Personalized Vitamins Market Size, Share, Trends, Industry Analysis Report

By Dosage Form (Tablets, Capsules, Powders, Gummies/Chewable, Liquids, Softgels), By Age Group, By Distribution Channel, Application, By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM6132

- Base Year: 2024

- Historical Data: 2020-2023

Overview

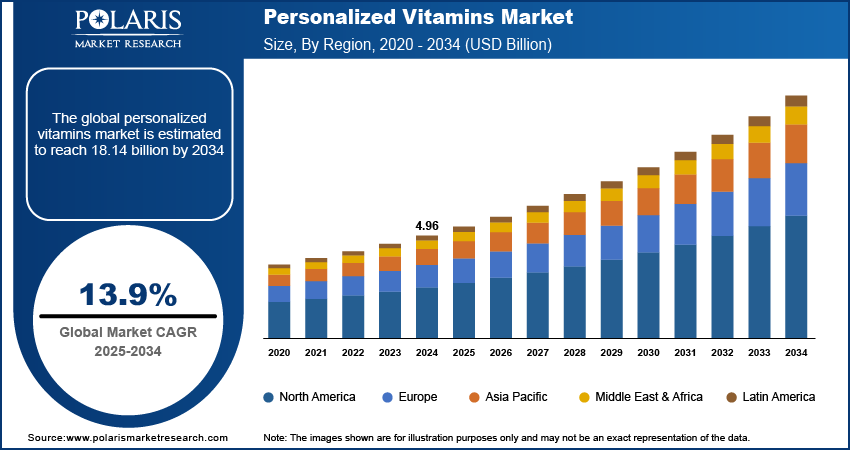

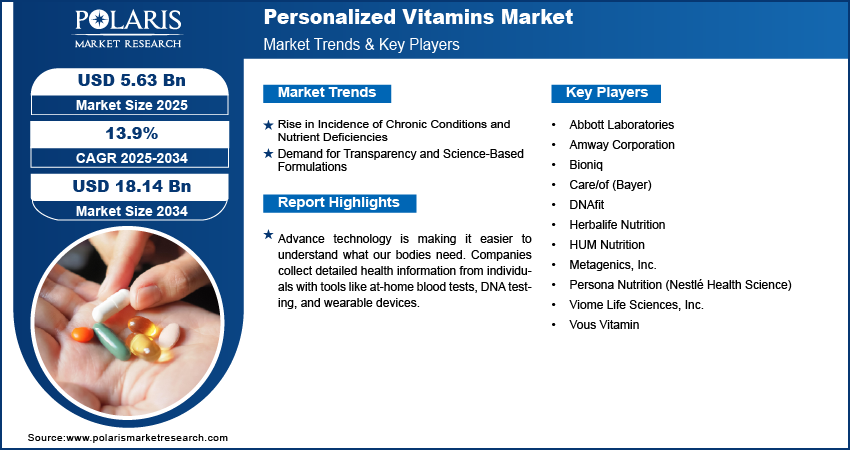

The global personalized vitamins market size was valued at USD 4.96 billion in 2024, growing at a CAGR of 13.9% from 2025 to 2034. The market growth is driven by rise in incidence of chronic conditions and nutrient deficiencies and an increase in demand for transparency and science-based formulations.

Key Insights

- In 2024, the tablets segment dominated with the largest share as consumers trust tablets due to their convenience, long shelf life, and consistent dosage.

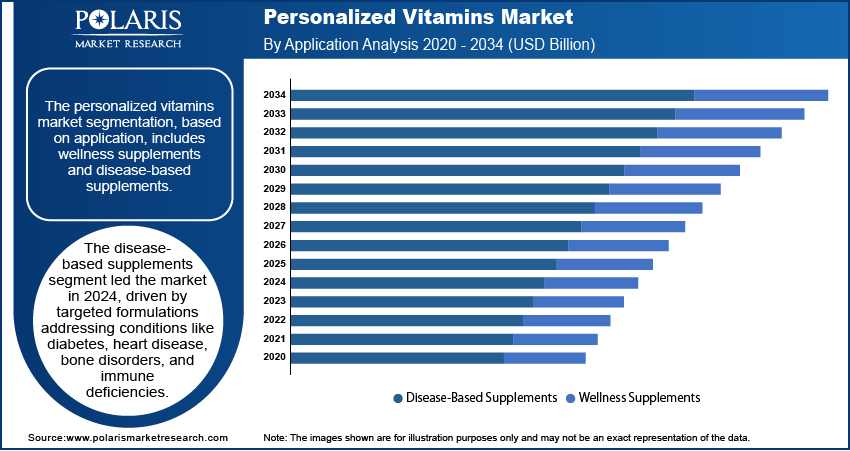

- The disease-based supplements segment dominated with the largest share in 2024, as these supplements are designed to help manage or prevent specific health conditions such as diabetes, cardiovascular disease, bone health issues, and immune system deficiencies.

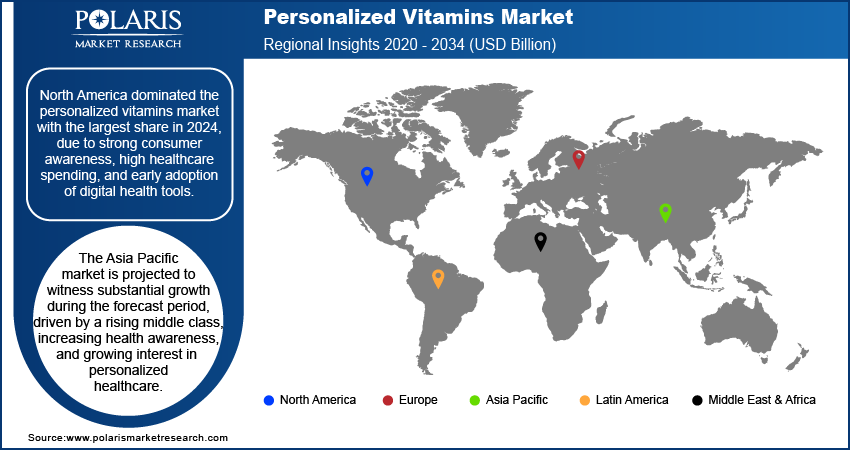

- The market in North America dominated with the largest share in 2024, due to strong consumer awareness, high healthcare spending, and early adoption of digital health tools.

- The market in the U.S. is expected to witness significant growth during the forecast period, as combination of health-conscious consumers, widespread internet access, and high use of e-commerce supports strong demand for personalized supplements.

- The Asia Pacific industry is projected to witness substantial growth during the forecast period driven by a rising middle class, increasing health awareness, and growing interest in personalized healthcare.

Industry Dynamics

- Rise in incidence of chronic conditions and nutrient deficiencies drives the demand for personalized vitamins.

- Demand for transparency and science-based formulations is fueling the industry growth.

- Technological advancements are making it easier to understand the requirement for nutrients and supplements in the body.

- High product costs and limited consumer awareness in emerging markets restrain the personalized vitamins industry.

Market Statistics

- 2024 Market Size: USD 4.96 billion

- 2034 Projected Market Size: USD 18.14 billion

- CAGR (2025–2034): 13.9%

- North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

Personalized vitamins are custom-formulated supplements tailored to an individual’s unique health needs, lifestyle, genetics, and diet. They often use data from quizzes, DNA tests, or blood biomarker analysis to determine optimal nutrient combinations. This approach aims to improve effectiveness and avoid under- or over-supplementation.

More people are using mobile apps and online platforms to manage their health. Personalized vitamin brands are taking advantage of this trend by offering online quizzes, subscription services, and user-friendly apps to deliver tailored supplements directly to consumers. These digital platforms make it easy to track progress, update preferences, and stay engaged in a wellness journey. The convenience and accessibility of personalized vitamins through digital channels are helping drive consumer adoption, especially among younger, tech-savvy customers who prefer smart and simple solutions for health management, thereby driving the growth.

Technological advancements are making it easier to understand the requirement for nutrients and supplements. Companies collect detailed health information of individuals using various tools such as at-home blood tests, DNA testing, and wearable devices. Using this data, they create custom vitamin formulas that are much more accurate than one-size-fits-all supplements. Additionally, artificial intelligence (AI) and machine learning (ML) further help analyze health data quickly and effectively. These technological advances are enabling companies to offer highly tailored products, giving consumers more confidence in their supplement choices and fueling the growth of the personalized vitamins demand.

Drivers and Opportunities

Rise in Incidence of Chronic Conditions and Nutrient Deficiencies: Modern lifestyles are contributing to more cases of chronic illnesses such as diabetes, heart disease, and obesity, many of which are linked to poor nutrition. According to the European Food Information Council Report, over half of the European population is anticipated to have obesity by 2030. At the same time, studies published by WHO show a large portion of the population suffers from deficiencies in essential vitamins and minerals, such as Vitamin D or iron. Personalized vitamins help address these issues by targeting specific health needs with tailored nutrient support. The demand for accurate, customized supplements continues to rise as more consumers seek solutions to manage or prevent chronic health conditions, thereby driving growth.

Demand for Transparency and Science-Based Formulations: Consumers are increasingly seeking supplements that are supported by scientific evidence and transparent practices. They prefer products that are supported by clinical data and made with high-quality, clearly labeled ingredients. Personalized vitamin brands emphasize medical-grade testing and use of bioavailable nutrients, which meet these consumer expectations. Transparency in formulation and sourcing builds trust and sets personalized products apart from traditional supplements. Companies offering science-based personalized vitamins are gaining a competitive advantage as consumers continue to seek effective and trustworthy health products, fueling the industry growth.

Segmental Insights

Dosage Form Analysis

The segmentation, based on dosage form, includes tablets, capsules, powders, gummies/chewable, liquids, and softgels. In 2024, the tablets segment dominated with the largest share as consumers trust tablets due to their convenience, long shelf life, and consistent dosage. Tablets are easy to pack, store, and deliver, making them suitable for subscription-based personalized supplement services. Additionally, advancements in tablet formulation have made it easier to include multiple nutrients in a single dose, increasing user compliance, thereby fueling the segment growth.

Age Group Analysis

The segmentation, based on age group, includes pediatric, adults, and geriatric. The geriatric segment is expected to experience significant growth during the forecast period as older adults face age-related health challenges, such as reduced nutrient absorption, weakened immunity, and chronic conditions that require targeted nutritional support. Personalized vitamins help address these specific needs by offering customized formulations based on age, health status, and medication interactions. The demand for tailored supplements in this age group is growing rapidly with rising global life expectancy and more seniors prioritizing preventive care and quality of life, thereby fueling the segment growth.

Distribution Channel Analysis

The segmentation, based on distribution channel, includes supermarkets/hypermarkets, specialty stores, retail pharmacies, online pharmacies & e-commerce sites. The online pharmacies & e-commerce site segment is expected to experience significant growth during the forecast period as these platforms offer convenience, easy access to health assessments, and home delivery, all of which appeal to today’s digital-first consumers. Subscription models and personalized dashboards allow users to track progress, reorder supplements, and receive ongoing support. The shift toward online health services has accelerated due to changing consumer preferences and increased trust in digital solutions. Moreover, more consumers are seeking personalized health products from the comfort of their homes further boosting the segment growth.

Application Analysis

The segmentation, based on application, includes wellness supplements and disease-based supplements. The disease-based supplements segment dominated with a larger share in 2024, as these supplements are designed to help manage or prevent specific health conditions such as diabetes, cardiovascular disease, bone health issues, and immune system deficiencies. Consumers with chronic conditions are increasingly seeking personalized vitamins that support medical needs and complement existing treatments. Companies deliver more effective and relevant solutions by tailoring supplements to address nutrient gaps linked to specific diseases. Additionally, the increasing burden of chronic illnesses globally fuels the segment growth.

Regional Analysis

North America Personalized Vitamins Market Trends

The market in North America dominated with the largest share in 2024, due to strong consumer awareness, high healthcare spending, and early adoption of digital health tools. The region has a well-developed supplement industry and a growing interest in personalized wellness solutions. Consumers are increasingly seeking customized health products supported by science and data. Additionally, the presence of key players and startups focusing on personalized nutrition has fueled demand. Moreover, advancements in at-home testing and AI-driven recommendations drive the growth in North America.

U.S. Personalized Vitamins Market Insights

The industry in the U.S. is expected to witness significant growth during the forecast period, as the combination of health-conscious consumers, widespread internet access, and high adoption of e-commerce supports strong demand for personalized supplements. Many U.S. companies offer advanced services, such as DNA-based formulations and biomarker testing, making personalization more accessible. Additionally, rising rates of chronic diseases, aging population, and a growing preference for preventive care are further contributing to growth. Moreover, both established brands and startups offering tailored solutions further fuels the growth.

Asia Pacific Personalized Vitamins Market Analysis

The Asia Pacific industry is projected to witness rapid growth during the forecast period, driven by a rising middle class, increasing health awareness, and growing interest in personalized healthcare. Urbanization and changing lifestyles have led to higher rates of nutrient deficiencies and chronic conditions, prompting demand for tailored supplements. Countries such as Japan, South Korea, and India are seeing more digital health startups and personalized wellness platforms. Additionally, consumers in the region are becoming more open to using online health services and at-home testing kits, thereby driving the growth.

China Personalized Vitamins Market Insights

The China industry is projected to witness substantial growth during the forecast period, driven by its large population, rising income levels, and focus on health and longevity. Consumers are willing to invest in supplements that match their specific health needs, especially those related to aging, immunity, and beauty. The Chinese government’s support for health tech innovation and digital health infrastructure is further accelerating adoption. Moreover, online retail platforms and social media are important sales channels, enabling companies to reach a wide and health-aware audience. Moreover, strong demand for premium, data-driven health products further boosts the growth.

Europe Personalized Vitamins Market Insights

The industry in Europe is expected to experience significant growth in the future, driven by increasing health awareness, demand for preventive care, and a strong regulatory environment supporting high product quality. Consumers across Europe are becoming more focused on targeted nutrition, particularly for immunity, aging, and chronic disease management. The region has a well-established supplement industry, with growing adoption of personalized health solutions through online platforms and wellness programs. Countries such as the UK, France, and the Netherlands are seeing increased interest in data-based supplementation. Europe is expected to record growth as personalization becomes a key trend in healthcare.

Germany Personalized Vitamins Market Outlook

The market in Germany is expected to experience significant growth driven by its strong pharmaceutical industry, emphasis on science-based healthcare, and growing interest in individualized wellness. German consumers tend to prefer high-quality, clinically tested products, making the market ideal for premium, personalized supplements. The country is further home to several personalized nutrition startups and manufacturers offering blood-testing and tailored formulations. Additionally, rising awareness around micronutrient deficiencies and healthy aging is driving demand. Moreover, a combination of traditional health values and openness to innovation is driving the growth.

Key Players and Competitive Analysis

The personalized vitamins industry is rapidly evolving, driven by growing consumer demand for tailored health solutions. Key players include major corporations such as Abbott Laboratories and Bayer’s Care/of, leveraging strong research and development (R&D) and distribution networks. Nestlé’s Persona Nutrition and Viome Life Sciences use advanced AI and microbiome testing to offer data-driven personalization. Amway and Herbalife Nutrition rely on established wellness branding and global reach. Smaller innovators such as DNAfit and Vous Vitamin focus on genetic and lifestyle-based customization, appealing to tech-savvy consumers. HUM Nutrition and Metagenics emphasize clean-label, premium formulations. Competition centers around scientific credibility, personalization technology, and consumer trust. Strategic partnerships, e-commerce growth, and integration of wearable data are reshaping engagement. Overall, the landscape reflects a mix of legacy health companies expanding into personalized wellness and agile startups pushing innovation, creating a dynamic and competitive environment poised for continued growth.

Key Players

- Abbott Laboratories

- Amway Corporation

- Bioniq

- Care/of (Bayer)

- DNAfit

- Herbalife Nutrition

- HUM Nutrition

- Metagenics, Inc.

- Persona Nutrition (Nestlé Health Science)

- Viome Life Sciences, Inc.

- Vous Vitamin

Personalized Vitamins Industry Developments

In January 2025, Bioniq launched a custom supplement product tailored for individuals with special health needs, targeting the 15% of the population seeking personalized vitamins.

In July 2024, Aurea launched its next-gen personalized multivitamin in the UK, offering custom formulations based on blood biomarkers. The brand introduced a wellness membership with self-testing, tailored supplements, and refillable Orb packaging, aiming to simplify routines and optimize individual micronutrient intake.

Personalized Vitamins Market Segmentation

By Dosage Form Outlook (Revenue, USD Billion, 2020–2034)

- Tablets

- Capsules

- Powders

- Gummies/Chewable

- Liquids

- Softgels

By Age Group Outlook (Revenue, USD Billion, 2020–2034)

- Pediatric

- Adults

- Geriatric

By Distribution Channel Outlook (Revenue, USD Billion, 2020–2034)

- Supermarkets/Hypermarkets

- Specialty Stores

- Retail Pharmacies

- Online Pharmacies & E-commerce Site

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Wellness Supplements

- Disease-Based Supplements

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Personalized Vitamins Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 4.96 Billion |

|

Market Size in 2025 |

USD 5.63 Billion |

|

Revenue Forecast by 2034 |

USD 18.14 Billion |

|

CAGR |

13.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 4.96 billion in 2024 and is projected to grow to USD 18.14 billion by 2034.

The global market is projected to register a CAGR of 13.9% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are Abbott Laboratories; Amway Corporation; Bioniq; Care/of (Bayer); DNAfit; Herbalife Nutrition; HUM Nutrition; Metagenics, Inc.; Persona Nutrition (Nestlé Health Science); Viome Life Sciences, Inc.; and Vous Vitamin.

The tablet segment dominated the market share in 2024.

The geriatric segment is expected to witness the significant growth during the forecast period.