Probiotics Market Size, Share, Trends, & Industry Analysis Report

By Source (Yeast, Bacteria), By End-Use, By Application, By Distribution Channel, By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 114

- Format: PDF

- Report ID: PM1057

- Base Year: 2024

- Historical Data: 2020 - 2023

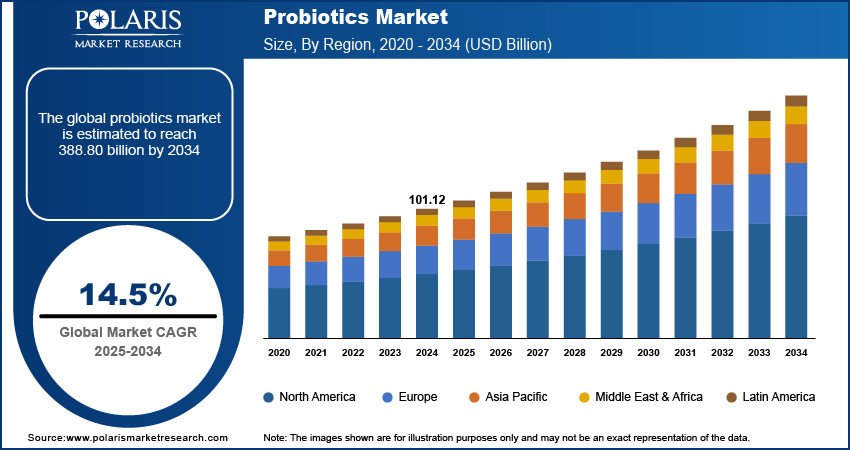

The global probiotics market was valued at USD 101.12 Billion in 2024 and is expected to grow at a CAGR of 14.5% during the forecast period. The growing consumer awareness towards preventive healthcare and advancement of systematic probiotic strains is driving the growth of the market.

Key Insights

- The bacteria segment is expected to witness significant growth due to growing consumption of dairy-based products across the globe.

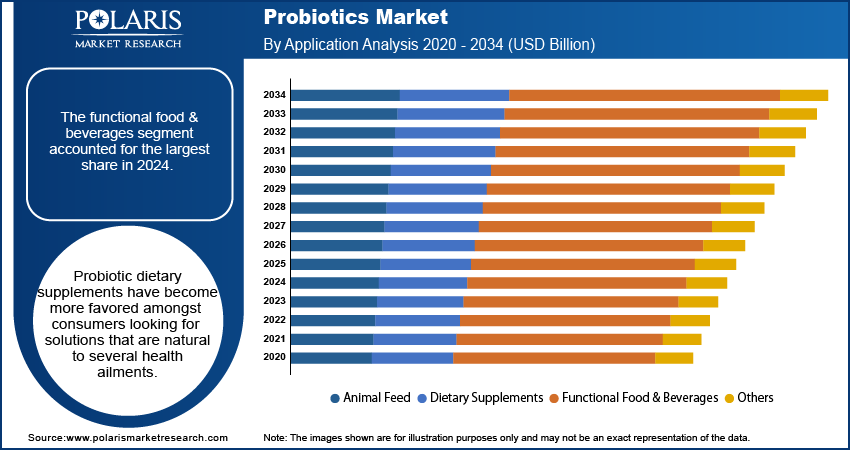

- The functional food & beverages segment accounted for the largest share in 2024 driven by rising demand for the packaged food with nutritional content.

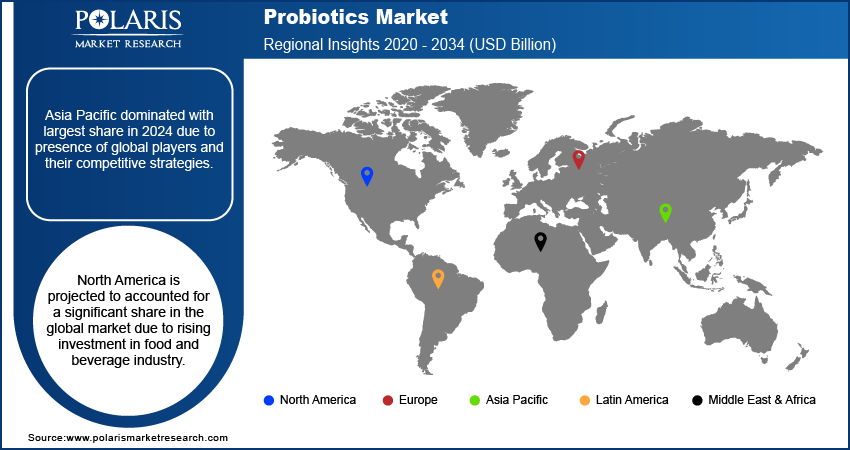

- Asia Pacific dominated with largest share in 2024 due to presence of global players and their competitive strategies.

- North America is projected to accounted for a significant share in the global market due to rising investment in food and beverage industry.

Industry Dynamics

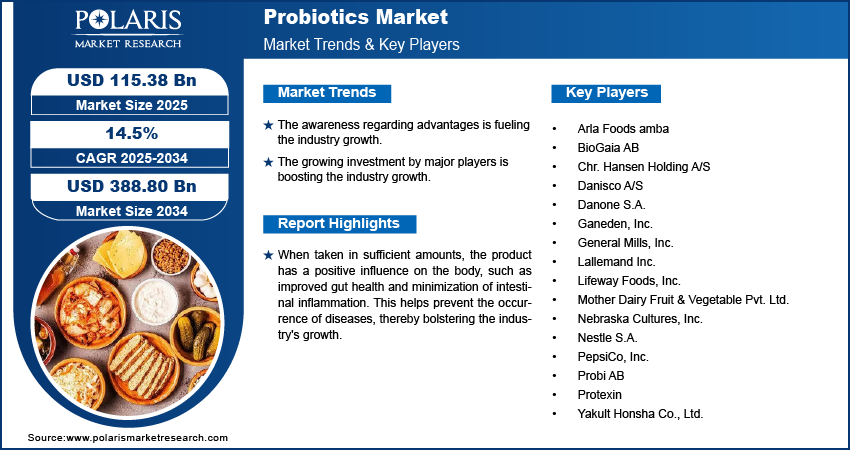

- The awareness regarding advantages is fueling the industry growth.

- The growing investment by major players is boosting the industry growth.

- The advancement in the probiotic strains is driving the growth.

- Lack of standardized regulations and scientific validation is leading to consumer skepticism and inconsistent product quality, thereby limiting the growth.

Market Statistics

- 2024 Market Size: USD 101.12 Billion

- 2034 Projected Market Size: USD 388.80 Billion

- CAGR (2025-2034): 14.5%

- Largest Market: Asia Pacific

To Understand More About this Research: Request a Free Sample Report

When taken in sufficient amounts, the product has a positive influence on the body, such as improved gut health and minimization of intestinal inflammation. This helps prevent the occurrence of diseases, thereby bolstering the industry's growth. Moreover, the increasing awareness regarding preventive healthcare due to factors such as rising disposable income, improving the standard of living, and a surge in the aging population are also some of the major factors driving the industry growth.

Industry Dynamics

Growth Drivers

Probiotics assist digestion with several advantages such as improving immunity, sustaining gut health, weight management, circumventing obesity, and many others. The growing awareness about this health benefits is driving the demand for the probiotics. This ever-increasing health consciousness amongst the consumers and the surfacing trend of veganism is inducing consumers toward a diet that is plant-based. Therefore, major industry players are initiating plant-based probiotics to expand their consumer base.

The growing investment by major players in the R&D of innovative products is anticipated to influence the industry growth affirmatively. For instance, in February 2022, Amorepacific Group launched its new Green Tea Probiotics Research Centre to enlarge the study of lactobacillus recently discovered in Jeju organic green tea garden.

There is an increasing presence of probiotics that are demographic-specific such as geriatrics and genders. These niche markets have allowed the regional players to adopt various strategies to improve their product portfolio and heighten their resources.

Which Innovations are Transforming the Probiotics Market?

The global probiotics industry is rapidly moving toward precision health, functional innovation, and cross-industry integration. Advances in microbiome research and biotechnology propel the industry expansion. Also, consumer demand for functional wellness solutions drives increased probiotic consumption. Companies are investing in next-generation strains, precision formulations, and novel delivery technologies. It helps them improve efficacy and stability. The developments redefine the role of probiotics across sectors such as food, nutraceuticals, and pharmaceuticals. AI-driven formulation and advanced delivery technologies expand the use of probiotics beyond digestive supplements into skin health, immunity, mental wellness, and pharmaceuticals. Industry players adopt these innovations to gain competitive advantages. The following table comprises innovations and their impact on the market.

|

Innovations |

Description |

Impact |

|

Next-Generation Strains |

Development of advanced probiotic strains, including Akkermansia muciniphila, Bacteroides uniformis, and Faecalibacterium prausnitzii, to target metabolic, gut, and immune health |

Expands applications beyond digestive health to metabolic, cognitive, and skin health. |

|

Synbiotics & Postbiotics |

Combining probiotics and prebiotics (synbiotics) or the introduction of heat-killed bacterial metabolites (postbiotics) |

Enhances shelf life, stability, and targeted product efficacy |

|

Precision & Personalized Probiotics |

AI and microbiome sequencing are used to design strain combinations tailored to individual gut profiles. |

Facilitates personalized nutrition and therapy-driven probiotic products. |

|

Novel Delivery Systems |

Lipid coating, microencapsulation, and time-release capsules are improving survivability through the GI tract. |

Enhances viability and bioavailability, mostly in supplements and functional foods. |

|

Probiotic-Infused Functional Foods & Beverages |

Focus on expanding into non-dairy options such as plant-based yogurts, juices, protein snacks, and kombucha. |

Expands consumer base to vegan, wellness-oriented, and lactose-intolerant users. |

|

Smart Packaging and Stability Innovations |

Packaging with oxygen-absorbing films, desiccants, and smart sensors for CFU count maintenance. |

Increases product shelf life and ensures potency till consumption. |

Report Segmentation

The market is primarily segmented on the basis of source, application, distribution channel, end-use, and region.

|

By Source |

By Application |

By Distribution Channel |

By End-Use |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

Insight by Source

On the basis of source, the market is segmented into yeast and bacteria. The bacteria segment is expected to witness significant growth due to the growing consumption of dairy-based products across the globe. Bacteria-based probiotics offer health benefits such as enhanced immune function, improved digestion, and greater lactase production. Bacteria such as Lactobacillus and Bifidobacterium has proven benefits such as gut health, boost immunity, improve digestion. This is fueling the adoption of the bacteria in the functional food and dietary supplements. Moreover, bacteria-based probiotics products such as yogurt, kefir, fermented milk, cheese, and plant-based beverages are readily available in the retail and e-commerce platform which improves the accessibility, thereby driving the segment demand.

Insight by Application

The functional food & beverages segment accounted for the largest share in 2024. Probiotics are included to improve the total nutritional value and the flavor of food. The demand for the functional food and beverages is rising worldwide. This rise is demand is fuel by expansion of the retail channel in urban as well as rural areas. This expansion is improving the product accessibility, which is fueling the demand for the probiotics. Additionally, growth of the e-commerce platform is further fueling the functional food and beverage accessibility which further drives the demand for the probiotics in this application.

Probiotic dietary supplements have become more favored amongst consumers looking for solutions that are natural to several health ailments. Probiotics, as contrasted to pharmacological solutions, are a natural way of curing various diseases connected to gut health, gastrointestinal situations, and immunity strengthening. The progression of new delivery systems such as fizzy powders, gummies, and chewable products is anticipated to boost growth.

Moreover, increasing preference by the consumers for buying snacks containing ingredients with digestive health benefits and soaring consolidation of food and beverage with the science-backed probiotic ingredients is anticipated to fuel the demand for probiotic food and drinks that are functional.

Geographic Overview

The Asia Pacific led the global market with a massive revenue share. The region is observing a considerable consumer consciousness growth because of the international players' competitive strategies. Robust demand from China, India, and Australia adds to the total change. The increasing population, with increasing disposable income and enhancement of the standard of living, is also anticipated to serve the regional growth.

In the recent past because of technology limitations, the industry was inundated with probiotics that were in want of stability at room temperature. The problem of quality was solved as prominent companies launched technologies such as microencapsulation which enhanced the stability of life of the probiotic bacteria. Furthermore, the proceeding R&D activities for the advancement of planned strains that possess a wide range of treatment and can bear high temperatures are anticipated to benefit the regional market growth over the forecast period.

North America is anticipated to observe substantial growth over the forecast period. Pursuing investments from manufacturers in the food and beverage and pharmaceutical industries is expected to present the regional growth. The regional players are investing in R&D to put forward contemporary products to handle consumers of different age groups and genders. Such factors are anticipated to fast-track the market growth over the forecast period.

Competitive Insight

The Leading Players in the probiotics market include Arla Foods amba, BioGaia AB, Chr Hansen Holding A/S, Danisco A/S, Danone S.A., Ganeden, Inc., General Mills, Inc., Lallemand Inc., Lifeway Foods, Inc., Mother Dairy Fruit & Vegetable Pvt. Ltd., Nebraska Cultures, Inc, Nestle S.A., PepsiCo, Inc., Probi AB, Protexin, and Yakult Honsha Co., Ltd.

Probiotics Market Report Scope

|

Report Attributes |

Details |

|

The market size value in 2024 |

USD 101.12 Billion |

| The market size value in 2025 | USD 115.38 Billion |

|

The revenue forecast in 2034 |

USD 388.80 Billion |

|

CAGR |

14.5% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Source, By Application, By Distribution Channel, By End Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Arla Foods amba, BioGaia AB, Chr Hansen Holding A/S, Danisco A/S, Danone S.A., Ganeden, Inc., General Mills, Inc., Lallemand Inc., Lifeway Foods, Inc., Mother Dairy Fruit & Vegetable Pvt. Ltd., Nebraska Cultures, Inc, Nestle S.A., PepsiCo, Inc., Probi AB, Protexin, and Yakult Honsha Co., Ltd. |

FAQ's

• The market size was valued at USD 101.12 Billion in 2024 and is projected to grow to USD 388.80 Billion by 2034.

• The market is projected to register a CAGR of 14.5% during the forecast period

• A few of the key players in the market are Arla Foods amba, BioGaia AB, Chr Hansen Holding A/S, Danisco A/S, Danone S.A., Ganeden, Inc., General Mills, Inc., Lallemand Inc., Lifeway Foods, Inc., Mother Dairy Fruit & Vegetable Pvt. Ltd., Nebraska Cultures, Inc, Nestle S.A., PepsiCo, Inc., Probi AB, Protexin, and Yakult Honsha Co., Ltd.

• The functional food & beverages accounted for the largest market share in 2024

• The bacteria segment is expected to record significant growth.