U.S. External Catheter Market Size, Share, Trend, Industry Analysis Report

By Product (Self-Adhesive, Non-Adhesive), By Material, By Gender, By End Use – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM6112

- Base Year: 2024

- Historical Data: 2020-2023

Overview

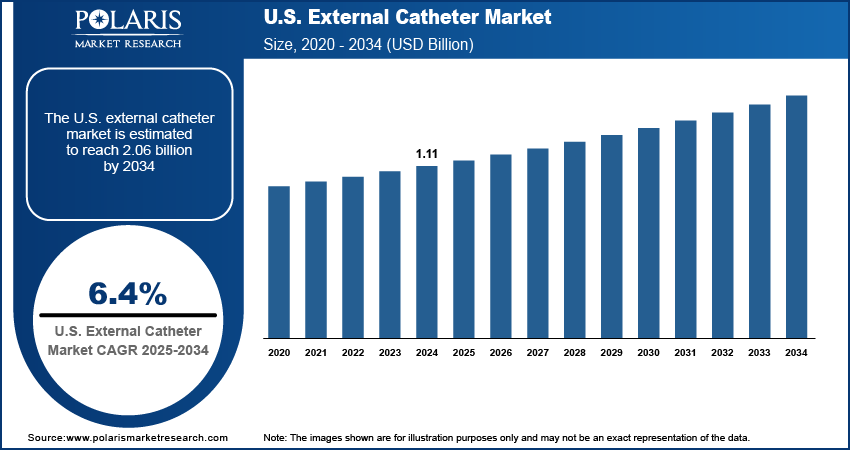

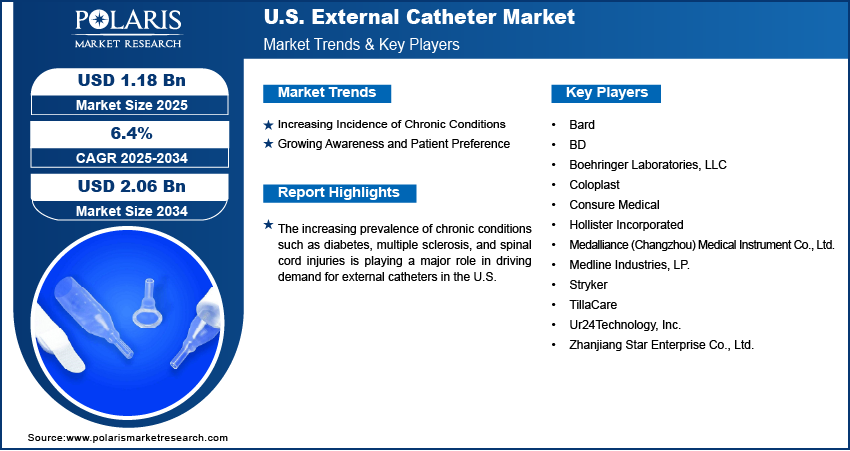

The U.S. external catheter market size was valued at USD 1.11 billion in 2024, growing at a CAGR of 6.4% from 2025 to 2034. There is an increasing prevalence of chronic conditions such as diabetes, multiple sclerosis, and spinal cord injuries among aging adults. These health issues often impair bladder control, leading to higher adoption of external catheters for long-term care.

Key Insights

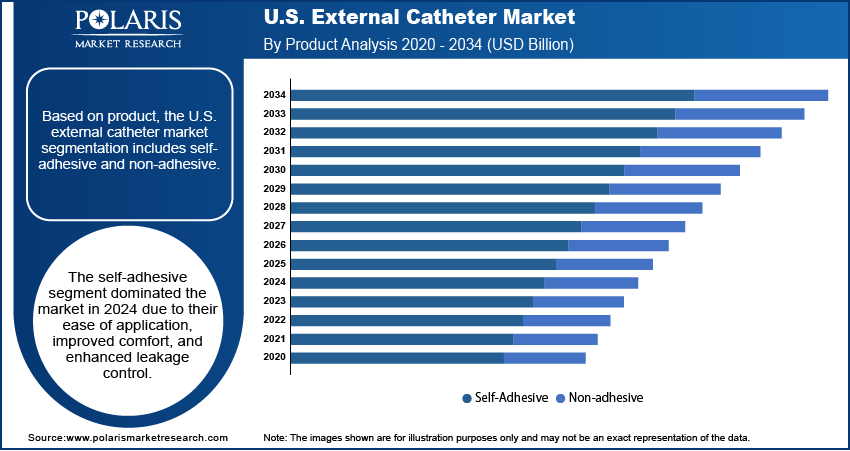

- The self-adhesive segment dominated the market in 2024 due to its ease of application, improved comfort, and enhanced leakage control.

- The silicone segment held the largest revenue share in 2024 due to its biocompatibility, flexibility, and lower risk of allergic reactions.

- The home care segment accounted for the largest revenue share in 2024 due to the rising preference for at-home management of chronic conditions and age-related incontinence.

Industry Dynamics

- Rising prevalence of urinary incontinence among aging male populations is driving increased adoption of external catheters.

- Growing preference for noninvasive, home-based urinary management solutions is boosting demand for external catheters in the U.S.

- The U.S. external catheter market opportunity lies in the expanding use of smart external catheters integrated with IoT-based monitoring and alert systems.

- High costs and limited awareness among patients and caregivers restrict the rapid adoption of advanced external catheter solutions in rural areas.

Market Statistics

- 2024 Market Size: USD 1.11 billion

- 2034 Projected Market Size: USD 2.06 billion

- CAGR (2025–2034): 6.4%

To Understand More About this Research: Request a Free Sample Report

The external catheter market refers to the industry focused on the production and distribution of noninvasive urinary drainage devices worn outside the body, primarily by male patients. These catheters are widely used in managing urinary incontinence, post-surgical care, and long-term chronic conditions, offering a lower risk of infection compared to indwelling catheters. The U.S. healthcare system is witnessing a significant shift toward home healthcare treatment due to cost containment and patient comfort. External catheters are well-suited for home use, supporting independence and improving quality of life for patients.

Innovation in silicone-based, hypoallergenic materials and improved adhesive systems is enhancing patient comfort and reducing skin irritation. This is making external catheters more acceptable for extended daily use. An interdisciplinary team at Caltech has developed an innovative catheter design that effectively hinders the upstream motility of bacteria, eliminating the necessity for antibiotics or chemical antimicrobial interventions. Moreover, medicare and private insurers in the U.S. are increasingly covering external urinary catheters, making them more accessible. Reimbursement improvements are reducing out-of-pocket expenses for patients and boosting the U.S. external catheter market penetration.

Drivers and Opportunities

Increasing Incidence of Chronic Conditions: Increasing incidence of chronic conditions such as diabetes, multiple sclerosis, and spinal cord injuries is playing a major role in driving demand for external catheters in the U.S. According to data from the Centers for Disease Control and Prevention, in 2024, ~14.7% of the adult population in the U.S. is diagnosed with diabetes. These medical conditions often lead to impaired nerve function, which affects bladder control and increases the risk of urinary incontinence. Patients dealing with these challenges require effective, long-term urinary management options that reduce complications and maintain comfort. External catheters provide a noninvasive solution that minimizes infection risk compared to indwelling types. Growing awareness among healthcare professionals about managing chronic conditions in a less invasive manner is also contributing to their widespread use in clinical and home settings.

Growing Awareness and Patient Preference: Growing awareness among patients and healthcare providers about the benefits of external catheters is positively influencing market demand. Educational efforts through physician consultations, digital health platforms, and patient advocacy groups are helping individuals understand how these products improve comfort and daily functioning. Many patients prefer external catheters over traditional indwelling types due to their reduced risk of urinary tract infections, greater ease of use, and improved skin-friendly materials. Increased focus on maintaining dignity and independence for patients suffering from incontinence is further encouraging the shift toward noninvasive solutions. Higher acceptance among users is driving adoption in both acute and long-term care environments.

Segmental Insights

Product Analysis

Based on product, the U.S. external catheter market segmentation includes self-adhesive and non-adhesive. The self-adhesive segment dominated the market in 2024 due to their ease of application, improved comfort, and enhanced leakage control. These devices are preferred in both clinical and home settings as they eliminate the need for additional securing devices. Their ability to offer a secure fit without irritating the skin has made them particularly attractive for patients needing prolonged use. Demand has also been driven by rising adoption among elderly individuals who require consistent and low-maintenance urinary care. Manufacturers continue to innovate in adhesive technologies, leading to better skin compatibility and durability, which reinforces their market leadership.

The non-adhesive segment is projected to grow at the fastest pace from 2025 to 2034, driven by rising usage in patients having sensitive skin or adhesive allergies. These catheters are designed for patients who need intermittent or short-term use and often come with securement devices such as straps or foam rings. Increased awareness of the importance of skin health, particularly among geriatric and post-surgical patients, is promoting their adoption. Healthcare providers are also recommending non-adhesive options for users who experience discomfort or skin breakdown from adhesive-based products, creating a niche but rapidly growing demand segment in both institutional and home care settings.

Material Analysis

In terms of material, the U.S. external catheter market segmentation includes silicone, latex, and others. The silicone segment held the largest revenue share in 2024 due to their biocompatibility, flexibility, and lower risk of allergic reactions. Healthcare professionals prefer silicone catheters for long-term use as they allow for better airflow to the skin and reduce moisture buildup, minimizing the risk of dermatitis or pressure injuries. Silicone materials also offer greater transparency, allowing easy visual monitoring of skin condition beneath the catheter. These attributes make them the material of choice in both home and clinical care. Consistent innovation in silicone formulations has further improved patient comfort, durability, and catheter effectiveness, supporting their continued dominance.

The latex segment is expected to register the highest CAGR from 2025 to 2034 due to their lower manufacturing cost and growing demand in cost-sensitive healthcare settings. They offer high elasticity and a snug fit, which makes them suitable for certain patient populations where secure placement is critical. While latex can cause allergic reactions in some individuals, newer formulations and improved coatings are helping to reduce skin sensitivity concerns. Increasing awareness about affordable urological care solutions is also encouraging the use of latex catheters in outpatient centers and among lower-income demographics. Their availability in a variety of sizes and styles supports customization and broad use.

Gender Analysis

In terms of gender, the U.S. external catheter market segmentation includes male and female. The male segment held the largest revenue share in 2024 due to the wider availability and application suitability of external catheters for male anatomy. These products are commonly used in managing urinary incontinence and bladder dysfunction in men suffering from chronic illnesses, mobility issues, or neurological disorders. The ability to use male external catheters comfortably in both hospital and home settings has increased their appeal. In addition, growing male patient awareness of discreet and hygienic urinary care options has encouraged a steady adoption rate. Manufacturers continue to expand design options to improve comfort, functionality, and compliance among male users.

The female segment is expected to register the highest CAGR from 2025 to 2034, fueled by advancements in anatomical design and improved user acceptability. Historically, female catheters faced limited use due to comfort and fit challenges, but newer versions offer better external positioning and moisture-wicking materials. The increasing emphasis on noninvasive urinary solutions for women suffering from post-operative incontinence, age-related bladder issues, and chronic diseases is accelerating market expansion. Clinical adoption is also increasing in hospitals, where female external urinary devices are used to reduce catheter-associated urinary tract infections. Innovations targeting comfort, fit, and leakage control are enhancing growth potential.

End Use Analysis

In terms of end use, the U.S. external catheter market segmentation includes home care, hospitals, and others. The home care segment accounted for the largest revenue share in 2024, due to the rising preference for at-home management of chronic conditions and age-related incontinence. Patients and caregivers value external catheters for their noninvasive nature, comfort, and ease of use, particularly when dealing with long-term urinary management. Increased availability of telehealth support and product subscriptions has improved accessibility and continuity of care. The shift toward home-based treatment for elderly and disabled patients is creating strong demand for safe and reliable urinary solutions. External catheters are reducing the burden on hospital systems while offering dignity and convenience for users in home settings.

The hospitals segment is projected to grow significantly from 2025 to 2034 driven by heightened focus on infection control and patient safety. External catheters are being increasingly adopted as a strategy to prevent catheter-associated urinary tract infections (CAUTIs), which are commonly linked to indwelling devices. Their use aligns with hospital initiatives aimed at reducing healthcare-associated infections and improving patient outcomes. The growing emphasis on evidence-based urinary management protocols is pushing hospitals to integrate external catheters into both acute and post-operative care pathways. Increasing volumes of elderly and surgical patients further support rising utilization in inpatient care environments.

Key Players and Competitive Analysis

The competitive landscape of the U.S. external catheter market is defined by robust innovation, strategic collaborations, and continuous portfolio optimization. Industry analysis indicates that companies are pursuing market expansion strategies focused on product diversification and geographic reach, particularly in outpatient and home care settings. Mergers and acquisitions are being used to consolidate capabilities, broaden product offerings, and strengthen distribution networks.

Joint ventures and strategic alliances are enabling technology transfer and integration of advanced materials for better patient outcomes. Post-merger integration efforts are focused on unifying research and supply chain operations to reduce time-to-market and improve scalability. Technology advancements, including breathable materials, skin-friendly adhesives, and leak-resistant designs, are enhancing patient compliance and device performance. Manufacturers are increasingly leveraging data from clinical feedback to improve product design and usability. The market also sees investments in direct-to-consumer channels and customized packaging for home use. Competitive intensity remains high, with emphasis on regulatory compliance, customer support services, and value-based pricing.

Key Players

- Bard

- BD

- Boehringer Laboratories, LLC

- Coloplast

- Consure Medical

- Hollister Incorporated

- Medalliance (Changzhou) Medical Instrument Co., Ltd.

- Medline Industries, LP.

- Stryker

- TillaCare

- Ur24Technology, Inc.

- Zhanjiang Star Enterprise Co., Ltd.

U.S. External Catheter Industry Developments

August 2024: Avalon’s Laboratory Services Management Services Organization (MSO) initiated the marketing of its proprietary FDA-registered external male catheter device.

November 2022: Ur24Technology launched its innovative ‘TrueClr’ external catheter line, designed to enhance comfort and effectiveness in urinary management.

U.S. External Catheter Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Self-Adhesive

- Non-Adhesive

By Material Outlook (Revenue, USD Billion, 2020–2034)

- Silicone

- Latex

- Others

By Gender Outlook (Revenue, USD Billion, 2020–2034)

- Male

- Female

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Home Care

- Hospitals

- Others

U.S. External Catheter Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.11 billion |

|

Market Size in 2025 |

USD 1.18 billion |

|

Revenue Forecast by 2034 |

USD 2.06 billion |

|

CAGR |

6.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

U.S. External Catheter Industry Trend Analysis (2024)

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The U.S. market size was valued at USD 1.11 billion in 2024 and is projected to grow to USD 2.06 billion by 2034.

The U.S. market is projected to register a CAGR of 6.4% during the forecast period.

A few of the key players in the market are Bard; BD; Boehringer Laboratories, LLC; Coloplast; Consure Medical; Hollister Incorporated; Medalliance (Changzhou) Medical Instrument Co., Ltd.; Medline Industries, LP.; Stryker; TillaCare; Ur24Technology, Inc.; and Zhanjiang Star Enterprise Co., Ltd.

The self-adhesive segment dominated the market in 2024 due to its ease of application, improved comfort, and enhanced leakage control.

The silicone segment held the largest revenue share in 2024 due to its biocompatibility, flexibility, and lower risk of allergic reactions.