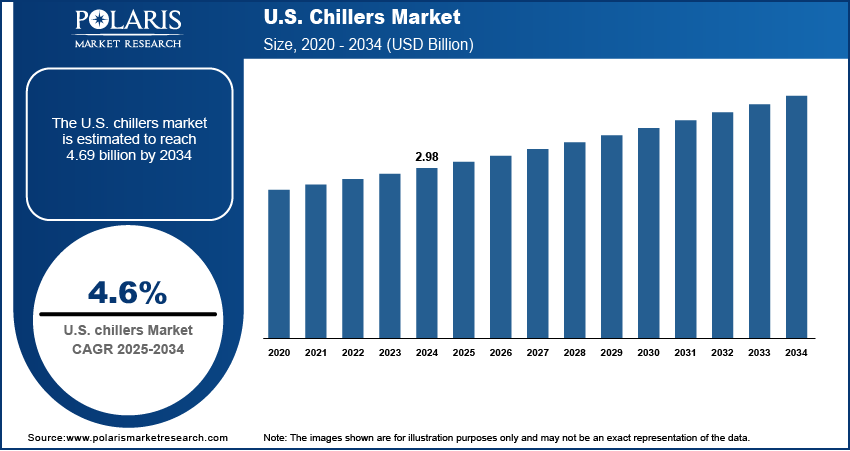

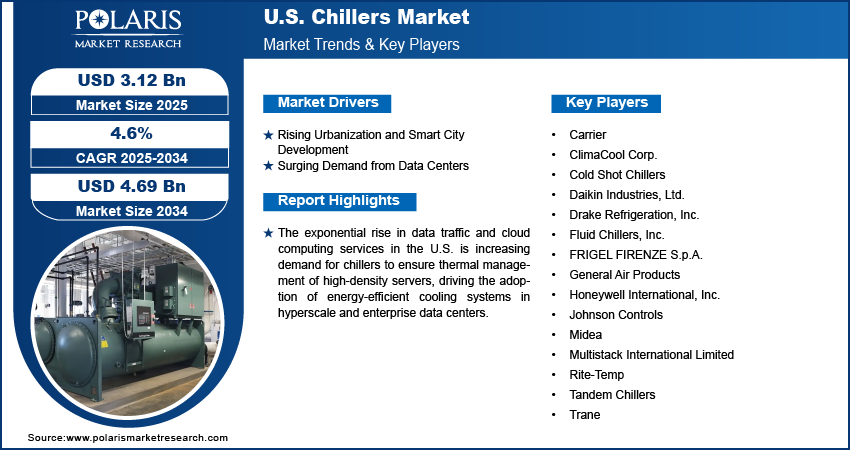

The U.S. chillers market size was valued at USD 2.98 billion in 2024, growing at a CAGR of 4.6% from 2025 to 2034. Rapid growth in cloud computing, 5G networks, and edge computing is driving a significant rise in data center development, requiring advanced chiller systems to ensure optimal thermal management, uptime reliability, and scalability for increasingly dense server environments.

Key Insights

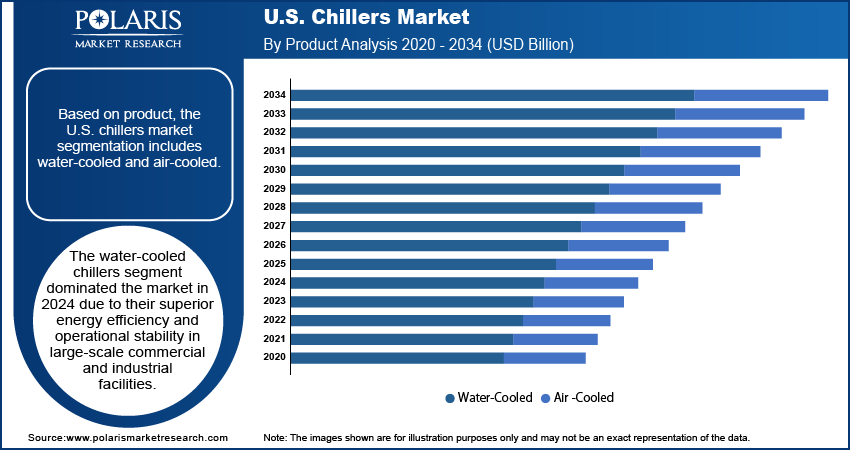

- The water-cooled chillers segment led the U.S. chillers market in 2024, driven by high energy efficiency and stable performance in large commercial and industrial cooling applications.

- The commercial segment held the largest revenue share in 2024, supported by widespread chiller installations in offices, shopping malls, hospitals, and educational facilities.

- The screw chillers segment captured the largest share in 2024 due to their high efficiency, reliable operation, and strong performance under variable and large cooling loads.

Industry Dynamics

- Rising demand for energy-efficient cooling in data centers and healthcare facilities is driving the adoption of advanced chiller systems across the U.S.

- Stringent federal and state energy regulations are accelerating the replacement of aging chillers with high-efficiency, compliant models in commercial buildings.

- Integration of smart controls and IoT enables predictive maintenance and optimized performance in modern chiller installations.

- High upfront costs and limited availability of skilled technicians slow down adoption, especially in small and mid-sized facility upgrades.

Market Statistics

- 2024 Market Size: USD 2.98 billion

- 2034 Projected Market Size: USD 4.69 billion

- CAGR (2025–2034): 4.6%

AI Impact on U.S. Chillers Market

- AI is reshaping the U.S. chillers market in various transformative ways. Smart AI-enabled chillers are becoming the new norm from industrial facilities to data centers.

- AI algorithms help detect early signs of wear or failure by analyzing sensor data, allowing for proactive repairs and reduced downtime.

- AI adjusts compressor speeds, water flow rates, and refrigerant cycles to match real-time cooling demands, reducing energy consumption

The U.S. chillers market focuses on the design, production, and sale of cooling systems used to remove heat from a liquid via a vapor-compression or absorption refrigeration cycle. These systems are widely deployed in industrial operations, commercial buildings, healthcare, and data centers for process cooling, HVAC systems, and environmental control. Chillers are critical for maintaining temperature-sensitive environments and improving energy efficiency in infrastructure and manufacturing facilities. Aging HVAC infrastructure in commercial buildings, hospitals, and institutions across the U.S. is undergoing upgrades, accelerating the demand for modern chiller solutions that offer enhanced performance, lower maintenance, and integration with intelligent building management systems.

Increased industrial activity, particularly in pharmaceuticals, food processing, and automotive sectors, is boosting the adoption of process chillers to maintain precise temperature control, improve product quality, and support continuous operations under regulated environmental conditions. Moreover, environmental regulations targeting high-GWP refrigerants are prompting a shift toward chillers that utilize eco-friendly, low-GWP or natural refrigerants, creating new product development opportunities and encouraging users to replace outdated systems with compliant technologies.

Drivers & Opportunities

Government Incentives and Rebates: Government support through incentives and rebate programs is playing a critical role in driving the adoption of energy-efficient chillers across the U.S. HVAC landscape. According to the U.S. Department of Energy, in March 2024, over USD 500 million in new rebates was allocated under the Inflation Reduction Act for energy-efficient commercial HVAC upgrades across 27 states. Federal and local authorities are increasingly promoting sustainability through financial benefits such as tax credits, grants, and rebates, encouraging public institutions and small- to medium-sized businesses to invest in upgraded chiller systems. These programs make advanced technologies more accessible, particularly in retrofitting older infrastructure where long-term energy savings are a priority. Building owners and facility managers are responding to these financial motivators by replacing outdated units with high-efficiency models that align with modern energy codes and green building standards. The push for decarbonization in commercial buildings and schools further reinforces this shift. In addition, the ability to achieve faster payback periods through lower energy costs and rebate-driven capital offsets strengthens the case for investment. These market dynamics accelerate demand for chillers across the private and public sectors.

Surging Data Center Construction: Data center construction is expanding rapidly across the U.S. in response to the explosive demand for cloud computing, artificial intelligence, 5G connectivity, and edge computing applications. In 2025, Amazon announced an investment of USD 30 billion in new data centers across the U.S. to enhance AI infrastructure, improving computing capabilities and supporting increasing AI workload demands. This trend is placing immense pressure on operators to deploy high-performance cooling infrastructure capable of maintaining ideal thermal conditions in increasingly high-density server environments. Chillers are a fundamental part of this thermal management strategy, offering scalable and energy-efficient cooling that ensures uptime and protects sensitive hardware. As server racks become denser and computational loads intensify, advanced chiller systems are being prioritized for their ability to operate reliably under continuous demand. Operators are turning to modular and low-GWP refrigerant-based chillers to reduce energy consumption while meeting environmental regulations. Innovations such as free cooling integration, real-time performance monitoring, and adaptive load control are further enhancing their value. Investments in colocation, hyperscale, and edge data facilities continue to surge, creating sustained demand for next-generation chiller systems across both new builds and existing site expansions.

Segmental Insights

Product Analysis

Based on product, the U.S. chillers market segmentation includes water-cooled and air-cooled. The water-cooled segment dominated the market in 2024, due to their superior energy efficiency and operational stability in large-scale commercial and industrial facilities. These systems perform well in environments with consistent water supply and are favored in applications that demand continuous cooling loads, such as hospitals, data centers, and high-rise office complexes. The ability to maintain lower condensing temperatures enhances performance in critical environments. Moreover, increasing investments in centralized HVAC infrastructure in urban redevelopment projects have strengthened demand. Their longer lifecycle and reduced maintenance in controlled environments have positioned water-cooled systems as the preferred choice among large-scale operators.

The air-cooled segment is expected to register the highest CAGR from 2025 to 2034, driven by rising demand for compact, cost-effective, and easy-to-install cooling systems in decentralized buildings. These systems are well-suited for retrofit applications and small-to-mid-sized commercial properties where access to a water source is limited. Advancements in variable-speed technologies and integrated control systems are enhancing their energy efficiency, making them more viable under evolving building energy codes. Growth in suburban construction, especially retail and office spaces using rooftop HVAC systems, is expanding their deployment. Flexibility in placement and lower installation costs contribute to increasing adoption across diverse non-industrial environments.

Application Analysis

In terms of application, the U.S. chillers market segmentation includes commercial, industrial, and residential. The commercial segment accounted for the largest revenue share in 2024, supported by robust chiller installations across offices, shopping centers, hospitals, and educational institutions. Stringent indoor air quality standards and occupant comfort expectations are driving upgrades to modern, efficient chiller systems. Urban expansion and redevelopment of aging buildings across U.S. cities are further stimulating demand. Many property managers are opting for centralized cooling systems that offer lifecycle cost savings and meet energy efficiency benchmarks. Sustainability goals among real estate developers are encouraging the adoption of chillers integrated with smart energy management platforms. This commercial demand reflects a broader shift toward green, intelligent infrastructure.

The industrial segment is growing due to expanding applications in manufacturing plants, food and beverage processing, chemical production, and pharmaceutical operations. These facilities require precise temperature control and uninterrupted cooling, which chillers can provide efficiently. Rising automation and production scale-ups are generating heat loads that must be managed to ensure operational consistency. Additionally, stricter thermal regulation and environmental compliance policies in industrial zones are reinforcing the shift toward advanced chiller solutions. Growth in industrial parks, especially those integrating renewable energy systems with HVAC infrastructure, is supporting increased deployment. Customized, high-capacity chillers are meeting diverse process cooling requirements in this sector.

Compressor Type Analysis

In terms of compressor type, the U.S. chillers market segmentation includes screw chillers, centrifugal chillers, absorption chillers, scroll chillers, and reciprocating chillers. The screw chillers segment held the largest revenue share in 2024 due to their high efficiency, part-load performance, and reliability in handling medium to large cooling loads. These chillers are commonly used in large commercial buildings and process industries that demand consistent operation and low noise levels. Their ability to operate under variable load conditions without compromising performance makes them ideal for HVAC systems running year-round. Demand has been propelled by upgrades in existing commercial infrastructure and the integration of oil-free screw compressor technology. Continued emphasis on energy savings and sustainability in both private and public sector projects is further supporting their adoption.

The growth of the scroll chillers segment is fueled by increasing demand for compact, energy-efficient, and low-noise cooling solutions in both commercial and residential buildings. In the U.S. chillers market, this demand is further driven by strict energy efficiency regulations, rising adoption of green building standards, and the expanding need for advanced HVAC systems in data centers, healthcare facilities, and hospitality sectors. The shift toward sustainable construction and climate-conscious technologies is prompting wider adoption of scroll chillers as a reliable solution for modern cooling requirements with minimal environmental impact.

Key Players & Competitive Analysis

The competitive landscape of the U.S. chillers market is shaped by a mix of market expansion strategies, joint ventures, and strategic alliances aimed at strengthening domestic production and distribution networks. Industry analysis reveals a strong focus on technology advancements to improve energy efficiency and operational reliability across various chiller systems. Mergers and acquisitions have played a significant role in consolidating market share and accelerating product innovation cycles. Companies are pursuing post-merger integration to optimize manufacturing capabilities and align R&D efforts. Strategic alliances with HVAC contractors and energy service companies are enhancing market reach and customer retention.

Players are also expanding into customized and modular chiller systems to cater to diverse application needs across industrial and commercial sectors. Regulatory compliance and environmental certifications are emerging as key differentiators, prompting further investment in low-GWP refrigerants and smart control systems.

Key Players

- Carrier

- ClimaCool Corp.

- Cold Shot Chillers

- Daikin Industries, Ltd.

- Drake Refrigeration, Inc.

- Fluid Chillers, Inc.

- FRIGEL FIRENZE S.p.A.

- General Air Products

- Honeywell International, Inc.

- Johnson Controls

- Midea

- Multistack International Limited

- Rite-Temp

- Tandem Chillers

- Trane

U.S. Chillers Industry Developments

May 2025: Modine announced it would invest more than USD 38 million to expand manufacturing capacity for data center chillers.

U.S. Chillers Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Water-Cooled

- <50kW

- 51–100kW

- 101–500kW

- 501–1000kW

- 1001–1500kW

- >1501kW

- Air-Cooled

- <50kW

- 51–100kW

- 101–500kW

- 501–1000kW

- 1001–1500kW

- >1501kW

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Commercial

- Corporate Offices

- Data Centers

- Public Buildings

- Mercantile & Service

- Healthcare

- Others

- Industrial

- Chemicals & Pharmaceuticals

- Food & Beverage

- Metal Manufacturing & Machining

- Medical & Pharmaceutical

- Plastics

- Others

- Residential

By Compressor Type Outlook (Revenue, USD Billion, 2020–2034)

- Screw Chillers

- Centrifugal Chillers

- Absorption Chillers

- Scroll Chillers

- Reciprocating Chillers

U.S. Chillers Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 2.98 billion |

|

Market Size in 2025 |

USD 3.12 billion |

|

Revenue Forecast by 2034 |

USD 4.69 billion |

|

CAGR |

4.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The U.S. market size was valued at USD 2.98 billion in 2024 and is projected to grow to USD 4.69 billion by 2034.

The U.S. market is projected to register a CAGR of 4.6% during the forecast period.

A few of the key players in the market are Carrier; ClimaCool Corp.; Cold Shot Chillers; Daikin Industries, Ltd.; Drake Refrigeration, Inc; Fluid Chillers, Inc.; FRIGEL FIRENZE S.p.A.; General Air Products; Honeywell International, Inc.; Johnson Controls; Midea; Multistack International Limited; Rite-Temp; Tandem Chillers; and Trane.

The chillers segment dominated the market in 2024 due to their superior energy efficiency and operational stability in large-scale commercial and industrial facilities.

The commercial segment accounted for the largest revenue share in 2024, supported by robust chiller installations across offices, shopping centers, hospitals, and educational institutions.