ATP Assays Market Size, Share, Trends, Industry Analysis Report

By Type [Luminometric ATP Assays, Enzymatic ATP Assays, Bioluminescence Resonance Energy Transfer (BRET) ATP Assays, Cell-based ATP Assays, Others], By Application, By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM6130

- Base Year: 2024

- Historical Data: 2020-2023

Overview

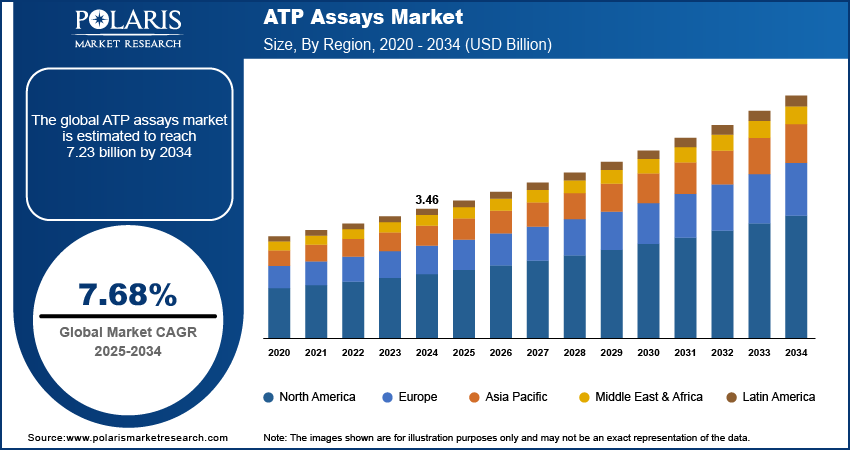

The global ATP assays market size was valued at USD 3.46 billion in 2024, growing at a CAGR of 7.68% from 2025 to 2034. Key factors driving demand for ATP assays include expanding healthcare expenditure, increasing prevalence of chronic diseases, and growing focus on food safety and quality testing.

Key Insights

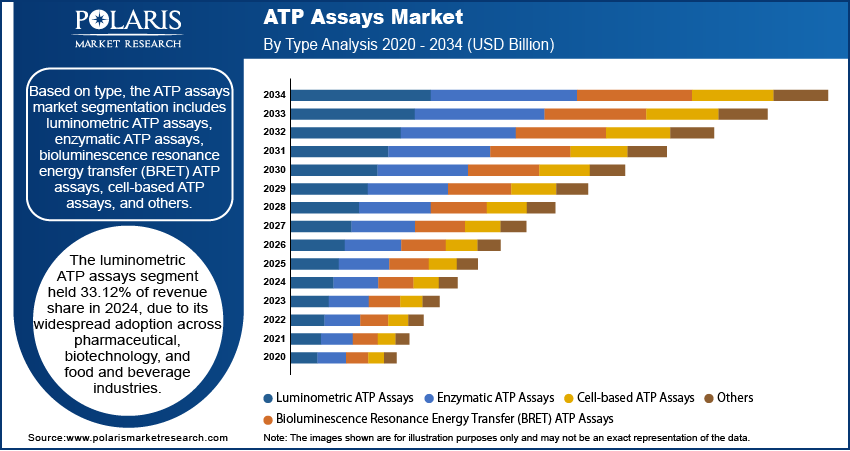

- The luminometric ATP assays segment held 33.12% of revenue share in 2024, due to its widespread adoption across food and beverage and other industries.

- The drug discovery segment accounted for 34.17% of the revenue share in 2024 owing to increasing reliance on cellular energy measurements during drug screening.

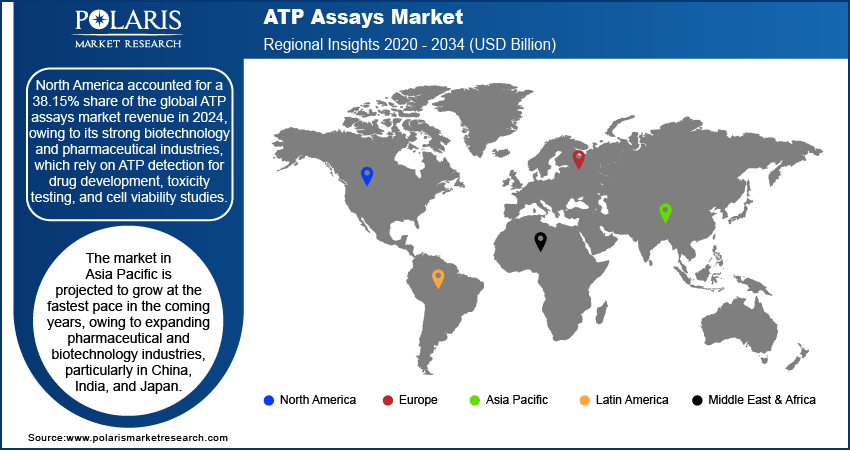

- North America accounted for a 38.15% share of the global ATP assays market revenue in 2024. This dominance is attributed to region's strong biotechnology and pharmaceutical industries.

- The U.S. held the largest revenue share in the North America ATP assays landscape in 2024 due to advanced biomedical research.

- The industry in Asia Pacific is projected to grow at the fastest pace in the coming years, owing to expanding pharmaceutical and biotechnology industries.

- Increasing government investments in healthcare infrastructure and rising outbreaks of infectious diseases in countries such as China and India are necessitating the use of ATP-based diagnostics.

Industry Dynamics

- The increasing prevalence of chronic diseases is driving the demand for ATP assays, as they are utilized in the development of targeted treatments.

- The growing focus on food safety and quality testing is fueling the adoption of ATP assays, as regulatory agencies are utilizing these assays to verify hygiene standards.

- The inability of ATP assays to differentiate between microbial and non-microbial ATP hinders the market growth.

- The increasing investments in cancer research globally are expected to create a lucrative market opportunity during the forecast period.

Market Statistics

- 2024 Market Size: USD 3.46 Billion

- 2034 Projected Market Size: USD 7.23 Billion

- CAGR (2025–2034): 7.68%

- North America: Largest Market Share

To Understand More About this Research: Request a Free Sample Report

Adenosine triphosphate (ATP) assays are analytical techniques designed to detect and quantify ATP, the primary energy carrier of living cells, and serve as a marker for cellular viability and metabolic activity. ATP is vital for numerous cellular processes, including biosynthesis, motility, and cell division. ATP assays most commonly employ bioluminescence-based detection, leveraging the enzyme luciferase, which catalyzes the oxidation of luciferin in the presence of ATP.

ATP assays are widely used in research laboratories to measure cell viability, proliferation, and cytotoxicity, making them crucial tools for assessing drug toxicity, studying cancer cell responses, and optimizing cell culture conditions. In oncology, ATP-bioluminescence assays are employed to determine the chemosensitivity of tumor cells. ATP assays also find practical application in environmental monitoring, food safety, and the pharmaceutical industry. They are employed for rapid detection of microbial contamination in water, food, beverages, and healthcare products by detecting ATP as a proxy for bacterial presence. In hygiene and sanitation industries, ATP assays provide near-instant verification of equipment and surface cleanliness, which is crucial for disease prevention and regulatory compliance. Additionally, ATP assays are utilized in industrial bioprocesses to guide biocide dosing, control fermentation, monitor biological reactors, and evaluate raw materials and production processes.

The global ATP assays market demand is driven by the expanding healthcare expenditure globally. The American Medical Association, in its report, stated that health spending in the U.S. increased by 7.5% to reach $4.9 trillion, or $14,570 per capita, in 2023 from 2022. This is prompting hospitals and laboratories to invest in advanced technologies, including ATP-based assays, to improve patient outcomes and streamline clinical workflows. Additionally, increasing healthcare expenditure is encouraging pharmaceutical companies to ramp up drug discovery efforts, which heavily rely on ATP assays to screen compounds and assess toxicity. Therefore, the expanding healthcare expenditure worldwide is fueling the demand for ATP assays.

Drivers and Opportunities

Increasing Prevalence of Chronic Diseases: Chronic diseases, such as cancer, diabetes, and cardiovascular disorders, are necessitating the use of advanced diagnostic and therapeutic research. Researchers and clinicians heavily rely on ATP assays to assess cell viability, metabolic activity, and drug responses, which are crucial for understanding chronic disease mechanisms and developing targeted treatments. Pharmaceutical companies are also using ATP-based testing to screen potential drug candidates and evaluate their efficacy against chronic conditions. Additionally, hospitals and diagnostic labs are employing ATP assays with the rising prevalence of chronic diseases to monitor disease progression and treatment effectiveness in patients. World Health Organization, in its report, stated that noncommunicable diseases (NCDs) or chronic diseases led to at least 43 million deaths globally in 2021. Therefore, the rising prevalence of chronic diseases is expected to propel the demand for ATP assays during the forecast period.

Growing Focus on Food Safety and Quality Testing: Regulatory agencies and food manufacturers worldwide are utilizing ATP assays to verify hygiene standards, ensuring compliance with stringent food safety regulations. The food industry is prioritizing ATP-based testing to monitor sanitation processes in production facilities, reducing the risk of foodborne illnesses and product recalls. Additionally, restaurants and retail chains are adopting ATP assays for real-time cleanliness checks and enhancing consumer trust. Therefore, as global food safety standards tighten and consumers demand higher-quality products, the need for efficient ATP testing solutions increases.

Segmental Insights

Type Analysis

Based on type, the adenosine triphosphate (ATP) assays market segmentation includes luminometric ATP assays, enzymatic ATP assays, bioluminescence resonance energy transfer (BRET) ATP assays, cell-based ATP assays, and others. The luminometric ATP assays segment held 33.12% of revenue share in 2024, due to its widespread adoption across pharmaceutical, biotechnology, and food and beverage industries. Researchers and quality control professionals prefer luminometric ATP assays for their high sensitivity, rapid results, and ease of use in detecting microbial contamination and cellular viability. The rising demand for high-throughput screening tools in drug discovery and quality control further drove the adoption of luminometric assays. Furthermore, their compatibility with automation and microplate readers propelled their integration into routine laboratory workflows, particularly in clinical diagnostics and research laboratories, where efficiency and precision are crucial, contributing to their dominance.

The cell-based ATP assays segment is projected to grow at a robust pace in the coming years, owing to the increasing reliance on cell viability and cytotoxicity testing in drug development, cancer research, and toxicity screening. These assays allow real-time analysis of living cells, providing insights into cellular health and metabolic activity under various experimental conditions. Researchers favor cell-based formats as they mimic physiological environments more accurately than biochemical assays, enhancing the predictive validity of preclinical studies. Additionally, the growing demand for personalized medicine and 3D cell culture models further fuels the adoption of these assays in both academic and industrial research settings.

Application Analysis

In terms of application, the adenosine triphosphate assays market segmentation includes drug discovery and development, clinical diagnostics, environmental testing, food safety and quality testing, and others. The drug discovery segment accounted for 34.17% of the revenue share in 2024, driven by the increasing demand for rapid and reliable methods to evaluate cell viability, cytotoxicity, and compound efficacy. Pharmaceutical and biotechnology companies have integrated ATP-based tools extensively into high-throughput screening platforms to accelerate the evaluation of early-stage drug candidates. Additionally, the growing complexity of drug pipelines and the need to reduce the time and costs associated with preclinical testing have prompted the widespread adoption of ATP-based assays.

End Use Analysis

In terms of end use, the segmentation includes pharmaceutical and biotechnology companies, academic and research institutes, and hospital and diagnostics laboratories. The pharmaceutical and biotechnology companies segment dominated the revenue share in 2024 by holding 40.23% of the share. This dominance is attributed to the increasing reliance on cellular energy measurements during drug screening, toxicity testing, and evaluations of therapeutic efficacy. These companies integrate ATP-based tools into their R&D to streamline high-throughput screening processes and accelerate the identification of viable drug candidates. Additionally, the industry’s focus on minimizing late-stage drug failures drove the adoption of ATP assay technologies that deliver reliable early-stage predictive data. Investments in automated platforms and robotic screening systems further encouraged the use of ATP assays as a critical component of drug discovery workflows.

The hospital and diagnostic laboratories segment is expected to grow at a rapid pace during the forecast period, owing to the increasing demand for rapid microbial detection, infection control, and metabolic disorder diagnostics. These facilities utilize ATP-based technologies to detect bacterial contamination on surfaces, equipment, and within clinical specimens, particularly in intensive care units and surgical environments where real-time cleanliness validation is critical. The growing burden of healthcare-associated infections (HAIs) and the global emphasis on infection prevention and control measures continue to drive the adoption of ATP assays in hospital and diagnostic laboratories.

Regional Analysis

The North America ATP assays market accounted for 38.15% of the global revenue share in 2024. This dominance is attributed to the region's strong biotechnology and pharmaceutical industries, which rely on ATP detection for drug development, toxicity testing, and cell viability studies. Additionally, stringent regulatory standards in healthcare and food safety necessitated ATP-based microbial monitoring, driving market revenue. The growing adoption of ATP assays in clinical diagnostics for diseases such as cancer and infections has further fueled market growth. Investments in life sciences research, along with the presence of key players, also contributed to the high demand for ATP assays in North America.

U.S. ATP Assays Market Insights

The U.S. held the largest revenue share in the North America ATP assays landscape in 2024, due to advanced biomedical research, increased cancer research studies, and the need for rapid microbial testing in food safety and water quality monitoring. The rise in personalized medicine and high-throughput screening in drug discovery in the U.S. fueled the use of ATP-based assays. Additionally, the FDA’s stringent hygiene compliance requirements in healthcare and pharmaceutical manufacturing drove ATP testing adoption. The presence of major biotech firms and academic research institutions further propelled market growth in the country.

Europe ATP Assays Market Trends

The market in Europe is projected to hold a substantial market share in 2034 due to strict regulatory frameworks that mandate ATP-based hygiene monitoring. The growing pharmaceutical and biotechnology sectors, particularly in the UK, France, and Switzerland, are driving industry expansion in the region as these sectors utilize ATP assays for drug efficacy and toxicity testing. Additionally, rising infectious disease surveillance and increasing government funding for life sciences research are contributing to the demand for ATP assays. The food & beverage industry’s emphasis on microbial contamination control is also propelling demand for ATP assays.

Germany ATP Assays Market Overview

The demand for ATP assays in Germany is projected to expand during the forecast period, driven by its strong pharmaceutical industry, advanced clinical diagnostics, and emphasis on industrial hygiene. The country’s stringent infection control policies in hospitals and laboratories are also driving the adoption of ATP testing. Additionally, Germany’s dominance in automated and high-throughput screening technologies is increasing the use of ATP assays in drug discovery.

Asia Pacific ATP Assays Market Outlook

The industry in the Asia Pacific is projected to grow at the fastest pace in the coming years, owing to expanding pharmaceutical and biotechnology industries, particularly in China, India, and Japan. Increasing government investments in healthcare infrastructure and rising infectious disease outbreaks in these countries are necessitating the use of ATP-based diagnostics. The share of Indian Government Health Expenditure (GHE) in the GDP increased from 1.13% in 2014–15 to 1.84% in 2021–22. Additionally, the region’s growing contract research organizations (CROs) and biomanufacturing sector are contributing to the adoption of ATP assays. The availability of cost-effective testing solutions is further fueling market expansion.

Key Players and Competitive Analysis

The ATP assays industry landscape is highly competitive, with key players such as Thermo Fisher Scientific, Merck KGaA, Promega Corporation, PerkinElmer Inc., and Danaher Corporation dominating the industry. These companies leverage strong R&D capabilities, extensive product portfolios, and global distribution networks to maintain dominance. Thermo Fisher Scientific is recognized for its extensive range of luminescence-based ATP detection kits and high-throughput screening solutions, serving the pharmaceutical, biotechnology, and academic research sectors. Merck KGaA competes through its advanced bioluminescence assays and strong presence in life sciences, while Promega Corporation specializes in sensitive, high-performance ATP detection systems, particularly in drug discovery and microbiology applications. PerkinElmer focuses on automated, high-throughput ATP assay platforms, which appeal to large-scale research and clinical diagnostics laboratories.

Emerging competitors are introducing cost-effective and portable ATP detection systems, intensifying competition, particularly in environmental monitoring and food safety sectors. However, established players maintain their dominance through brand reputation, regulatory compliance, and integration with complementary technologies, such as PCR and next-generation sequencing.

A few major companies operating in the ATP assays industry include Abcam plc; Becton, Dickinson and Company (BD); Biomerieux SA; Biotium; Danaher Corporation; Lonza Group Ltd.; Merck KGaA; PerkinElmer Inc.; Promega Corporation; Quest Diagnostics Incorporated; Reaction Biology; and Thermo Fisher Scientific.

Key Players

- Abcam plc

- Becton, Dickinson and Company (BD)

- Biomerieux SA

- Biotium

- Danaher Corporation

- Lonza Group Ltd.

- Merck KGaA

- PerkinElmer Inc.

- Promega Corporation

- Quest Diagnostics Incorporated

- Reaction Biology

- Thermo Fisher Scientific

ATP Assays Industry Developments

March 2025, Biotium, a provider of innovative fluorescent reagents and kits for life science research, announced the release of the Steady-ATP HTS Viability Assay Kit for assessing cell proliferation or cytotoxic potential of compounds.

April 2024, Reaction Biology, a provider of drug discovery and development services, announced the launch of the HotSpot ATP-Max KinomeScreen assay platform at the American Association for Cancer Research (AACR) Annual Meeting 2024.

ATP Assays Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Luminometric ATP Assays

- Enzymatic ATP Assays

- Bioluminescence Resonance Energy Transfer (BRET) ATP Assays

- Cell-based ATP Assays

- Others

By Application Mode Outlook (Revenue, USD Billion, 2020–2034)

- Drug Discovery and Development

- Clinical Diagnostics

- Environmental Testing

- Food Safety and Quality Testing

- Others

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Pharmaceutical and Biotechnology Companies

- Academic and Research Institutes

- Hospital and Diagnostics Laboratories

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

ATP Assays Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 3.46 Billion |

|

Market Size in 2025 |

USD 3.72 Billion |

|

Revenue Forecast by 2034 |

USD 7.23 Billion |

|

CAGR |

7.68% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 3.46 billion in 2024 and is projected to grow to USD 7.23 billion by 2034.

The global market is projected to register a CAGR of 7.68% during the forecast period.

North America dominated the market in 2024

A few of the key players in the market are Abcam plc; Becton, Dickinson and Company (BD); Biomerieux SA; Biotium; Danaher Corporation; Lonza Group Ltd.; Merck KGaA; PerkinElmer Inc.; Promega Corporation; Quest Diagnostics Incorporated; Reaction Biology; and Thermo Fisher Scientific.

The luminometric ATP assays segment dominated the market revenue share in 2024.

The hospital and diagnostics laboratories segment is projected to witness the fastest growth during the forecast period.