Pet Herbal Supplements Market Size, Share, Trends, Industry Analysis Report

: By Product, By Application, By Animal Type, By Dosage Form, By Distribution Channel (Online, Offline), and By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM4298

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

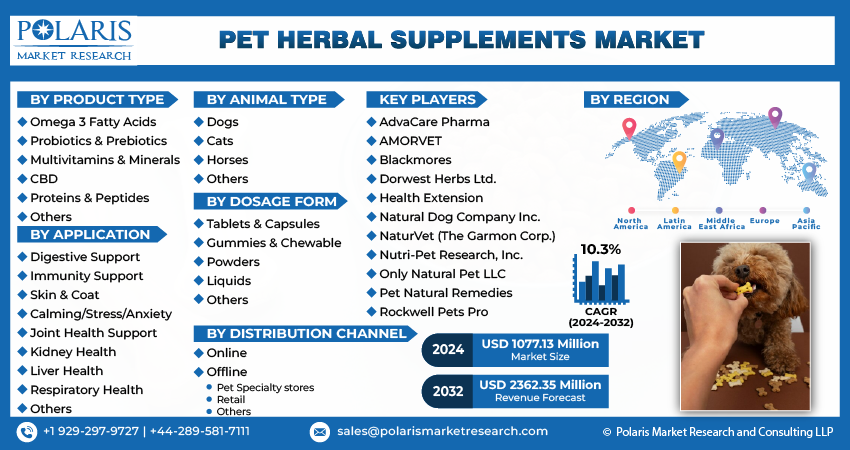

The pet herbal supplements market size was valued at USD 994.57 million in 2024, growing at a CAGR of 10.7% during 2025–2034. The growing adoption of pets worldwide and rising investments in animal healthcare are a few of the key factors driving market expansion.

Key Insights

- The proteins & peptides segment accounted for the largest market share in 2024. The segment’s dominance is attributed to the growing demand for functional ingredients that support joint health and immune function in pets.

- The gummies & chewable segment led the market in 2024. The segment’s dominance is attributed to the rising preference for convenient and easily administered forms.

- Asia Pacific dominated the market in 2024, primarily driven by rapid urbanization and a growing middle-class population in the region.

- North America is anticipated to witness the fastest growth. The high rates of pet ownership and the presence of a well-established pet care industry fuel regional market growth.

Industry Dynamics

- The rising number of aging cats and dogs, which face health issues such as weakened immunity and joint pain, drives market growth.

- Increasing disposable income globally has enabled pet owners to prioritize the health and wellness of their pets, fueling market demand.

- Growing focus on preventive healthcare is expected to provide several market opportunities in the coming years.

- Limited scientific evidence may hinder market growth.

Market Statistics

2024 Market Size: USD 994.57 million

2034 Projected Market Size: USD 2,738.68 million

CAGR (2025-2034): 10.7%

Asia Pacific: Largest Market in 2024

To Understand More About this Research: Request a Free Sample Report

Pet herbal supplements are products derived from plant-based ingredients formulated to support the health and well-being of pets, including dogs, cats, and horses. These supplements typically include herbs such as turmeric, ashwagandha, basil, parsley, and others. They are available in various forms such as tablets, capsules, powders, liquids, and chews. The primary purpose of these supplements is to address specific health concerns, such as joint pain, digestive issues, anxiety, skin and coat health, immunity, and age-related conditions, or to provide general wellness support.

The COVID-19 pandemic had a significant impact on the industry. Data from the American Society for the Prevention of Cruelty to Animals (ASPCA) indicates that almost one in five American households welcomed a cat or dog into their homes in the first year of the crisis. This surge in pet ownership has led to increased expenditure on herbal supplements to support pet health, thereby driving market expansion.

The rising adoption of pets globally is propelling the pet herbal supplements market growth. People now prioritize preventive care and holistic remedies for their pets, driving interest in herbal supplements that support digestion, joint health, and anxiety relief. The trend of treating pets as family members further drives demand for premium wellness products, including pet herbal supplements. Additionally, veterinarians are increasingly recommending pet herbal supplements, boosting consumer confidence and adoption. Therefore, with pet ownership expanding globally, the demand for pet herbal supplements continues to rise as owners prioritize safer, more natural ingredients to take care of their pets. As per the data published by the European Pet Food Industry Federation, there were around 352 million pets in Europe in 2022.

The pet herbal supplements market demand is driven by the rising investments in animal healthcare. Companies and research institutions are allocating more funds to animal health to develop advanced herbal formulations that appeal to pet owners seeking safe and effective alternatives to conventional medicine. Greater investment also expands distribution channels, making pet herbal supplements more widely available in veterinary clinics, pet stores, and online platforms. Additionally, increased funding supports clinical studies that validate the efficacy of pet herbal supplements, building trust among pet owners. Marketing campaigns and educational initiatives, backed by higher budgets, further highlight the benefits of pet herbal solutions, encouraging more consumers to try them. Thus, as investment in animal healthcare grows, the emphasis on preventive and holistic care continues to push demand for natural pet supplements.

Market Dynamics

Rising Number of Aging Dogs and Cats

Older dogs and cats commonly face health issues such as joint pain, reduced mobility, and weakened immunity. This drives pet owners increasingly to turn to herbal remedies and supplements to manage these age-related conditions naturally, avoiding the side effects of long-term pharmaceutical use. AniCura, one of Europe’s leading providers of high-quality veterinary care, stated that in February 2024, there were 31% senior dogs and 33% senior cats in Europe. Veterinarians worldwide are also recommending herbal supplement options as part of geriatric pet care, reinforcing consumer trust in these products. Additionally, pet owners are prioritizing preventive care to extend their pets’ lifespans, fueling demand for herbal supplements that help in immune boosters and digestive aids.

Increasing Disposable Income Worldwide

Increasing disposable income is allowing pet owners to prioritize their pets' health and wellness, opting for natural and holistic remedies over cheaper, conventional options. Pet owners are now willingly investing in high-quality herbal supplements that provide various benefits such as improved digestion, joint support, and stress relief. Additionally, increased spending power allows them to experiment with specialized herbal blends and vet-recommended supplements. According to data published by the Bureau of Economic Analysis, the disposable personal income in the US increased by 0.5% in February 2025 compared to January 2025. As disposable incomes rise, consumers perceive herbal pet supplements not as luxuries but as essential components of proactive pet healthcare. Hence, the rising disposable income boosts the industry expansion.

Segmental Insights

Market Evaluation by Product

Based on product, the market is divided into omega 3 fatty acids, probiotics & prebiotics, multivitamins & minerals, CBD, proteins & peptides, and others. The proteins & peptides segment accounted for the major pet herbal supplements market share in 2024 due to rising demand for functional ingredients that support muscle development, joint health, and immune function in pets. Pet owners, increasingly aware of the nutritional needs of aging dogs and high-energy breeds, prioritized supplements such as proteins & peptides that offered tangible benefits in strength, recovery, and mobility. The segment benefited from a strong base of clinical research supporting the efficacy of bioactive peptides in managing conditions such as osteoarthritis and inflammation, particularly in older dogs and large breeds. Additionally, the growing trend of formulating grain-free and high-protein diets for pets further boosted the adoption of proteins & peptides across both premium and mainstream product lines.

The probiotics & prebiotics segment is expected to grow at a robust pace in the coming years, owing to a surge in consumer focus on gut health and the microbiome’s impact on overall well-being. Pet parents increasingly recognize the connection between digestive health and issues such as allergies, anxiety, and immune function. The rising prevalence of gastrointestinal disorders among pets, especially in urban environments with exposure to processed foods and environmental stressors, has amplified the demand for probiotic solutions. The segment is also estimated to gain momentum from the broader humanization or family pet trend in pet care, where supplements match human wellness practices, including daily gut health routines.

Market Insight by Dosage Form

In terms of dosage form, the market is segregated into tablets & capsules, gummies & chewable, powders, liquids, and others. The gummies & chewable segment dominated the market share in 2024 due to a strong preference for convenient, palatable, and easily administered forms. Pet owners prioritized supplements that integrated seamlessly into daily routines without causing stress or resistance from their pets. Chewables offered a practical solution for both cats and dogs, particularly those that resist pills or powders. Brands capitalized on this trend by developing soft chews that combine herbal actives with flavor enhancers, increasing compliance and effectiveness. The growing number of pet parents treating supplementation as an extension of treat-giving habits further propelled demand for gummies & chewable forms. The ability of gummies and chewables to support multi-functional formulations further contributed to the segment’s dominance.

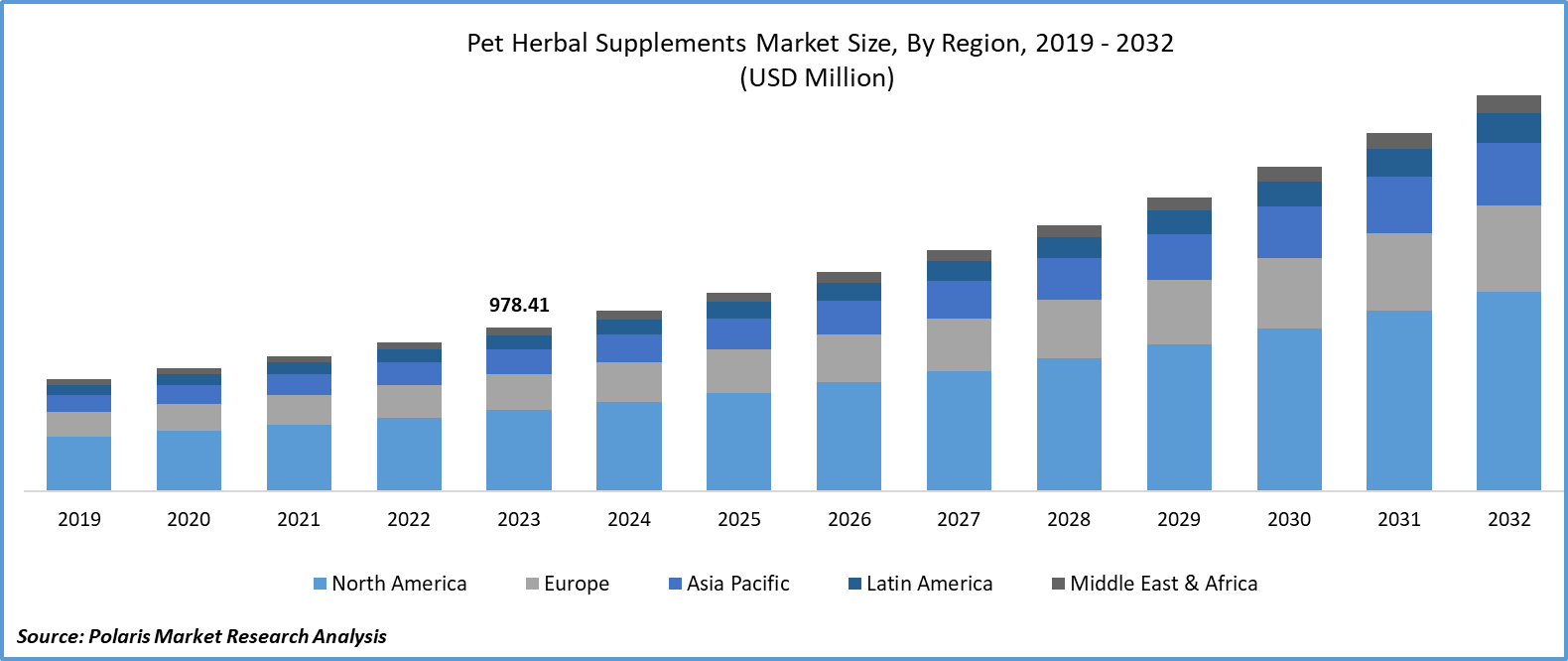

Regional Outlook

By region, the report provides the pet herbal supplements market insight into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. Asia Pacific accounted for a major market share in 2024 due to rapid urbanization, a growing middle-class population, and increasing adoption of pets in metropolitan areas. Consumers in the region are becoming more conscious of pet health and actively seeking herbal alternatives that align with traditional medicine systems such as Ayurveda and Traditional Chinese Medicine (TCM). Local manufacturers are leveraging indigenous botanical knowledge and integrating it with modern formulations, creating products that resonate with cultural preferences. Furthermore, rising investments in the pet care sector, improved access to veterinary care, and expanding e-commerce networks have made pet herbal supplements more accessible across urban and semi-urban markets, accelerating regional growth.

The North America pet herbal supplements market is expected to witness the fastest growth in the coming years, owing to its well-established pet care industry, high pet ownership rates, and increasing consumer awareness about natural health solutions for animals. American pet parents are showing a strong inclination toward holistic and preventive healthcare, driving demand for herbal products that promote wellness, manage anxiety, and support mobility in aging pets. The industry in the region also benefits from a robust retail infrastructure, including pet specialty stores, e-commerce platforms, and veterinary clinics. Additionally, rising disposable income countries such as the US and Canada are encouraging consumers to invest in premium, herbal supplements such as plant-based meat backed by scientific research and transparent labeling. Regulatory clarity around pet nutraceuticals in the US is also enabling brands to innovate and launch new products with minimal barriers, thereby fueling the industry expansion.

Key Players and Competitive Analysis

The pet herbal supplements industry is highly competitive, with key players leveraging mergers and acquisitions, and strategic collaborations to strengthen their market position. Major companies have expanded their product portfolios through acquisitions of niche brands specializing in natural pet health solutions. Strategic collaborations between supplement manufacturers and e-commerce platforms have improved market accessibility. Additionally, companies are investing in R&D to develop clinically validated herbal remedies, addressing pet owners’ growing demand for natural wellness solutions. Partnerships with veterinary professionals and pet wellness influencers further enhance brand credibility, intensifying competition in the market.

The market is fragmented, with the presence of numerous global and regional market players. A few major players in the market are AdvaCare Pharma; AMORVET; Blackmores; Cymbiotika; Dorwest Herbs Ltd.; Health Extension; Natural Dog Company Inc.; NaturVet; Nutri-Pet Research, Inc.; Only Natural Pet LLC; Pet Honesty; Pet Natural Remedies; and Rockwell Pets Pro.

Natural Dog Company Inc. is a major brand in the pet care industry, dedicated to providing natural, holistic solutions for common canine conditions. Founded in 2008 and headquartered in Charlotte, North Carolina, the company has built a reputation for its commitment to dog wellness, using meticulously researched, plant-based ingredients to create products that are 100% dog-safe and veterinary-approved. The company’s product range includes healing balms for skin issues, nourishing supplements, gentle shampoos, and long-lasting gnawer treats, all designed to support the health and happiness of dogs of all breeds, ages, and sizes.

Only Natural Pet is a prominent company in the natural pet products industry, founded in Boulder, Colorado, in 2004 by Marty Grosjean. The company’s inception was inspired by Grosjean’s personal experience with his dog, Crinkles, who suffered from health issues that conventional pet foods and treatments failed to resolve. Motivated by the positive transformation he observed after switching Crinkles to a natural diet, Grosjean established Only Natural Pet with the mission to make natural, healthy pet products easily accessible to pet owners nationwide. The company prioritizes consumer education, offering a Holistic Healthcare Library with articles and videos to help pet owners make informed decisions about their pets’ health.

List of Key Companies

- AdvaCare Pharma

- AMORVET

- Blackmores

- Cymbiotika

- Dorwest Herbs Ltd.

- Health Extension

- Natural Dog Company Inc.

- NaturVet

- Nutri-Pet Research, Inc.

- Only Natural Pet

- Pet Honesty

- Pet Natural Remedies

- Rockwell Pets Pro

Pet Herbal Supplements Industry Developments

February 2025: Elanco Animal Health Incorporated announced the launch of Pet Protect, a line of veterinarian-formulated supplements for dogs and cats. The line includes products such as multivitamins, Omega-3, and fast-acting calming supplements.

August 2024: Pet Honesty, a vet-recommended natural pet wellness brand, announced the launch of its latest liquid supplements. This advanced collection includes Skin + Coat Health, Hip + Joint Health, and a 10-in-1 Multivitamin to address common pet wellness needs.

April 2024: Cymbiotika announced the launch of its new pet line to enhance the health and vitality of beloved pets. The new line includes four revolutionary products—Hip & Joint, Probiotic+, Calm, and Allergy & Immune Health.

Pet Herbal Supplements Market Segmentation

By Product Outlook (Revenue, USD Million, 2020–2034)

- Omega 3 Fatty Acids

- Probiotics & Prebiotics

- Multivitamins & Minerals

- CBD

- Proteins & Peptides

- Others

By Application Outlook (Revenue, USD Million, 2020–2034)

- Digestive Support

- Immunity Support

- Skin & Coat

- Calming/Stress/Anxiety

- Joint Health Support

- Kidney Health

- Liver Health

- Respiratory Health

- Others

By Animal Type Outlook (Revenue, USD Million, 2020–2034)

- Dogs

- Cats

- Horses

- Others

By Dosage Form Outlook (Revenue, USD Million, 2020–2034)

- Tablets & Capsules

- Gummies & Chewable

- Powders

- Liquids

- Others

By Distribution Channel Outlook (Revenue, USD Million, 2020–2034)

- Online

- Offline

- Pet Specialty Stores

- Retail

- Others

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Pet Herbal Supplements Market Report Scope

|

Report Attributes |

Details |

|

Market Value in 2024 |

USD 994.57 Million |

|

Market Forecast in 2025 |

USD 1,098.80 Million |

|

Revenue Forecast in 2034 |

USD 2,738.68 Million |

|

CAGR |

10.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 994.57 million in 2024 and is projected to grow to USD 2,738.68 million by 2034.

The global market is projected to register a CAGR of 10.7% during the forecast period.

Asia Pacific held the largest share of the global market in 2024.

A few of the key players in the market are AdvaCare Pharma; AMORVET; Blackmores; Cymbiotika; Dorwest Herbs Ltd.; Health Extension; Natural Dog Company Inc.; NaturVet; Nutri-Pet Research, Inc.; Only Natural Pet LLC; Pet Honesty; Pet Natural Remedies; and Rockwell Pets Pro.

The gummies & chewable segment dominated the market revenue in 2024.

The probiotics & prebiotics segment is expected to grow at the fastest pace in the coming years.