Edge Computing Market Size, Share, Trends, & Industry Analysis Report

By Component (Hardware, Software), By Application, By Organization Size, By Verticals, By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 118

- Format: PDF

- Report ID: PM2833

- Base Year: 2024

- Historical Data: 2020-2023

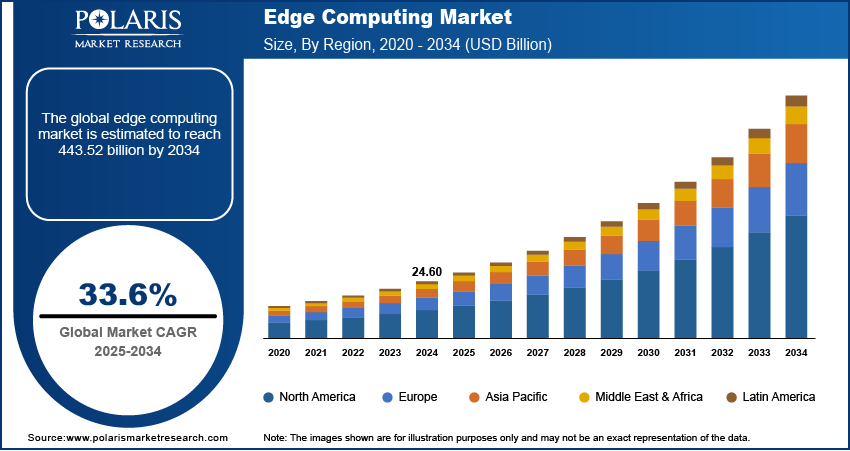

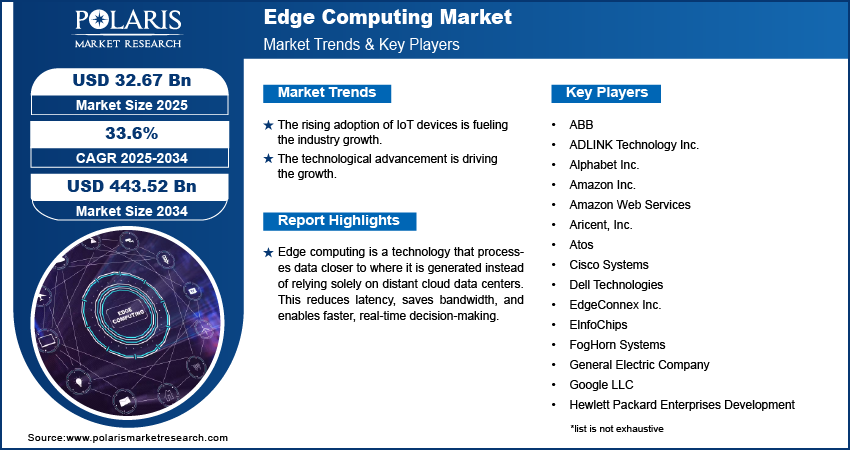

The global edge computing market was valued at USD 24.60 billion in 2024 and is expected to grow at a CAGR of 33.6% during the forecast period. The growing demand for the edge computing market is driven by the rising adoption of smart devices and industrial IoT, increasing expenditure for autonomous vehicles, and growing demand for deployment of a 5G network.

Key Insights

- The large enterprises segment is expected to witness significant growth during the forecast period due to the increased demand for data security and growing cloud-based data traffic.

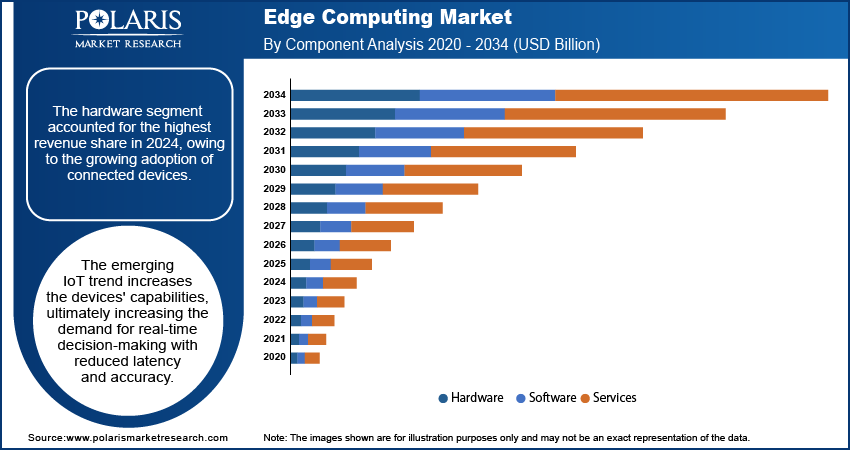

- The hardware segment accounted for the largest share in 2024 driven by the growing adoption of connected devices.

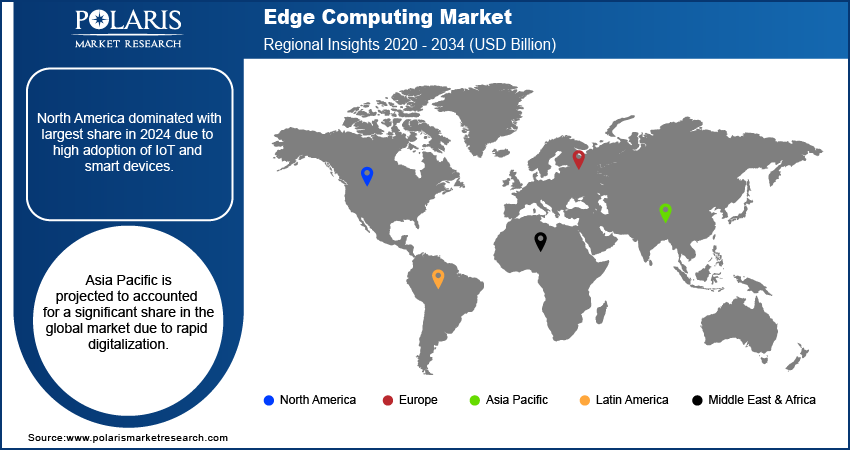

- North America dominated with largest share in 2024 due to high adoption of IoT and smart devices.

- Asia Pacific is projected to accounted for a significant share in the global market due to rapid digitalization.

Industry Dynamics

- The rising adoption of IoT devices is fueling the industry growth.

- The rising data volume in traditional data center infrastructure is boosting the industry growth.

- The technological advancement is driving the growth.

- High infrastructure cost and complexity of deployment across diverse and remote environments limits the growth.

Market Statistics

- 2024 Market Size: USD 24.60 Billion

- 2034 Projected Market Size: USD 443.52 Billion

- CAGR (2025-2034): 33.6%

- Largest Market: North America

To Understand More About this Research: Request a Free Sample Report

Impact of AI on Industry

- Reduce latency, improve responsiveness, and support real-time applications.

- Improve privacy and data security by processing sensitive data locally

- Reduce bandwidth and cut the cost. It also reduces cloud storage and computation expenses.

Edge computing is a technology that processes data closer to where it is generated instead of relying solely on distant cloud data centers. This reduces latency, saves bandwidth, and enables faster, real-time decision-making. It is especially useful for applications like IoT, autonomous vehicles, smart cities, and industrial automation.

A large number of devices are connected to the internet, which creates a high volume of data in traditional data center infrastructures. The emerging technologies & evolution of rapid adoption of computing devices across many industries are anticipated to create a high volume of decentralized data. A large amount of data generation reduces latency and inefficiencies while processing; edge computing relocates this data processing to the data sources rather than relying on the data center to handle and analyze data. This help organization optimizes their systems, which is driving the demand for the edge computing.

Industry Dynamics

Growth Drivers

The global edge computing market is driven by the rising adoption of IoT devices, which creates a huge amount of data that needs to be processed and analyzed. In addition, organizations shifting from cloud computing and storage systems to edge computing owing to its better bandwidth and low latency for analysis is an essential factor fueling the market growth. Furthermore, edge computing brings computation closer to IoT devices. As a result, data is more secure, and network latency is decreased due to a reduction in the distance for data transfer. This enables edge computing to optimize IoT applications requiring real-time responses, supporting market growth.

For instance, Klika Tech partnered with the tinyML foundation to solve real business issues by integrating machine learning models, software, and hardware. Moreover, the partnership is based on empowering tinyML to expand its business using resource-limited devices to become better, smarter, and more responsive, which is projected to propel the market growth.

Report Segmentation

The market is primarily segmented based on component, application, organization size, verticals, and region.

|

By Component |

By Application |

By Organization Size |

By Verticals |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

Hardware segment accounted for the largest share in 2024

The hardware segment accounted for the highest revenue share in 2024, owing to the growing adoption of connected devices. The emerging IoT trend increases the devices' capabilities, ultimately increasing the demand for real-time decision-making with reduced latency and accuracy. Additionally, with the increasing volume of data, hardware is deployed to relieve the burdens from data and cloud centers, which is anticipated to support segment growth. Furthermore, businesses are opting for hardware that is robust, compact, has enough storage capacity, offers a variety of connectivity choices to operate over a wide power range, and also meets the requirement for which it is used. This hardware is mostly used in situations where it must perform reliably and optimally, increasing its demand in the military and defense sector; such factors influence segment growth.

Large enterprises are expected to witness faster growth

The demand for edge computing in large enterprises is expected to surge significantly over the forecast period due to the increased demand for data security and growing cloud-based data traffic. Many large enterprises are adopting advanced technologies such as artificial intelligence and machine learning to improve the overall productivity of their firms. Additionally, these firms generate a large amount of raw data which needs to be processed and analyzed, which increases the demand for edge computing. Moreover, many end-use industries are deploying edge computing as it enables data retrieval more quickly as keeps data near the devices that are using it, which guarantees real-time data utilization. Also, large enterprises create a lot of data that needs to be confidential and free from threat; edge computing improves the privacy and security of the generated data, which drives segment growth.

North America dominated with largest share in 2024

The North America dominated with largest share in 2024 due to presence of mature cloud infrastructure and high internet penetration. Both urban as well as rural areas in the region has strong access to internet. This strong access to internet increases the number of connected devices and data generation which fuels the need for edge computing to process data locally and reduce latency. Moreover, the governments in the region are increasingly investing in the smart city infrastructure, which further fuels the demand for the edge computing. Edge computing enables real time data processing from cameras, sensors, and IoT devices which are used in traffic management, thereby driving the growth in the North America.

Asia Pacific is expected to witness the fastest growth over the forecast period

Asia Pacific is expected to witness faster growth over the forecast period owing to the rapid digitalization, innovation in technologies, and expansion of connected devices across developing nations such as China, India, Japan, and South Korea. In addition, the presence of major telecom players and increasing IT investments to deploy edge computing support regional growth. Furthermore, rising government funding to empower digitization and the increasing need for many businesses to store and process data contribute to market growth. Moreover, emerging IoT applications across smart cities create huge amounts of data. The increasing demand for processing and analyzing data at a comparatively low cost compared to cloud computing to produce information and enhance real-time decision-making near the data source drives segment growth.

Competitive Insight

Some of the major players operating in the global market include ABB, ADLINK Technology Inc., Alphabet Inc., Amazon Inc, Amazon Web Services, Aricent, Inc., Atos, Cisco Systems, Dell Technologies, EdgeConnex Inc, ElnfoChips, FogHorn Systems, General Electric Company, Google LLC, Hewlett Packard Enterprises Development, Honeywell International Inc., Huawei Technologies Co. Ltd, IBM Corporation, Intel Corporation, Juniper Networks, Microsoft Corporation, Rockwell Automation, Inc, Saguna Networks, SAP SE, Schneider Electric SE, and Siemens AG.

Recent Developments

In July 2022: SixSq participated in the 5G-EMERGE project to develop solutions that use 5G technology and satellite broadcasting and enable distribution of high-quality content services all over Europe.

In November 2021: Litmus acquired kickdynamic to expand its portfolio with content automation, and AI-driven product users can build, test, and collaborate on high volumes of emails and also provide personalized email customer experience.

Edge Computing Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 24.60 billion |

| Market size value in 2025 | USD 32.67 billion |

|

Revenue forecast in 2034 |

USD 443.52 billion |

|

CAGR |

33.6% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Component, By Application, By Organization Size, By Verticals, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

ABB, ADLINK Technology Inc., Alphabet Inc., Amazon Inc, Amazon Web Services, Aricent, Inc., Atos, Cisco Systems, Dell Technologies, EdgeConnex Inc, ElnfoChips, FogHorn Systems, General Electric Company, Google LLC, Hewlett Packard Enterprises Development, Honeywell International Inc., Huawei Technologies Co. Ltd, IBM Corporation, Intel Corporation, Juniper Networks, Microsoft Corporation, Rockwell Automation, Inc, Saguna Networks, SAP SE, Schneider Electric SE, and Siemens AG |

FAQ's

• The market size was valued at USD 24.60 Billion in 2024 and is projected to grow to USD 443.52 Billion by 2034.

• The market is projected to register a CAGR of 33.6% during the forecast period.

• A few of the key players in the market are ABB, ADLINK Technology Inc., Alphabet Inc., Amazon Inc, Amazon Web Services, Aricent, Inc., Atos, Cisco Systems, Dell Technologies, EdgeConnex Inc, ElnfoChips, FogHorn Systems, General Electric Company, Google LLC, Hewlett Packard Enterprises Development, Honeywell International Inc., Huawei Technologies Co. Ltd, IBM Corporation, Intel Corporation, Juniper Networks, Microsoft Corporation, Rockwell Automation, Inc, Saguna Networks, SAP SE, Schneider Electric SE, and Siemens AG.

• The hardware accounted for the largest market share in 2024.

• The large enterprises segment is expected to record significant growth.