Ophthalmic Equipment Market Size, Share, Trends, Industry Analysis Report

By Product, By End Use (Consumers, Hospitals, Specialty Clinics & Ambulatory Surgery Centers, and Others), and By Region -Market Forecast, 2025 - 2034

- Published Date:Sep-2025

- Pages: 119

- Format: PDF

- Report ID: PM2844

- Base Year: 2024

- Historical Data: 2020-2023

Overview

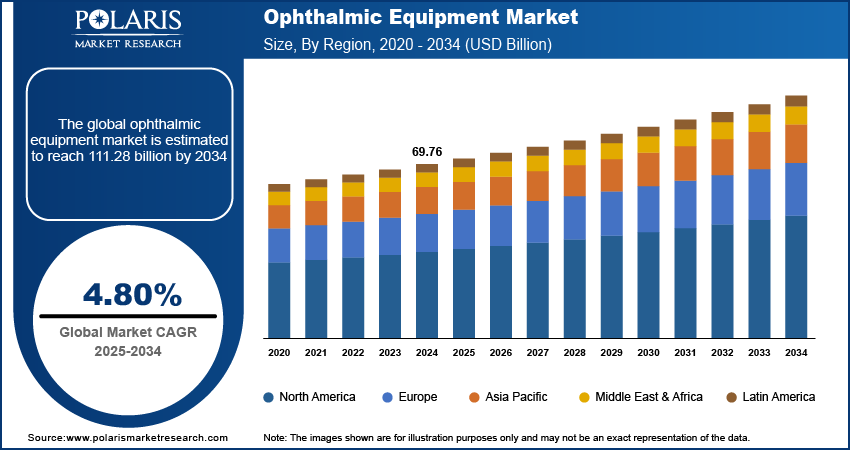

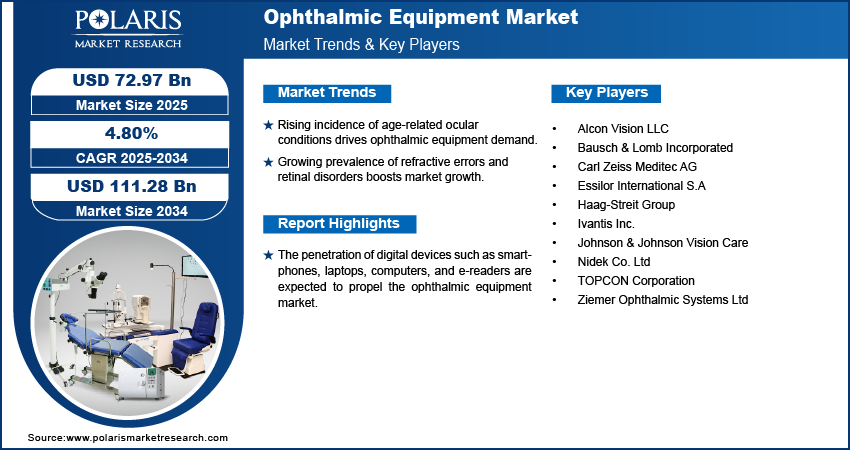

The global ophthalmic equipment market size was valued at USD 69.76 billion in 2024. The market is projected to grow at a CAGR of 4.80% during 2025 to 2034. Key factors driving demand for ophthalmic equipment include a growing aging population globally, rising prevalence of chronic eye conditions such as glaucoma, diabetic retinopathy, and myopia, and technological advancements.

Key Insights

- Vision care products held the largest revenue share in 2024 due to the growing demand for spectacles and contact lenses.

- The consumer segment dominated the market share in 2024 due to the growing use of contact lenses to treat a wide range of vision problems.

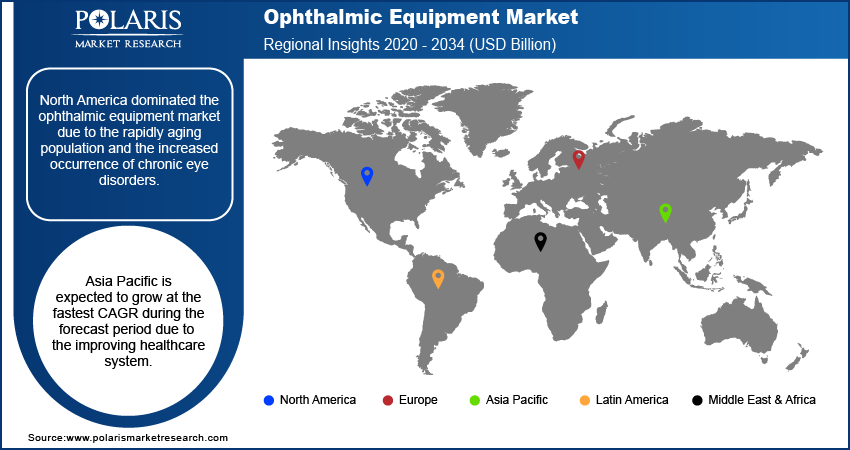

- North America dominated the ophthalmic equipment market due to the rapidly aging population and the increased occurrence of chronic eye disorders.

- Asia Pacific is expected to grow at the fastest CAGR during the forecast period due to the improving healthcare system.

Industry Dynamics

- The primary factor driving the market growth is numerous ocular conditions associated with age, including cataracts, glaucoma, and macular degeneration.

- The prevalence of refractive errors, retinal detachment, uveitis, bulging eyes, and diabetic macular edema is also anticipated to increase demand for ophthalmic equipment.

- Technology advancements like the combination of OCT with artificial intelligence (AI) are creating a lucrative market opportunity.

- High cost of this equipment may hamper the market growth.

Market Statistics

- 2024 Market Size: USD 69.76 Billion

- 2034 Projected Market Size: USD 111.28 Billion

- CAGR (2025-2034): 4.80%

- North America: Largest Market Share

To Understand More About this Research: Request a Free Sample Report

A field of medicine called ophthalmology studies the structure, function, and various eye illnesses. Ophthalmic equipment are components of medical technology used in surgery, diagnostics, and vision therapy. These devices are becoming increasingly important and widely used, due to the rising frequency of several ophthalmic disorders like glaucoma, cataracts, and other vision-related problems. Rapid technological advancements like the introduction of intraocular lenses and an increasing focus on customer training and education among eye care professionals regarding eye diseases and associated complications are supposed to accelerate the market's growth in the coming years.

The penetration of digital devices such as smartphones, laptops, computers, and e-readers are expected to propel the ophthalmic equipment market. The market players are supposed to have growth opportunities in the coming years due to factors such as expanding healthcare spending, rising medical tourism, and increasing governmental investments. However, the high cost of some equipment, particularly those exported, hinders the market’s growth.

Industry Dynamics

Growth Drivers

The primary factor driving the market growth is numerous ocular conditions associated with age, including cataracts, glaucoma, and macular degeneration. Additionally, the prevalence of refractive errors, retinal detachment, uveitis, bulging eyes, diabetic macular edema, visual impairment, blindness, and diabetic retinopathy is also anticipated to increase demand for ophthalmic equipment.

The utilization of the femtosecond laser has been boosted, as it offers more accuracy than conventional surgical techniques, which accelerated the market's growth. A femtosecond laser produces light pulses with a duration of less than one picosecond (ps) or in the femtosecond range (1 fs = 10-15 s). Compared to traditional operations, this laser’s medical procedure is performed under computer-guided OCT imaging, providing greater control and reliability over the incisions' size, shape, and position. This procedure also offers a quicker recovery time and a lower risk of human error during surgery. These benefits offered by femtosecond laser is driving people to go for femtosecond laser-based suergery, thereby driving the market growth.

Technology advancements such as the combination of OCT with artificial intelligence (AI) are anticipated to increase the rate of turn of this equipment by healthcare professionals. For instance, the US Food and Drug Administration approved Abbott's most recent OCT imaging platform, powered by Ultreon Software, in August 2021. The OCT and artificial intelligence (AI) are combined in this state-of-the-art imaging software to give doctors a complete image of coronary blood flow and blockages, assisting in decision-making and choosing the best course of therapy.

Report Segmentation

The market is primarily segmented based on product, end-use, and region.

|

By Product |

By End-Use |

By Region |

|

|

|

Know more about this report: Request for sample pages

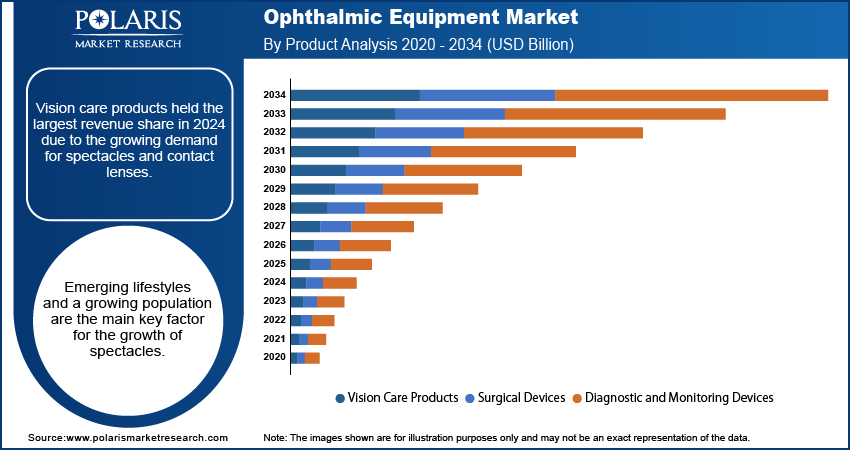

Vision Care Products Accounted for the Largest Market Share in 2024

Vision care products held the largest revenue share in 2024 due to the growing demand for spectacles and contact lenses. Emerging lifestyles and a growing population are the main key factor for the growth of spectacles. The ever-increasing demand for spectacles in Gen Z to shield eyes from the sun and look smarter & fashionable is growing daily. This contributed to the segment's dominance. The growing adoption of smartphones and other smart devices such as laptops, TVs, Gaming devices also led to the high adoption of vision care products such as spectacles and contact lenses.

The demand for contact lenses, a vision care products, is also increasing, owing to their ability to adjust to the eye’s curvature. These lenses provide a wider field of view with less distortion and viewer obstruction than eyeglasses, which is propelling people to move to these lenses from tratipnal spectacles. The increasing prevalence of myopia is leading to the adoption of soft contact lenses. Additionally, increased utilization of lenses to correct irregularly shaped corneas is supposed to drive the demand for the segment.

Consumers Segment Dominated the Market Share in 2024

The consumers' segment dominated the market share in 2024 and is projected to continue its dominance during the forecast period due to several factors. These factors include the growing use of contact lenses to treat a wide range of vision problems, including myopia, astigmatism, presbyopia, and hyperopia, the increasing emphasis on aesthetics and the popularity of colored contact lenses in the fashion industry. The growing employment rate and rising digitalization at workplaces is further encouraging people to opt for lenses or spectacles to reduce the chances of eye diseases such as red eye and others.

The hospital segment is supposed to grow fastest over the forecast perios due to the growing use of ophthalmic equipment in hospitals and the availability of affordable and efficient treatment. The need for new installations in hospitals is projected to increase due to the rising number of mergers and acquisitions between ophthalmic clinics and hospitals. For instance, Aditya Jyot Eye Hospital and Dr. Agarwal's eye facilities collaborated in October 2021, expanding the latter's market reach in India and internationally.

North America Dominated the Regional Market Share in 2024

North America dominated the ophthalmic equipment market share in 2024. This is attributed to the rapidly aging population and the increased occurrence of chronic eye disorders caused by destructive lifestyles and high-stress levels, such as diabetic retinopathy. The demand for ophthalmic equipment in this region is also driven by adoption of new reimbursement models for ophthalmologic therapy and a strict regulatory environment designed to ensure patient safety. Moreover, high popularity of computer games in the region also contributed to the high demand for ophthalmic equipment.

Asia Pacific is expected to grow at the fastest CAGR during the forecast period due to the improving healthcare system, the increased prevalence of eye conditions like glaucoma, and patients' growing awareness of it. The growth can alos be attributed to significant market participants like Alcon, Inc. boosting their outsourcing efforts for ophthalmology devices. Furthermore, rising awareness of advanced corrective eye procedures is driving growth of the market in developing countries like China and India.

Competitive Insight

Some of the major players operating in the global market include Alcon Vision LLC, Bausch & Lomb Incorporated, Carl Zeiss Meditec AG, Essilor International S.A, Haag-Streit Group, Ivantis Inc., Johnson & Johnson Vision Care, Nidek Co. Ltd, TOPCON Corporation, and Ziemer Ophthalmic Systems Ltd.

Recent developments

In January 2022: Alcon Acquired Ivantis Inc. to help ensure the continuity of the business and relationships with existing customers and allow Alcon to begin its future growth plants to bring Hydrus Microstent to more international markets.

In April 2020, Haag-Streit Group acquired VRmagic Holdings AG to enhance Haag-Streit’s position as the market leader in ophthalmology.

In February 2020, Bausch collaborated with Lomb Incorporated to increase awareness about AMD through social media accounts and to start sharing ADM information with the public.

Ophthalmic Equipment Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 69.76 billion |

| Market size value in 2025 | USD 72.97 billion |

|

Revenue forecast in 2034 |

USD 111.28 billion |

|

CAGR |

4.80% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Segments Covered |

|

|

Regional scope |

|

|

Key Companies |

Alcon Vision LLC, Bausch & Lomb Incorporated, Carl Zeiss Meditec AG, Essilor International S.A, Haag-Streit Group, Ivantis Inc., Johnson & Johnson Vision Care, Nidek Co. Ltd, TOPCON Corporation, and Ziemer Ophthalmic Systems Ltd. |

FAQ's

• The global market size was valued at USD 69.76 billion in 2024 and is projected to grow to USD 111.28 billion by 2034.

• The global market is projected to register a CAGR of 4.80% during the forecast period.

• North America dominated the market in 2024

• A few of the key players in the market are Alcon Vision LLC, Bausch & Lomb Incorporated, Carl Zeiss Meditec AG, Essilor International S.A, Haag-Streit Group, Ivantis Inc., Johnson & Johnson Vision Care, Nidek Co. Ltd, TOPCON Corporation, and Ziemer Ophthalmic Systems Ltd.

• The vision care products segment dominated the market revenue share in 2024.