Alcoholic Beverages Market Share, Size, Trends & Industry Analysis Report

By Type (Cider, Perry & Rice Wine, Wine, Beer, Spirits, Hard Seltzer, Others); By Distribution Channel; By Region; Segment Forecast, 2025 - 2034

- Published Date:Sep-2025

- Pages: 116

- Format: PDF

- Report ID: PM1941

- Base Year: 2024

- Historical Data: 2020-2023

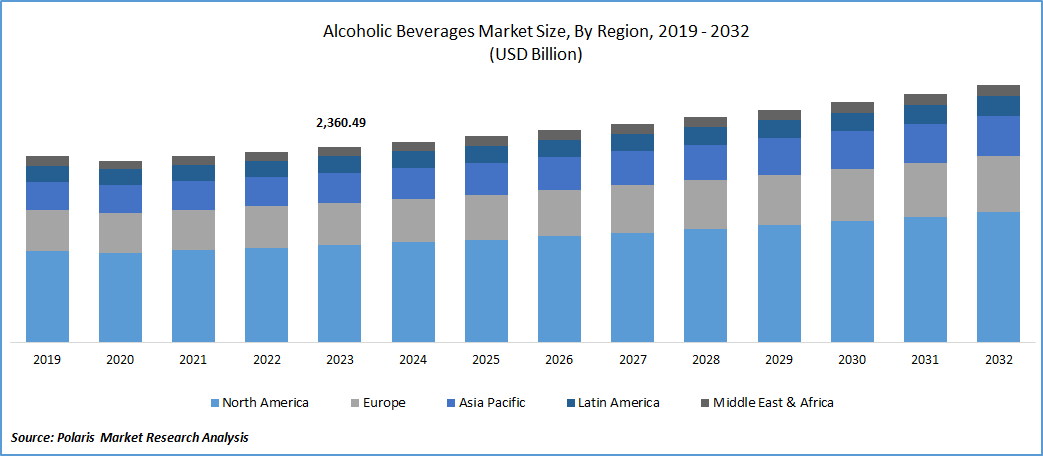

The global alcoholic beverages market was valued at USD 1,705.11 billion in 2024 and is expected to register a CAGR of 9.50% from 2025 to 2034. Increasing social drinking culture and premiumization trends are supporting steady demand for alcoholic beverages. The growing popularity of premium beer, especially in developed economies such as the U.S. and the UK, propels the industry expansion.

Key Insights

- The beer segment accounted for the largest revenue share in 2024. The rise in popularity of California common beer stimulated the segment growth.

- The liquor stores segment held the largest revenue share in 2024. Domestic liquor stores, offering a diverse range of alcoholic beverages at competitive prices, boost segmental growth.

- North America dominated the global revenue share in 2024. The regional market growth is attributed to the increasing demand for refined malt Scotch whiskey in the U.S. and Canada.

- The Asia Pacific alcoholic drinks industry is expected to register the highest CAGR during the forecast period. The increasing demand for agave-based spirits in emerging economies such as China and India propels the industry expansion in the region.

Industry Dynamics

- Rising disposable income is fueling alcohol consumption, especially among young adults, which contributes to market growth.

- Increasing consumer acceptance of hybrid alcohol beverages is driving the industry expansion.

- Surging demand for natural and functional ingredients in premium category alcohols will provide lucrative market opportunities during the forecast period.

- Increasing preference for non-alcoholic beverages among consumers reduces the demand for alcoholic beverages.

Market Statistics

2024 Market Size: USD 1,705.11 billion

2034 Projected Market Size: USD 4,210.23 billion

CAGR (2025–2034): 9.50%

North America: Largest market in 2024

AI Impact on Alcoholic Beverages Market

- Online retailers use AI-powered chatbots that provide personalized recommendations, which enhance customer experiences.

- Brand marketers use AI tools to analyze current and emerging industry trends to create targeted marketing strategies.

- AI-based systems help market players optimize logistics and forecast future demand, which streamlines supply chain management efficiently.

- Beverage producers adopt the technology to create interactive customer experiences and preferences. It helps them develop innovative alcoholic drinks.

To Understand More About this Research: Request a Free Sample Report

Expanding social drinking culture and premiumization trends are supporting steady market growth.

The increase can be attributed to the rising consumption of premium beer in developed economies like the U.S. and the U.K. The demand for alcoholic beverages, including beer, wine, and dark spirits, is on the rise. Additionally, the increasing popularity of pubs, bars, and restaurants is expected to contribute to market growth. The industry is driven by the growing appreciation for the distinctive flavors of beers that support digestive health.

Furthermore, the increasing interest in artisanal spirits in emerging economies like China and India is expected to drive the expansion of the alcoholic drinks market. An upcoming opportunity lies in the growing demand for affordable value-added hard seltzer products. However, the market faces a challenge due to the growing preference for non-alcoholic beverages. Currently, major players are concentrating on introducing cordials and liquors with reduced alcoholic content to prioritize human health.

The alcoholic drinks market is experiencing renewed growth with substantial investments from leading U.K.-based players in acquiring high-quality Scotch whisky products. Key Alcoholic Beverages market players are sourcing top-tier cider, perry, and rice wine to meet the increasing demand. The U.S. market is witnessing a surge in interest for lower-calorie beer supplements, contributing to the industry's expansion. An upcoming opportunity lies in the rising demand for value-added, cost-effective hard seltzer products. Despite these positive trends, challenges include the hindrance posed by the growing preference for non-alcoholic beverages and the considerable capital and time investments required for new businesses in the alcoholic drinks industry. The market is also impacted by health-conscious consumers, limiting overall growth. To address health concerns, major players are introducing cordials and liquors with lower alcoholic content, aligning with the ongoing trend of expanding consumer bases. Additionally, strategies like the "Quarter Strategy," as employed by key players like the Asahi brand, involve offering free beer with every twenty-bottle order through liquor stores to maximize market share.

Industry Dynamics

Growth Drivers

Rising Disposable Income is Fueling Increased Alcohol Consumption Among Young Adults, Contributing to Market Growth

The surge in spending on alcoholic beverages is notable in various developing economies, including China, India, Singapore, and Indonesia, driven by the expanding young adult workforce. According to the Organization for Economic Co-operation and Development (OECD), a slight increase in alcohol purchases has been observed in some countries, such as the U.K., where total alcohol beverage duty receipts rose by 4.5% from April to October 2020 compared to the previous year. Moreover, consumers' drinking frequency has shown an uptick, with 43% of individuals in 11 countries reporting increased drinking frequency in 2021. The trend extends to increase at-home consumption, marked by substantial growth in retail and online sales. With the global economy on the rise and robust growth in developing economies like India, Brazil, and China, disposable income is expected to increase, leading to heightened purchases of premium alcoholic beverages. Consequently, the escalating alcohol consumption among young adults, fueled by a rise in disposable income, is a significant driver of market growth.

Report Segmentation

The market is primarily segmented based on type, distribution channel, and region.

|

By Type |

By Distribution Channel |

By Region |

|

|

|

To Understand the Scope of this Report:Speak to Analyst

By Type Analysis

The Beer Segment Held the Largest Revenue Share in 2024

The segment offers a varied selection of ales, German-style altbiers, and the conventional special bitter type of beer. The expected rise in popularity of California common beer is poised to stimulate market growth in the upcoming years. Furthermore, the increasing request for Belgian-style Flanders to provide B-group vitamins will contribute to the sales of the beer segment over the forecast period.

The hard seltzer category is poised to achieve the most significant growth rate in the alcoholic drinks market during the forecast period. This is linked to the growing popularity of Arctic Chill Ginger-Lime Hard Seltzer in Europe. In the U.S., the increasing trend of Bud Light Seltzer Strawberry is satisfying the demand for fruit-flavored alcoholic beverages. The Orange Guava Hard Seltzer is anticipated to enhance sales in the spirits segment throughout the assessment period.

By Distribution Channel Analysis

The Liquor Stores Segment Accounted for the Highest Market Share During the Forecast Period

The ongoing urbanization in emerging economies is set to establish a well-connected network of liquor stores. The increasing inclination of consumers towards embracing Western culture is anticipated to drive the growth of the alcoholic drinks market. Domestic liquor stores, offering a diverse range of alcoholic beverages at competitive prices, are poised to contribute to segmental growth. Supportive initiatives undertaken by various governments globally to streamline liquor licensing processes are expected to propel market growth.

The internet retailing segment is expected to experience the most rapid growth throughout the forecast period. This is attributed to suppliers' heightened focus on adopting advanced e-commerce trading technology. Internet retailing facilitates doorstep liquor delivery, contributing to market growth. The rising demand for super-premium wine products via e-commerce portals is a key factor driving market expansion. The proactive measures taken by private firms in the U.S. to meet the demand for alcoholic beverages through e-commerce platforms are further propelling market growth.

Regional Insights

North America Dominated the Largest Market in 2024

The market is expected to grow due to the increasing demand for refined malt Scotch whiskey in the U.S. and Canada. The rising trend in the U.S. to embrace classic brands of alcoholic beverages, such as Arnold Palmer Spiked Half & Half, Bergenbier, and Burgasko, is poised to contribute to market growth. Furthermore, the financial support provided by private firms in Canada to acquire premium alcoholic beverages is anticipated to enhance market growth.

In the Asia Pacific, the alcoholic drinks market is expected to experience the fastest CAGR. This growth can be attributed to the increasing demand for agave-based spirits in emerging economies such as China and India, meeting the rising demand for alcoholic beverages. The emerging trend in India of consuming local spirits like Black Label, VAT69, and McDowell's whiskey is driving market growth. The increasing adoption of beer, gin, and tequila flavors in China is expected to exhibit the fastest growth rate during the forecast period.

Key Market Players & Competitive Insights

The market is characterized by intense competition, with established players relying on advanced technology, high-quality products, and a strong brand image to drive revenue growth. These companies employ various strategies such as research and development, mergers and acquisitions, and technological innovations to expand their product portfolios and maintain a competitive edge in the market.

Some of the major players operating in the global market include:

- Anheuser-Busch InBev SA/NV

- Asahi Breweries Ltd.

- Bacardi Limited

- Beam Suntory Inc.

- Carlsberg A/S

- Constellation Brands Inc.

- Diageo Plc

- Molson Coors Brewing Co.

- Pernod Ricard SA

- United Spirits Ltd.

Recent Developments

- In September 2024, The Coca‑Cola Company and Bacardi Limited announced an agreement to debut BACARDÍ rum and Coca‑Cola as a ready-to-drink (RTD) pre-mixed cocktail.

- In November 2022, Diageo recently acquired Balcones Distillery, a Texas-based craft distillery renowned as one of the leading producers of American Single Malt Whiskey in the country.

- In October 2022, Bacardi has launched Legacy, a whisky produced in India, as part of its business strategy to establish a discounted price category for its customers in the Indian market.

- September 2024: Coca-Cola and Bacardi teamed up to introduce 'Bacardi Mixed with Coca-Cola RTD,' a ready-to-drink pre-mixed cocktail, in a few European markets as well as in Mexico in 2025. The beverage will have a 5% ABV worldwide standard, with market-specific variances.

- March 2023: Pernod Recard announced the acquisition of Skrewball’s majority stakes. Founded in 2018, Skrewball is the world’s first super-premium flavored whiskey with a smooth, nutty taste.

Alcoholic Beverages Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 1863.35 billion |

|

Revenue forecast in 2034 |

USD 4,210.23 billion |

|

CAGR |

9.50% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments Covered |

By Type, By Distribution Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The global Alcoholic Beverages market size is expected to reach USD 4210.23 billion by 2034.

The top market players in Alcoholic Beverages Market are Anheuser-Busch InBev SA/NV,Asahi Breweries Ltd.Bacardi Limited Beam Suntory Inc. Carlsberg A/S

North America is the region contribute notably towards the Alcoholic Beverages Market.

The global Alcoholic Beverages market was valued at USD 1863.35 billion in 2025 and is expected to grow at a CAGR of 9.50% during the forecast period.

The key segments in the Alcoholic Beverages Market are type, distribution channel, and region.