Online Retail Platforms Market Size, Share, Trends, Industry Analysis Report

: By Product, Platform (Web Based Platform and App Based Platform), Payment Mode, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:May-2025

- Pages: 125

- Format: PDF

- Report ID: PM5618

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

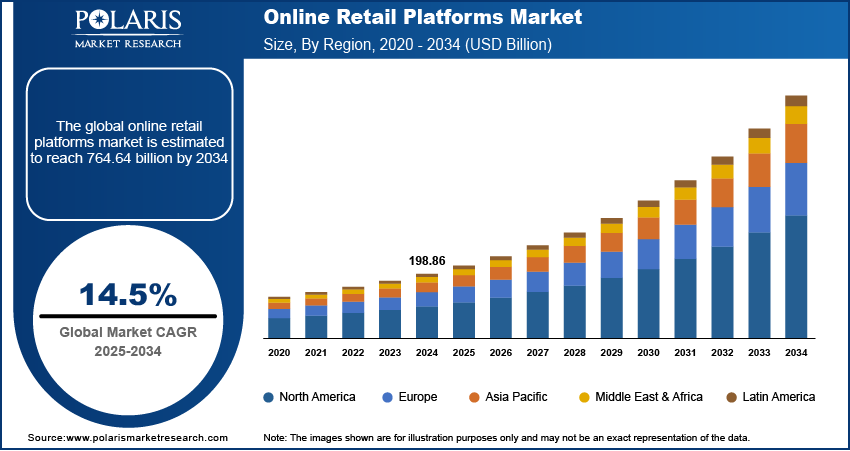

The global online retail platforms market size was valued at USD 198.86 billion in 2024, exhibiting a CAGR of 14.5% during 2025–2034. Growing internet and smartphone access, rising adoption of digital payments, increasing urbanization, the rise of social commerce, and omnichannel retail strategies are collectively driving the rapid expansion of the market.

Key Insights

- The clothing, footwear, and accessories segment is growing fastest due to affordable fashion, frequent sales, easy returns, and wide online selections.

- App-based retailing leads market share because of smartphone use, fast loading, personalized experience, and secure digital payments.

- Asia Pacific dominates with a large population, high smartphone penetration, fast internet, and major e-commerce platforms, which improve shopping convenience.

- North America has strong digital infrastructure, high-speed internet, cybersecurity, data analytics use, and growing niche and subscription e-commerce models.

Industry Dynamics

- Growing internet and smartphone penetration globally expands the online shopper base, especially in developing and remote regions.

- Increasing social commerce and omnichannel strategies enhance customer engagement and convenience, boosting online retail platform adoption.

- Rising digital payment adoption offers safer, faster transactions, encouraging more consumers to shop online with confidence.

- Rapid urbanization improves internet access, infrastructure, and logistics, increasing demand for convenient online shopping services.

- High competition among online retailers and logistical challenges in less-developed areas may hinder a seamless customer experience.

Market Statistics

2024 Market Size: USD 198.86 billion

2034 Projected Market Size: USD 764.64 billion

CAGR (2025–2034): 14.5%

Asia Pacific: Largest market in 2024

To Understand More About this Research:Request a Free Sample Report

Online retail focuses on B2C sales, targeting end consumers. A popular form is D2C (direct-to-consumer), where businesses sell and ship products directly to customers, bypassing intermediaries. This model allows brands to control their image, reduce costs, and access customer data. Online retailers aim to replicate the personalized, seamless experience of physical stores to enhance customer engagement solution and brand loyalty in the digital shopping space.

More people around the world have access to the internet and smartphones, increasing the number of potential online shoppers. According to the World Bank, in 2023, 65% of the world's population had access to the internet. Mobile devices have become more affordable, and data plans are easier to access, making it possible for individuals in rural or remote areas to shop online. Smartphones give users the ability to browse products, compare prices, and make purchases anytime and anywhere. This widespread digital connectivity enables online retail platforms to tap into new markets and grow rapidly, particularly in developing regions where digital technology is spreading quickly, driving the online retail platform market growth.

Shopping is no longer limited to websites. Many people now discover and buy products directly on social media platforms such as Instagram and Facebook, a trend known as social commerce. At the same time, retailers are combining online and offline experiences to provide seamless service across all channels. Customers order online and pick up in-store or return items in a physical shop. This “omnichannel” approach keeps shoppers engaged and makes shopping more convenient, helping online retail platforms grow and thereby driving the online retail platform market expansion.

Market Dynamics

Rising Digital Payments Adoption

Digital payment options have made online shopping faster, safer, and more convenient. Customers can pay using mobile wallets (such as PayPal, Apple Pay, or Google Pay), credit/debit cards, bank transfers, or even Buy Now, Pay Later (BNPL) services. According to the National Payments Corporation of India, in January 2025, USD 951.91 million worth of transactions were made in India through Google Pay. These payment methods are easy to use and come with security features that protect against fraud. Customers are more likely to shop online as more people become comfortable with digital transactions. Therefore, the increasing digital payments adoption is driving the online retail platform market demand.

Rising Urbanization

More people are moving to cities, where internet access, infrastructure, and digital literacy are generally better. According to the World Bank Group, in 2023, 63% of the total population in Asia Pacific lived in urban areas, showcasing urbanization. Urban residents also tend to have higher incomes and busier lifestyles, making them more likely to shop online for convenience. Cities have better logistics networks, enabling faster delivery and better service. This trend of rising urbanization is increasing the number of online shoppers and encouraging more brands and retailers to invest in digital platforms that meet the demands of modern urban consumers. Hence, rising urbanization propels the online retail platform market expansion.

Segment Analysis

Market Assessment by Product Outlook

The online retail platforms market segmentation, based on product, includes home appliances and electronics; clothing, footwear, and accessories; food and personal care; furniture and home décor; and other products. The clothing, footwear, and accessories segment is expected to witness the fastest growth during the forecast period. Increasing demand for affordable fashion, along with frequent online sales and easy return policies, is driving more consumers to shop for apparel online. The convenience of browsing a wide range of styles, sizes, and brands from home further contributes to the growing interest in this category, thereby driving the segmental growth.

Market Evaluation by Platform Outlook:

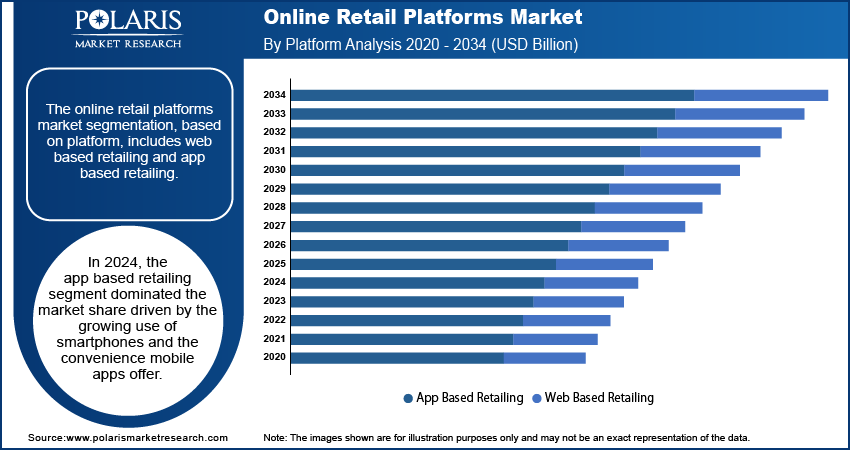

The market evaluation, based on platform, includes web based retailing and app based retailing. The app based retailing segment dominated the online retail platforms market share in 2024 driven by the growing use of smartphones and the convenience mobile apps offer. Consumers prefer apps for their fast-loading speed, personalized shopping experience, and easy access to exclusive deals and notifications. Many apps support secure digital payments and features such as saved preferences and real-time tracking. These advantages make shopping faster and more engaging, encouraging more users to shop through apps and helping app-based platforms, thereby driving the segmental growth.

Regional Analysis

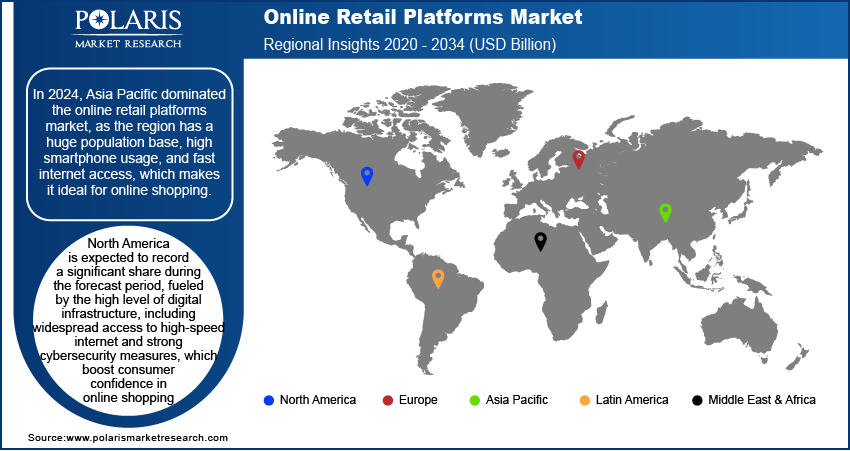

By region, the study provides the online retail platforms market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, Asia Pacific dominated the online retail platforms market revenue share, driven by countries such as China, Japan, South Korea, and Southeast Asia. According to the People's Republic of China, in 2023, China's e-commerce sales surpassed USD 300.74 billion, reflecting a robust year-on-year growth of 58.9%, driving the growth of online retail sales by 7.5%. The region has a huge population base, high smartphone usage, and fast internet access, which makes it ideal for online shopping. Major platforms such as Alibaba, JD.com, and Rakuten have made shopping convenient and accessible. Additionally, digital payment systems and efficient logistics networks have improved the customer experience, thereby driving the market growth in Asia Pacific.

The market in India is experiencing substantial growth due to the rapid 5G smartphone penetration, affordable internet, and a growing middle-class population. E-commerce platforms such as Flipkart, Amazon India, and Reliance JioMart have expanded their services even in smaller towns and rural areas. Government support for digital payments and growing adoption of online transactions have further boosted the market growth in India.

North America is expected to record a significant market share during the forecast period, driven by the high level of digital infrastructure, including widespread access to high-speed internet and strong cybersecurity measures, which boost consumer confidence in online shopping. Retailers are also using data analytics and risk analytics to improve supply chain efficiency and enhance customer satisfaction. Additionally, the rise of niche and subscription-based e-commerce businesses is reshaping how consumers discover and interact with online brands, which, in turn, is fueling the online retail platforms market opportunity in North America.

Key Players & Competitive Analysis Report

The online retail platforms market trends are characterized by dynamic evolution, with numerous players engaged in continuous innovation to gain a competitive edge. Major global enterprises dominate the landscape through significant investments in research and development, employing advanced methodologies to improve their operational efficiency and market reach. These corporations actively pursue strategic maneuvers, including mergers and acquisitions, partnerships, and collaborative ventures, aimed at augmenting their product portfolios and penetrating new markets.

Emerging companies are influencing the sector by introducing disruptive innovations tailored to meet the specific demands of niche market segments. Current online retail platform market analysis indicates that this competitive landscape is further intensified by relentless advancements in product offerings, driving differentiation and responsiveness to consumer needs. A few major players in the market are Shopify; BigCommerce; WooCommerce; Amazon; eBay; JD.com, Inc.; Alibaba.com; Walmart; Rakuten; and Banggood.

Shopify Inc., established in 2006 and based in Ottawa, Canada, is a technology company that provides an e-commerce platform for businesses to create and manage online stores. Initially developed to sell snowboards online, the company has expanded its services to support a wide range of merchants globally. Shopify’s platform allows users to build websites, manage inventories, process payments, and analyze sales data, serving businesses of various sizes and industries. The company’s product offerings include its core e-commerce platform, which provides tools for website creation and store management. It also offers point-of-sale (POS) systems designed for physical retail locations, enabling integration between online and offline sales channels. Additional services include payment processing, shipping solutions, and marketing analytics. Shopify operates on a subscription model, with different plans available depending on the size and needs of the business. Recently, Shopify has extended its services to the business-to-business (B2B) segment, providing tools for wholesalers and manufacturers. Its customer base includes a variety of industries, from fashion brands to general retailers. Shopify operates internationally, supporting merchants in over 175 countries. The platform includes features to facilitate cross-border trade, such as multi-currency support, tax compliance, and localized payment options through tools such as Shopify Markets Pro. The company has partnerships with several global brands, including Suntory in Japan and On Running in Sweden. It also engages in sustainability efforts, including initiatives aimed at reducing carbon emissions and promoting renewable energy use.

Amazon.com, Inc. is a retail company specializing in the sale of consumer products, advertising, and subscription services via both online platforms and physical stores. The company operates in segments and regions, including North America, International, and Amazon Web Services (AWS). It is also involved in the manufacturing and distribution of electronic devices such as Fire tablets, Kindle, Blink, Fire TVs, Ring, Echo, and Eero, alongside the development and production of media content. Furthermore, Amazon facilitates programs for sellers to list and sell their products within its marketplace, as well as opportunities for authors, independent publishers, filmmakers, musicians, app developers, Twitch streamers, and others to publish and monetize their content. The company also offers a range of cloud computing services, including computing, analytics, storage, machine learning, database, and advertising services such as display, sponsored ads, and video advertising. The company offering is Amazon Prime, a membership program that provides various benefits to subscribers. The products available through Amazon's stores encompass a wide array of merchandise and content, including items purchased for resale and those offered by third-party sellers. Amazon serves a diverse customer base, including consumers, sellers, developers, enterprises, content creators, advertisers, and its employees. Founded in 1994, the company is headquartered in Seattle, Washington.

List of Key Companies

- Alibaba.com.

- Amazon

- Banggood

- BigCommerce

- eBay

- JD.com, Inc.

- Rakuten

- Shopify

- Walmart

- WooCommerce

Online Retail Platforms Industry Developments

In February 2025, Amazon and DGFT renewed their partnership to boost e-commerce exports from India, aiming to empower MSMEs with skills and resources, building on their initial MoU signed in November 2023.

In May 2023, StoryStream’s Live Video Shopping platform was launched following successful pilots, enabling retailers to host interactive, real-time shopping events, which were seen as a breakthrough in humanizing online commerce.

Online Retail Platforms Market Segmentation

By Product Outlook (Revenue USD Billion, 2020–2034)

- Home Appliances and Electronics

- Clothing, Footwear, and Accessories

- Food and Personal Care

- Furniture and Home Decor

- Other Products

By Platform Outlook (Revenue USD Billion, 2020–2034)

- Web Based Retailing

- App Based Retailing

By Payment Mode Outlook (Revenue USD Billion, 2020–2034)

- Digital Payments

- COD

- Others

By Regional Outlook (Revenue USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Online Retail Platforms Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 198.86 billion |

|

Market Size Value in 2025 |

USD 226.91 billion |

|

Revenue Forecast by 2034 |

USD 764.64 billion |

|

CAGR |

14.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 198.86 billion in 2024 and is projected to grow to USD 764.64 billion by 2034.

The global market is projected to record a CAGR of 14.5% during the forecast period.

Asia Pacific held the largest share in the global market in 2024.

A few key players in the market are Shopify; BigCommerce; WooCommerce; Amazon; eBay; JD.com, Inc.; Alibaba.com; Walmart; Rakuten; and Banggood.

The app based retailing segment dominated the market in 2024, driven by the growing use of smartphones and the convenience mobile apps offer.

The clothing, footwear, and accessories segment is expected to witness the fastest growth during the forecast period due to increasing demand for affordable fashion, along with frequent online sales and easy return policies.