Automotive Coatings Market Size, Share, Trends, Industry Analysis Report

: By Product (Primer, E-coat, Basecoat, Clearcoat), Technology, Application, End Use, Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 134

- Format: PDF

- Report ID: PM1109

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

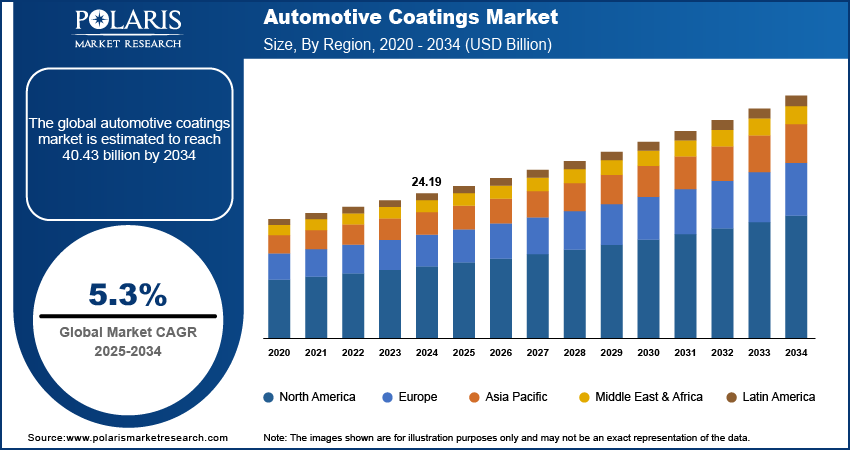

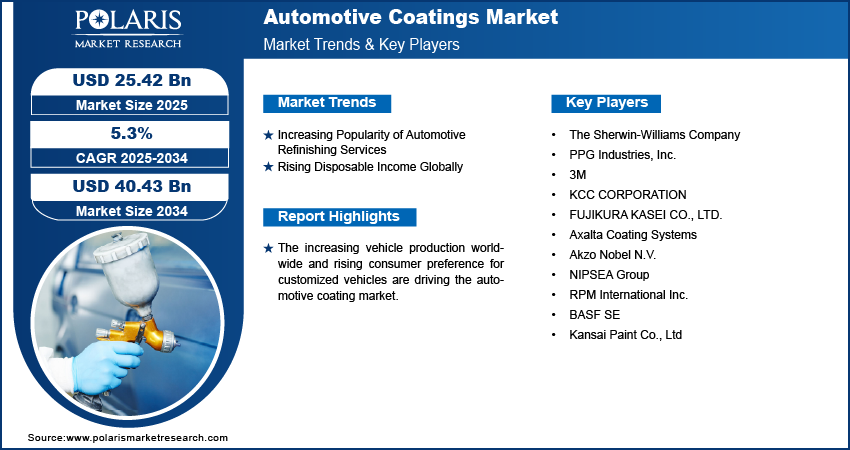

The automotive coatings market size was valued at USD 24.19 billion in 2024 and is projected to reach USD 40.43 billion by 2034, exhibiting a CAGR of 5.3% from 2025 to 2034. The market is growing due to rising vehicle production and demand for advanced finishes. Coatings provide corrosion resistance, UV protection, and aesthetic appeal. OEMs are adopting waterborne and eco-friendly solutions, fueling innovation in the automotive coatings sector.

Automotive coatings play a crucial role in the manufacturing and longevity of vehicles, serving both aesthetic and protective functions. These coatings are primarily composed of three layers: primer, basecoat, and clearcoat. The primer provides a foundation for adhesion and corrosion resistance, while the basecoat imparts color and visual appeal. The clearcoat acts as a protective layer, enhancing durability and gloss.

The increasing vehicle production worldwide is driving the market. According to the European Automobile Manufacturers' Association, 85.4 million motor vehicles were produced around the world in 2022, an increase of 5.7% compared to 2021. As manufacturers ramp up vehicle production to meet consumer demand, the need for high-quality coatings rises. Each vehicle requires multiple layers of coatings, including primers, basecoats, and clearcoats, to ensure durability, protection against corrosion, and aesthetic appeal. Thus, higher production of vehicles leads to a significant increase in the volume of coatings needed.

The rising consumer preference for customized vehicles is projected to fuel the market growth. Automobile brands are increasingly engaging with consumers through customization options, leading to higher production of unique vehicles and, consequently, an increased demand for coatings.

To Understand More About this Research: Request a Free Sample Report

The automotive coatings market is further driven by advancements in chemical engineering. These advancements have led to the development of high-performance coatings that offer improved durability, resistance to environmental factors, and enhanced aesthetics. As such, vehicle owners are increasingly adopting these high-performance coatings.

Drivers Analysis

Increasing Popularity of Automotive Refinishing Services

The increasing popularity of automotive refinishing services worldwide is propelling the market. These services, which include repainting, scratch repair, and restoring faded finishes, have expanded as more consumers look to maintain or enhance the appearance of their vehicles. Each of these services relies on a variety of coatings, thereby driving demand.

Rising Disposable Income Globally

The rising disposable income globally is estimated to fuel this industry. Higher disposable income gives consumers financial freedom to purchase vehicles. This surge in vehicle ownership directly increases the demand for coatings, as each new vehicle requires multiple layers of protective and aesthetic coatings. Furthermore, consumers with higher disposable incomes are more likely to spend on automotive refinishing, enhancements, and protective coatings to maintain their vehicles’ appearance and value, further boosting demand.

Segment Analysis

Product Insights

The basecoat segment accounted for a major share of the market in 2024 due to its critical role in determining the color and appearance of vehicles. Basecoats provide the essential foundation for aesthetic appeal, allowing manufacturers to create a wide range of colors and finishes that meet consumer preferences. The demand for innovative basecoat solutions has surged as automakers increasingly focus on design differentiation and personalization. Advances in technology, including the development of metallic and pearlescent finishes, have further fueled the growth of the segment. Manufacturers are keen to invest in high-quality basecoats that enhance visual appeal while offering improved durability and protection against environmental factors, including UV rays and harsh weather conditions.

The clearcoat segment is expected to grow at a robust pace in the coming years, owing to its ability to serve as a protective layer over the basecoat, enhancing gloss, depth, and overall durability. The rise in urbanization and exposure to environmental pollutants has created a growing need for clearcoats that resist scratches, fading, and corrosion. Additionally, the shift towards electric vehicles, which often feature advanced paint technologies, further boosts the demand for high-performance clearcoats. Innovations in formulations, such as self-healing clearcoats that enhance hydrophobic properties, position this segment for significant growth.

Application Insights

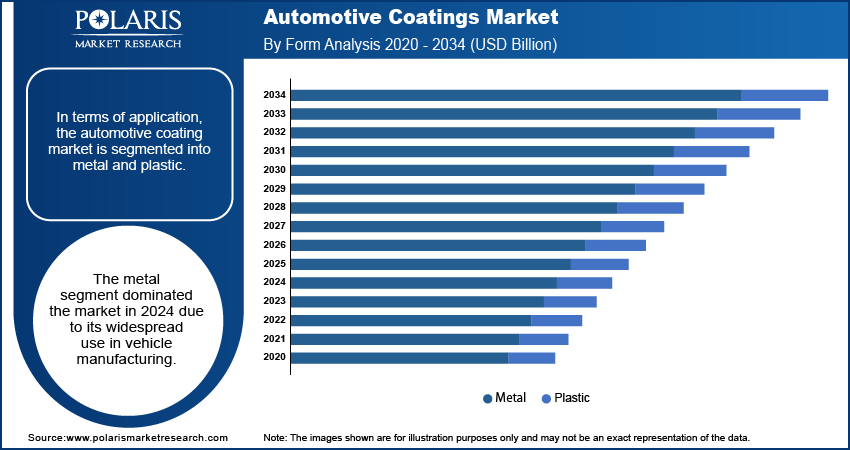

The metal segment dominated the market in 2024 due to its widespread use in vehicle manufacturing. Manufacturers prioritize metal components as they contribute significantly to vehicle strength and safety. Metal components, including body panels and chassis, require robust coatings to protect against corrosion, wear, and environmental damage. Additionally, advancements in coating technologies, including high-performance primers and durable clearcoats, have enhanced the durability and aesthetic appeal of metal surfaces, further driving this segment’s growth.

The plastic segment is projected to grow at a robust pace in the coming years, owing to the rising demand for lightweight vehicles. The growing demand for electric and hybrid vehicles also accelerates the need for innovative plastic coatings, as these vehicles often use advanced plastic materials to improve energy efficiency. Additionally, advancements in coating technology specifically tailored for plastics, such as improved adhesion and UV resistance, make these products more appealing to manufacturers.

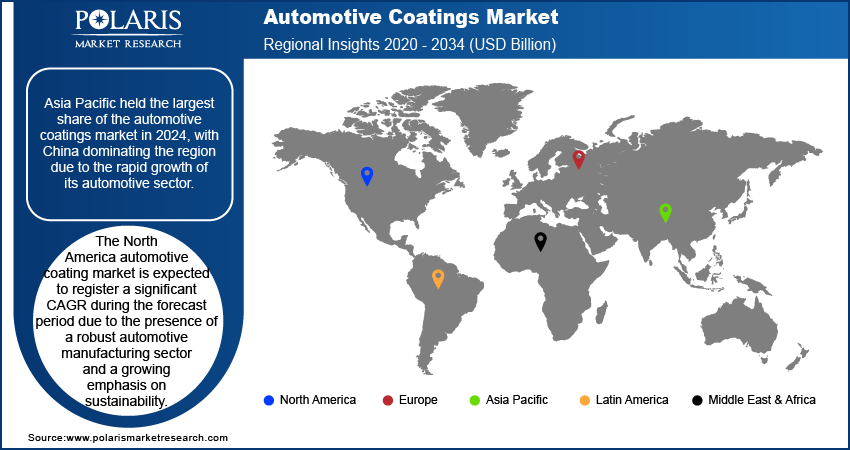

Regional Insights

Asia Pacific automotive coatings market held the largest share in 2024, with China dominating the region. The rapid growth of the automotive sector in China has been a significant driver, fueled by increasing consumer demand for vehicles and a strong manufacturing base. The country’s focus on innovation and the production of electric vehicles has further enhanced the demand for high-quality coatings that provide durability and aesthetic appeal. Additionally, rising disposable incomes and urbanization in China and neighboring countries have led consumers to invest more in vehicle customization and maintenance, pushing the demand for diverse coating solutions. India also contributes significantly to this growth, as its expanding automotive industry continues to adopt advanced coating technologies to meet the needs of a rapidly expanding middle class.

The North America automotive coatings market is expected to register a significant CAGR during the forecast period due to the presence of a robust automotive manufacturing sector and a growing emphasis on sustainability. The rising popularity of electric vehicles in the US also stimulates demand for innovative coatings that enhance performance and aesthetics. Furthermore, the trend toward vehicle customization and premium finishes aligns with consumer preferences, encouraging investments in high-quality coatings and driving market growth in the region.

Key Players & Competitive Analysis Report

Major market players are investing heavily in research and development in order to expand their offerings, which will help the automotive coatings market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including innovative launches, international collaborations, higher investments, and mergers and acquisitions between organizations. To expand and survive in a more competitive and rising market environment, the automotive coatings industry must offer innovative solutions.

The automotive coatings industry is fragmented, with the presence of numerous global and regional market players. Major players in the automotive coating market include The Sherwin-Williams Company; PPG Industries, Inc.; 3M; KCC CORPORATION; FUJIKURA KASEI CO., LTD.; Axalta Coating Systems; Akzo Nobel N.V.; NIPSEA Group; RPM International Inc.; BASF SE; and Kansai Paint Co., Ltd.

The Sherwin-Williams Company, founded in 1866 in Cleveland, Ohio, has established itself as a major manufacturer and distributor of paints and coatings globally. The company has evolved significantly, with a history spanning over 150 years, expanding its product offerings and market reach. Sherwin-Williams operates through multiple segments, including the Paint Stores Group, Consumer Brands Group, and Performance Coatings Group, catering to various customer needs across professional, industrial, commercial, and retail sectors. The company has also made significant strides in the automotive coatings sector. Its Performance Coatings Group specializes in high-performance coatings that are engineered to provide exceptional durability, corrosion resistance, and aesthetic appeal to vehicles.

Axalta Coating Systems, headquartered in Philadelphia, Pennsylvania, is a prominent global leader in the coatings industry, specializing in high-performance coatings for various applications, including automotive, industrial, and refinish markets. With a legacy that spans over 150 years, Axalta has evolved from its origins as a German company, Herberts GmbH, into a major player in the global coatings sector. The company was rebranded as Axalta after being acquired by The Carlyle Group in 2013 and has since established itself as an independent entity listed on the New York Stock Exchange. Axalta is particularly renowned for its innovative automotive coatings solutions. The company offers a comprehensive range of products tailored for both original equipment manufacturers (OEMs) and the refinish market. In August 2022, Axalta launched next-generation basecoat technology for the automotive refinish industry in Latin America.

List of Key Companies

- The Sherwin-Williams Company

- PPG Industries, Inc.

- 3M

- KCC CORPORATION

- FUJIKURA KASEI CO., LTD.

- Axalta Coating Systems

- Akzo Nobel N.V.

- NIPSEA Group

- RPM International Inc.

- BASF SE

- Kansai Paint Co., Ltd

Industry Developments

September 2024: BASF, a global chemical company, announced the launch of ChemCycling technology to manufacture clearcoats.

December 2022: BASF announced the launch of the first biomass balance automotive coatings in China to help reduce 20% product's carbon footprint.

November 2021: 3M, a manufacturer and distributor of industrial products and solutions, announced the introduction of ceramic coating for the India-based automotive and paint industry.

Automotive Coating Market Segmentation

By Product Outlook (Volume, Kilotons: Revenue – USD Billion, 2020–2034)

- Primer

- E-coat

- Basecoat

- Clearcoat

By Technology Outlook (Volume, Kilotons: Revenue – USD Billion, 2020–2034)

- Waterborne Coatings

- Solventborne Coatings

- Powder Coating

- UV-Cured Coatings

By Application Outlook (Volume, Kilotons: Revenue – USD Billion, 2020–2034)

- Metal

- Plastic

By End Use Outlook (Volume, Kilotons: Revenue – USD Billion, 2020–2034)

- Light Vehicle OEM

- Commercial OEM

- Automotive Refinish

By Regional Outlook (Volume, Kilotons: Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Automotive Coating Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 24.19 billion |

|

Market Size in 2025 |

USD 25.42 billion |

|

Revenue Forecast in 2034 |

USD 40.43 billion |

|

CAGR |

5.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Volume, Kilotons: Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The automotive coating market size was valued at USD 24.19 billion in 2024 and is projected to grow to USD 40.43 billion by 2034.

The market is projected to grow at a CAGR of 5.3% from 2025 to 2034.

Asia Pacific had the largest share of the global market in 2024.

The key players in the market are The Sherwin-Williams Company; PPG Industries, Inc.; 3M; KCC CORPORATION; FUJIKURA KASEI CO., LTD.; Axalta Coating Systems; Akzo Nobel N.V.; NIPSEA Group; RPM International Inc.; BASF SE; and Kansai Paint Co., Ltd.

The clearcoat segment is projected for significant growth in the global market.

The metal segment dominated the automotive coating market.