U.S. Medical Waste Container Market Size, Share, Trends, Industry Analysis Report

By Product (Chemotherapy Containers, Biohazardous Waste Containers, Sharps Waste Containers), By Waste Type, By End Use – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM6252

- Base Year: 2024

- Historical Data: 2020-2023

Overview

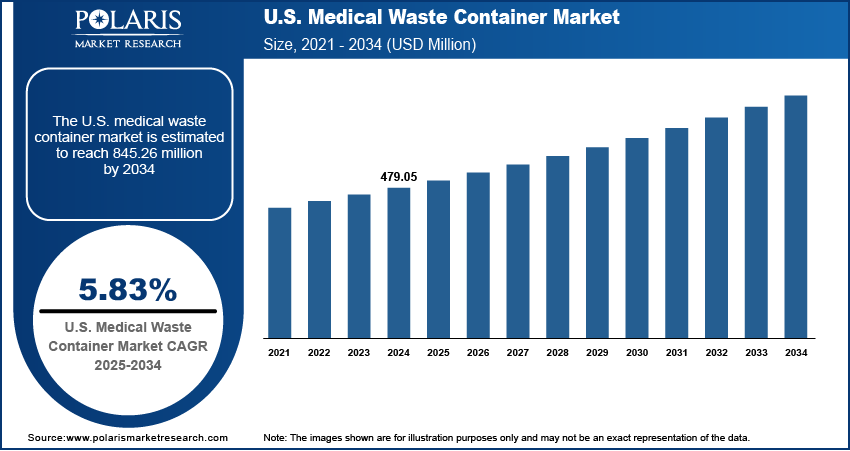

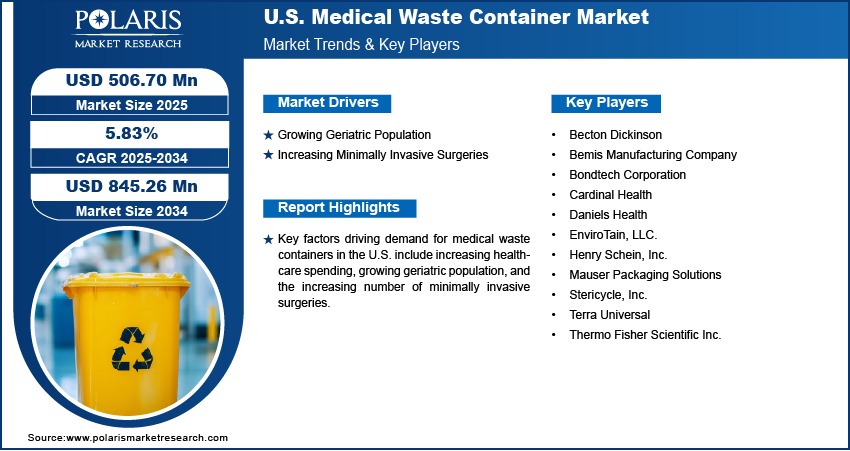

The U.S. medical waste container market size was valued at USD 479.05 million in 2024, growing at a CAGR of 5.83% from 2025 to 2034. Key factors driving demand for medical waste containers in the U.S. include increasing healthcare spending, growing geriatric population, and increasing adoption of minimally invasive surgeries.

Key Insights

- The chemotherapy containers segment accounted for 36.22% of revenue share in 2024 due to a rise in chemotherapy treatments.

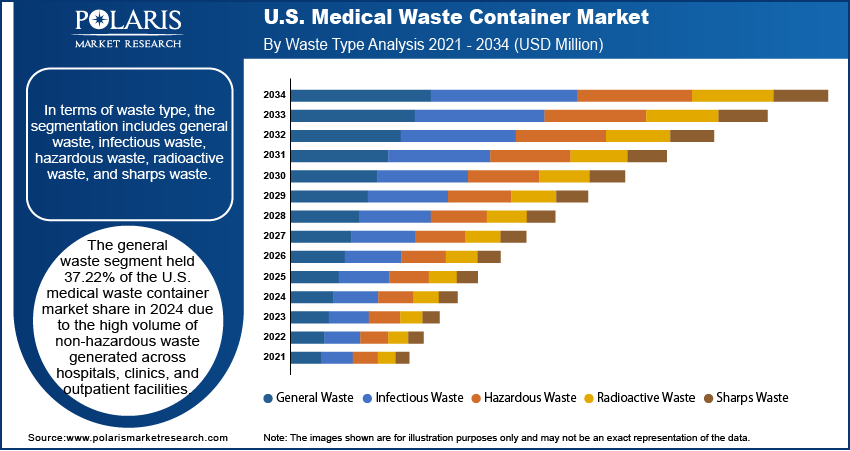

- The general waste segment held 37.22% of the U.S. market share in 2024 due to high volume non-hazardous waste generated across hospitals and clinics.

- The pharmaceutical and biotechnology companies & CROs segment is estimated to register a CAGR of 7.48% from 2025 to 2034 due to a surge in biomanufacturing processes and clinical trials.

Industry Dynamics

- The growing geriatric population in the U.S. is propelling the demand for medical waste containers as elderly individuals require more frequent medical care, including hospital visits, leading to higher volumes of medical waste.

- The increasing demand for minimally invasive surgeries is fueling the adoption of medical waste containers as these surgeries rely on single-use disposable instruments, such as trocars, guidewires, and specialized catheters.

- The expanding healthcare facilities in the U.S. are expected to create a lucrative market opportunity during the forecast period.

The growing competition among key players in the U.S. medical waste container market is restraining overall industry growth.

Market Statistics

- 2024 Market Size: USD 479.05 Million

- 2034 Projected Market Size: USD 845.26 Million

- CAGR (2025–2034): 5.83%

AI Impact on U.S. Medical Waste Container Market

- There is no direct integration of artificial intelligence (AI) into medical waste containers. However, the adoption of AI and other related technologies in the medical waste container market in the U.S. is in the early stages.

- The technologies would enhance smart medical waste management capabilities, which is expected to improve the way medical waste containers are designed, produced, monitored, and used in the coming years.

A medical waste container is a specially designed vessel used for the safe collection, storage, and disposal of biomedical waste. These containers are constructed from puncture-resistant, leak-proof, and durable materials to prevent contamination and injury. They are color-coded and labeled to distinguish between types of waste, such as sharps, infectious, hazardous, or general medical waste. Medical waste containers ensure compliance with health regulations, reduce the risk of infection, and promote safe handling practices for healthcare workers, patients, and waste management personnel. The usage of these containers is essential in hospitals, clinics, laboratories, dental offices, and veterinary facilities.

The U.S. medical waste container market is growing rapidly due to increasing patient volume and strict regulatory frameworks from agencies such as OSHA and the EPA. Hospitals, outpatient facilities, and diagnostic labs in the country are driving demand for specialized containers that ensure safe disposal of infectious and hazardous waste. The growing use of disposable medical supplies and the expanding elderly population in the country is further contributing to waste generation, leading to market growth. Technological advancements in container design, such as tamper-proof lids and smart tracking systems are enhancing safety and efficiency in medical waste sector in the country.

The U.S. medical waste container market demand is driven by the increasing healthcare spending. American Medical Association, in its findings, stated that health spending in the U.S. reached $4.9 trillion in 2023 or $14,570 per capita. This increased spending encouraged hospitals and clinics to expand their services, purchase more equipment, and treat more patients, which generated higher volumes of hazardous waste, requiring additional containers for safe disposal. Additionally, rising budgets allowed institutions to upgrade to specialized, high-capacity containers, fueling market growth. Therefore, as healthcare spending increases, the need for reliable, efficient waste containment solutions grows proportionally.

Drivers & Opportunities

Growing Geriatric Population: Elderly individuals require more frequent medical care, including hospital visits, long-term treatments, and home healthcare services, leading to higher volumes of used prefilled syringes, medical tapes & bandages, and other disposable medical supplies, which increases the need for proper disposal in specialized containers, contributing to market growth. According to the Population Reference Bureau, the number of Americans aged 65 and above is projected to increase from 58 million in 2022 to 82 million by 2050. Furthermore, chronic conditions such as such as diabetes and heart disease are common among older adults, necessitating regular use of medical devices and medications, further increasing demand for medical waste containers to accommodate waste output. Hence, as the elderly population grows, healthcare providers and waste management companies in the country scale up their container supply to handle the rising waste volume safely.

Increasing Minimally Invasive Surgeries: Minimally invasive surgeries rely on single-use disposable instruments, such as trocars, guidewires, and specialized catheters, which generate significant medical waste and drive demand for medical waste containers. Additionally, minimally invasive surgeries often require pre-packaged sterile kits containing multiple disposable components, further contributing to waste output. Hospitals and ambulatory surgical centers must ensure safe handling of this waste, driving demand for puncture-resistant and leak-proof containers. Therefore, as these surgeries become more common, healthcare facilities require more containers to maintain compliance with waste disposal regulations.

Segmental Insights

Product Analysis

Based on product, the segmentation includes chemotherapy containers, biohazardous waste containers, sharps waste containers, resource conservation and recovery act (RCRA) containers, and others. The chemotherapy containers segment accounted for 36.22% of revenue share in 2024 due to increasing prevalence of cancer and the corresponding rise in chemotherapy treatments across hospitals and oncology centers. The growing emphasis on safe disposal of cytotoxic drugs and contaminated materials further accelerated demand for these containers. Strict regulations from agencies like the Environmental Protection Agency (EPA) and the Occupational Safety and Health Administration (OSHA) pushed healthcare facilities to adopt specialized containers designed to prevent leakage, contamination, and accidental exposure. Additionally, advancements in container design, such as tamper-proof lids and puncture resistance, enhanced chemotherapy containers usability and safety, making them the preferred choice for handling hazardous pharmaceutical waste.

The resource conservation and recovery act (RCRA) containers segment is projected to register a CAGR of 7.17% from 2025 to 2034, owing to the rise in hazardous waste generated from laboratories, research centers, and pharmaceutical manufacturing units. Increased federal enforcement of hazardous waste regulations under the Resource Conservation and Recovery Act has compelled healthcare and industrial facilities to invest in standardized containers that ensure legal and environmental compliance. Moreover, the expanding use of hazardous chemicals in diagnostic testing and drug development continues to fuel the demand for RCRA-compliant storage and disposal systems.

Waste Type Analysis

In terms of waste type, the segmentation includes general waste, infectious waste, hazardous waste, radioactive waste, and sharps waste. The general waste segment held 37.22% of the U.S. medical waste container market share in 2024 due to the high volume of non-hazardous waste generated across hospitals, clinics, and outpatient facilities. Paper, packaging materials, food waste, and disposable supplies contributed significantly to daily waste output. Healthcare providers continue to expand services to meet rising patient demand, especially in urban areas, which has led to an increase in general waste generation. Regulatory requirements for proper segregation and disposal, even for non-infectious materials, have reinforced the need for durable, clearly labeled containers. Cost-efficiency and the wide applicability of general waste containers across multiple healthcare settings have also supported their widespread adoption.

The sharps waste segment is expected to register a CAGR of 9.51% from 2025 to 2034, owing to rising use of needles, syringes, scalpels, and other sharp instruments in both inpatient and outpatient care. The expansion of home-based care and self-administered therapies, such as insulin injections and biologics, is increasing the need for safe and puncture-resistant sharps containers outside traditional clinical environments. Additionally, strict disposal regulations by OSHA and the FDA require proper containment of sharps to prevent needlestick injuries and transmission of bloodborne pathogens.

End Use Analysis

In terms of end use, the segmentation includes hospitals & private clinics, diagnostic laboratories, pharmaceutical and biotechnology companies & CROs, academic research institutes, and others. The hospitals & private clinics segment dominated the U.S. medical waste container market share in 2024 by holding 39.22% revenue share. This is attributed to their substantial contribution to overall medical waste generation. These facilities perform a broad spectrum of diagnostic, surgical, and therapeutic procedures that produce a mix of general, infectious, sharps, and hazardous waste daily. The need to manage large volumes of waste efficiently and in compliance with OSHA and EPA regulations has led hospitals and clinics to adopt a wide range of specialized containers. Increased patient admissions, growth in chronic disease management, and the expansion of outpatient services have further fueled waste output in hospitals, strengthening the demand for high-capacity, durable, and clearly labeled disposal solutions.

The pharmaceutical and biotechnology companies & CROs segment is estimated to register a CAGR of 7.48% from 2025 to 2034 due to a surge in drug development activities, clinical trials, and biomanufacturing processes. These organizations face strict federal and state waste disposal mandates, which require the use of compliant containers that ensure containment, traceability, and safe handling. Additionally, the growing investments in R&D, particularly in biologics and personalized medicines, are expanding the operational footprint of these companies, thereby boosting demand for high-performance medical waste containment systems.

Key Players & Competitive Analysis

The U.S. medical waste container market is highly competitive, with key players such as Stericycle, Inc., Becton Dickinson, and Cardinal Health dominating the industry through extensive distribution networks and compliance expertise. Thermo Fisher Scientific Inc. and Henry Schein, Inc. leverage their strong brand reputation and diversified healthcare portfolios, while Daniels Health focuses on sustainable, cost-effective solutions. Mauser Packaging Solutions and Bemis Manufacturing Company emphasize durable, high-capacity containers for industrial clients. Emerging players such as EnviroTain, LLC. and Terra Universal specialize in niche segments, such as biohazard containment. Innovation in smart waste tracking and eco-friendly materials is intensifying competition, with stricter regulations driving demand for compliant, high-quality disposal solutions.

A few major companies operating in the U.S. medical waste container industry include Becton Dickinson; Bemis Manufacturing Company; Bondtech Corporation; Cardinal Health; Daniels Health; EnviroTain, LLC.; Henry Schein, Inc.; Mauser Packaging Solutions; Stericycle, Inc.; Terra Universal; and Thermo Fisher Scientific Inc.

Key Companies

- Becton Dickinson

- Bemis Manufacturing Company

- Bondtech Corporation

- Cardinal Health

- Daniels Health

- EnviroTain, LLC.

- Henry Schein, Inc.

- Mauser Packaging Solutions

- Stericycle, Inc.

- Terra Universal

- Thermo Fisher Scientific Inc.

U.S. Medical Waste Container Industry Developments

In October 2023, BD announced that it recycled 40,000 pounds of medical waste in a circular economy pilot project.

In August 2023, Stericycle, Inc. announced the launch of its re-engineered one-gallon SafeDrop Sharps Mail Back and one-gallon CsRx Controlled Substance Wastage containers, featuring a contemporary design.

U.S. Medical Waste Container Market Segmentation

By Product Type Outlook (Revenue, USD Million, 2021–2034)

- Chemotherapy Containers

- Biohazardous Waste Containers

- Sharps Waste Containers

- Resource Conservation and Recovery Act (RCRA) Containers

- Others

By Waste Type Outlook (Revenue, USD Million, 2021–2034)

- General Waste

- Infectious Waste

- Hazardous Waste

- Radioactive Waste

- Sharps Waste

By End Use Outlook (Revenue, USD Million, 2021–2034)

- Hospitals & Private Clinics

- Diagnostic Laboratories

- Pharmaceutical and Biotechnology Companies & CROs

- Academic Research Institutes

- Others

U.S. Medical Waste Container Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 479.05 Million |

|

Market Size in 2025 |

USD 506.70 Million |

|

Revenue Forecast by 2034 |

USD 845.26 Million |

|

CAGR |

5.83% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2021–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 479.05 million in 2024 and is projected to grow to USD 845.26 million by 2034.

The market is projected to register a CAGR of 5.83% during the forecast period.

A few of the key players in the market are Becton Dickinson; Bemis Manufacturing Company; Bondtech Corporation; Cardinal Health; Daniels Health; EnviroTain, LLC.; Henry Schein, Inc.; Mauser Packaging Solutions; Stericycle, Inc.; Terra Universal; and Thermo Fisher Scientific Inc.

The chemotherapy containers segment dominated the market share in 2024.

The pharmaceutical and biotechnology companies & CROs segment is expected to witness the fastest growth during the forecast period.