Ready to Drink Tea & Coffee Market Size, Share, Trends, Industry Analysis Report

: By Product, By Packaging (PET Bottle, Canned, Glass Bottle, and Others), By Price, By Distribution Channel, and By Region – Market Forecast, 2025–2034

- Published Date:May-2025

- Pages: 129

- Format: PDF

- Report ID: PM1147

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

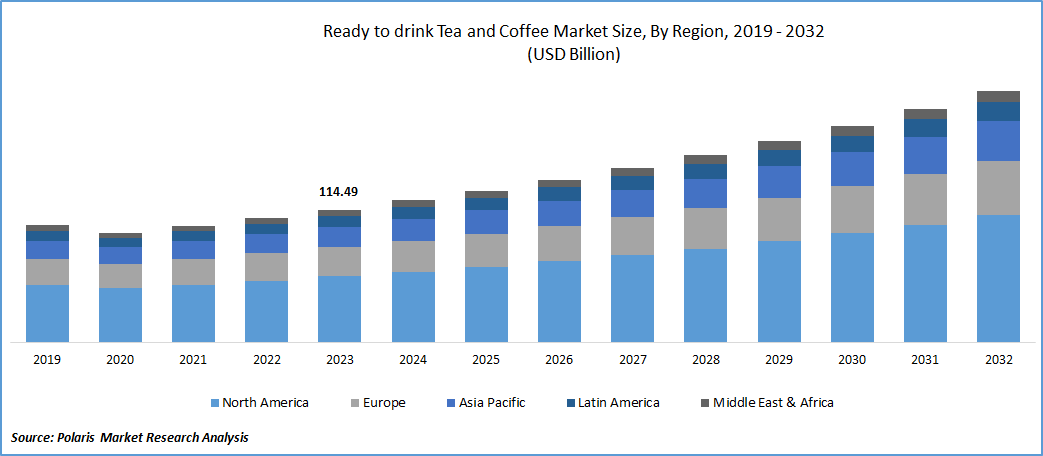

The global ready-to-drink tea and coffee market was valued at USD 119.84 billion in 2024 and is expected to grow at a CAGR of 6.3% from 2025 to 2034. The growth is driven by the increasing demand for convenient and healthy beverage options among busy consumers.

Ready to drink (RTD) tea and coffee are packaged beverages that are pre-brewed, processed, and sold in a form that is immediately ready for consumption, eliminating the need for any preparation such as brewing or mixing. These drinks are available in bottles, cans, cartons, or cups, making them highly portable and convenient for on-the-go lifestyles. RTD tea encompasses a wide variety of tea types such as black, green, oolong, white, herbal, sparkling tea, and fruit teas. The tea is often served chilled or iced, sometimes sweetened or flavored to cater to diverse consumer preferences. RTD coffee, on the other hand, includes a range of options such as cold brew, iced coffee, lattes, cappuccinos, and specialty blends with added flavors, plant-based milks, or functional ingredients such as protein or antioxidants. The primary usage of RTD tea and coffee is to provide consumers with a quick, hassle-free beverage solution that fits into busy lifestyles, offering consistent taste and quality without the need for brewing equipment or barista skills.

The rising disposable income globally is propelling the ready to drink tea & coffee market growth. Increased disposable income drives people to prioritize products that align with their evolving lifestyles, including healthier, ready-to-drink options that save time without sacrificing taste or nutritional value. Additionally, higher disposable income encourages experimentation with new flavors and premium brands, driving demand for innovative and premium RTD offerings. According to data published by the Bureau of Economic Analysis, the disposable personal income in the US increased by 0.5% in February 2025 compared to January 2025. This shift in increasing disposable income fuels the expansion of both the economy and demand for premium ready to drink tea & coffee.

To Understand More About this Research: Request a Free Sample Report

The RTD tea & coffee market demand is driven by the rising popularity of e-commerce platforms. E-commerce platforms offer a wider variety of brands and flavors than physical stores, attracting curious shoppers who want to try new products. Convenient home delivery and subscription options offered by these platforms encourage repeat purchases, as consumers enjoy hassle-free access to their favorite beverages. These platforms also provide detailed product descriptions, reviews, and personalized recommendations, helping shoppers make informed choices and increasing trust in startup brands. Flash sales, discounts, and bundled deals provided by e-commerce platforms further incentivize impulse buys, driving higher sales volumes of ready to drink tea & coffee. Additionally, social media and digital marketing on these platforms raise awareness and create trends, making RTD tea & coffee more appealing to younger, tech-savvy consumers, driving high adoption.

Market Dynamics

Growing Urbanization Globally

Urban areas have fast-paced work environments, leaving professionals with less time to prepare hot beverages, making ready-to-drink options more appealing. The proliferation of convenience stores, supermarkets, and vending machines in urban areas also makes RTD products easily accessible. Additionally, urban consumers tend to have higher disposable incomes and greater exposure to global trends, leading them to explore premium and innovative RTD varieties. The rise of café culture and quick service restaurants in urban areas also fuels demand for ready-to-drink tea & coffee, as consumers seek bottled versions of their favorite tea and coffee flavors for quick consumption. According to data published by the United Nations Development Programme in 2024, cities host more than half of the global population and are projected to double by 2050. Hence, as urbanization increases globally, the demand for RTD tea and coffee also increases.

Wide Population of Gen-Z and Millennials Worldwide

Gen-Z and millennial generations, known for their fast-paced lifestyles and convenience-driven preferences, increasingly prefer ready-to-drink beverages, as these beverages offer quick and easy consumption without compromising on taste or quality. Gen-Z and millennials further value products that align with their health-conscious mindsets, often preferring options with natural ingredients and lower sugar content. RTD tea and coffee cater to these preferences, offering a convenient and often healthier alternative to traditional sodas and sugary drinks. Consumers of these generations also show a willingness to experiment with new formulations such as sparkling teas and cold brew coffees, fueling rapid innovation in the industry. As per the data published by the World Economic Forum, the population of millennials is 1.8 billion around the world, equal to 23% of the global population, while Gen Z accounts for 2.47 billion. Therefore, the presence of a wide population of Gen-Z and millennials worldwide is propelling the ready to drink tea & coffee market expansion.

Segment Insights

Market Evaluation by Product

Based on product, the market is divided into RTD coffee and RTD tea. The RTD coffee segment dominated the ready to drink tea & coffee market share in 2024 due to shifting consumer preferences toward convenient, premium-quality beverages. Urbanization, fast-paced lifestyles, and the growing demand for functional drinks with energy-boosting properties fueled the RTD coffee segment growth. Major brands introduced innovative options such as cold brew, nitro coffee, and plant-based formulations, appealing to health-conscious millennials and Gen Z consumers. Furthermore, advancements in packaging technology, particularly the widespread use of recyclable aluminum cans and PET bottles, have enhanced product shelf life and portability, making RTD coffee a preferred choice among on-the-go consumers. The strategic expansion of coffeehouse chains into the bottled coffee space also strengthened brand loyalty, encouraging frequent purchases and driving robust sales growth across the globe markets.

The RTD tea segment is expected to grow at a rapid pace during the forecast period, with sparkling tea emerging as a key sub-segment. Health and wellness trends have increasingly directed consumers toward tea-based beverages, especially those offering lower sugar content, functional benefits such as antioxidants, and botanical infusions. The adoption of sparkling tea, in particular, is estimated to grow due to its blend of sophistication, flavor innovation, and perceived healthfulness, offering a refreshing alternative to traditional carbonated soft drinks. The rising popularity of natural and organic product lines, coupled with premiumization strategies that emphasize artisanal brewing methods and exotic tea varieties, is projected to accelerate demand for RTD tea during the forecast period.

Market Insight by Price

In terms of price, the market is segregated into economy and premium. The economy segment accounted for a major market share in 2024 due to widespread consumer demand for affordable, convenient beverages. Budget-conscious shoppers, particularly in developing regions such as Asia Pacific and Latin America, fueled demand for affordable ready to drink tea & coffee. Rising urbanization and an expanding working-class population contributed to higher consumption rates in this segment, as consumers sought quick refreshment options at accessible prices. Additionally, inflationary pressures in several economies encouraged greater adoption of economy-tier products, making them a staple choice for daily consumption among a broad demographic base.

Regional Outlook

By region, the report provides RTD tea & coffee market insight into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific accounted for a major market share in 2024 due to strong consumer demand, cultural affinity for tea, and rapid urbanization. Countries such as China, Japan, and South Korea led this growth, with China emerging as the dominant country in the region. China's booming middle class population, combined with increasing health consciousness and the popularity of on-the-go beverage consumption, created a fertile ground for the ready to drink tea & coffee industry expansion. Major brands launched a wide variety of innovative products, including herbal-infused teas, milk-based coffees, and functional drinks enriched with vitamins and probiotics, catering to evolving consumer preferences. Additionally, the widespread presence of modern retail infrastructure and the growing influence of e-commerce and user generated content platforms accelerated product accessibility and brand visibility, further strengthening market dominance in the region.

The market in North America is expected to grow at a robust pace in the coming years, owing to the shifting lifestyle patterns, where consumers seek healthier, functional alternatives to craft sodas. The strong coffee culture in the US, combined with rising interest in specialty teas such as matcha and sparkling tea, is encouraging brands to diversify offerings and invest in creative marketing campaigns. Consumer emphasis on sustainability, transparency in sourcing, and artisanal craftsmanship continues to drive the success of new product lines, particularly among millennials and Gen Z. Furthermore, the robust presence of convenience stores, supermarkets, and online grocery services ensures wide product distribution, enabling North America to build its emerging leadership role in the global market.

Key Players & Competitive Analysis

The ready-to-drink (RTD) tea & coffee industry is highly competitive, characterized by frequent mergers and acquisitions, collaborations, and strategic partnerships as key players expand their global footprint and product portfolios. Major companies dominate the industry through aggressive M&A activities. New entrants and health-focused brands are leveraging product innovation and retail collaborations to compete. Additionally, startups are gaining traction through niche positioning and partnerships with organic retailers. Regional players are expanding through localized flavors and joint ventures. The rise of private-label RTD beverages from retailers such as Trader Joe’s and Whole Foods further pressures pricing strategies.

The market is fragmented, with the presence of numerous global and regional market players. A few major players are AriZona Beverages; Asahi Group Holdings, Ltd.; Danone; Monster Energy Company; Nestlé; PepsiCo; Starbucks Coffee Company; Suntory Holdings Limited; The Coca Cola Company; and Unilever.

The Coca-Cola Company, founded in 1892 and headquartered in Atlanta, Georgia, is a major American multinational corporation primarily known for manufacturing, selling, and marketing soft drinks, including its flagship product, Coca-Cola. Over the years, the company has evolved into a total beverage company, offering more than 200 brands and thousands of beverages worldwide, including soft drinks, waters, coffees, and teas. Its products are enjoyed in more than 200 countries and territories, with over 2.2 billion servings consumed daily. In recent years, Coca-Cola has strategically expanded into the ready-to-drink (RTD) tea and coffee segments to capture shifting consumer preferences toward healthier and more convenient beverage options. Coca-Cola's tea portfolio ranges from organic, fair trade-certified teas to sweeter, fruit-forward varieties, catering to diverse tastes globally.

Nestlé, headquartered in Vevey, Switzerland, is one of the world's largest food and beverage companies, operating in 189 countries with over 339,000 employees and a portfolio of more than 2,000 brands. Nestlé's beverage portfolio prominently features ready-to-drink (RTD) tea and coffee products, which align with global consumer trends favoring convenience, premium quality, and health-conscious options. Nestlé has a strong presence in the RTD coffee segment through its Nescafé brand, which is one of the world's most recognized coffee brands. The company has expanded its offerings to include a variety of RTD coffee beverages, such as iced coffees and specialty blends that cater to diverse tastes and occasions. Additionally, Nestlé owns Nespresso, a premium coffee brand known for its single-serve capsules, which also supports its broader coffee ecosystem. Nestlé’s strategic acquisitions, such as the majority stake in Blue Bottle Coffee, further bolster its position in the premium and specialty coffee market.

List of Key Companies in RTD Tea & Coffee Market

- AriZona Beverages

- Asahi Group Holdings, Ltd.

- Danone

- Monster Energy Company

- Nestlé

- PepsiCo

- Starbucks Coffee Company

- Suntory Holdings Limited

- The Coca Cola Company

- Unilever

Ready to Drink Tea & Coffee Industry Developments

August 2025: Singapore-based startup Prefer announced the commercial launch of its products. The newly introduced products by the company are cocoa powders and soluble coffee. Prefer also revealed its first commercial partnerships for international expansion.

April 2025: Nestlé expanded its Nescafé Ready-to-Drink cold coffee range to India, the Middle East and North Africa (MENA), and Brazil to meet the needs of young consumers who prioritize convenience, variety, and on-the-go options.

March 2025: Starbucks announced the availability of two new ready-to-drink (RTD) beverages. The two new RTD beverages, RTD Starbucks Frappuccino Lite and RTD Starbucks Iced Energy, have been developed in partnership with the North American Coffee Partnership (NACP). They can be purchased by consumers at convenience and grocery stores.

September 2024: Twinings announced the launch of its new ready-to-drink range of Twinings Sparkling Tea. The sparkling tea is fortified with multiple vitamins and minerals, including antioxidant Vitamin C to support general wellbeing.

November 2023: Coca-Cola entered the ready-to-drink tea market in India with the launch of 'Honest Tea'.

Ready to Drink (RTD) Tea & Coffee Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- RTD Coffee

- Flavored Coffee

- Cold Brew Coffee

- Iced Coffee

- Others

- RTD Tea

- Kombucha

- Green

- Black

- Fruit

- Sparkling Tea

- Others

By Packaging Outlook (Revenue, USD Billion, 2020–2034)

- PET Bottle

- Canned

- Glass Bottle

- Others

By Price Outlook (Revenue, USD Billion, 2020–2034)

- Economy

- Premium

By Distribution Channel Outlook (Revenue, USD Billion, 2020–2034)

- Food Service

- Supermarkets/Hypermarkets

- Convenience Stores

- Online

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Ready to Drink Tea & Coffee Market Report Scope

|

Report Attributes |

Details |

|

Market Value in 2024 |

USD 119.84 Billion |

|

Market Forecast in 2025 |

USD 127.13 Billion |

|

Revenue Forecast by 2034 |

USD 219.95 Billion |

|

CAGR |

6.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 119.84 billion in 2024 and is projected to grow to USD 219.95 billion by 2034.

The global market is projected to record a CAGR of 6.3% during the forecast period.

Asia Pacific held the largest share of the global market in 2024.

A few of the key players in the market are AriZona Beverages; Asahi Group Holdings, Ltd.; Danone; Monster Energy Company; Nestlé; PepsiCo; Starbucks Coffee Company; Suntory Holdings Limited; The Coca Cola Company; and Unilever.

The economy segment dominated the market revenue share in 2024.

The RTD tea segment is expected to grow at a faster pace in the coming years.