Craft Soda Market Size, Share & Trends Analysis Report

By Flavor (Cola, Tropical Fruits, Berries); By Packaging (Glass, Cans, Plastic); By Distribution Channel (On-trade, Off-trade); By Region; Segment Forecasts, 2025 - 2034

- Published Date:Sep-2025

- Pages: 115

- Format: PDF

- Report ID: PM2803

- Base Year: 2024

- Historical Data: 2020-2023

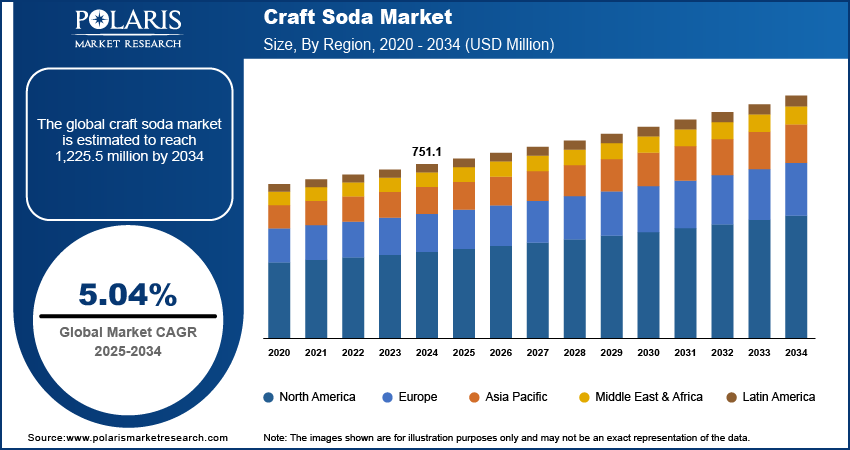

The global craft soda market was valued at USD 751.1 million in 2024 and is expected to grow at a CAGR of 5.03% during the forecast period. The rise in disposable income, rapid urbanization, and changing consumer preferences are the major factors driving the global market’s growth. Furthermore, the increasing emphasis by critical players on investing heavily in acquisitions & product launches to have a competitive edge over other players demonstrates the market's growth potential in the coming years.

Key Insights

- The on-trade distribution channel is expected to hold a significant market share over the forecast period. This is due to the consumers across the worldwide who enjoy consuming craft sodas and carbonated drinks at hotels and nightclubs.

- The cola segment dominated the market in 2024. This is due to the boost in demand for soda-based soft beverages among youngsters and the millennial population of the world.

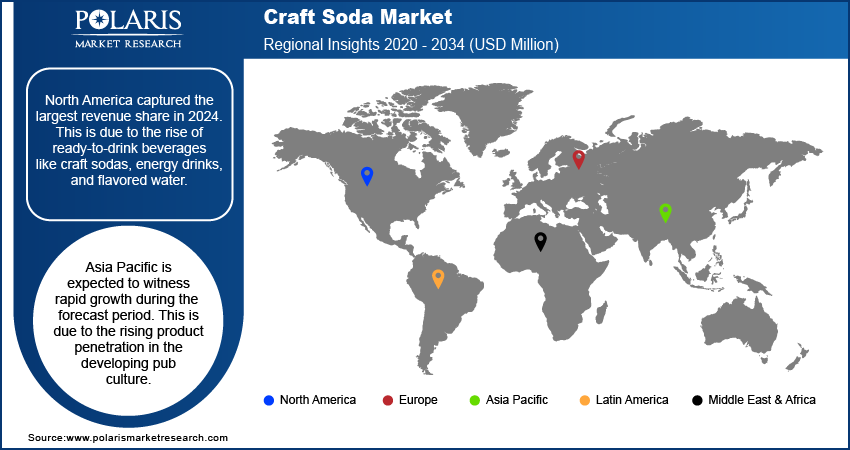

- North America captured the largest revenue share in 2024. This is due to the rise of ready-to-drink beverages like craft sodas, energy drinks, and flavored water.

- Asia Pacific is expected to witness rapid growth during the forecast period. This is due to the rising product penetration in the developing pub culture.

Industry Dynamics

- High prices and competition from major soft drink companies and private brands create a burden on profit margin and market revenue share.

- The growth in consumer preference for natural, premium, and locally sourced ingredients allows brands to provide crafted products to capture a health-conscious population.

- The rise in consumer choice for functional and low-calorie beverages developed with natural ingredients has boosted the expansion of these healthy and hydrated drinks.

- Rise in health consciousness and demand for natural sweeteners has encouraged the companies to reformulate products, which further accelerates the growth opportunities.

Market Statistics

- 2024 Market Size: USD 751.1 million

- 2034 Projected Market Size: USD 1,225.5 million

- CAGR (2025-2034): 5.04%

- North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

Moreover, the rising prevalence of cardiovascular disease, arthritis, diabetes, etc., increasing demand for healthy beverages, changing lifestyles, and attractive bottle packaging are some of the major driving factors contributing to craft soda sales in the market.

Furthermore, companies and businesses across the globe are investing and launching new innovative products with attractive packaging, which has positively contributed to the overall market growth. Jones Soda Co., a premium craft beverage manufacturer, has been manufacturing tasting glass bottles of craft sodas for decades. The company put user-generated artistic photography labels and their signature with inspiring messages. The company has recently expanded its product portfolio with innovative packaging and labels that feature inspirational images and pictures.

However, the outbreak of the COVID-19 pandemic had a negative impact on market growth due to the decline in tourism and other factors. The pandemic restrictions imposed by governments worldwide had a significant impact on the revenue generation of restaurants, hotels, and other outlets, thereby impacting the overall HORECA industry. According to the data given by the key industrial firms, there was a significant decline in beverages in 2020 due to social restrictions and on-trade closures. Countries such as China, the United States, and Germany have reported a decline in the sales of the overall beverages industry.

Although at-home consumption has shown a positive trend, the decline in out-of-home consumption had a profound impact on market growth. The out-of-home consumption market had been registering and providing more profits and margins than the at-home consumption. Moreover, the travel ban had a significant impact on the global supply chain, which led to a decline in trade and demand for raw materials. The agricultural output and trade also varied, thereby impacting the production of beverages globally. But, with the introduction of vaccines and the relaxation in the pandemic measures, the market has been projected to surge at a decent rate in the subsequent years.

For Specific Research Requirements, Request for a Customized Report

Industry Dynamics

Growth Drivers

Growing demand for healthy hydration products is positively impacting the market growth. Consumers are inclined towards health-oriented beverages such as craft soda and other functional drinks. Rising awareness among consumers about the health benefits of low-calorie drinks, which are manufactured with natural ingredients, is the key factor that is projected to drive the demand for healthy hydration drinks, which in turn is anticipated to drive the overall market’s growth during the forecast period.

Moreover, the rising prevalence of cardiovascular disease, arthritis, diabetes, etc. coupled with increasing demand for healthy beverages and changing lifestyles, is the major driver for the growth. Additionally, diabetic patients are more aware of the importance of healthy diets, and because of this, they prefer beverages with natural sweeteners such as stevia. Companies like Pepsico Inc. and Coca-Cola are making efforts to reduce the quantity of sugar in their products. Pepsico has also launched the ‘Craft’ soda brand worldwide; the company sells its craft soda glass bottles in five flavors. Each bottle of craft soda contains 90-100 calories and is sweetened with stevia and sugar cane.

Report Segmentation

The market is primarily segmented based on flavor, packaging, distribution channel, and region.

|

By Flavor |

By Packaging |

By Distribution Channel |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Segmental Analysis

Flavor Analysis

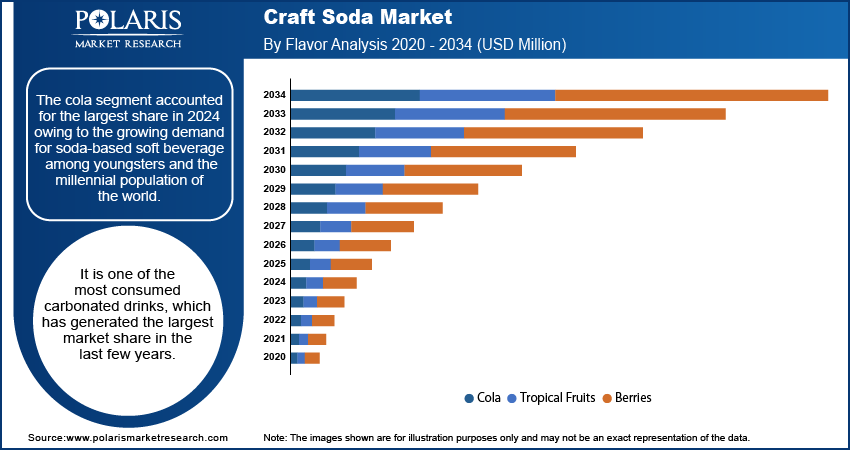

The cola segment accounted for the largest share in 2024 owing to the growing demand for soda-based soft beverages among youngsters and the millennial population of the world. It is one of the most consumed carbonated drinks, which has generated the largest market share in the last few years.

In addition to this, the rising innovations by key market players in the development of new products like sugar-free and low-calorie drinks are further estimated to drive the popularity of the cola flavor segment growth during the forecast period. For instance, in 2022, Coca-Cola introduced a range of four new carbonated drinks in the market, which includes the newest addition to coke’s line-up, which tastes like cream soda and caramel flavor. The company has also collaborated with Molson Coors to launch a spiked lemonade concoction of fruit juices.

Packaging Analysis

Glass packaging is projected to dominated the packaging type segment in 2024 as they come under the category of sustainable packaging. Ban on single-use plastic across various countries has increased the demand for sustainable packaging options. Due to the constant pressure from Government, the packaging industry is not considered to be more sustainable.

In the last few years, the interest in sustainability has increased, and the government of various countries has responded to public concerns regarding packaging waste, especially single-use packaging waste. Governments across the globe are implementing rules/regulations and policy measures such as taxation to improve waste management processes and minimize environmental waste. Packaging manufacturers are adopting eco-friendly wrapping solutions to reduce the contamination of the environment, which is expected to drive the glass packaging market during the forecast period.

Increasing adoption of environment-friendly biodegradable wrapping material such as paper, metal, glass, and paper boards doesn’t cause any environmental contamination, due to which their demand is high across the packaging industry. Countries across various regions are making efforts to ban single-use plastic bags. For example- Thailand, in 2020, announced its nationwide ban on single-use plastic bags at major retail stores and is aiming for a full ban in the next few years to reduce the contamination caused by plastic leakage in the environment.

Distribution Channel Analysis

On trade distribution channel is expected to hold a significant market share over the forecast period due to the rising consumption of soda drinks in pubs, cafes, nightclubs, and hotels. Many surveys have concluded that consumers across the world enjoy consuming craft sodas and carbonated drinks at hotels and nightclubs.

Regional Analysis

North America Craft Soda Market Assessment

North America dominated the market in 2024 due to the rising popularity of ready-to-drink beverages like craft sodas, energy drinks, and flavored water is one of the major driving factors for the overall market growth across the region. Market players across the region offer recyclable plastic packaging, which provides longer shelf life for single-serve packaging. Consumers in countries like U.S and Canada are becoming health conscious for their well-being, owing to which they are spending more on beverages that contain less sugar content. Also, the demand for flavored tropical fruit juices is anticipated to grow decently during the estimated period.

Asia Pacific Craft Soda Market Insights

Asia Pacific is expected to grow with the highest CAGR during the forecast period due to the rising product penetration in the developing pub culture, such as India, China, Australia, Japan, and South Korea. Many national and international players are launching their products in these countries to generate more revenue. Moreover, the rise in the middle-class population in this region has boosted the disposable income, which reflects more spending capacity on premium and innovative alcoholic experiences. This shift, with the expansion of major breweries and distilleries, is rapidly launching these beverages to a wide audience.

Key Players & Competitive Analysis Report

Some of the major players operating in the global market include Jones Soda, Appalachian Brewing, Reed’s, PepsiCo., Original Craft Soda, Coca-Cola Company, Crooked Beverage, SIPP eco beverage, Boylan Bottling, Wild Poppy Company, Tuxen Brewing, Five Star Soda, Batch Craft Soda, Brooklyn Organics, and Dry Soda.

Industry Developments

July 2024: Jones Soda collaborated with Nitrocross Motorsports to launch Jones Craft Cola and Jones Craft Zero Cola. The soda is made with natural cane sugar, and Jones Zero Cola, serving consumers who prefer no-calorie beverages, elevates cola taste to a new level.

January 2022: Green Cola launched a new sugar-free cola product in the US. The product doesn’t contain any calories or artificial sweeteners, or preservatives in it. The product is available for sale at 1,000 retail outlets and at Amazon and Walmart.

January 2021: Jones Soda introduced its first mass-market variety of 12-packs and the first mass-market variety of 12-packs that will change every six months.

Craft Soda Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 751.1 million |

| Market size value in 2025 | USD 787.9 million |

|

Revenue forecast in 2034 |

USD 1,225.5 million |

|

CAGR |

5.03% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Segments Covered |

By Flavor, By Packaging, By Distribution Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Jones Soda Co., Appalachian Brewing Co., Reed’s Inc., PepsiCo, Inc., The Original Craft Soda Company, The Coca-Cola Company, Crooked Beverage Co., SIPP eco beverage co. Inc., Boylan Bottling Co., Wild Poppy Company, Tuxen Brewing Co., Five Star Soda, Batch Craft Soda, Brooklyn Organics, Dry Soda Co. |

FAQ's

• The global market size was valued at USD 751.1 million in 2024 and is projected to grow to USD 1,225.5 million by 2034.

• The global market is projected to register a CAGR of 5.03% during the forecast period.

• North America dominated the global market share in 2024.

• A few market players are Jones Soda Co., Appalachian Brewing Co., Reed’s Inc., PepsiCo, Inc., The Original Craft Soda Company, The Coca-Cola Company, Crooked Beverage Co., SIPP eco beverage co. Inc., Boylan Bottling Co., Wild Poppy Company, Tuxen Brewing Co., Five Star Soda, Batch Craft Soda, Brooklyn Organics, and Dry Soda Co.

The cola segment dominated the market in 2024.

• The on-trade distribution channel is expected to hold a significant market share over the forecast period.