Silica Flour Market Share, Size, Trends, Industry Analysis Report

By Type (Quartz, Cristobalite), By End-use (Glass & Clay, Foundry, Fiberglass, Oil Well Cement), By Region, And Segment Forecasts, 2024 - 2032

- Published Date:Jan-2024

- Pages: 117

- Format: PDF

- Report ID: PM4231

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

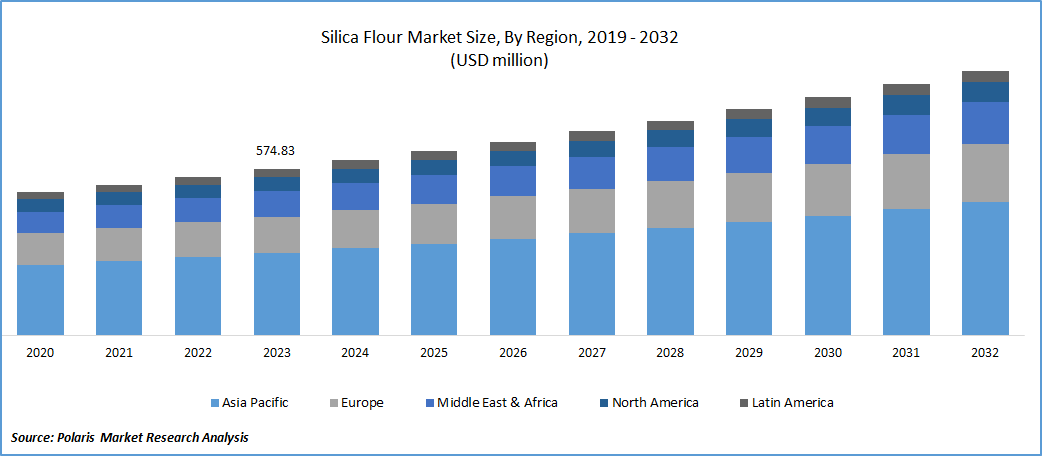

The global silica flour market was valued at USD 574.83 million in 2023 and is expected to grow at a CAGR of 5.3% during the forecast period.

The growth of silica flour can be attributed to its versatile applications spanning various industries. This finely grounded silica sand is renowned for its outstanding purity & high silica content. One of the key factors driving the rising demand is the flourishing construction and infrastructure sectors, where silica flour finds extensive use in producing concrete, mortars, and grouts. Notably, the global construction industry experienced significant expansion, increasing from USD 6.4 Tn in 2020 to USD 8.2 Tn in 2022, as reported by the World Paints & Coatings Industry Association.

To Understand More About this Research: Request a Free Sample Report

Silica finds extensive use in various products due to its efficiency, affordability, and non-toxic properties. It is utilized in a wide array of items including powdered spices, dairy products, beverages, construction materials like concrete and bricks, personal care items such as toothpaste and sunscreen, electronic components like computer chips, optical fibers, household items like paints and cat litter, and even sports equipment like golf balls and tennis racquets. Its versatile applications touch many aspects of our daily lives, underscoring its vital role in numerous products.

The market is expected to grow during the forecast period due to the thriving construction industry, where silica flour is essential for producing high-strength concrete, mortars, and grouts. Its exceptional properties, including enhanced durability and resistance to chemical attacks, make it a crucial additive in construction materials. According to the Associated General Contractors of America (AGC), the U.S. constructs structures worth approximately USD 1.8 trillion annually, with over 0.92 million construction establishments completed in the 1st quarter of 2023.

The increasing construction projects in the country are expected to boost the demand for the product in the coming years. Additionally, the fiberglass industry in the U.S. is experiencing a growing need for silica flour. Fiberglass is used in various applications, such as automotive components, wind turbine blades, and aerospace parts. Silica flour plays a vital role in fiberglass production as it improves the strength and overall performance of the final fiberglass product.

Growth Drivers

Growing Construction Industry

Silica flour is widely used in the construction industry for manufacturing concrete and mortar. As construction activities increase globally, the demand for silica flour market is likely to rise.

Silica flour's exceptional properties, including enhanced strength, durability, and resistance to chemical attacks, make it a perfect additive in various applications. The electronics sector, especially in semiconductor and optical fiber manufacturing, has experienced a surge in demand for silica flour. Additionally, the pharmaceutical and cosmetics industries increasingly require silica flour as an excipient in formulations due to its capacity to improve the flow properties and stability of drugs and cosmetic products. Given its diverse advantages and growing use across multiple sectors, the demand for this product is anticipated to rise in the future.

Report Segmentation

The market is primarily segmented based on type, end use, and region.

|

By Type |

By End Use |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

Quartz Segment Held the Largest Share

Quartz segment held the largest share in the market. This dominance is linked to the significant influence of quartz type on the physical & chemical characteristics of the silica flour, encompassing factors like particle size distribution, & reactivity. These attributes play a crucial role in determining the product's performance across diverse applications.

For instance, finer quartz particles tend to enhance flow properties and strengthen construction materials. Quartz particles typically exist as fine grains, falling between gravel and silt in coarseness. Various types of quartz, such as crystalline and amorphous quartz, can be utilized to produce silica flour. The selection of quartz type hinges on the specific properties and intended applications of the product.

Cristobalite segment will grow at significant pace. Cristobalite offers exceptional thermal stability, minimal thermal expansion, and excellent electrical insulation properties, making it well-suited for high-temperature applications in sectors such as construction, ceramics, and foundries. Moreover, cristobalite is considered a safer option than crystalline quartz concerning worker safety and health risks related to inhalation. As industries expand and demand high-performance materials, the need for cristobalite in silica flour is expected to rise.

By End Use Analysis

Fiberglass Segment Accounted for the Largest Market Share in 2022

Fiberglass segment accounted for the largest market share. This dominance is due to Silica flour's widespread use as a reinforcing agent in fiber-glass manufacturing. During production, it is incorporated into the resin matrix to enhance the mechanical properties & overall strength of fiber-glass composites. The product's fine particles seamlessly integrate with the resin, providing superior reinforcement and enhancing the structural integrity of the final fiberglass item. Additionally, silica flour serves as a surface coating & a smoothing agent in fiberglass material production, ensuring a uniform finish, thereby improving the aesthetics & visual appeal of fiber-glass products.

Integrating silica flour enables manufacturers to achieve uniform texture, minimizing imperfections and ensuring a visually appealing surface. Furthermore, silica flour's outstanding thermal insulation properties make it a preferred option for heat-resistant applications. Its inclusion in fiberglass production enhances the final product's thermal insulation capabilities, rendering it suitable for critical industries like construction, automotive, aerospace, and marine, where effective thermal protection is vital. The oil well cement sector is expected to experience growth in the forecast period.

Silica flour boosts the cement's strength and durability, ensuring a secure seal between the well casing and the surrounding formation. Its exceptional thermal stability enables the cement to withstand high temperatures during drilling and production. Additionally, it serves as a fluid loss control agent, regulates cement setting time, and is compatible with diverse additives, enabling customized cement formulations tailored to specific well needs. In essence, silica flour's role in oil well cement is crucial for preserving the integrity and functionality of oil wells.

Regional Insights

Asia Pacific Region Accounted for the Largest Share of Global Market in 2022

APAC emerged as the largest region. This dominance is credited to the region's burgeoning construction, fiberglass, foundry, and personal care & cosmetic sectors. Notably, China stands as the world's largest construction market, expected to grow by approximately 8.6% from 2022 to 2030, as per the International Trade Administration. Additionally, India, according to Oxford Economics, is poised to become the world's fastest-growing construction market by 2030, with a growth rate nearly double that of China.

Europe will grow at the substantial pace. Silica flour is crucial in glass production, demanding high-quality input. The increasing need for glass products in sectors like construction, automotive, and packaging is fueling the product demand in this region. As reported by the Glass Alliance Europe, European glass production reached 39.5 million tons in 2021, with Germany leading as the largest producer.

The automotive sector in Europe is a major consumer of this product, employing it in tire manufacturing to enhance vehicle performance and fuel efficiency. As the demand for automobiles rises in Europe, there is a corresponding increase in demand for this product in the tire manufacturing industry. Consequently, the expanding end-use industries are expected to boost product demand in the region throughout the forecast period.

Key Market Players & Competitive Insights

The market is fiercely competitive, driving companies to adopt diverse strategic measures to extend their influence across various regions.

Some of the major players operating in the global market include:

- Adwan Chemical Industries Co. Ltd.

- AGSCO Corporation

- Capital Sand Company

- Fineton Industrial Minerals Limited

- Hoben International Ltd.

- Sibelco

- Sil Industrial Minerals

- U.S. Silica Holdings, Inc.

Recent Developments

- In June 2023, Sibelco has completed the acquisition of Kremer Zand en Grind (KZG). It expands Sibelco's customer reach but also enhances its silica reserves & resources in the Western Europe.

Silica Flour Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 604.60 million |

|

Revenue forecast in 2032 |

USD 914.94 million |

|

CAGR |

5.3% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2020 – 2022 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

By Type, By End Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

Explore the market dynamics of the 2024 Silica Flour Market share, size, and revenue growth rate, meticulously examined in the insightful reports crafted by Polaris Market Rersearch Industry Reports. The analysis of Silica Flour Market extends to a comprehensive market forecast up to 2032, coupled with a retrospective examination. Avail yourself of a complimentary PDF download to sample this in-depth industry analysis.

Browse Our Top Selling Reports

Pet Herbal Supplements Market Size, Share 2024 Research Report

Vegan Dips Market Size, Share 2024 Research Report

Calcium Fortified Foods Market Size, Share 2024 Research Report

FAQ's

Type, end use, and region are the key segments in the Silica Flour Market

The global silica flour market size is expected to reach USD 914.94 million by 2032

The global silica flour market and is expected to grow at a CAGR of 5.3% during the forecast period

Asia Pacific region is leading the global market

Growing Construction Industry are the key driving factors in Silica Flour Market