Data Center Market Share, Size, Trends, & Industry Analysis Report

By Type (Hyperscale, Colocation, Edge, and Others); By Component; By Enterprise Size; By End-User; By Region; Segment Forecast, 2025- 2034

- Published Date:Aug-2025

- Pages: 130

- Format: PDF

- Report ID: PM3871

- Base Year: 2024

- Historical Data: 2020-2023

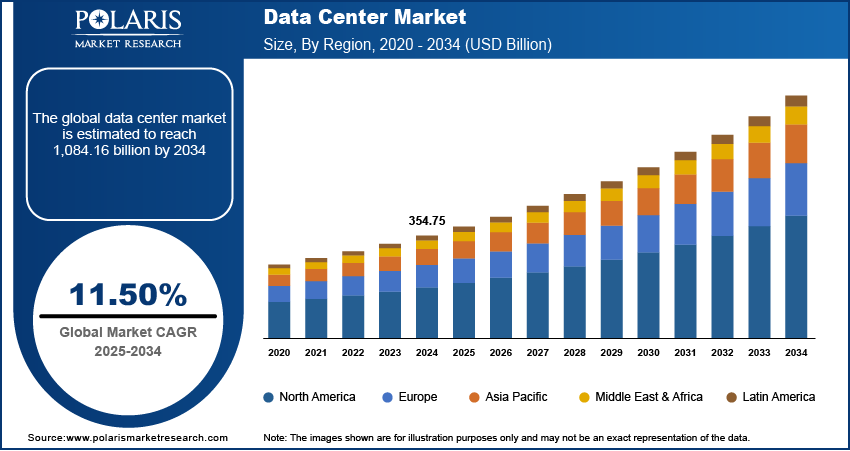

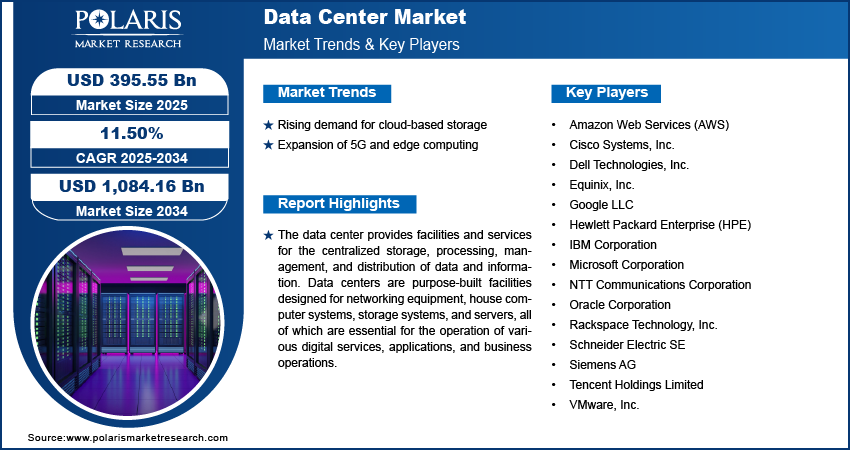

The global data center market size was valued at USD 354.75 billion in 2024, exhibiting a CAGR of 11.50% during 2025–2034. The market is driven by increasing cloud computing adoption, rising volumes of data generation, and the expansion of hyperscale and colocation facilities.

Key Insights

- The colocation segment is expected to grow fastest due to increasing demand for scalable, cost-effective infrastructure that allows businesses to outsource data center management.

- The services segment is poised for the highest growth, driven by rising complexities, security challenges, and the need for advanced technological support in data center operations.

- In 2024, large enterprises dominated the market, as their vast data needs require robust, secure, and high-capacity data center solutions.

- North America leads the data center market, driven by advanced digital infrastructure, robust cloud adoption, and substantial investments in technology.

- The Asia Pacific region is growing at the fastest rate due to rapid digital transformation, expanding internet penetration, and increasing demand for data storage and processing capabilities.

Industry Dynamics

- Rapid growth in cloud computing and rising data consumption are driving demand for advanced data centers.

- The expansion of IoT and AI technologies further accelerates data center capacity requirements.

- High energy consumption and associated operational costs restrict sustainable growth.

- Adoption of green technologies and renewable energy sources presents significant opportunities for eco-friendly data centers.

Market Statistics

- 2024 Market Size: USD 354.75 billion

- 2034 Projected Market Size: USD 1084.16 billion

- CAGR (2025-2034): 11.50%

- North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

The data center provides facilities and services for the centralized storage, processing, management, and distribution of data and information. Data centers are purpose-built facilities designed for networking equipment, house computer systems, storage systems, and servers, all of which are essential for the operation of various digital services, applications, and business operations.

A data center is a physical place that holds computing machines and their affiliated hardware tools. It possesses the computing infrastructure that IT systems need, such as data storage drives, servers, and network equipment. It is the physical structure that holds any company’s digital data. The scale and quantity of equipment needed also rise dramatically as the business and IT activities expand. Maintaining equipment that is dispersed across multiple branches and locations can be challenging. Instead, businesses utilize data centers to locate centrally and affordably manage their devices, which expands the data center market size.

Moreover, there are various sorts of data center structures, and a single enterprise can utilize more than one kind of data center, depending on business requirements and workloads. Different types of data centers include public cloud data centers, enterprise (on-premises) data centers, and, managed data centers and colocation facilities.

In today's digital landscape, data centers serve as the core of contemporary technological infrastructure. These specialized facilities are meticulously engineered to house, oversee, process, and distribute extensive volumes of crucial information essential for the functioning of businesses, institutions, and governments on a global scale. As the cornerstone of the digital realm, data centers play a crucial role in facilitating the smooth transmission of information worldwide.

Data centers serve as the nerve center for a wide array of digital operations. They store everything from personal emails to massive enterprise databases, streaming content for entertainment platforms, and the complex algorithms that power artificial intelligence systems. Beyond storage, data centers enable real-time processing of transactions, support cloud computing services, and host critical applications for businesses and public services.

- For instance, In October of 2022, Intel Corp collaborated with Alphabet Inc's Google Cloud and unveiled a jointly developed chip poised to enhance both security and operational efficiency within data centers.

One of the primary advantages of centralized data centers is their ability to ensure data availability and accessibility. Redundant power supplies, robust security measures, and climate-controlled environments safeguard against disruptions, guaranteeing uninterrupted services. This reliability is especially crucial for industries such as finance, healthcare, and emergency services, where downtime can have dire consequences.

The research study provides a comprehensive analysis of the industry, assessing the market on the basis of various segments and sub-segments. It sheds light on the competitive landscape and introduces data center market key players from the perspective of market share, concentration ratio, etc. The study is a vital resource for understanding the growth drivers, opportunities, and challenges in the industry.

Furthermore, data centers empower the execution of big data analytics and machine learning algorithms. These cutting-edge technologies hinge on substantial computational capabilities and a service centralized data centers deliver proficiently. This capability empowers businesses to garner invaluable insights from colossal datasets.

Industry Dynamics

Growth Drivers

The rapid adoption of cloud computing service

The exponential growth of digital data creation, fueled by the proliferation of internet-connected devices and the advent of the Internet of Things (IoT), necessitates larger, more efficient data storage solutions. Additionally, the rapid adoption of cloud computing services and the increasing reliance on virtualization technologies have further augmented the need for data centers.

The increasing usage of various technologies such as 5G, edge computing, and quantum computing are driving the expansion of data center infrastructure. Also, the arrival of 5G networks demands a sturdy network of data centers proficient in managing the colossal volumes of data generated by high-speed, low-latency mobile connectivity. Conversely, edge computing prioritizes the processing of data in close proximity to its origin, mandating a mix of smaller, scattered data centers in conjunction with larger centralized facilities.

Report Segmentation

The market is primarily segmented based on type, component, enterprise size, end-user, and region.

|

By Type |

By Component |

By Enterprise Size |

By End-User |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

The colocation segment is expected to witness the fastest growth during the forecast period.

The colocation segment is expected to witness the fastest growth during the forecast period. Colocation data centers are gaining popularity as businesses recognize the numerous advantages of leasing space rather than constructing their own data center infrastructure. The intricacies of infrastructure facilities are on the rise, primarily due to the integration of technologies such as networks and connectivity devices.

Colocation services allow businesses to share the costs of data center infrastructure, including space, power, cooling, and security, with other tenants. It significantly reduces the capital expenditure required to build and maintain a private data center.

Further, colocation providers offer scalable solutions, allowing businesses to easily expand or downsize their IT footprint as their needs change. Its flexibility is crucial in today's dynamic business environment.

By Component Analysis

The services segment is expected to witness the highest growth during the forecast period.

The services segment is expected to witness the highest growth during the forecast period due to the evolving complexities, security concerns, and technological advancements within data center environments. Specialized services are essential for businesses to navigate this dynamic landscape and extract maximum value from their data center investments.

Moreover, as data centers become more sophisticated and integrate advanced technologies like cloud computing, virtualization, and edge computing, businesses require specialized services to design, implement, and manage these complex environments. Hence, these factors are providing significant growth in the data center market.

By Enterprise Size Analysis

Large enterprises segment held the largest market share in 2024

In 2024, the large enterprises segment held the largest market share. The evolution from traditional, on-premises physical servers to virtual network-based data centers is a consequence of the remarkable progress in multi-cloud computing. This transformation is propelling the expansion of data centers on a global scale. In the modern enterprise landscape, data centers are equipped to establish robust communication links with multiple locations, encompassing both cloud computing platforms and on-premises infrastructure. This adaptability ensures that the data center remains a dynamic and responsive nucleus for the enterprise's digital operations.

Regional Insights

The North America data center market dominates the global landscape, with the United States leading in terms of data center capacity, investment, and innovation. This dominance is attributed to the presence of major cloud service providers, such as Amazon Web Services, Microsoft Azure, and Google Cloud, as well as a robust IT ecosystem. North America also benefits from favorable government policies, advanced infrastructure, and high-speed internet penetration. The key markets, such as Northern Virginia, Silicon Valley, Dallas, and Phoenix, serve as major data center hubs due to their access to reliable power, fiber connectivity, and strong demand from hyperscalers and colocation providers.

The European data center market is also growing steadily, supported by stringent data privacy regulations, such as GDPR, and the rising demand for local data hosting solutions. Countries such as Germany, the UK, and the Netherlands are key contributors to regional growth, offering advanced digital infrastructure and strong enterprise demand.

The Asia Pacific data center market is experiencing rapid growth, driven by increasing internet penetration, growing cloud adoption, and expanding digital economies in countries such as China, India, Singapore, and Australia. Investments from global tech giants are accelerating market maturity in the region.

Key Market Players & Competitive Insights

The data center market needs to be more cohesive and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- Amazon Web Services (AWS)

- Cisco Systems, Inc.

- Dell Technologies, Inc.

- Equinix, Inc.

- Google LLC

- Hewlett Packard Enterprise (HPE)

- IBM Corporation

- Microsoft Corporation

- NTT Communications Corporation

- Oracle Corporation

- Rackspace Technology, Inc.

- Schneider Electric SE

- Siemens AG

- Tencent Holdings Limited

- VMware, Inc.

Recent Developments

- In May 2025, Qualcomm unveiled data center processors built for artificial intelligence workloads, designed to interoperate with Nvidia’s chips. The launch signals Qualcomm’s renewed push into the data center arena after earlier attempts in the previous decade saw limited success.

-

In May 2025, Supermicro launched its next-generation DLC‑2 direct liquid-cooling solution—achieving 40% power savings and 20% lower total cost of ownership for modern data centers.

-

In February 2025, Alibaba Cloud, the digital technology branch of Alibaba Group, launched its second data center in Thailand to address the increasing need for cloud computing services, especially for generative AI applications. The new center improves local capabilities and aligns with the Thai government's initiatives to support digital innovation and sustainable technology.

-

In December 2024, Amazon Web Services (AWS) introduced an updated data center architecture to support AI innovation and improve energy efficiency. These advancements integrate innovations in power, cooling, and hardware design, resulting in a more energy-efficient data center that will support ongoing customer innovation.

-

In May 2024, Equinix, Inc. officially opened its first two data centers in Malaysia, located in Johor and Kuala Lumpur. These International Business Exchange (IBX) facilities are designed to support the company’s customer base within the country and strengthen digital connectivity across the region.

Data Center Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 355.95 billion |

|

Revenue Forecast in 2034 |

USD 1084.16 billion |

|

CAGR |

11.50% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments Covered |

By Type, By Component. By Enterprise Size, By End-User, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

Delve into the intricacies of the data center market landscape with the latest statistical insights for 2025, meticulously crafted by Polaris Market Research Industry Reports. Uncover the market's share, size, and revenue growth rate, supplemented by a forward-looking market forecast until 2034 and a retrospective glance at its history. Elevate your understanding of this dynamic industry by securing a complimentary PDF download of the sample report and stay ahead in the ever-evolving realm of data center.

Browse Our Top Selling Reports

Subdural Electrodes Market Size, Share 2024 Research Report

Silica Flour Market Size, Share 2024 Research Report

Biophotonics Market Size, Share 2024 Research Report

Healthcare Data Integration Market Size, Share 2024 Research Report

AI in Telecommunication Market Size, Share 2024 Research Report

FAQ's

The global market size was valued at USD 354.75 billion in 2024 and is projected to grow to USD 1,084.16billion by 2034.

The global market is projected to register a CAGR of 11.50% during the forecast period.

North America leads the data center market, driven by advanced digital infrastructure, robust cloud adoption, and substantial investments in technology.

A few of the key players in the market are Amazon Web Services (AWS); Cisco Systems, Inc.; Dell Technologies, Inc.; Equinix, Inc.; Google LLC; Hewlett Packard Enterprise (HPE); IBM Corporation; Microsoft Corporation; NTT Communications Corporation; Oracle Corporation; Rackspace Technology, Inc.; Schneider Electric SE; Siemens AG; Tencent Holdings Limited; VMware, Inc.

The services segment is poised for the highest growth, driven by rising complexities, security challenges, and the need for advanced technological support in data center operations.

In 2024, large enterprises dominated the market, as their vast data needs require robust, secure, and high-capacity data center solutions.